Halliburton Swings to Loss but Signals Upturn -- Update

July 20 2016 - 12:03PM

Dow Jones News

By Anne Steele and Alison Sider

Halliburton Co. swung to a loss in its latest quarter as it

booked hefty charges related to its failed tie-up with Baker Hughes

Inc.

Still, results came in better than anticipated for the second

largest oil-field-services company behind Schlumberger Ltd., and

the industry bellwether emphasized that the North American oil

industry is poised for a turnaround in the second half of the

year.

Halliburton shares fell 1.1% to $44.49 Wednesday morning.

Halliburton reported a loss of $3.21 billion, or $3.73 a share,

for the period ended June 30, compared with a year-earlier profit

of $54 million, or 6 cents a share. Excluding special items, the

company posted an adjusted loss from continuing operations of 14

cents a share. Total revenue slid 35% to $3.84 billion.

Analysts polled by Thomson Reuters had projected an adjusted

loss of 19 cents a share on $3.75 billion in revenue.

Halliburton said revenue in its North American operations -- the

largest contributor to its top line -- tumbled 43% amid reduced

activity throughout the U.S. land sector, particularly pressure

pumping services and drilling activity.

But Halliburton Chief Executive Dave Lesar cited a more positive

climate for the remainder of the year, saying an emotional

threshold was crossed when oil prices hit $50 per barrel during the

quarter. Though they've slid some since then to $44.65 Tuesday, oil

companies are starting to think about growing rather than just

hanging on.

"There's a spring in their step I didn't see earlier in the

year," Mr. Lesar said of Halliburton's customers. "In short, they

are getting back to business."

The company believes the U.S. rig count bottomed out during the

quarter, pointing out that it has improved by 26 over the past

several weeks, reflecting operator confidence in stabilizing

commodity prices. Mr. Lesar said he expects a "modest uptick" in

the rig count during the second half of the year and a more

significant ramp up in 2017.

Some of the pain from nearly two years of low oil prices will

linger. Oil-field services companies made deep pricing concessions

at the depths of the downturn, idling equipment and laying off tens

of thousands of workers.

Mr. Lesar cautioned that the exploration and production

companies will have to adjust to paying more for work from drillers

and frackers if they expect the services providers to stay in

business.

"They know in their heart of hearts that service prices have to

go up," he said.

In May, Halliburton and Baker Hughes called off their merger,

which was once valued at nearly $35 billion, after the companies

had faced intense regulatory pressure on several continents. They

had struck the deal in 2014, but it had appeared especially

troubled since April, when the Justice Department filed a lawsuit

to block it.

The company booked $3.52 billion of costs related to terminating

the Baker Hughes deal, as well as $423 million of other impairments

and charges during the quarter.

Write to Anne Steele at Anne.Steele@wsj.com and Alison Sider at

alison.sider@wsj.com

(END) Dow Jones Newswires

July 20, 2016 11:48 ET (15:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

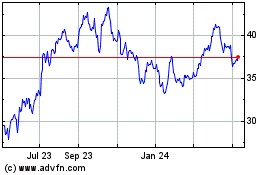

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

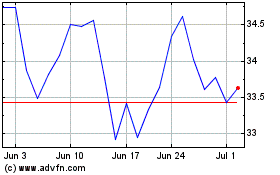

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024