By Ellie Ismailidou and Sara Sjolin, MarketWatch

Microsoft, Morgan Stanley earnings beat forecasts; Halliburton

reports losses

The S&P 500 and the Dow industrials were on track for record

closing highs, buoyed by a rally in tech stocks after a flurry of

corporate earnings beat the market's lowered expectations.

Notably, Morgan Stanley (MS) and Microsoft Corp.(MSFT) released

better-than-feared earnings, boosting the broader benchmarks after

disappointing quarterly results from Netflix Inc.(NFLX) on Tuesday

led both the S&P 500 and the Nasdaq to finish lower.

Gains in oil futures , which erased earlier losses after the

U.S. Energy Information Administration reported

(http://www.marketwatch.com/story/oil-pares-losses-after-eia-reports-fall-of-23-mln-barrels-in-us-crude-supplies-2016-07-20)that

domestic crude supplies declined, also helped boost risk

appetite.

The S&P 500 index climbed 11 points, or 0.5% to 2,174, led

by a 2% rise in technology stocks. Four out of the index's 10

sectors were in negative territory, with utilities stocks leading

the modest losses, down 0.5%.

The Dow Jones Industrial Average rose 60 points, or 0.3% to

18,618, led by a 6.2% surge in Microsoft, which was contributing

over 20 points to the Dow. The blue-chip gauge was weighed by a

1.5% drop in Walt Disney Co.(DIS).

Meanwhile, the Nasdaq Composite Index advanced 53 points, or 1%,

to 5,089, hitting its highest level this year amid the broad tech

rally.

In absence of U.S. economic data, earnings reports dominated the

headlines. So far 14% of company's on the S&P 500 have reported

quarterly results, 64% of which have beat expectations, according

to S&P Global Market Intelligence.

The overall optimism and boost in risk appetite was evident in

strong gains for the ultrarisky junk bonds(HYG) and a selloff in

haven investments, such as Treasurys and gold futures .

"Whereas international headlines threatened to disrupt markets

just days ago, today it is hard to find a Brexit story or one about

the attempted coup in Turkey," said James Meyer, chief investment

officer at Tower Bridge Advisors, in emailed comments.

"When you have prices at all-time highs and volumes relatively

low, the setup is there for a couple of good earnings reports to

lift the broader market," said Mike Antonelli, equity sales trader

at R.W Baird & Co.

Aggregate earnings so far in the second quarter have shown a

4.4% decline in profits year-over-year, marking a fourth straight

quarter of weaker earnings, according to S&P Global Market

Intelligence.

Still, in terms of how earnings affect market moves "it's all

about the expectations, not the actual numbers," Antonelli said.

Even though the expectation bar is set low, as more and more

companies manage to beat forecasts and improve their outlook,

investors are thinking that "this is the trough and going forward

we will see an improvement."

Movers and shakers: On Tuesday, both the S&P and the Nasdaq

as the broader market retreated after disappointing quarterly

results from Netflix Inc.(NFLX). The online-streaming service sank

13% for its worst percentage drop in a single day since October

2014. Wednesday morning, Netflix was up 2.1%.

On a more upbeat note in the earnings season, shares of

Microsoft jumped 6.2% after the software giant's earnings released

late Tuesday beat analyst forecasts

(http://www.marketwatch.com/story/microsoft-quarterly-profit-beats-expectations-2016-07-19).

The company also said its cloud and productivity businesses posted

revenue growth, even as overall sales fell.

In notable earnings on Wednesday, Morgan Stanley rose 2.1% after

reporting earnings and revenue that beat Wall Street's expectations

(http://www.marketwatch.com/story/morgan-stanley-profit-and-revenue-fall-2016-07-20).

The report comes after Goldman Sachs Group

(http://www.marketwatch.com/story/goldman-sachs-stock-turns-lower-analyst-sees-reason-to-be-less-bullish-2016-07-19)

Inc. (GS), J.P. Morgan Chase & Co

(http://www.marketwatch.com/story/jp-morgan-profit-falls-but-beats-estimates-2016-07-14-114851746).(JPM)

and Citigroup Inc

(http://www.marketwatch.com/story/citigroup-profit-drops-but-beats-expectations-2016-07-15-8485346).(C)

also all beat on earnings for the second quarter.

Oil-field-services company Halliburton Co.(HAL) shares fell 2%

after the company said it swung to a second-quarter loss of $3.21

billion, but still beat analyst forecasts

(http://www.marketwatch.com/story/halliburton-results-beat-expectations-sees-turn-in-north-america-market-2016-07-20).

Homeware-products maker Tupperware Brands Corp.(TUP) jumped 6.7%

after the company beat profit views, but cut its outlook

(http://www.marketwatch.com/story/tupperware-beats-profit-views-but-cuts-outlook-2016-07-20).

Intel Corp.(INTC), American Express Co.(AXP) and eBay Inc.(EBAY)

are among companies reporting after the bell.

There are no Federal Reserve speakers or major economic data on

tap for Wednesday.

Other markets: Asian markets closed mixed, with Japan's Nikkei

225 index breaking a six-session winning streak

(http://www.marketwatch.com/story/nikkei-rally-stalls-as-asian-markets-mixed-2016-07-20).

European stocks (European%20stocks) were near a one-month high,

helped by some upbeat corporate updates.

(END) Dow Jones Newswires

July 20, 2016 11:46 ET (15:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

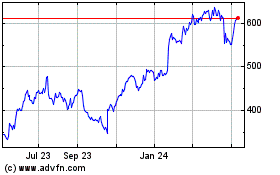

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

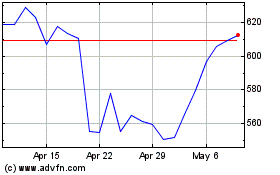

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024