Unilever Gets More Than a Name in Dollar Shave Club

July 20 2016 - 8:20AM

Dow Jones News

LONDON—Unilever PLC's $1 billion deal to buy Dollar Shave Club

is the consumer-goods giant's latest effort to get a leg up on

rivals in the fight for customer data.

Dollar Shave Club's direct-to-consumer model—through which it

sells disposable razors and other grooming products to 3.2 million

members—will give Unilever "unique consumer and data insights,"

said Kees Kruythoff, Unilever's North America president, in the

company's deal announcement early Wednesday.

The acquisition gives Unilever a foothold in the U.S. shaving

market, where Dollar Shave Club has been stealing share from

Procter & Gamble Co. unit Gillette. That trend could accelerate

under Unilever's deep-pocketed ownership. It is also in line with

Unilever Chief Executive Paul Polman's strategy to shift Unilever

toward home and personal-care products and away from slow-growing

foods.

More important, Unilever's decision to buy the unprofitable

Venice, Calif., startup gives it further ammunition in the war to

harness a burgeoning wave of online data. Companies have been

mining customer data online for years, but the race to better

understand shoppers has heated up as executives grapple with

quickening change. Unilever is facing a growth threat from

Amazon.com Inc., which has been expanding in traditional Unilever

strongholds such as laundry detergents and tea, as well as with a

host of local startups.

In response, Unilever is getting smarter.

The company collects data on 100 million people, allowing it to

target products or advertising specifically for them. It listens to

about 200,000 conversations by scraping the internet.

Unilever has test-launched an online portal in India connecting

shoppers with the plethora of small, physical stores that carry

products from Unilever and others.

Unilever runs the site, Humarashop, but local stores fulfill and

deliver orders. By playing middleman—often for products that aren't

even its own—Unilever gets access to customer data it then uses to

refine the promotions it lists on Humarashop.

E-commerce currently makes up just 1% of Unilever's global

sales, but grew 50% last year.

Gathering local customer insights helps Unilever stay relevant

in various regions, said Alan Jope, Unilever's president of

personal care, at a June conference. "We're increasingly capturing

huge amounts of information about what really matters to our

consumers and feeding these insights virtually and real time to our

global and local marketing teams," he said.

After online data collection helped it deduce that 2016 was

going to be the year of the "messy bun"—a hairstyle in which women

messily pile hair atop their heads—Unilever embarked on a

guerrilla-marketing campaign, paying or helping bloggers to create

video tutorials on how to create the look. The bloggers

incidentally used an array of Unilever products, such as TRESemmé

hair spray and Dove dry shampoo.

In an interview earlier this year, Stan Sthanunathan, Unilever's

senior vice president of consumer and market insights, said the

company looks for "the words that bubble up to the top" on Google

and for things that have "substantial volume." Unilever likes

analyzing customer conversations online because it gets less

contrived responses, he added.

Unilever noticed that people discussed dandruff more in the

winter, leading the company to put more money into advertising its

"Clear" range of products during the season.

Trawling through customer data also helped Unilever decide to

advertise ice cream brands such as Magnum before it rains. The

Anglo-Dutch company discovered that on rainy days in the U.K.,

people like to stay at home, eat ice cream and watch movies.

Changing the timing of its ads has helped sales, it said.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 20, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

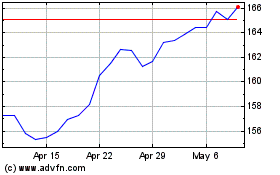

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

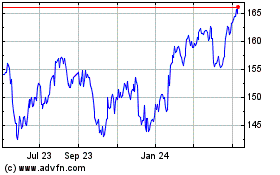

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024