Beasley Broadcast Group, Inc. (Nasdaq:BBGI) (“the Company” or

“Beasley”), a large- and mid-size market radio broadcaster, and

Greater Media, Inc. (“Greater Media”) today announced that they

have entered into a definitive agreement pursuant to which Beasley

will acquire all of the outstanding stock of Greater Media for an

aggregate consideration of approximately $240 million, subject to

adjustments. Under the terms of the agreement, Greater

Media shareholders are expected to receive approximately $100

million in cash and approximately $25 million in shares of the

Company’s Class A common stock (at a fixed value of $4.61 per

share). In addition, the shareholders of Greater Media will

receive the net cash proceeds from the sale of its tower assets,

estimated to be approximately $20 million. Beasley will

refinance approximately $80 million of debt of Greater Media.

In connection with the acquisition, Beasley will initially

acquire 21 radio stations in seven markets including four new

markets (Detroit, MI; Middlesex, NJ; Monmouth, NJ; and, Morristown,

NJ) and three markets where the Company has existing operations

(Philadelphia, PA; Boston, MA; and, Charlotte, NC).

Excluding transaction costs, the transaction is

expected to be accretive to Beasley’s operating results immediately

upon closing (inclusive of expected financial and operating

synergies and the planned divestiture of certain stations).

Beasley intends to fund the acquisition through borrowings under a

new credit facility that Beasley expects to enter into in

connection with the closing of the acquisition, together with cash

and cash equivalents available to the Company and the issuance of

Class A common stock as described above. RBC Capital Markets

and U.S. Bank have provided committed financing in support of the

acquisition.

The acquisition of Greater Media is expected to

significantly broaden Beasley’s local radio broadcasting and

digital platform, scale and revenue base by adding stations that

are geographically complementary to the Company’s operating base

while presenting the opportunity for significant financial and

operating synergies with its existing station portfolio and digital

operations. Upon closing, Beasley’s portfolio of stations

that it owns and operates (prior to planned divestitures) is

expected to expand to 73 stations (52 FM and 21 AM) in 16

markets. Giving effect to the transaction on a pro forma

basis as of December 31, 2015, Beasley’s net revenue would have

increased from approximately $106 million to approximately $247

million. Beasley intends to divest certain radio stations in

Charlotte, NC to obtain FCC approval of the proposed

transaction.

Caroline Beasley, Interim Chief Executive

Officer & Chief Financial Officer of Beasley Broadcast Group,

commented, “The acquisition of Greater Media’s broadcasting and

related digital assets represents a transformational growth

opportunity for Beasley and is strategically and financially

compelling for our shareholders. The transaction increases

our broadcast portfolio by approximately 40% and more than doubles

our audience reach, giving us both market leading stations and

great brands.

“Throughout Beasley Broadcast Group’s 55-year

history, we have actively managed our station portfolio with the

goal of providing our local communities with great entertainment

and critical information, diversifying our operations, managing

risk and improving financial results. Similarly, Greater

Media and the Bordes family have a 60-year track record of serving

local communities and developing new technology and services to

improve media communications. A focus on strong core

programming and targeted localism has been the foundation of both

companies’ operating philosophies, ratings strength and market

leadership. As such, we intend to implement our proven

strategy of focusing on local programming and effective digital

media marketing solutions across the two companies as well as best

practices from our existing operations with those from Greater

Media.”

Greater Media Chairman and Chief Executive

Officer Peter H. Smyth commented, “We share with Beasley a common

appreciation for the enduring strength of local radio broadcasting

and we are delighted that our stations will become part of

Beasley’s expanded footprint. As part of the Beasley

portfolio, we believe our stations will be positioned extremely

well for future growth and that our team members, customers and the

communities we serve will continue to thrive.

“Our employees have provided the skills and

talent necessary to drive our ongoing growth and success over the

years and we are proud of this heritage. I am thankful for

their hard work and dedication and am confident they will continue

to make many valuable contributions as part of a larger

organization. I look forward to working with the Beasley team to

bring our companies together to realize the power of this

compelling combination and ensure a smooth transition.”

The transaction, which has been approved by the

boards of directors of both Beasley and Greater Media, is subject

to FCC approval and other regulatory approvals (including the

termination or expiration of the applicable Hart-Scott-Rodino

waiting period) and other customary closing conditions.

Upon completion of the transaction, expected in

the fourth quarter of 2016, Beasley shareholders and Greater Media

shareholders will hold approximately 81% and 19%, respectively, of

Beasley’s outstanding shares. In addition, Greater Media

shareholders will have the right to appoint one member to the

Beasley Board of Directors which will expand the size of the Board

to nine members.

RBC Capital Markets is acting as financial

advisor to Beasley Broadcast Group and Latham & Watkins LLP is

acting as its legal counsel. Rockdale Partners is acting as

financial advisor to Greater Media and Debevoise & Plimpton LLP

is acting as its legal counsel.

About Beasley Broadcast

GroupCelebrating its 55th anniversary this year, Beasley

Broadcast Group, Inc., (www.bbgi.com) was founded in 1961 by George

G. Beasley who remains the Company’s Chairman and Chief Executive

Officer. Today, Beasley Broadcast Group owns and operates 52

stations (34 FM and 18 AM) in twelve large- and mid-size markets in

the United States.

About Greater MediaGreater

Media celebrated its 60th Anniversary in broadcasting on March 31,

2016. Owned by the Bordes family, the Company was founded in 1956

by Yale classmates Peter A. Bordes and Joseph Rosenmiller and grew

to become one of the premiere privately-held broadcast companies in

America. From the ownership of a single radio station in

Southbridge, Massachusetts, Greater Media built a diversified

portfolio of successful communications companies.

Important Additional

Information

Beasley will file an Information Statement and

other relevant documents concerning the proposed transaction and

related matters with the Securities and Exchange Commission

(“SEC”). The Information Statement and other materials filed with

the SEC will contain important information regarding the

transaction and the issuance of Beasley’s Class A common stock in

connection with the transaction. SHAREHOLDERS ARE ENCOURAGED TO

READ THE INFORMATION STATEMENT AND OTHER MATERIALS THAT THE COMPANY

FILES WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE ISSUANCE

OF THE SHARES OF CLASS A COMMON STOCK IN THE TRANSACTION AND

RELATED MATTERS. You will be able to obtain the Information

Statement, as well as other filings containing information about

the Company, free of charge, at the website maintained by the SEC

at www.sec.gov. Copies of the proxy statement and other filings

made by the Company with the SEC can also be obtained, free of

charge, by directing a request to Beasley Broadcast Group, Inc.,

3033 Riviera Drive, Suite 200, Naples, Florida 34103, Attention:

Corporate Secretary.

Note Regarding Forward-Looking

Statements:This release contains

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements are based upon

current beliefs and expectations of the Company’s management and

are subject to known and unknown risks and uncertainties.

Words or expressions such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “estimates” “may,” “will,” “plans,”

“projects,” “could,” “should,” “would,” “seek,” “forecast,” or

other similar expressions help identify forward-looking statements.

Factors that could cause actual events to differ include, but are

not limited to:

- the risk that the transaction may not be completed;

- the ability of the Company to obtain debt financing for the

transaction;

- the ability to successfully combine the businesses of Beasley

and Greater Media;

- the ability of the Company to achieve the expected cost

savings, synergies and other benefits from the proposed transaction

within the expected time frames or at all;

- the incurrence of significant transaction and other related

fees and costs;

- the incurrence of unexpected costs, liabilities or delays

relating to the transaction;

- the risk that the public assigns a lower value to Greater

Media’s business than the value used in negotiating the terms of

the transaction;

- the effects of the transaction on the interests of the

Company’s current stockholders in the earnings, voting power and

market value of the Company;

- the risk that the transaction may not be accretive to the

Company’s current stockholders;

- the risk that the transaction may prevent the Company from

acting on future opportunities to enhance stockholder value;

- the impact of the issuance of the Class A common stock in

connection with the transaction;

- the risk that any goodwill or identifiable intangible assets

recorded due to the transaction could become impaired;

- the risk due to business uncertainties and contractual

restrictions while the transaction is pending that could disrupt

the Company’s business;

- the risk that a closing condition to the proposed transaction

may not be satisfied;

- the occurrence of any event, change or other circumstances that

could give rise to the termination of the transaction; and

- other economic, business, competitive, and regulatory factors

affecting the businesses of Beasley and Greater Media generally,

including those set forth in Beasley’s filings with the SEC,

including its annual reports on Form 10-K, quarterly reports on

Form 10-Q, current reports on Form 8-K, and other SEC filings.

Actual results, events and performance may

differ materially. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. The Company undertakes no obligation to release

publicly the result of any revisions to these forward-looking

statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

CONTACT:

B. Caroline Beasley, Interim Chief Executive

Officer & Chief Financial Officer

Beasley Broadcast Group, Inc.

239/263-5000

Joseph N. Jaffoni

JCIR

212/835-8500 or bbgi@jcir.com

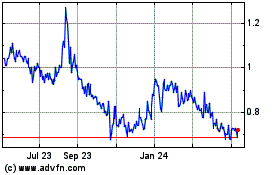

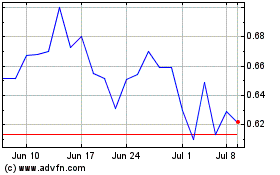

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Apr 2023 to Apr 2024