SAP SE 2Q 2016 -- Forecast

July 19 2016 - 6:32AM

Dow Jones News

FRANKFURT--The following is a summary of analysts' forecasts for

SAP SE (SAP) second-quarter results, based on a poll of 11 analysts

conducted by Dow Jones Newswires (figures in million euros, EPS,

dividend and target price in euro,

according to IFRS). Earnings figures are based on Non-IFRS and

scheduled to be released July 20.

===

Revenue Revenue

Total C & S Software CSS

2nd Quarter revenue (a) licenses (b)

AVERAGE 5,241 4,322 983 723

Prev. Year 4,972 4,065 979 555

+/- in % +5.4 +6.3 +0.4 +30

MEDIAN 5,265 4,313 979 722

Maximum 5,317 4,391 1,057 738

Minimum 5,109 4,236 941 713

Amount 10 11 11 11

Baader-Helvea 5,317 4,391 1,057 722

Bernstein 5,302 4,379 994 738

Bryan Garnier 5,137 4,236 941 713

Commerzbank -- 4,270 965 723

Deutsche Bank 5,109 4,236 975 718

DZ Bank 5,221 4,313 1,020 714

Haitong Research 5,294 4,359 979 722

Jefferies 5,297 4,362 1,008 721

Morgan Stanley 5,202 4,312 944 733

Pacific Crest 5,235 4,308 942 722

Warburg Research 5,299 4,376 991 730

Net

Operating Net attrib.

2nd Quarter profit income profit EPS

AVERAGE 1,443 1,051 1,046 0.87

Prev. Year 1,394 960 963 0.80

+/- in % +3.5 +9.5 +8.6 +8.9

MEDIAN 1,448 1,062 1,050 0.86

Maximum 1,538 1,070 1,070 0.91

Minimum 1,378 1,012 1,014 0.85

Amount 11 7 4 10

Baader-Helvea 1,463 -- -- 0.91

Bernstein 1,451 1,038 1,038 0.86

Bryan Garnier 1,397 1,062 1,062 0.86

Commerzbank 1,378 -- -- --

Deutsche Bank 1,421 -- -- 0.86

DZ Bank 1,400 1,070 1,070 0.86

Haitong Research 1,538 1,070 -- 0.89

Jefferies 1,479 1,012 1,014 0.85

Morgan Stanley 1,448 1,067 -- 0.89

Pacific Crest 1,450 1,039 -- 0.87

Warburg Research 1,445 -- -- 0.86

Target price Rating DPS 2016

AVERAGE 81.83 positive 7 AVERAGE 1.24

Prev. Quarter 82.00 neutral 1 Prev. Year 1.15

+/- in % -0.2 negative 1 +/- in % +7.8

MEDIAN 85.00 MEDIAN 1.20

Maximum 94.00 Maximum 1.40

Minimum 63.50 Minimum 1.10

Amount 9 Amount 5

Baader-Helvea 85.00 Buy 1.30

Bernstein 94.00 Outperform 1.10

Bryan Garnier 74.00 Neutral 1.20

Commerzbank 90.00 Buy 1.20

Credit Suisse 90.00 Outperform --

Deutsche Bank 80.00 Buy --

DZ Bank 74.00 Buy --

Jefferies 63.50 Underperform --

Warburg Research 86.00 Buy 1.40

===

Year-earlier figures are as reported by the company.

(a) Cloud & Software

(b) Cloud-subscriptions and -support

DJG/mus

(END) Dow Jones Newswires

July 19, 2016 06:17 ET (10:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

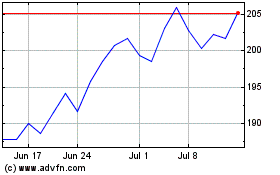

SAP (NYSE:SAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

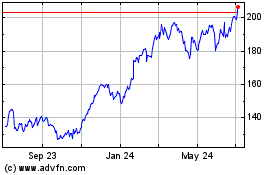

SAP (NYSE:SAP)

Historical Stock Chart

From Apr 2023 to Apr 2024