Clean Energy Fuels Corp. Retires 2016 Debt with Stock and Cash

July 15 2016 - 6:00AM

Business Wire

Clean Energy Fuels Corp., (NASDAQ: CLNE) announced today that it

issued 14.0 million shares of common stock and paid an aggregate of

$37.9 million in cash, plus $0.2 million for accrued and unpaid

interest, in exchange for all of its outstanding 7.5% Convertible

Notes due in August 2016 (the “2016 Notes”), which totaled $85.2

million in principal and accrued and unpaid interest. No amounts

remain due and owing under the 2016 Notes and all 2016 Notes have

been terminated and cancelled in full.

Clean Energy had approximately $182.0 million in cash and

short-term investments as of June 30, 2016.

“We have achieved several significant milestones in the last six

months, including retiring all the 2016 Notes, repurchasing over

$65 million of the 5.25% Convertible Notes due 2018, cutting

capital expenditures and reporting improved financial results,”

said Andrew J. Littlefair, president and CEO of Clean Energy. “We

completed the build-out of the initial phase of our America’s

Natural Gas Highway and will continue to focus on leveraging our

existing infrastructure with new customers and expanding with our

existing customers. I’m proud that the Clean Energy team has been

able to accomplish so much despite the competitive environment of

low oil prices the last few years. I remain optimistic about the

future as more and more fleets are realizing the environmental and

cost benefits of natural gas fuel.”

Clean Energy has North America’s most robust network of natural

gas fueling with over 550 public and private stations including 212

compressed natural gas (CNG) and liquefied natural gas (LNG) public

stations that make up its America’s Natural Gas Highway for heavy

duty trucks. The company anticipates completing over 60 additional

station projects before the end of the year.

About Clean Energy

Clean Energy Fuels Corp. (Nasdaq: CLNE) is the leading provider

of natural gas fuel for transportation in North America. We build

and operate CNG and LNG fueling stations; manufacture CNG and LNG

equipment and technologies for ourselves and other companies;

develop renewable natural gas (RNG) production facilities; and

deliver more CNG and LNG fuel than any other company in the U.S.

Clean Energy also sells Redeem™ RNG fuel and believes it is the

cleanest transportation fuel commercially available, reducing

greenhouse gas emissions by up to 90%. For more information,

visit www.CleanEnergyFuels.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 that

involve risks, uncertainties and assumptions, such as statements

regarding, among other things: adoption of natural gas as a vehicle

fuel in multiple transportation markets; continued interest and

investment in natural gas as a vehicle fuel; the benefits of

natural gas relative to gasoline, diesel and other vehicle fuels,

including economic and environmental benefits; and the Company’s

ability to successfully enter new markets and more deeply penetrate

its current key markets, build, sell and open new natural gas

fueling stations and add incremental volume to its gallons

delivered, and future growth and sales opportunities in all of the

Company’s key customer markets, which include trucking, refuse,

airports, public transit, industrial and institutional energy users

and government fleets. Actual results and the timing of events

could differ materially from those anticipated in these

forward-looking statements as a result of several factors

including, among others: future supply, demand, use and prices of

crude oil and natural gas and fossil and alternative fuels,

including gasoline, diesel, natural gas, renewable natural gas,

biodiesel, ethanol, electricity and hydrogen, as well as vehicles

powered by these various fuels; the Company’s ability to recognize

the anticipated benefits of building CNG and LNG stations; future

availability of capital, including equity or debt financing, as

needed to fund the growth of the Company’s business and its debt

repayment obligations (whether at or prior to maturity); the

availability of tax credits and other government incentives for

natural gas fueling and vehicles; changes to federal, state or

local fuel emission standards or other environmental regulation

applicable to natural gas production, transportation or use; the

Company’s ability to compete successfully; the

Company’s ability to manage risks and uncertainties related to

its international operations; construction, permitting and other

factors that could cause delays or other problems at station

construction projects; compliance with governmental regulations;

and the Company’s ability to effectively manage and grow its RNG

business. The forward-looking statements made herein speak only as

of the date of this press release and the Company undertakes no

obligation to update publicly such forward-looking statements to

reflect subsequent events or circumstances, except as otherwise

required by law. Additionally, the Company’s Annual Report on Form

10-K filed on March 3, 2016 and its Quarterly Report on

Form 10-Q filed on May 5, 2016 with the Securities and

Exchange Commission (www.sec.gov), contain more information on

potential factors that may cause actual results to differ

materially from the forward-looking statements contained in this

press release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160715005152/en/

Clean Energy Fuels Corp.Media:Jason A. Johnston,

949-437-1411jason.johnston@cleanenergyfuels.comorInvestors:Tony

Kritzer, 949-437-1403tkritzer@cleanenergyfuels.com

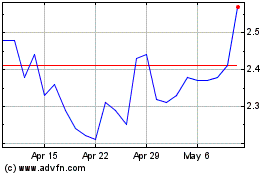

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

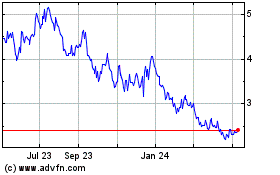

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Apr 2023 to Apr 2024