Registration of Securities of Successor Issuers (8-k12g3)

July 14 2016 - 5:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June

30, 2016

CANTERBURY

PARK HOLDING CORPORATION

(Exact name of registrant as specified in charter)

|

Minnesota

|

001-31569

|

41-1775532

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

1100 Canterbury Road

Shakopee, Minnesota 55379

(Address, including zip code, of principal executive

offices)

Registrant's telephone number, including area code:

(952)

445-7223

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Introduction

On June 30, 2016, Canterbury Park Holding Corporation (the “Company”),

completed its previously announced reorganization of the Company’s business into a holding company structure pursuant to

an Agreement and Plan of Merger dated as of March 1, 2016 (the “

Reorganization Agreement

”), among the Company,

New Canterbury Park Holding Corporation, a recently formed wholly owned subsidiary of the Company (herein, for purposes of this

filing, “NewHoldingCo”) and Canterbury Entertainment LLC (“EntertainmentCo”), a wholly-owned subsidiary

of NewHoldingCo. The Reorganization Agreement provided for the merger (“Merger”) of the Company with and into EntertainmentCo

with EntertainmentCo surviving the Merger as a wholly owned subsidiary of NewHoldingCo, and the automatic conversion of each share

of common stock, par value $0.01 per share, of the Company issued and outstanding immediately prior to the effective time of the

Merger (“Company Common Stock”), into one duly issued, fully paid and non-assessable share of common stock, par value

$0.01 per share, of NewHoldingCo (“NewHoldingCo Common Stock”) (collectively with the other transactions contemplated

by the Reorganization Agreement, the “

Reorganization

”). In addition, each outstanding option to purchase or

other right to acquire shares of Company common stock automatically converted into an option to purchase or right to acquire, upon

the same terms and conditions, an identical number of shares of NewHoldingCo Common Stock. As a result of the Reorganization, NewHoldingCo

replaced the Company as the public company that was collectively owned by the Company’s shareholders prior to the Merger.

Also, pursuant to the Reorganization Agreement, the name of NewHoldingCo was changed to Canterbury Park Holding Corporation. The

Reorganization was approved by the Company’s shareholders at its Annual Meeting of Shareholders held on June 28, 2016.

The foregoing description of the Reorganization is not complete and is qualified

in its entirety by reference to the Reorganization Agreement, which was supplied as Exhibit A to Company’s definitive proxy

statement/prospectus filed with the Commission on May 27, 2016 and is incorporated herein by reference as Exhibit 2.1 hereto.

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

In connection with the completion of the Reorganization,

on June 29, 2016, the Company notified the NASDAQ Stock Market (“

NASDAQ

”) that each issued and outstanding share

of Company Stock would be converted into one share of NewHoldingCo Common Stock and the Company requested that NASDAQ (i) suspend

trading of the Company Common Stock on June 30, 2016, and (ii) commence trading of NewHoldingCo Common Stock, as of the open of

business on Friday, July 1, 2016. As of the open of business on July 1, 2016, NASDAQ had suspended trading of the Company Common

Stock and shares of NewHoldingCo Common Stock commenced trading on the NASDAQ Global Market under the symbol “CPHC”,

which was the symbol used by the Company prior to the Reorganization. Each outstanding certificate of the Company that, immediately

prior to the Reorganization, evidenced shares of Company Common Stock will be deemed and treated for all corporate purposes to

evidence the ownership of the same number of shares of NewHoldingCo Common Stock until such certificate is thereafter surrendered

for transfer or exchange in the ordinary course.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Pursuant to the Reorganization Agreement, the directors and principal executive

officers of NewHoldingCo are the same individuals who were directors and principal executive officers of the Company immediately

prior to the Reorganization.

NewHoldingCo has adopted the Company’s Stock

Plan and Employee Stock Purchase Plan as its Stock Plan and Employee Stock Purchase Plan, has assumed all stock options and other

equity awards granted under said Plans as described in the Reorganization Agreement, and has filed post-effective amendments adopting

the S-8 Registration Statements related to said Plans.

As of July 1, 2016, NewHoldingCo Common Stock is

deemed to be registered under Section 12(b) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12g-3(a)

promulgated thereunder. For purposes of Rule 12g-3(a), NewHoldingCo is the successor issuer to the Company. As a result, effective

as of July 1, 2016, future filings with the Securities and Exchange Commission will be filed by NewHoldingCo under CIK No. 0001672909.

On July 1, 2016, the Company issued a press release

relating to the consummation of the Reorganization. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits.

|

Exhibit No.

|

Description

|

|

|

|

|

2.1

|

Agreement and Plan of Merger, dated March 1, 2016, among Canterbury Park Holding Corporation, a Minnesota corporation, New Canterbury Park Holding Corporation, a Minnesota corporation, Canterbury Park Entertainment LLC, a Minnesota limited liability corporation. (Incorporated by reference to Exhibit 2.1 to the Registration Statement on Form S-4 (File No. 333-210877) filed with the SEC on April 22, 2016.)

|

|

99.1

|

Press Release, dated July 1, 2016.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CANTERBURY PARK HOLDING CORPORATION

|

|

|

|

|

|

|

|

Date: July 1, 2016

|

By:

|

/s/ Randall D. Sampson

|

|

|

|

Randall D. Sampson, President and Chief

|

|

|

|

Executive Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

|

|

2.1

|

Agreement and Plan of Merger, dated March 1, 2016, among Canterbury Park Holding Corporation, a Minnesota corporation, New Canterbury Park Holding Corporation, a Minnesota corporation, Canterbury Park Entertainment LLC, a Minnesota limited liability corporation. (Incorporated by reference to Exhibit 2.1 to the Registration Statement on Form S-4 (File No. 333-210877) filed with the SEC on April 22, 2016.)

|

|

99.1

|

Press Release, dated July 1, 2016.

|

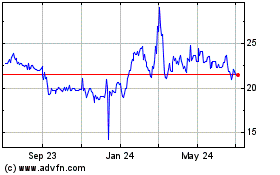

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

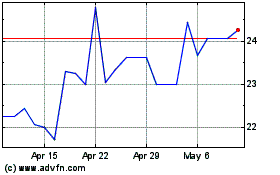

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024