Horizon Bancorp (NASDAQ: HBNC) (“Horizon”) and CNB Bancorp today

announced they have executed a definitive merger agreement (the

“Merger Agreement”) pursuant to which Horizon will acquire CNB

Bancorp, parent company of The Central National Bank and Trust

Company (“Central National Bank & Trust”).

Under the terms of the Merger Agreement, stockholders of CNB

Bancorp will receive cash consideration consisting of a special

dividend (calculated as capital in excess of 8% of CNB Bancorp’s

total assets, less certain after tax transaction costs, all as

described in the Merger Agreement) and an amount to be paid by

Horizon equal to 120% of remaining capital. These amounts will be

determined as of the end of the month prior to the closing of the

merger. These amounts are dependent on CNB Bancorp’s earnings and

other factors, but if the cash consideration for the stockholders

were calculated as of March 31, 2016, the stockholders would

receive, in the aggregate, a $6.7 million special dividend and a

$5.3 million payment from Horizon.

CNB Bancorp is headquartered in Attica, Indiana, and through its

wholly-owned subsidiary Central National Bank & Trust, which

was established in 1887, serves the greater Attica area with one

full-service banking location and one drive-up location. As of

March 31, 2016, CNB Bancorp had total assets of approximately $55.3

million.

Horizon Bancorp is a community bank holding company

headquartered in Michigan City, Indiana with total assets of $2.6

billion as of March 31, 2016. Horizon Bancorp’s wholly-owned

subsidiary, Horizon Bank, NA (“Horizon Bank”), still operates under

its original charter, dating back to 1873, with fifty offices

extending throughout northern and central Indiana and southwestern

and central Michigan.

“We are enthusiastic about this merger, as it is consistent with

Horizon’s philosophy of partnering with banks that hold core values

similar to ours and a commitment to serving their local

communities,” said Horizon’s Chairman and Chief Executive Officer,

Craig M. Dwight. “Horizon will add value to Central National Bank

& Trust’s customer base through our extensive product and

service offerings and on-line banking services.”

Dwight further explained, “This merger provides an excellent

complement for Horizon to fill in the gap between our branch

locations in northern and central Indiana. We believe increasing

our presence in this region will provide Horizon with growth

opportunities and the ability to attract and retain seasoned

bankers, which are key components to our future success.”

William C. McAdams, Chief Executive Officer of Central National

Bank & Trust stated, “We are pleased with the opportunity to

partner with the Horizon Bank family and the increased

opportunities this provides our customers, employees and the

community we serve. Horizon’s demonstrated commitment to preserve

true community banking, which means local decision-making,

retention of local staff, commitment to community involvement, and

personal one-on-one service, will be keys to our joint and future

success. In addition, we are excited about Horizon’s ability to

offer mobile and internet banking services to our customer base and

higher lending limits to help us serve the business and

agricultural communities.”

In keeping with Horizon’s closely held belief to hire and retain

local talent, Horizon will name Sherri McGraw, Senior Vice

President, Central National Bank & Trust, as Horizon’s Market

President. “I am very excited about our merger with Horizon and all

of the new opportunities it will bring to the community, and I want

to assure our customers that I will be here to personally serve

them and all of their banking needs,” commented Sherri McGraw.

The merger is expected to close in the fourth quarter of 2016,

subject to approval by bank regulatory authorities and the

shareholders of CNB Bancorp, as well as the satisfaction of other

customary closing conditions. Central National Bank & Trust

will be merged with and into Horizon Bank, and the combined

operations will be continued under the Horizon Bank name.

Following the merger, and after the data processing and systems

conversion is complete, the customers of Central National Bank

& Trust will be able to access the product and service line-up

offered by Horizon Bank. “The depth of offerings we will be able to

provide after our banks become one is tremendous. Services like

mobile banking, remote check deposit, expanded agriculture and

mortgage loan products, cash management services for businesses and

investment services for both businesses and individuals – just to

name a few – will be fantastic additions to the personal service we

already provide our customers,” continued McAdams.

Horizon Bancorp was advised by the law firm of Barnes &

Thornburg LLP. CNB Bancorp was advised by the law firm of

SmithAmundsen, LLC and the investment banking firm Renninger &

Associates, LLC.

About Horizon Bancorp

Horizon Bancorp is a locally owned, independent, commercial bank

holding company serving northern and central Indiana and

southwestern and central Michigan through its commercial banking

subsidiary Horizon Bank, NA. Horizon also offers mortgage-banking

services throughout the Midwest. Horizon Bancorp may be reached

online at www.horizonbank.com. Its

common stock is traded on the NASDAQ Global Select Market under the

symbol HBNC.

About CNB Bancorp

CNB Bancorp is an Indiana corporation headquartered in Attica,

Indiana with The Central National Bank and Trust Company as its

wholly owned subsidiary. The Central National Bank and Trust

Company was founded in 1887 and offers banking services from its

full service office and drive-up facilities in Attica, Indiana. The

Central National Bank and Trust Company may be reached online at

www.centralnationalbankismybank.com

Forward Looking Statements

This press release may contain forward-looking statements

regarding the financial performance, business prospects, growth and

operating strategies of Horizon. For these statements, Horizon

claims the protections of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995. Statements in this press release should be considered

in conjunction with the other information available about Horizon,

including the information in the filings we make with the

Securities and Exchange Commission. Forward-looking statements

provide current expectations or forecasts of future events and are

not guarantees of future performance. The forward-looking

statements are based on management’s expectations and are subject

to a number of risks and uncertainties. We have tried, wherever

possible, to identify such statements by using words such as

“anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,”

“will” and similar expressions in connection with any discussion of

future operating or financial performance.

Although management believes that the expectations reflected in

such forward-looking statements are reasonable, actual results may

differ materially from those expressed or implied in such

statements. Risks and uncertainties that could cause actual results

to differ materially include risk factors relating to the banking

industry and the other factors detailed from time to time in

Horizon’s reports filed with the Securities and Exchange

Commission, including those described in “Item 1A Risk Factors” of

Part I of Horizon’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2015. Undue reliance should not be placed on the

forward-looking statements, which speak only as of the date hereof.

Horizon does not undertake, and specifically disclaims any

obligation, to publicly release the result of any revisions that

may be made to update any forward-looking statement to reflect the

events or circumstances after the date on which the forward-looking

statement is made, or reflect the occurrence of unanticipated

events, except to the extent required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160712006662/en/

Horizon:Craig M. DwightChairman and Chief Executive

OfficerPhone: (219) 873-2725Fax: (219) 874-9280orMark E. SecorChief

Financial OfficerPhone: (219) 873-2611Fax: (219) 874-9280orCNB

Bancorp:William C. McAdamsChief Executive OfficerPhone: (765)

762-2414orSherri L. McGrawSenior Vice PresidentPhone: (765)

762-2414

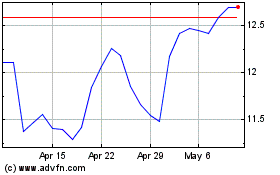

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

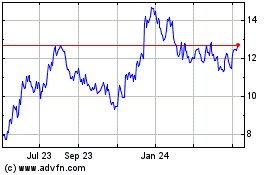

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024