Current Report Filing (8-k)

July 12 2016 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 7, 2016

PARAMOUNT GOLD NEVADA CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

001-36908

|

|

98-0138393

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

665 Anderson Street

Winnemucca, Nevada

89445

(Address of Principal Executive Offices)

(775) 625-3600

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.01

Completion of Acquisition or Disposition of Assets.

As previously announced on March 14, 2016, Paramount Gold Nevada Corp. (“Paramount”) and Calico Resources Corp. (“Calico”) entered into an Arrangement Agreement (the “Agreement”) providing for the acquisition of Calico by Paramount (the “Transaction”). On July 7, 2016, pursuant to the terms and conditions of the Agreement, Calico became a wholly-owned subsidiary of Paramount.

Arrangement Agreement

On July 7, 2016, Paramount and Calico completed the transaction contemplated by the Agreement, pursuant to which Calico became a wholly-owned subsidiary of Paramount. Pursuant to the Agreement, at the effective time, each issued and outstanding share of Calico common share, no par value per share, was converted into the right to receive 0.07 of a share of common stock of Paramount, par value $0.01 per share. No cash or other compensation will be paid for fractional shares. Paramount issued approximately 7.2 million shares of Paramount common stock as consideration in the transaction. Based on the closing price of Paramount common stock on July 6, 2016 as reported on the New York Stock Exchange MKT, the aggregate value of the consideration paid or payable to former holders of Calico’s common shares is approximately $15.2 million.

The requisite approval of the Plan of Arrangement by the Calico shareholders was obtained at annual and special meeting of the Calico shareholders held on June 29, 2016. On July 5, 2016, a final order (the “Final Order”) was entered by the Supreme Court of British Columbia (the “Court”) in connection with the Plan of Arrangement (Vancouver Registry No. S-105075).

Additional information regarding the transaction may be found in the press release issued by Paramount in connection with the announcement of the completion of the transaction, which is filed as Exhibit 99.3 to this Current Report on Form 8-K and incorporated herein by reference.

The foregoing description of the Agreement and the Transaction contemplated by the Agreement does no purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the Agreement, which was previously filed with the Securities and Exchange Commission (the “SEC”) as exhibit 2.1 to Paramount’s Current Report on Form 8-K dated March 17, 2016 and is incorporated by reference as Exhibit 2.1 to this Current Report on 8-K.

Item 3.02.

Unregistered Sales of Equity Securities

As described in Item 2.01 of this Current Report on Form 8-K, on July 7, 2016, Paramount issued approximately 7.2 million shares of its common stock to the holders of common shares of Calico. The issuance of the Paramount common stock is exempt from registration under Section 3(a)(10) of the Securities Act of 1933, as amended (“the Securities Act”). Section 3(a)(10) of the Securities Act exempts the issuance of securities issued in exchange for one or more bona fide outstanding securities, or partly in such exchange and partly for cash, from the registration requirements of the Securities Act where the terms and conditions of such issuance and exchange have been approved by a court of competent jurisdiction, after a hearing upon the fairness of the terms and conditions of such issuance and exchange at which all persons to whom the securities will be issued have the right to appear and receive timely notice thereof. On July 5, 2016, the Court issued the Final Order.

The information disclosed under Item 2.01 of this Current Report on Form 8-K is incorporated into this Item 3.02 in its entirety.

Item 9.01.

Financial Statem

ents and Exhibits.

(a)

The audited financial statements of Calico as at and for the fiscal years ended June 30, 2015 and 2014 and the unaudited interim financial statements of Calico as at and for the nine month periods ended March 31, 2016 and 2015 are included as Exhibit 99.1 hereto and incorporated herein by reference.

(b)

The unaudited pro forma condensed combined balance sheet of Paramount and Calico as of March 31, 2016 and the unaudited pro forma condensed combined statements of operations of Paramount and Calico for the nine months ended March 31, 2016, and for the year ended June 30, 2015 are included as Exhibit 99.2 hereto and incorporated herein by reference.

(d)

List of Exhibits

|

Exhibit

Number

|

|

Description

|

|

|

|

|

2

|

Exhibit 2.1

|

|

Arrangement Agreement and Plan of Arrangement dated March 14, 2016, among Paramount Gold Nevada Corp. and Calico Resources Corp. (incorporated by reference to Exhibit 2.1 to the registrant’s Current Report on Form 8-K on March 17, 2016).

|

|

Exhibit 99.1*

|

|

Audited financial statements of Calico as at and for the fiscal years ended June 30, 2015 and 2014 and the unaudited interim financial statements of Calico as at and for the nine month period ended March 31, 2016 and 2015.

|

|

Exhibit 99.2*

|

|

Unaudited pro forma

condensed combined balance sheet of Paramount and Calico as of March 31, 2016 and the unaudited pro forma condensed combined statements of operations of Paramount and Calico for the nine months ended March 31, 2016, and for the year ended June 30, 2015.

|

|

Exhibit 99.3*

|

|

Press Release of Paramount dated July 7, 2016.

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

PARAMOUNT GOLD NEVADA CORP.

|

|

|

|

|

|

|

Date: July 12, 2016

|

|

By:

|

/s/ Carlo Buffone

|

|

|

|

|

Carlo Buffone

|

|

|

|

|

Chief Financial Officer

|

4

Exhibit Index

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

Exhibit 2.1

|

|

Arrangement Agreement and Plan of Arrangement dated March 14, 2016, among Paramount Gold Nevada Corp. and Calico Resources Corp. (incorporated by reference to Exhibit 2.1 to the registrant’s Current Report on Form 8-K filed on March 17, 2016)

|

|

Exhibit 99.1*

|

|

Audited financial statements of Calico as at and for the fiscal years ended June 30, 2015 and 2014 and the unaudited interim financial statements of Calico as at and for the nine month period ended March 31, 2016 and 2015.

|

|

Exhibit 99.2*

|

|

Unaudited pro forma

condensed combined balance sheet of Paramount and Calico as of March 31, 2016 and the unaudited pro forma condensed combined statements of operations of Paramount and Calico for the nine months ended March 31, 2016, and for the year ended June 30, 2015.

|

|

Exhibit 99.3*

|

|

Press Release of Paramount dated July 7, 2016.

|

*

Filed herewith

5

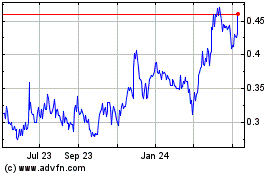

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Apr 2023 to Apr 2024