Current Report Filing (8-k)

July 12 2016 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 6, 2016

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33958

|

|

20-8099512

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

2000 Crow Canyon Place, Suite 380,

San Ramon, CA 94583

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code: (855) 855-4253

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 3.02

|

Unregistered Sale of Equity Securities.

|

In connection with a negotiated settlement of

outstanding claims in a certain matter, Galena Biopharma, Inc. (“the Company”) agreed on July 6, 2016, to issue to 5 parties in a settlement a total of 3,125,000 shares of the Company’s common stock. The parties in the litigation

and settlement discussions were sophisticated persons represented by professional advisers. The Company issued the shares without registration in a private placement in reliance on the exemption provided by Section 4(a)(2) of the Securities Act

of 1933, as amended (the “Securities Act”), and in reliance on similar exemptions under applicable state laws.

In addition, as

previously disclosed, on December 3, 2015, the Company also agreed in principal to resolve and settle the securities putative class action lawsuit,

In re Galena Biopharma, Inc. Securities Litigation

, Civil Action

No. 3:14-cv-00367-SI, against the Company, certain of the Company’s current and former officers and directors and other defendants in the United States District Court for the District of Oregon. Following the hearing on June 23, 2016,

on June 24, 2016, the U.S. District Court for the District of Oregon entered a final order and partial judgment in

In re Galena Biopharma, Inc. Securities Litigation

, granting final approval of the settlement. On the same day, the Court

also issued an opinion and order awarding attorney’s fees of $4.5 million plus costs, which is paid out of the settlement funds. The agreement provides for a settlement payment of $20 million to the class and the dismissal of all claims against

the Company and the other defendants in connection with the consolidated federal securities class actions. Of the $20 million settlement payment to the class, $16.7 million was paid by the Company’s insurance carriers and $2.3 million in cash

was paid by the Company on July 1, 2016. Pursuant to the court order, the Company issued 480,053 shares of its common stock as part of the settlement on July 6, 2016 without registration in reliance on an exemption provided by

Section 3(a)(10) of the Securities Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: July 11, 2016

|

|

|

|

GALENA BIOPHARMA, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Thomas J. Knapp

|

|

|

|

|

|

|

|

Thomas J. Knapp

|

|

|

|

|

|

|

|

Interim General Counsel and Secretary

|

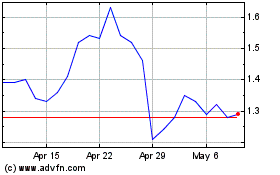

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

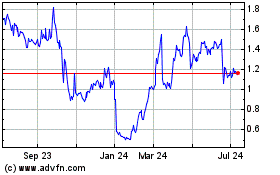

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024