Current Report Filing (8-k)

July 08 2016 - 5:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): July 1, 2016

ROYAL GOLD, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-13357

|

|

84-0835164

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

1660 Wynkoop Street, Suite 1000, Denver, CO

|

|

80202-1132

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code:

303-573-1660

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry

into a Material Definitive Agreement.

On July 1, 2016, Royal Gold, Inc. (the

“

Company

”) entered into an Indemnification Agreement (the “

Agreement

”) with Mark Isto, the

newly appointed Vice President Operations. The Indemnification Agreement provides that the Company will hold harmless

and indemnify Mr. Isto to the fullest extent authorized or permitted by law, even if such indemnification is not specifically authorized

by the other provisions of the Agreement, the certificate of incorporation, the Company’s bylaws or by statute. The

Agreement provides additional detail on the scope of the indemnification, the procedures for seeking indemnification and the methods

for determining entitlement to indemnification. The terms of the Agreement are described in the form of Amended and

Restated Indemnification Agreement, a copy of which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K

on September 4, 2014, and incorporated herein by reference.

Item 5.02. Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

On July 1, 2016, the Company entered into

employment agreements (“

Employment Agreements

”) with Tony Jensen, President and Chief Executive Officer; Karli

Anderson, Vice President Investor Relations; William Heissenbuttel, Vice President Corporate Development; Mark Isto, Vice President

Operations; Bruce C. Kirchhoff, Vice President, General Counsel and Secretary; and Stefan Wenger, Chief Financial Officer and Treasurer

(each, an “

Executive

”). The Employment Agreements became effective July 1, 2016, and supersede employment agreements

with each Executive that were due to expire on September 15, 2018 in accordance with their terms (the “

Prior Employment

Agreements

”), other than in the case of Mr. Isto, who was not previously party to an employment agreement with the Company.

The terms of the Prior Employment Agreements were described in the Company’s 2015 proxy statement, and copies of which were

filed as Exhibits 10.1 and 10.2 to the Company’s current report on Form 8-K filed on September 19, 2013. The Employment Agreements

are identical to the Prior Employment Agreements in all material respects, with the following exceptions:

|

|

·

|

Base Salaries

. The base salaries of Messrs. Jensen, Heissenbuttel, Wenger, and Kirchhoff, and Ms. Anderson, have increased to $700,000, $450,000, $425,000, $375,000, and $310,000, respectively. Base salaries may be increased annually as determined by the Compensation, Nominating and Governance Committee of the Board of Directors of the Company.

|

|

|

|

|

|

|

·

|

Bonus Opportunities

. Eligibility to receive discretionary cash incentive compensation, if any, requires the Executive to be actively employed by the Company on the last day of the fiscal year for which such incentive compensation is paid.

|

|

|

·

|

Long-Term Incentive Award Opportunities

. The Employment Agreements reference the Company’s 2015 Omnibus Long-Term Incentive Plan, which was approved by the Company’s shareholders at its most recent annual meeting in November 2015.

|

|

|

·

|

Termination by Executive for Good Reason

. The Employment Agreements require that, in order for the Executive to terminate employment and the Employment Agreement for Good Reason (as defined in the Employment Agreement), the Executive must give notice of the occurrence of one or more of the enumerated circumstances constituting Good Reason, such circumstances must not have been fully corrected within thirty days of such notice, and the Executive must actually terminate employment within sixty days following the expiration of a thirty day cure period.

|

Employment Agreement with Mark Isto, Vice President Operations

As previously reported on a Current Report on Form 8-K on June

2, 2016, the Company’s Board of Directors appointed Mark Isto as Vice President Operations of the Company effective July

1, 2016. On May 25, 2016, the Board approved an Employment Agreement between the Company and Mr. Isto, effective July 1, 2016,

the material terms of which include: (a) an annual base salary of $255,000; (b) eligibility to receive discretionary incentive

cash compensation in an amount determined by the Board of Directors or the Compensation, Nominating and Governance Committee in

accordance with the Company’s compensation policies and practices; and (c) eligibility to participate in the Company’s

2015 Omnibus Long-Term Incentive Plan in accordance with the Company’s compensation policies and practices. Mr. Isto is also

eligible to participate in the Company’s benefit and retirement plans.

There is no other arrangement or understanding

between Mr. Isto and any other persons pursuant to which he was elected as Vice President Operations of the Company. Mr. Isto

does not have a family relationship with any member of the Board of Directors or any executive officer of the Company, and Mr. Isto

has not been a participant or had any interest in any transaction with the Company that is reportable under Item 404(a) of

Regulation S-K.

The foregoing description of the Employment

Agreements is qualified in its entirety by reference to (a) the form of Employment Agreement by and between Royal Gold, Inc. and

Chief Executive Officer filed herewith as Exhibit 10.1, and (b) the form of Employment Agreement by and between Royal Gold, Inc.

and Executives filed herewith as Exhibit 10.2, each of which is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On July 8, 2016, the Company issued an update on its fiscal

2016 fourth quarter and announced its fiscal 2016 fourth quarter earnings call on August 11, 2016 at noon Eastern Daylight Time.

A copy of the press release is furnished as Exhibit 99.1 to

this Current Report on Form 8-K.

The information furnished under this Item 7.01, including the

exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it

be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by reference

to such filing.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Form of Employment Agreement by and between Royal Gold, Inc. and Chief Executive Officer.

|

|

10.2

99.1

|

|

Form of Employment Agreement by and between Royal Gold, Inc.

and Executives.

Press Release dated July 8, 2016 Providing an Update on Fiscal

2016 Fourth Quarter.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Royal Gold, Inc.

|

|

|

(Registrant)

|

|

|

|

|

|

Dated: July 8, 2016

|

By:

|

/s/ Bruce C. Kirchhoff

|

|

|

|

Name:

|

Bruce C. Kirchhoff

|

|

|

|

Title:

|

Vice President, General Counsel and Secretary

|

EXHIBIT INDEX

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Form of Employment Agreement by and between Royal Gold, Inc. and Chief Executive Officer.

|

|

10.2

99.1

|

|

Form of Employment Agreement by and between Royal Gold, Inc.

and Executives.

Press Release dated July 8, 2016 Providing an Update on Fiscal

2016 Fourth Quarter.

|

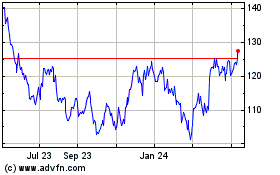

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024