Robbins Arroyo LLP: Extreme Networks, Inc. (EXTR) Misled Shareholders According to a Recently Filed Lawsuit

July 08 2016 - 4:09PM

Business Wire

Shareholder rights law firm Robbins Arroyo LLP announces that a

lawsuit was filed against Extreme Networks, Inc. (NASDAQCM: EXTR)

in the Superior Court of the State of California, Santa Clara

County. The complaint is brought on behalf of Extreme Networks for

alleged breaches of fiduciary duty by Extreme Networks' officers

and directors from November 4, 2013 to the present. Extreme

Networks provides software-driven networking solutions

worldwide.

View this information on the law firm's Shareholder Rights Blog:

www.robbinsarroyo.com/shareholders-rights-blog/extreme-networks-inc-july-2016

Extreme Networks Accused of Misrepresenting Its Financial

State

According to the complaint, on October 31, 2013, Extreme

Networks acquired Enterasys Networks, Inc. ("Enterasys"), a

privately held provider of wired and wireless network

infrastructure and security solutions. Prior to the acquisition,

Extreme Networks officials represented that the transaction would

be beneficial for the company, stating that Enterasys "will

certainly be transformational for our Companies, the industry, and

create significant value for the Extreme shareholders." Extreme

Networks officials also stated that its partnership with Lenovo

Group Ltd. ("Lenovo") would be among its large revenue drivers

going forward. Throughout the relevant period, Extreme Networks

officials submitted several filings with the U.S. Securities and

Exchange Commission and released numerous press releases touting

positive financial results and emphasizing its progress with

integrating Enterasys and developing its partnership with

Lenovo.

However, the complaint alleges that these statements were

misleading because they failed to disclose that: (1) Extreme

Networks' revenue depended on the successful integration of

Enterasys and its salesforce, but the company's integration of

operations was not successful; (2) the failure to integrate the

respective salesforces of Extreme Networks and Enterasys materially

impacted the company's prospect of redressing problems with delays

and cancellations; and (3) Extreme Networks did not control, let

alone have visibility into, Lenovo's server business plans and/or

that Extreme Networks officials knew that Lenovo was unprepared or

unwilling to sell Extreme Networks products. On April 20, 2015, the

market learned the truth of Extreme Networks' financial and

operational difficulties. On this news, Extreme Networks stock

dropped 25% to close at $2.50 per share on April 20, 2015.

Extreme Networks Shareholders Have Legal Options

Concerned shareholders who would like more information about

their rights and potential remedies can contact attorney Darnell R.

Donahue at (800) 350-6003, DDonahue@robbinsarroyo.com, or via the

shareholder information form on the firm's website.

Robbins Arroyo LLP is a nationally recognized leader in

shareholder rights law. The firm represents individual and

institutional investors in shareholder derivative and securities

class action lawsuits, and has helped its clients realize more than

$1 billion of value for themselves and the companies in which they

have invested.

Attorney Advertising. Past results do not guarantee a similar

outcome.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160708005841/en/

Robbins Arroyo LLPDarnell R. Donahue(619) 525-3990 or Toll Free

(800) 350-6003DDonahue@robbinsarroyo.comwww.robbinsarroyo.com

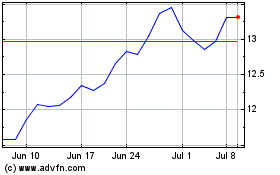

Extreme Networks (NASDAQ:EXTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Extreme Networks (NASDAQ:EXTR)

Historical Stock Chart

From Apr 2023 to Apr 2024