UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

x

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

¨

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12

|

VAPOR

CORP.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

Vapor

Corp.

3001 Griffin Road

Dania Beach, Florida 33312

(888) 482-7671

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

July [__], 2016

Dear Fellow Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders

of Vapor Corp. to be held at our corporate headquarters in Dania Beach, Florida, at the above address on [Tuesday, August 2],

2016 at 2:00 p.m., local time. The attached notice and proxy statement describe the formal business to be transacted at the meeting.

You may vote your shares by regular mail, Internet,

phone or in person at the Special Meeting. Whether or not you plan to attend the Special Meeting, it is important that your shares

be represented and voted at the meeting. Therefore, you are urged to complete, sign, date and promptly return the enclosed proxy

card in the enclosed postage-paid envelope. Returning your completed proxy card will ensure your representation at the Special

Meeting. If you later decide to attend the Special Meeting and wish to change your vote, you may do so simply by voting in person

at the meeting. Due to voting rules that may prevent your bank or broker from voting your uninstructed shares on a discretionary

basis on non-routine matters, it is important that you cast your vote.

The Special Meeting is being held so that stockholders may consider

and take action on the following proposals, which are more fully described in the Proxy Statement:

|

|

1.

|

to approve an amendment

to the Amended and Restated Certificate of Incorporation of Vapor Corp. to increase the

number of shares of authorized common stock from 5,000,000,000 to 750,000,000,000; and

|

|

|

2.

|

to transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof.

|

The Board of Directors of Vapor Corp. has determined that the

matters to be considered at the Special Meeting are in the best interests of Vapor Corp. and its stockholders. For the reasons

set forth in the Proxy Statement, the Board of Directors unanimously recommends a vote “FOR” each matter to be considered.

The Board of Directors has fixed the close of business on June

16, 2016 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Special Meeting.

Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Special Meeting.

A list of the stockholders of record as of the close of business on June 16, 2016 will be available for inspection by any of our

stockholders for any purpose germane to the Special Meeting during normal business hours at our principal executive offices, 3001

Griffin Road, Dania Beach, Florida 33312, beginning on [August 2], 2016 and at the Special Meeting.

Important Notice Regarding the Availability of Proxy Materials

for the Special Meeting of Stockholders to be Held on [August 2], 2016.

The Notice of Special Meeting of Stockholders, Proxy

Statement and Proxy Card are available at:

https://www.proxyvote.com

. Information contained on or connected to our website

is not incorporated by reference into this Proxy Statement and should not be considered a part of this Proxy Statement or any other

filing that we make with the U.S. Securities and Exchange Commission.

On behalf of the Board of Directors and

the officers and employees of Vapor Corp., I would like to take this opportunity to thank our stockholders for their continued

support of Vapor Corp. We look forward to seeing you at the meeting.

|

|

By the Order of the Board of Directors:

|

|

|

|

|

|

/s/ Jeffrey Holman

|

|

|

Jeffrey Holman

|

|

|

Chairman of the Board and Chief Executive Officer

|

TABLE OF CONTENTS

Vapor

Corp.

3001 Griffin Road

Dania Beach, Florida 33312

(888) 482-7671

SPECIAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

Why am I receiving these materials?

These proxy materials

are being sent to the holders of shares of the voting stock of Vapor Corp., a Delaware corporation, which we refer to as “Vapor”

or the “Company,” in connection with the solicitation of proxies by our Board of Directors, which we refer to as the

“Board,” for use at the Special Meeting of Stockholders to be held at 2:00 p.m. on [August 2], 2016 at our corporate

headquarters at the above address in Dania Beach, Florida. The proxy materials relating to the Special Meeting are first being

mailed to stockholders entitled to vote at the meeting on or about July [19], 2016.

Why did I receive

a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the full set of proxy

materials?

We

are pleased to be using the SEC rule that allows companies to furnish their proxy materials over the Internet. As a result, we

are mailing to many of our stockholders a notice of the Internet availability of the proxy materials instead of a paper copy of

the proxy materials. All stockholders receiving the notice will have the ability to access the proxy materials over the Internet

and request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the

Internet or to request a paper copy may be found in the notice of the Internet availability of the proxy materials. In addition,

the notice contains instructions on how you may request to access proxy materials in printed form by mail or electronically on

an ongoing basis.

Why didn’t

I receive a notice in the mail about the Internet availability of the proxy materials?

We

are providing some of our stockholders, including stockholders who have previously requested to receive paper copies of the proxy

materials, with paper copies of the proxy materials instead of a notice of the Internet availability of the proxy materials.

In

addition, we are providing notice of the Internet availability of the proxy materials by e-mail to those stockholders who have

previously elected delivery of the proxy materials electronically. Those stockholders should have received an e-mail containing

a link to the website where those materials are available and a link to the proxy voting website.

How can I access

the proxy materials over the Internet?

Your

notice of the Internet availability of the proxy materials, proxy card or voting instruction card will contain instructions on

how to:

|

|

●

|

View our proxy materials for the Special Meeting on the Internet; and

|

|

|

●

|

Instruct us to send our future proxy materials to you electronically by e-mail.

|

Our proxy materials

are also available at

www.proxyvote.com.

Your

notice of the Internet availability of the proxy materials, proxy card or voting instruction card will contain instructions on

how you may request to access proxy materials electronically on an ongoing basis. Choosing to access your future proxy materials

electronically will help us conserve natural resources and reduce the costs of distributing our proxy materials. If you choose

to access future proxy materials electronically, you will receive an e-mail with instructions containing a link to the website

where those materials are available and a link to the proxy voting website. Your election to access proxy materials by e-mail will

remain in effect until you terminate it.

How may I obtain

a paper copy of the proxy materials?

Stockholders

receiving a notice of the Internet availability of the proxy materials will find instructions about how to obtain a paper copy

of the proxy materials on their notice. Stockholders receiving notice of the Internet availability of the proxy materials by e-mail

will find instructions about how to obtain a paper copy of the proxy materials as part of that e-mail. All stockholders who do

not receive a notice or an e-mail will receive a paper copy of the proxy materials by mail.

Who is entitled to vote?

Our Board has fixed

the close of business on June 16, 2016 as the record date for a determination of stockholders entitled to notice of, and to vote

at, this Special Meeting or any adjournment thereof. On the record date, there were approximately 224.2 million shares of common

stock outstanding. Each share of Vapor common stock represents one vote that may be voted on each matter that may come before the

Special Meeting. As of the record date, Vapor had issued no preferred stock which is entitled to vote.

What is the difference between holding

shares as a record holder and as a beneficial owner?

If your shares are

registered in your name with our transfer agent, Equity Stock Transfer, LLC, you are the “record holder” of those shares.

If you are a record holder, these proxy materials have been provided directly to you by Vapor.

If your shares are

held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those

shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to

you by that organization. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who may attend the meeting?

Record holders and

beneficial owners may attend the Special Meeting. If your shares are held in street name, you will need to bring a copy of a brokerage

statement or other documentation reflecting your stock ownership as of the record date. Please see below for instructions on how

to vote at the Special Meeting if your shares are held in street name.

How do I vote?

Whether

you hold shares directly as the stockholder of record or through a broker, trustee or other nominee as the beneficial owner, you

may direct how your shares are voted without attending the Special Meeting. There are three ways to vote by proxy:

|

|

1.

|

Vote by Internet

. By following the instructions on the notice, proxy card or voting instruction card.

|

|

|

2.

|

Vote by phone

. Stockholders of record may vote by phone by calling 1 (800) 690-6903

.

Stockholders who are beneficial owners of their shares may vote by phone by calling the number specified on the voting instruction

card provided by their broker, trustee or nominee.

|

|

|

3.

|

Vote by mail

. Stockholders of record may vote by mail by completing, signing and dating their proxy card or voting instruction

card and mailing it in the accompanying pre-addressed envelope.

|

If you vote by Internet or phone, please DO NOT mail your proxy

card.

What constitutes a quorum?

To carry on the business

of the Special Meeting, we must have a quorum. A quorum is present when a majority of the outstanding shares of stock entitled

to vote, as of the record date, are represented in person or by proxy. Shares owned by Vapor are not considered outstanding or

considered to be present at the Special Meeting. Broker non-votes (because there are routine matters presented at the Special Meeting)

and abstentions are counted as present for the purpose of determining the existence of a quorum.

What happens if Vapor is unable to obtain

a quorum?

If a quorum is not

present to transact business at the Special Meeting or if we do not receive sufficient votes in favor of the proposal by the date

of the Special Meeting, the chairperson of the meeting may propose one or more adjournments of the Special Meeting to permit solicitation

of proxies.

What is a broker non-vote?

If your shares are

held in street name, you must instruct the organization who holds your shares how to vote your shares. If you do not provide voting

instructions, your shares will not be voted on any non-routine proposal. This vote is called a “broker non-vote.” Broker

non-votes do not count as a vote “FOR” or “AGAINST” any of the proposals. Because Proposal 1 requires a

majority of our outstanding shares to vote “FOR” approval, a broker non-vote will adversely affect that proposal.

If you are the stockholder

of record, and you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your

shares in the manner recommended by our Board on all matters presented in this Proxy Statement and as the proxy holders may determine

in their discretion with respect to any other matters properly presented for a vote at the meeting. If your shares are held in

street name and you do not provide specific voting instructions to the organization that holds your shares, the organization may

generally vote at its discretion on routine matters, but not on non-routine matters. If you sign your vote instruction form but

do not provide instructions on how your broker should vote, your broker will vote your shares as recommended by our Board on any

non-routine matter. See the note below and the following question and answer.

Is Proposal 1 “routine”

or “non-routine”?

Proposal 1 is non-routine.

How are abstentions treated?

Abstentions only have

an effect on the outcome of any matter being voted on that requires the approval based on our total voting stock outstanding. Because

Proposal 1 requires a majority of our outstanding shares to vote “FOR” approval, abstentions will adversely affect

the proposal.

How many votes are needed for Proposal

1 to pass, is broker discretionary voting allowed and what is the effect of an abstentions?

|

Proposals

|

|

Vote

Required

|

|

Broker

Discretionary

Vote Allowed

|

|

Effect

of

Abstentions on

the Proposal

|

|

|

|

|

|

|

|

|

|

1. To approve the amendment to the Amended and Restated Certificate of Incorporation to Increase the Authorized Shares

|

|

Majority of the outstanding voting shares

|

|

No

|

|

Vote against

|

Is my proxy revocable?

You may revoke your

proxy and reclaim your right to vote up to and including the day of the Special Meeting by giving written notice to the Corporate

Secretary of Vapor, by delivering a proxy card dated after the date of the proxy or by voting in person at the Special Meeting.

All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Vapor

Corp., 3001 Griffin Road, Dania Beach, Florida 33312, Attention: Corporate Secretary.

Who is paying for the expenses involved

in preparing and mailing this proxy statement?

All of the expenses

involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by Vapor.

In addition to the solicitation by mail, proxies may be solicited by our officers and regular employees by telephone or in person.

Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made

with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners

of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred

by them in so doing. We have engaged Okapi Partners, LLC as proxy solicitor at an estimated expense of $12,000.

What happens if additional matters are

presented at the Special Meeting?

Other than the items of business described in this Proxy Statement,

we are not aware of any other business to be acted upon at the Special Meeting. If you submit a signed proxy card, the persons

named as proxy holders, Messrs. Jeffrey Holman and Christopher Santi, will have the discretion to vote your shares on any additional

matters properly presented for a vote at the Special Meeting.

What is “householding” and

how does it affect me?

Record holders who

have the same address and last name will receive only one copy of their proxy materials, unless we are notified that one or more

of these record holders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage

fees. Stockholders who participate in householding will continue to receive separate proxy cards.

If you are eligible

for householding, but you and other record holders with whom you share an address, receive multiple copies of these proxy materials,

or if you hold Vapor stock in more than one account, and in either case you wish to receive only a single copy of each of these

documents for your household, please contact our Corporate Secretary at: Vapor Corp., 3001 Griffin Road, Dania Beach, Florida 33312,

(888) 482-7671.

If you participate

in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate

in householding and prefer to receive separate copies of these documents in the future, please contact our Corporate Secretary

as indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of

record.

Do I have dissenters’ (appraisal)

rights?

Appraisal rights are

not available to Vapor stockholders with the proposal brought before the Special Meeting.

Interest of officers and directors in

matters to be acted upon.

If the proposal described

in this proxy statement is approved, none of our officers and directors will receive any extra or special benefit not shared on

a pro rata basis by all other holders of the Company’s securities.

The Board recommends that stockholders

vote “

For

” Proposal No. 1.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING

COMPLIANCE

Section 16(a) of the Exchange

Act requires our directors, executive officers, and persons who own more than 10% of our common stock to file initial reports of

ownership and changes in ownership of our common stock and other equity securities with the SEC. These individuals are required

by the regulations of the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies

of the forms furnished to us, and written representations from reporting persons that no Forms 5 were required to report delinquent

filings, we believe that all filing requirements applicable to our officers, directors and 10% beneficial owners were complied

with during fiscal year 2015.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets

forth the number of shares of our Common Stock beneficially owned as of June 30, 2016 by (i) those persons known by us to be owners

of more than 5% of our common stock, (ii) each director, (iii) our Named Executive Officers (described below) and (iv) all of our

executive officers and directors of as a group. Unless otherwise specified in the notes to this table, the address for each person

is: c/o Vapor Corp., 3001 Griffin Road, Dania Beach, Florida 33312.

|

Title of Class

|

|

Name and Address of

Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

(1)

|

|

|

Percent of Class (1)

|

|

|

Directors and Named Executive Officers:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Jeffrey Holman (2)

|

|

|

3

|

|

|

|

|

*

|

|

Common Stock

|

|

Gina Hicks (3)

|

|

|

0

|

|

|

|

|

*

|

|

Common Stock

|

|

Christopher Santi (4)

|

|

|

3

|

|

|

|

|

*

|

|

Common Stock

|

|

Gregory Brauser (5)

|

|

|

9

|

|

|

|

|

*

|

|

Common Stock

|

|

Clifford J. Friedman (6)

|

|

|

0

|

|

|

|

|

*

|

|

Common Stock

|

|

Anthony Panariello, M.D. (7)

|

|

|

0

|

|

|

|

|

*

|

|

Common Stock

|

|

All directors and executive officers as a group (6 persons) (8)

|

|

|

15

|

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Kevin Frija

|

|

|

1,405,910,203

|

|

|

|

28.12

|

%

|

* Less than 1%.

|

|

(1)

|

Applicable percentages are based on

approximately 4.7 billion shares of Common Stock outstanding as of June 30, 2016, adjusted

as required by rules of the SEC. Beneficial ownership is determined under the rules of

the SEC and generally includes voting or investment power with respect to securities.

Shares of Common Stock underlying options, warrants and convertible notes

currently exercisable or convertible, or exercisable or convertible within 60 days are

deemed outstanding for computing the percentage of the person holding such securities

but are not deemed outstanding for computing the percentage of any other person. Unless

otherwise indicated in the footnotes to this table, Vapor believes that each of the stockholders

named in the table has sole voting and investment power with respect to the shares of

Common Stock indicated as beneficially owned by them. The table includes

only vested securities or securities that will vest and become exercisable within 60

days.

|

|

|

(2)

|

Holman

: A director and executive officer.

|

|

|

(3)

|

Hicks

: An executive officer.

|

|

|

(4)

|

Santi:

An executive officer. Includes vested options.

|

|

|

(5)

|

Gregory Brauser:

A former executive officer.

|

|

|

(6)

|

Friedman:

A director.

|

|

|

(7)

|

Panariello:

A director.

|

|

|

(8)

|

Total D&O

: Includes securities

beneficially owned by executives including Named Executive Officers.

|

PROPOSAL 1. AUTHORIZED SHARE INCREASE

Introduction

Our Board has unanimously determined that it

is in the best interests of the Company and our stockholders to amend Section 4 of the Certificate of Incorporation (such amendment

as shown in

Appendix A

) to increase the number of authorized shares of Common Stock to 750,000,000,000, par value $0.0001

(the “

Authorized Share Increase

”).

Why did the Board approve the Authorized Share Increase?

As of June 30, 2016,

there were no shares of unissued and unreserved Common Stock available for issuance under our authorized capital. Because the

Company’s authorized share capital is currently 5,000,000,000 shares of Common Stock, we have insufficient shares to cover

our obligations unless the Company’s stockholders approve the Authorized Share Increase. On March 8, 2016, the Company effected

a 1:70 reverse stock split and on May 31, 2016, the Company effected a 1:20,000 reverse stock split. As of June 30, 2016, there

were approximately 4.7 billion shares of Common Stock outstanding, approximately 278 million shares are reserved for pending Series

A Warrant exercise transactions, approximately 49,000 shares (32 shares on a post-split basis including rounding up to the nearest

whole share for fractional shares) reserved for future issuance of options and restricted stock under our 2015 Equity Incentive

Plan, and approximately 59,000 shares (60 shares on a post-split basis including rounding for fractional shares) reserved

upon the conversion of our Series A Convertible Preferred Stock. Based on the closing bid price of our Common Stock on

June 30, 2016 of $0.0001, we would need approximately 723 billion shares of Common Stock to settle the cashless exercise of all

outstanding Series A Warrants.

If we do not have sufficient

available authorized Common Stock for issuance upon exercise of the Series A Warrants, we are required to make cash payments in

lieu of the issuance of Common Stock. We do not believe that we currently have sufficient available Common Stock to fully satisfy

these obligations based on the price of our Common Stock as of June 30, 2016. We, therefore, could be required to make significant

cash payments, which we estimate could be up to approximately $72.3 million. As of June 30, 2016, we had cash and cash equivalents

of approximately $17 million and as of the date hereof we had insufficient cash and cash equivalents to settle all of the Series

A Warrants in cash.

What is the purpose of the Authorized Share Increase?

The Board recommends the Authorized Share Increase

for the following reasons:

|

|

·

|

To permit the Company to issue shares of Common Stock to holders of the Company’s Series

A Warrants upon exercise of the Series A Warrants;

|

|

|

·

|

To permit the Company to make future issuances or exchanges of Common Stock for capital raising

purposes or to restructure outstanding securities of the Company, including the Series A Warrants; and

|

|

|

·

|

To permit the Company to make future issuances of options, warrants and other convertible securities.

|

Why would the Company

not have sufficient shares of Common Stock to issue shares of Common Stock upon the exercise of the Series A Warrants?

On July 29, 2015,

we sold 3,761,657 Units in a public offering. Each Unit consisted of one-fourth of a share of Series A Convertible Preferred Stock

and 20 Series A Warrants (0.000014 Series A Warrants on a post-split basis). Each one-fourth share of Series A Convertible Preferred

Stock is convertible into ten shares of Common Stock (0.000007 on a post-split basis) at the option of the holder. Each Series

A Warrant is exercisable into one share of common stock (0.0000007 on a post-split basis) at an exercise price of $1.24 per share

($1,736,000 per share on a post-split basis) in cash or, in lieu of payment of the exercise price in cash by electing to receive

a cash payment from us (subject to certain conditions not being met by the Company) equal to the Black Scholes Value (as discussed

below) of the number of shares the holder

elects to exercise, which we refer to as the “Black Scholes Payment”; provided, that we have discretion

as to whether to deliver the Black Scholes Payment or, subject to meeting certain conditions, to deliver a number of shares of

our Common Stock determined according to the following formula, referred to as the “cashless exercise.”

The Series A Warrant’s “cashless

exercise” feature is based on a Black Scholes valuation model that could create a potentially material adverse liability

on the Company’s balance sheet if an insufficient number of shares of Common Stock were available to satisfy

the warrant exercises. The Series A Warrants can be exercised for either (1) cash at $1.24 per share ($1,736,000 per share on

a post-split basis) or (2) in a “cashless exercise” using a Black Scholes Value (BSV)

of the warrant. If submitted for a “cashless exercise”, the warrant holder exchanges the warrant for

the number of common shares equal to the BSV divided by the closing bid price of the Common Stock two days

before exercise notice is submitted or, instead, the Company has the option to pay the BSV in cash to the warrant holder.

As defined in the Series A Warrants, BSV is determined based on the BSV of an option for one share of Common Stock

of the Company at the date of the applicable Black Scholes Payment or “cashless exercise,” as such BSV

is determined, calculated using the Black Scholes Option Pricing Model obtained from the “OV” function on Bloomberg

utilizing (i) an underlying price per share equal to the closing bid price of our Common Stock as of July 23, 2015 (ii) a

risk-free interest rate corresponding to the U.S. Treasury rate for a period equal to the remaining term of the Series A Warrant

as of the applicable Black Scholes Payment or “cashless exercise”, (iii) a strike price equal

to the exercise price in effect at the time of the applicable Black Scholes Payment or “cashless exercise”,

(iv) an expected volatility equal to 135% and (v) a remaining term of such option equal to five years (regardless of the actual

remaining term of the Series A Warrant). If all of our Series A Warrants were exercised simultaneously, we would not have sufficient

authorized Common Stock to fulfill our issuance obligations pursuant to the Series A Warrants and we could be required

to use our cash to pay warrant holders.

What could happen if the stockholders do not approve the Authorized

Share Increase?

|

|

·

|

If we do not receive stockholder approval for the Authorized Share Increase, we will have insufficient

authorized shares of Common Stock to settle the Series A Warrants and we will be required to make cash payments with respect to

the exercise of the Series A Warrants, which we estimate to be approximately $72.3 million. As of June 30, 2016, we had cash and

cash equivalents of approximately $17 million and as of the date hereof we had insufficient cash and cash equivalents to settle

all of the Series A Warrants in cash. To the extent our cash and cash equivalents are insufficient to enable us to make cash payments

with respect to the exercise of the Series A Warrants, if we are unable to negotiate a settlement or restructuring with the holders

of the Series A Warrants, we may be required to seek protection under the federal bankruptcy laws.

|

|

|

·

|

If we do not increase our authorized shares of Common Stock, we may be unable to conduct further

offerings of our equity securities to raise additional capital to implement our business plan or to further our corporate objectives.

|

What amendments are being made to the Certificate of

Incorporation?

Section 4 of the Certificate of Incorporation shall be amended to

read as follows:

“4.

The

total number of shares of stock which the Corporation is authorized to issue is

750,001,000,000

.

750,000,000,000 shares shall be common stock, par value $0.0001 per share (“

Common Stock

”), and 1,000,000

shall be preferred stock, par value $0.001 per share (“

Preferred Stock

”). Except as otherwise provided

in this Certificate of Incorporation, authority is hereby vested in the Board of Directors of the Corporation from time to time

to provide for the issuance of shares of one or more series of Preferred Stock and in connection therewith to fix by resolution

or resolutions providing for the issue of any such series, the number of shares to be included therein, the voting powers thereof,

and such of the designations, preferences and relative participating, optional or other special rights and qualifications, limitations

and restrictions of each such series, including, without limitation, dividend rights, voting rights, rights of redemption, or conversion

into Common Stock rights, and liquidation preferences, to the fullest extent now or hereafter permitted by the Delaware General

Corporation Law and any other provisions of the Corporation’s Certificate of Incorporation, as amended. The Board of Directors

is further

authorized

to increase or decrease (but not below the number of such shares of such class or series then outstanding) the number of shares

of any such class or series subsequent to the issuance of shares of that class or series.

”

Does the Board recommend approval of the

Authorized Share Increase?

Yes. After considering the

entirety of the circumstances, the Board has unanimously concluded that the Authorized Share Increase is in the best interests

of the Company and its stockholders and the Board unanimously recommends that the Company’s stockholders vote in favor of

the Authorized Share Increase.

What vote is required to approve the Authorized

Share Increase?

The affirmative vote of

the holders of a majority of the outstanding shares of our Common Stock is required to amend our Certificate of Incorporation

to effect the Authorized Share Increase. Failures to vote, abstentions and broker “non-votes”, if any, will be the

equivalent of a vote “AGAINST” this proposal.

IF OUR STOCKHOLDERS DO

NOT APPROVE THE AUTHORIZED SHARE INCREASE, THE BOARD BELIEVES THAT THE LONG-TERM FINANCIAL VIABILITY OF THE COMPANY COULD BE THREATENED

DUE TO (1) THE CASH PAYMENTS REQUIRED OF THE COMPANY IF IT IS UNABLE TO SETTLE THE EXERCISES OF THE SERIES A WARRANTS WITH SHARES

OF COMMON STOCK AND (2) THE COMPANY’S INABILITY TO CONSUMMATE FUTURE EQUITY OFFERINGS TO MEET ITS ONGOING EXPENSES.

Possible Anti-Takeover Implications of the

Authorized Share Increase

The Company has no intent

or plan to employ the additional unissued authorized shares as an anti-takeover device. As indicated above, the purpose of the

Authorized Share Increase is to ensure that we have sufficient authorized Common Stock to, among other things, consummate future

equity financings and attempt to mitigate risk in connection with the exercise of the Series A Warrants. However, the Company’s

authorized but unissued shares of Common Stock could (within the limits imposed by applicable law and regulation) be issued in

one or more transactions that could make a change of control more difficult and therefore more unlikely.

Our Board did not propose

the Authorized Share Increase in response to any effort known to our Board to accumulate Common Stock or to obtain control of the

Company by means of a merger, tender offer or solicitation in opposition to management. Further, our Board does not currently contemplate

recommending the adoption of any other amendments to our Certificate of Incorporation that could be construed as limiting the ability

of third parties to take over or effect a change of control.

The issuance in the future

of additional authorized shares of Common Stock may have the effect of diluting the earnings or loss per share and book value per

share, as well as the ownership and voting rights of the holders of our then-outstanding shares of Common Stock. In addition, an

increase in the number of authorized but unissued shares of Common Stock may have a potential anti-takeover effect, as our ability

to issue additional shares could be used to thwart persons, or otherwise dilute the stock ownership of stockholders, seeking to

control us. The Authorized Share Increase is not being recommended by our Board as part of an anti-takeover strategy.

No Effect on Authorized Preferred Stock

Pursuant to our current

Certificate of Incorporation, our capital stock consists of a total of 5,001,000,000 authorized shares, of which 5,000,000,000

shares, par value $0.0001 per share, are designated as Common Stock and 1,000,000 shares, par value $0.001 per share, are designated

as preferred stock. The proposed Authorized Share Increase would not impact the total authorized number of shares of preferred

stock or the par value of the preferred stock.

The Board recommends a vote “

For

”

this proposal.

OTHER MATTERS

Vapor has no knowledge

of any other matters that may come before the Special Meeting and does not intend to present any other matters. However, if any

other matters shall properly come before the Meeting or any adjournment, the persons soliciting proxies will have the discretion

to vote as they see fit unless directed otherwise.

If you do not plan to attend

the Special Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign, date

and return your proxy promptly. In the event you are able to attend the Special Meeting, at your request, Vapor will cancel your

previously submitted proxy.

|

|

By the Order of the Board of Directors:

|

|

|

|

|

|

/s/ Jeffrey Holman

|

|

|

Jeffrey Holman

|

|

|

Chairman of the Board and Chief Executive Officer

|

July [__], 2016

APPENDIX A

CERTIFICATE OF AMENDMENT TO CERTIFICATE OF

INCORPORATION OF VAPOR CORP.

Vapor Corp. (the “Company”),

a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Delaware General Corporation

Law”), hereby certifies as follows:

1. Pursuant to Sections

242 and 228 of the Delaware General Corporation Law, the amendment herein set forth has been duly approved by the Board of Directors

and holders of a majority of the outstanding capital stock of the Company.

2. Section 4 of the Certificate

of Incorporation is amended to read as follows:

4.

The total number of shares of stock which the Corporation is authorized to issue is

750,001,000,000

.

750,000,000,000 shares shall be common stock, par value $0.0001 per share (“

Common Stock

”), and 1,000,000

shall be preferred stock, par value $0.001 per share (“

Preferred Stock

”). Except as otherwise provided

in this Certificate of Incorporation, authority is hereby vested in the Board of Directors of the Corporation from time to time

to provide for the issuance of shares of one or more series of Preferred Stock and in connection therewith to fix by resolution

or resolutions providing for the issue of any such series, the number of shares to be included therein, the voting powers thereof,

and such of the designations, preferences and relative participating, optional or other special rights and qualifications, limitations

and restrictions of each such series, including, without limitation, dividend rights, voting rights, rights of redemption, or conversion

into Common Stock rights, and liquidation preferences, to the fullest extent now or hereafter permitted by the Delaware General

Corporation Law and any other provisions of the Corporation’s Certificate of Incorporation, as amended. The Board of Directors

is further authorized to increase or decrease (but not below the number of such shares of such class or series then outstanding)

the number of shares of any such class or series subsequent to the issuance of shares of that class or series.

3. This Certificate of

Amendment to Certificate of Incorporation was duly adopted and approved by the stockholders of this Company on the ___

day

of August, 2016 in accordance with Section 242 of the Delaware General Corporation Law.

IN WITNESS WHEREOF, the

undersigned has executed this Certificate of Amendment to Certificate of Incorporation as of the ___ day of ______, 2016.

VAPOR CORP.

THIS PROXY IS SOLICITED ON BEHALF OF THE

BOARD OF DIRECTORS

SPECIAL MEETING OF STOCKHOLDERS – [AUGUST

2], 2016 AT 2:00 PM

|

VOTING INSTRUCTIONS

|

|

|

|

If you vote by phone or internet, please DO NOT mail your proxy card.

|

|

|

MAIL:

|

Please mark, sign, date, and return this Proxy Card promptly using the enclosed envelope.

|

|

|

|

|

|

|

PHONE:

|

Call 1 (800) 690-6903

|

|

|

|

|

|

|

INTERNET:

|

https://www.proxyvote.com

|

|

Control ID:

|

|

|

Proxy ID:

|

|

|

Password:

|

|

MARK “X” HERE IF YOU PLAN TO

ATTEND THE MEETING:

¨

MARK HERE FOR ADDRESS CHANGE

¨

New Address (if applicable):

IMPORTANT:

Please sign exactly

as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator,

attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name

by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized

person.

Dated: _______, 2016

|

|

|

(Print Name of Stockholder and/or Joint Tenant)

|

|

|

|

|

|

(Signature of Stockholder)

|

|

|

|

|

|

(Second Signature if held jointly)

|

The stockholder(s) hereby appoints Jeffrey

Holman and Christopher Santi, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes

them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of common stock of VAPOR

CORP. that the stockholder(s) is/are entitled to vote at the Special Meeting of Stockholder(s) to be held at 2:00 p.m., New York

time on [August 2], 2016, at Vapor Corp.’s headquarters, located at 3001 Griffin Road, Dania Beach, Florida 33312,

and any adjournment or postponement thereof.

This proxy, when properly executed, will

be voted in the manner directed herein. If

no such direction is made, this proxy will be

voted “FOR” Proposal 1. If any other business is presented at the meeting, this proxy will

be

voted by the above-named proxies at the direction of the Board of Directors. At the present time, the Board of Directors

knows of no other business to be presented at the meeting.

Proposal

:

|

1. To approve the amendment to Vapor’s Certificate of Incorporation to increase the authorized shares of common stock to 750,000,000,000 shares.

|

|

FOR

¨

AGAINST

¨

ABSTAIN

¨

|

Control ID:

Proxy ID:

Password:

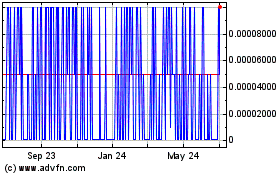

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

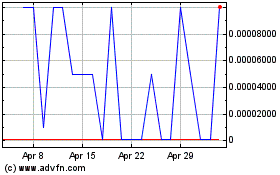

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024