Hershey Trust Holds Key -- WSJ

July 02 2016 - 3:02AM

Dow Jones News

For Mondelez to succeed in its bid, it must persuade secretive

shareholder

By Annie Gasparro and Julie Jargon

Snack maker Mondelez International Inc. or any other potential

bidder for Hershey Co. is up against not only a board that

indicated it doesn't want to sell, but a secretive, controlling

shareholder -- and the state's top law officer.

Mondelez, whose roughly $23 billion bid was quickly rebuffed

this week, is expected to continue fighting for a union. The

company said Friday it handles situations such as this "through

private communications between companies."

But, if the company continues its pursuit, it will have to

contend with an unusual number of additional legal and political

hurdles unique to deal making with the famous chocolate maker.

No deal would happen without the blessing of Hershey Trust Co.,

which controls 81% of the company's voting power and 8.4% of its

common stock.

Set up in 1905 by chocolate icon Milton Hershey, the trust's

mission is to make decisions based on the potential impact to the

Milton Hershey School for underprivileged children, and the

community of Hershey, Pa. -- which had protested selling the

company in the past.

Any sale would also need final approval of Pennsylvania's

attorney general, who -- under an unusual 2002 state law -- has the

power to countermand the trust, and has done so in the past.

Yet another challenge is the current political turmoil in the

state, where Attorney General Kathleen Kane is riding out the last

few months of her first term, having been stripped of her law

license after being accused of leaking confidential information and

lying about it. Ms. Kane has said the charges against her are part

of a conspiracy involving former state prosecutors she was

investigating.

Other food makers, including Kellogg Co. and Campbell Soup Co.,

have significant ownership by family and trusts, but Hershey is

further subject to a state law that requires the top

law-enforcement official to green light the sale of any company

controlled by a charitable trust.

The law is a "public policy tragedy," according to Robert

Sitkoff, a Harvard Law School professor who has studied the trust.

He said that diversifying the trust's portfolio would benefit the

school and community but said he thinks any deal would face

difficulties.

Others, including a former Pennsylvania attorney general, said a

sale would hurt the community by resulting in job losses and other

adverse economic and social impacts.

"Predicting and trying to rationalize the Trust's behavior has

always been a tricky exercise," said Susquehanna analyst Pablo

Zuanic.

A spokesman for the Hershey Trust board said it wouldn't comment

on whether it supports selling the company, but three trust board

members have seats on Hershey's board, which unanimously voted

against the Mondelez offer of $107 a share on Thursday.

The trust itself is juggling other problems. A continuing

investigation by the attorney general's office into alleged

overpayment of directors and conflicts of interest has led to

several directors resigning. The trust has said it is cooperating

with the probe.

The fate of the 2002 deal talks is instructive. Hershey called

off a sale to chewing-gum maker Wm. Wrigley Jr. Co., now a unit of

the privately held Mars Inc., at the final hour, after facing

resistance from the attorney general's office, which obtained an

injunction granted by Pennsylvania Orphans' Court, saying a sale

would hurt the community.

Less than two months after the scuttled deal, the Pennsylvania

governor signed an amendment to a statute requiring the attorney

general to approve the sale of any company controlled by a

charitable trust.

A spokesperson for the attorney general's office said this week

that it would need to review the details of any offers to buy

Hershey before determining if it would be in the best interest of

the school.

Write to Annie Gasparro at annie.gasparro@wsj.com and Julie

Jargon at julie.jargon@wsj.com

(END) Dow Jones Newswires

July 02, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

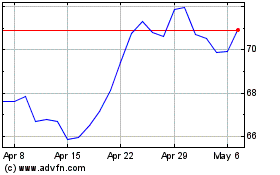

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Apr 2023 to Apr 2024