Visa, MasterCard Class-Action Settlement With Retailers Rejected by U.S. Court -- 2nd Update

June 30 2016 - 12:46PM

Dow Jones News

By Austen Hufford

A U.S. Court of Appeals rejected the 2012 swipe-fee settlement,

originally valued at $7.25 billion, between the retail industry and

payments companies Visa Inc. and MasterCard Inc., calling the

agreement "unreasonable and inadequate."

"The benefits of litigation peace do not outweigh class members'

due process right to adequate representation," the Thursday ruling

said.

The court ruled that the settlement violated the rule that

requires the representative parties to "fairly and adequately

protect the interests of the class" and uncover any conflicts of

interest.

The 2012 settlement broke the class of plaintiffs into two

groups: one which accepted Visa or MasterCard from 2004 through

2012 and another which would accept the cards from 2012 onward. In

its ruling, the appeals court noted the conflict between the

merchants in the first class, which were pursuing solely monetary

relief, and the merchants in the second class, which were seeking

only injunctive relief.

"The former would want to maximize cash compensation for past

harm, and the latter would want to maximize restraints on network

rules to prevent harm in the future," the ruling said. In addition,

only the first group was eligible for the $7.25 billion cash

settlement and could opt out of the settlement.

Shares of MasterCard fell 1.9% to $90.36, while Visa shares

dropped 2.4% to $74.90.

The court said the class seeking injunctive relief "were

inadequately represented" because those merchants couldn't opt out

of the deal and they shared representation with the other class.

The court added that the only apparent benefits to putting the

competing claims into one class were higher fees for counsel and

the ability of the defendants to pay a bundled group with a single

payment.

The court noted the $544.8 million in fees granted to lawyers,

saying the firms stood to gain "enormously" if the deal was

completed.

"We expressly do not impugn the motives or acts of class

counsel," the court wrote. "Nonetheless, class counsel was charged

with an inequitable task."

According to the deal's critics, it also protected Visa and

MasterCard from future litigation. Wal-Mart Stores Inc. and Target

Corp. both opposed the deal.

A Visa representative declined to comment. MasterCard said it

was disappointed by the ruling and is reviewing the decision to

determine its next steps.

"We believe we presented a clear case to the court that the

settlement was fair and appropriate based on more than four years

of negotiation and the close involvement of the District Court,"

the company said in a statement.

"The settlement orchestrated by the card networks and banks

would have undermined merchants' legal rights," said Deborah White,

general counsel for the Retail Industry Leaders Association, which

opposed the settlement. "Today's decision is a victory for all

merchants and consumers."

In a class-action lawsuit, a large number of plaintiffs with

similar claims are able to sue a defendant, allowing for a bunch of

smaller-scale claims to get handled in the aggregate. A court

grants a "class" to a group that it determines meets the criteria;

in return, those within the defined class generally have to follow

the terms of any settlement reached.

Billed at the time as the largest settlement of an antitrust

class-action case in U.S. history, the deal -- reached in July 2012

-- was to end years of litigation brought by merchants against Visa

and MasterCard and several large banks that issue the companies'

credit cards, such as Bank of America Corp. and J.P. Morgan Chase

& Co.

Lawsuits filed by trade groups and several retailers in 2005

accused Visa and MasterCard of conspiring with banks to set

so-called swipe fees on credit-card transactions at arbitrarily

high levels. The fees, also called interchange fees, are set by

Visa and MasterCard and flow to banks that issue cards as revenue

each time a customer swipes a card at a merchant.

The settlement reignited a long-running battle over credit-card

transaction fees, with big-box merchants and retail trade groups

making their case for why the deal should be blocked.

"We conclude that the class plaintiffs were inadequately

represented," the court wrote.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 30, 2016 12:31 ET (16:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

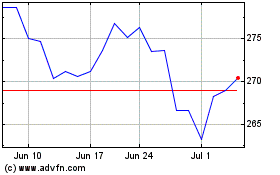

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024