WellDyneRx in Talks With Private Equity on Possible Sale

June 29 2016 - 6:40PM

Dow Jones News

WellDyneRx Inc. has hired an investment bank to explore a sale

of itself to private equity, said people familiar with the

situation.

The Lakeland, Fla.-based pharmacy-benefit manager hired J.P.

Morgan Chase & Co. to run a limited process, the people said.

They added that WellDyneRx is only talking to a small number of

private-equity firms.

WellDyneRx's sale process provides an opportunity for private

equity to back a sizable pharmacy benefit manager, which negotiates

for medicines on behalf of employers and health plans.

Pharmacy-benefit managers typically garner a price multiple of

about 12 to 13 times their earnings before interest, taxes,

depreciation and amortization. Based on the company's $75 million

in annual ebitda, WellDyneRx could be valued at about $1 billion,

the people said.

They said the pricing for WellDyneRx could be higher given the

intense interest in assets in an industry that is consolidating as

companies seek to build scale to better negotiate against rising

prescription-drug costs.

The nation's largest insurers and pharmacies have in recent

years purchased a number of assets, sometimes from private-equity

owners, in an effort to contain spending on drugs.

Insurer UnitedHealth Group, for example, last year acquired

pharmacy-benefits manager Catamaran Corp. for $12.8 billion to add

to its OptumRx unit, while Aetna Inc. agreed to buy Humana Inc. for

$34 billion. Also in 2015, CVS Health Corp. paid $10.4 billion for

Omnicare Inc., while Rite Aid Corp. acquired Envision

Pharmaceutical Services Inc. for about $2 billion from TPG.

WellDyneRx serves health-plan members through a retail network

of more than 65,000 pharmacies, and uses robotics to fill more than

1 million mail-order prescriptions each year, according to the

company's website.

Interest in WellDyneRx likely will be buoyed by the increasingly

scarce availability of sizable companies in the space. Data

provider IBISWorld said pharmacy benefit management is an area with

a "high level of concentration," with the top four providers

estimated to account for more than 72% of industry revenue for

2015.

Although private equity has backed pharmacy-benefit managers

over the years, a number of them have been absorbed by corporate

buyers.

Between 2010 and 2012, private-equity firm Abry Partners LLC

held a minority ownership interest in HealthTrans LLC, a Greenwood

Village, Colo., provider of midmarket pharmacy benefit management

services and health-care information technology. Abry in early 2012

sold its stake in HealthTrans to larger peer SXC Health Solutions

Corp. for $250 million.

Another private-equity firm, SilverStream Capital LLC, sold Apex

Affinity, a provider of consumer prescription-savings programs, to

MedImpact Healthcare Systems Inc. in 2013.

Consonance Capital Partners continues to be invested in Enclara

Health LLC, a hospital-specialty pharmacy services provider it has

backed since 2014. The New York firm helped the company acquire

excelleRx Inc. and PBM Holding Co. later that year.

Write to Amy Or at amy.or@wsj.com

(END) Dow Jones Newswires

June 29, 2016 18:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

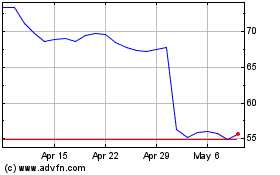

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

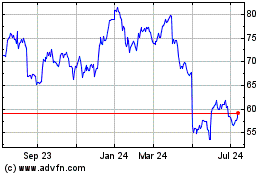

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024