Aqua Metals Joins the Russell 2000 Index

June 29 2016 - 8:30AM

Aqua Metals, Inc. (NASDAQ:AQMS), which is commercializing

AquaRefining™, a non-polluting electrochemical lead recycling

technology, today announced that it was added to the Russell 2000®

Index after market close on June 24, 2016.

"We are very pleased to join the Russell 2000 Index,” said Dr.

Stephen Clarke, Chairman and CEO of Aqua Metals. “This is an

important milestone for Aqua Metals and represents an opportunity

to increase our visibility within the public market investment

community.”

Aqua Metals is building the world’s first AquaRefinery in

Nevada’s Tahoe Reno Industrial Complex, which is slated to begin

operation early in the third quarter of 2016.

The Russell 2000 Index measures the performance of approximately

2,000 of the leading small company stocks in the United

States. FTSE Russell, a leading global index provider,

determines membership for its equity indices primarily by

objective, market-capitalization rankings, and style

attributes.

Indexes provided by FTSE Russell are widely used by investment

professionals for index funds and as benchmarks for investment

strategies. Approximately $6 trillion in assets are

benchmarked to the Russell Indexes.

Market analysis on the Russell Indexes is available at

https://www.ftserussell.com/research-insights/russell-reconstitution.

About Aqua Metals, Inc. Aqua Metals is

reinventing lead recycling with its patent-pending AquaRefining

technology. Unlike smelting, AquaRefining is a modular, room

temperature, water-based process that is fundamentally

non-polluting. These modular systems allow the lead acid battery

industry to simultaneously improve environmental impact and scale

production to meet demand. Aqua Metals is based in Alameda,

California, and is building its first recycling facility in

Nevada’s Tahoe Reno Industrial Complex. To learn more, please visit

www.aquametals.com.

Safe Harbor This press release contains

forward-looking statements concerning Aqua Metals, Inc., the

lead-acid battery recycling industry, the future of lead-acid

battery recycling via traditional smelters, the Company’s

development of its commercial lead-acid battery recycling

facilities and the quality, efficiency and profitability of the

Company’s proposed lead-acid battery recycling operations. Those

forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially. Among those factors are: (1) the fact that

Company has not yet commenced revenue producing operations or

developed its initial commercial recycling facility, thus

subjecting the Company to all of the risks inherent in a

pre-revenue start-up; (2) risks related to Aqua Metals’ ability to

raise sufficient capital, as and when needed, to develop and

operate its recycling facilities; (3) changes in the federal, state

and foreign laws regulating the recycling of lead-acid batteries;

(4) the Company’s ability to protect its proprietary technology,

trade secrets and know-how and (5) those other risks disclosed in

the section “Risk Factors” included in the Annual Report on Form

10-K filed with the SEC on March 28, 2016. Aqua Metals cautions

readers not to place undue reliance on any forward-looking

statements. The Company does not undertake, and specifically

disclaims any obligation, to update or revise such statements to

reflect new circumstances or unanticipated events as they

occur.

Aqua Metals Investor Relations:

MZ North America

Greg Falesnik

Senior Vice President

Main: 949-385-6449

greg.falesnik@mzgroup.us

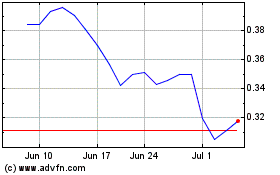

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

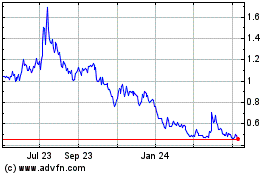

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Apr 2023 to Apr 2024