CIBC to Buy PrivateBanCorp in $3.8 Billion Deal

June 29 2016 - 8:10AM

Dow Jones News

Canadian Imperial Bank of Commerce on Wednesday said it agreed

to buy PrivateBancorp Inc., a Chicago-based middle-market

commercial bank, for about $3.8 billion in cash and stock, as CIBC

looks to expand its reach in North America.

CIBC said it would swap $18.80 in cash plus 0.3657 CIBC shares,

which closed Tuesday at $77.11, for each share of PrivateBancorp,

valuing the deal at $47 a share—a 31% premium over PrivateBancorp's

closing price of $35.93 on Tuesday.

PrivateBancorp stock has fallen 19% over the past month but rose

27% in premarket trading to $45.46. CIBC stock has remained

inactive in premarket trading.

CIBC said the acquisition would allow it to deliver banking

services to clients in the U.S., specifically to those of Atlantic

Trust, a private wealth-management firm that CIBC acquired in its

fiscal 2014.

For PrivateBancorp, the deal brings added financial strength,

the benefits of a bigger bank and the ability to provide banking

services in Canada. As of March 31, PrivateBancorp had $17.7

billion in assets.

Toronto-based CIBC recently sold its 41% minority stake in U.S.

wealth manager American Century Investments to Japanese

financial-services firm Normura Holdings Inc. for about $1 billion.

CIBC acquired its 41% interest in American Century in 2011 for $848

million.

Write to Brittney Laryea at brittney.laryea@wsj.com

(END) Dow Jones Newswires

June 29, 2016 07:55 ET (11:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

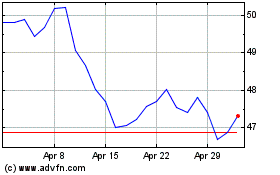

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024