Nike Reports Sluggish North American Sales--3rd Update

June 28 2016 - 7:27PM

Dow Jones News

By Sara Germano and Tess Stynes

Nike Inc.'s long streak of strong growth on its home turf

stalled in the latest quarter.

The sportswear and sneaker giant's profit fell 2% and sales were

flat in North America, as the company continued to clear excess

inventory and battled increased competition from Under Armour Inc.

and Adidas AG. Overall revenue rose 6% in the quarter ended May 31,

driven by gains overseas, but the results disappointed

analysts.

Shares of the Beaverton, Ore., company fell 3.8% to $51.05 in

after-hours trading. Before Tuesday's results, the stock price had

fallen 15% in 2016.

Andy Campion, Nike's chief financial officer, said the company

faced a tough comparison to the year prior. "We continue to see

strong underlying momentum in the fundamentals that drive our

growth and profitability," Mr. Campion told investors on a

conference call.

Futures orders for North America increased 6% for products

scheduled for delivery over the next six months. That compared with

growth of 13% a year earlier and an increase of 10% in the previous

quarter.

For the first time, Nike broke out sales of its Jordan Brand

segment, the eponymous sneaker and apparel line for basketball star

Michael Jordan. Jordan sales rose 18% to $2.8 billion for the

fiscal year ended May 31, while Nike brand basketball sales fell 1%

to $1.4 billion.

Analysts have been concerned about Nike's performance in North

America and in basketball in particular, with several downgrading

price targets on the company's stock in recent weeks. Nike has

faced increased competition at home from Adidas, which has been

pushing retro shoes, and Under Armour, which has an endorsement

deal with NBA star Stephen Curry.

"Other brands are providing solid competition across multiple

categories and I feel that is having an affect on the Nike numbers

domestically," said Neil Schwartz, vice president of business

development for industry tracker SportsOneSource. "Adidas came out

of nowhere in the classics and casual athletic categories."

For the quarter ended May 31, Nike reported a profit of $846

million, down from $865 million a year earlier. Revenue was $8.24

billion, up from $7.78 billion a year earlier. In North America,

revenue edged up 0.1% to $3.74 billion.

Nike said futures orders, which reflect products scheduled for

delivery from June through November, rose 8% on a global basis,

compared with an increase of 2% a year earlier and the 12% growth

logged for the previous quarter. Futures orders are closely watched

by investors as a benchmark for demand for Nike products.

Gross margin fell to 45.9% from 46.2%.

Nike has used expensive sponsorships to increase its market

share in sports such as soccer and basketball. In the latest

period, Nike increased such spending -- called demand creation --

by 6.6% to $873 million.

Write to Sara Germano at sara.germano@wsj.com and Tess Stynes at

tess.stynes@wsj.com

(END) Dow Jones Newswires

June 28, 2016 19:12 ET (23:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

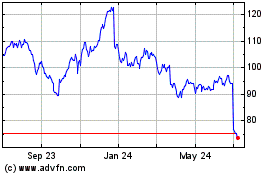

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

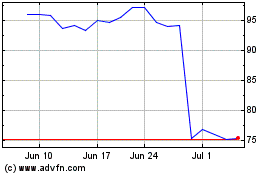

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024