Current Report Filing (8-k)

June 28 2016 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 22, 2016

NetApp, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

0-27130

|

|

77-0307520

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

495 East Java Drive

Sunnyvale, CA 94089

(Address of principal executive offices) (Zip Code)

(408) 822-6000

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.02. Termination of a Material Definitive Agreement.

On June 22, 2016, NetApp, Inc. (the “Company”) delivered an irrevocable notice of prepayment notifying the lenders under its term loan agreement

among the Company, Sonoma Holdings C.V., as Assuming Borrower, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent (the “Loan Agreement”), that the Company would prepay $850 million of borrowings currently

outstanding (together with all accrued and unpaid interest to the extent required and any required break funding payments). The Company expects this prepayment to occur on June 27, 2016. Following the prepayment, the Loan Agreement will be

terminated.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

On June 22, 2016, as a result of the expiration of a majority of existing change in control agreements and in

connection with a review of executive compensation, the Compensation Committee (the “Committee”) of the Company’s Board of Directors approved a new form of double trigger Change of Control Severance Agreement (the

“Agreement”). The Agreement will supersede any existing change of control severance agreement entered into by the Company and will be used on a going forward basis by the Company. The Company expects to enter into an Agreement with each of

its named executive officers, including the Chief Executive Officer, and certain senior executives.

The material terms of the Agreement are as follows:

Severance Benefits

. If the Company terminates an executive’s employment without Cause (as such term is defined in the Agreement) (and

not by reason of executive’s death or Disability (as such term is defined in the Agreement)) or if the executive resigns for Good Reason (as such term is defined in the Agreement), and such termination occurs on or within 24 months after the

first Change of Control (as such term is defined in the Agreement) that occurs after the effective date of the Agreement, then, subject to the executive signing and not revoking a separation agreement and release of claims in favor of the Company,

the executive will receive the following from the Company:

|

|

•

|

|

A lump sum severance payment (less applicable withholding taxes) equal to the sum of (A) 150% (200% in the case of the Chief Executive Officer) of an executive’s annual base salary as in effect immediately

prior to the executive’s termination date or (if greater) at the level in effect immediately prior to the Change of Control; and (B) 150% (200% in the case of the Chief Executive Officer) of an executive’s target annual bonus in

effect immediately prior to the executive’s termination date or (if greater) at the level in effect immediately prior to the Change of Control.

|

|

|

•

|

|

All outstanding equity awards that are subject to time-based vesting will vest as to that portion of the award that would have vested through the 48 month period following the executive’s termination date had the

executive remained employed through such period. Additionally, unless otherwise provided in the applicable award agreement, the executive will be entitled to accelerated vesting as to an additional 100% of the then-unvested portion of all of his or

her outstanding equity awards that are scheduled to vest pursuant to performance-based criteria, if any. Each executive will have one year following the date of his or her termination in which to exercise any outstanding stock options or other

similar rights to acquire Company stock (but such post-termination exercise period will not extend beyond the original maximum term of the award).

|

|

|

•

|

|

If the executive elects continuation coverage pursuant to COBRA for executive and his or her eligible dependents,

the Company will reimburse the executive for the COBRA premiums for such coverage until the earlier of (A) 18 months, (B) the date upon which the executive and/or the executive’s eligible dependents are covered under similar plans or

(C) the date upon which executive ceases to be eligible for coverage under COBRA. If the Company determines that it cannot provide the foregoing benefit without violating applicable law or being subject to an excise tax, then the

|

|

|

Company will, in lieu of the COBRA reimbursement, pay the executive a taxable lump-sum payment in an amount equal to the monthly COBRA premium that the executive would have been required to pay

to continue the executive’s group health coverage multiplied by 18.

|

Excise Tax

. In the event that the severance

payments and other benefits payable to an executive constitute “parachute payments” under Section 280G of the U.S. tax code and would be subject to the applicable excise tax, then the executive’s severance benefits will be either

(A) delivered in full or (B) delivered to such lesser extent which would result in no portion of such benefits being subject to the excise tax, whichever results in the receipt by the executive on an after-tax basis of the greatest amount

of benefits.

Term

. Each Agreement has a term of three years. If a Change of Control occurs at any time during the term of the Agreement,

the term of the Agreement will automatically be extended for 24 months following the effective date of the Change of Control. Additionally, if there is an initial occurrence of an act or omission by the Company that could constitute “Good

Reason” for termination, and the expiration date of any Company cure period related to such act or omission could occur following the expiration of the term of the Agreement, then the term of the Agreement will extend automatically through the

date that is 90 days following the expiration of such cure period. If an executive becomes entitled to severance benefits pursuant to his or her Agreement, the Agreement will not terminate until all obligations of the Company under the Agreement

have been satisfied.

The foregoing description of the material terms of the Agreement does not purport to be complete and is qualified in its entirety by

the terms and conditions of the Agreement, the form of which is filed herewith as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Form of Change of Control Severance Agreement

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NETAPP, INC.

|

|

|

|

|

|

|

Date: June 28, 2016

|

|

|

|

By:

|

|

/s/ Matthew K. Fawcett

|

|

|

|

|

|

|

|

Matthew K. Fawcett

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Form of Change of Control Severance Agreement

|

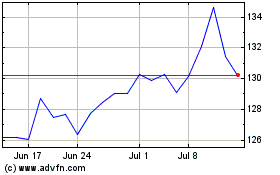

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

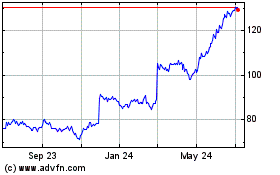

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024