By Robert Wall, Saabira Chaudhuri and Art Patnaude

LONDON -- Fallout from Britain's vote to break with the European

Union cascaded through the boardrooms of the U.K's biggest

businesses on Monday, triggering profit warnings from two of the

country's best-known firms and forcing executives across Europe to

rethink investment and hiring plans.

Budget airline easyJet PLC warned that consumer and economic

uncertainty following last week's so-called Brexit vote would hurt

results for its third quarter ending June 30. London-focused real

estate agency Foxtons Group PLC said its 2016 earnings would be

significantly lower than last year's. It had been forecasting a

boost in London sales on an expected "remain" vote. That "is now

unlikely to materialize," it said on Monday.

Foxtons shares plunged more than 22% to GBP1.05 ($1.43), and

easyJet shares fell by a similar margin to GBP10.62. The profit

warnings follow one Friday from British Airways parent

International Consolidated Airlines Group SA.

Other executives were already charting strategic shifts and

defensive plays. In a weekend survey of more than 1,000 members by

the Institute of Directors, an organization for company directors

and senior business leaders, more than a third of those polled said

the vote would force them to cut investment.

"We can't sugarcoat this -- many of our members are feeling

anxious," said Simon Walker, the institute's director-general. "A

majority of business leaders think the vote for Brexit is bad for

them."

Michael O'Leary, chief executive of Dublin-based Ryanair

Holdings PLC, Europe's largest airline by annual passengers flown,

said he is rethinking how to deploy new planes across Europe after

the vote.

"We are taking another 50 aircraft next year. Would we place any

of those in the U. K.? It is highly unlikely," he said in an

interview. "We will pivot all of our growth into the European

Union."

Mr. O'Leary, an outspoken advocate for the remain camp ahead of

the vote, said "there clearly is going to be a hit to U.K. GDP and

to European GDP. There is three to four months of considerable

uncertainty. The pound has fallen through the floor. It has all the

feel and hallmark of another 9/11."

It wasn't all gloom and doom. Consumer-goods companies and

pharmaceutical giants, which sell a big chunk of their products

outside Europe, are relatively protected from the weakening pound

and euro. And big oil companies, which do most of their business in

dollars around the world, lured British investors fleeing other

sectors.

Still, a quarter of directors and executives polled in the IoD

survey said they would freeze hiring and 5% said they would cut

jobs because of the vote. Roughly 22% said they are considering

moving some of their operations outside of the U.K.

In British real estate, uncertainty over a possible Brexit had

already hit the housing market ahead of the referendum. Earlier

this month, property brokers were predicting prices would fall this

summer for the first time since 2012. After the vote, analysts were

widely predicting transaction volumes and values would fall

throughout the U.K.

"The outcome of the referendum will almost certainly have a

negative impact on both prices and transaction numbers," the Centre

for Economics & Business Research said.

There were some optimists among agents. Amid a fast-weakening

pound, David Adams, the head of John Taylor's real estate office in

London, said he has made verbal agreements on GBP50 million, or

about $66 million at exchange rates on Monday, in sales in the

three days following the vote -- more than his total since the

beginning of the year.

"One person bought without even seeing the property and another,

who hasn't seen it either, is about to sign," said Mr. Adams,

adding that all five people in his office worked all weekend.

Still, "buyers will expect a seriously good deal," said Roarie

Scarisbrick, partner at London buying agent Property Vision. "A few

of our clients have asked us to put a hold on the search until they

know what's going on, while an equal number have asked us to step

it up while they monitor their currency advantage."

Multinational, consumer-focused firms are among those likely to

go unscathed from a weaker U.K. currency. Unilever PLC and Reckitt

Benckiser Group PLC both sell their wares mostly overseas, so won't

see a big hit from the falling currency in their home market.

Unilever shares ended Monday up 1.2% amid the carnage

elsewhere.

Danone SA and Nestlé SA, both based in continental Europe, also

moved higher, as investors rushed into safe-haven plays like food

and drinks firms that do a lot of business outside Europe. RBC

Capital Markets analyst James Edward Jones said the U.K. is a

relatively small market for all of them, protecting them from

currency exposure and the impact of any slowing growth in Britain

or Europe. That is the same for the two big pharmaceutical

companies based here, AstraZeneca PLC and GlaxoSmithKline PLC.

Liquor giant Diageo PLC should benefits from any sustained

decline in sterling. All of its Scotch is made in Britain and most

of it is sold elsewhere. Cigarettes are often one of the last

discretionary-spending indulgences to go in a souring economy,

providing a consistent revenue stream for tobacco companies like

British American Tobacco PLC and Imperial Brands PLC.

Royal Dutch Shell PLC and BP PLC bucked the selloff, too. They

aren't exposed to sterling or the euro, since they do most of their

business in dollars. For the two, "what it comes down to is their

revenues are largely USD based," said Jefferies analyst Jason

Gammel.

The rapid depreciation of the pound against the dollar over the

last two days also makes the companies' dividends look more

affordable, attracting investors. "Right now if you're an investor

that has to have exposure to U.K. markets you're moving into names

with less perceived risk," Mr. Gammel said.

Write to Robert Wall at robert.wall@wsj.com, Saabira Chaudhuri

at saabira.chaudhuri@wsj.com and Art Patnaude at

art.patnaude@wsj.com

(END) Dow Jones Newswires

June 27, 2016 15:33 ET (19:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

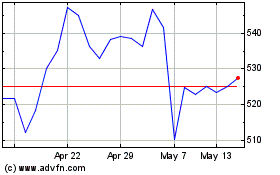

Easyjet (LSE:EZJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Easyjet (LSE:EZJ)

Historical Stock Chart

From Apr 2023 to Apr 2024