Brexit' Bookings Strong But Fares Lower, Says Ryanair

June 27 2016 - 12:50PM

Dow Jones News

LONDON—Britain's decision to leave the European Union will

weaken airfares and is causing Ryanair Holdings PLC, Europe's

largest carrier by passengers, to consider shifting growth away

from the U.K., the airline's chief executive said Monday.

"We are taking another 50 aircraft next year. Would we place any

of those in the U.K.? It is highly unlikely," Michael O'Leary said

in an interview. "We will pivot all of our growth into the European

Union."

Shares in airlines have been among the hardest hit by the U.K.

vote last week amid concern a plummeting British currency and

slowdown in economic growth will impact demand. British Airways

parent International Consolidated Airlines Group SA issued a profit

warning Friday in part linked to the outcome of the referendum, and

British budget carrier easyJet PLC Monday said earnings would be

hit. Shares in easyJet are down about 24% in afternoon London

trading.

Mr. O'Leary said "there clearly is going to be a hit to U.K. GDP

and to European GDP. There is three to four months of considerable

uncertainty. The pound has fallen through the floor. It has all the

feel and hallmark of another 9/11." Ryanair's response will be to

discount seats, he said, to fill planes.

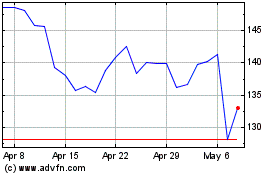

Ryanair's stock also has been dragged down sharply by the

selloff in airline shares. Mr. O'Leary said the company used the

Friday market slump to buy back its own stock. The airline

purchased about €150 million ($165 million) worth of its own

shares, Mr. O'Leary said, and would have bought more if it hadn't

reached the upper limit of its authorized annual total.

Ryanair isn't wavering from its growth plans in terms of

aircraft being introduced or passenger figures, the chief executive

said. The airline, which carried 116 million passengers last year,

expects to reach 180 million passengers by 2024. More of that

growth now will likely be generated in the EU rather than U.K., he

said.

Mr. O'Leary said bookings haven't been dented by the uncertainty

of the referendum or the fall in the British currency. The airline

early Friday, with the outcome of the vote still uncertain,

launched a previously planned seat sale celebrating the U.K.

remaining in the EU. "We had a surge of bookings," Mr. O'Leary

said, adding that having called the outcome of the vote wrong only

helped spread the word about the sale.

Despite the sharp fall in sterling, Mr. O'Leary expects to see a

limited impact on near-term bookings from the U.K. to other

destinations that are now relatively more expensive. "Bookings are

already pretty strong through June, July, August," he said. The

airline's sales made in the British currency will now translate

into fewer euros, though, impacting earnings, he said.

Airlines also face regulatory uncertainty following the U.K.

vote. British airlines and those serving the U.K. have operated

under the EU's single aviation market, which allows any airline

within the region to fly to any city in the bloc. There has been no

decision on how future traffic rights would be governed, though

British carriers have urged the U.K. to remain part of the European

aviation area.

Mr. O'Leary said he expected the U.K. to eventually negotiate

some sort of access to the EU market. If not, he said, Ryanair

could seek a U.K. license to maintain traffic rights, even though

that could entail higher costs. One of the airline's largest bases

is London Stansted airport.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

June 27, 2016 12:35 ET (16:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

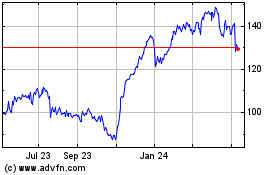

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024