Property-Sector Profit Warning Highlights 'Brexit' Risk for U.K. -- Update

June 27 2016 - 12:24PM

Dow Jones News

By Art Patnaude and Olga Cotaga

LONDON--Shares in U.K. real-estate firms--from office landlords

to property brokers and home builders--were hammered Monday after

Britons last week voted to leave the European Union, a move

analysts warned could cause property values to drop.

Foxtons Group PLC, a prominent property broker focused in

London, warned that its 2016 earnings will be significantly lower

than last year, suggesting an impending slowdown in housing deals.

Foxtons shares fell as much as 24% in morning trading in London

before being temporarily suspended.

Suspensions occur when a shares fall more than 10% from their

closing price level on the previous day.

Shares in the biggest U.K. housebuilders were also temporarily

suspended after steep losses, with Persimmon PLC down 23%. Other

home builders, including Taylor Wimpey PLC, Barratt Developments

PLC and Berkeley Group Holdings PLC, took big hits.

Land Securities PLC and British Land PLC, the two biggest listed

U.K. landlords, also saw shares drop. Since the referendum results

were announced Friday morning, Land Securities lost 24% of its

value, while British Land shed 29%.

The sharp falls followed a broad expectation that U.K.

real-estate values could drop, caused by transactions drying up

amid uncertainty about how the U.K. will extricate itself from the

EU.

In the run-up to the referendum, uncertainty over a possible

Brexit vote had already hit the housing market throughout the U.K.

Earlier this month, property brokers were predicting prices would

fall this summer for the first time since 2012.

For housebuilders' earnings, a Brexit-inspired fall in consumer

confidence, or if banks become less willing to lend, could be "very

damaging," analysts at Swiss lender UBS Group AG said.

For landlords that own U.K. commercial real estate, values "now

look likely to decline moderately over the remainder of the year,"

according to U.K. asset manager Aviva PLC.

Part of this could be driven by exodus of companies to Europe,

led by financial services firms, which would have an outsize impact

on London office market, analysts said.

Jefferies analysts estimate the U.K. capital could lose 100,000

jobs to Europe.

Like with commercial property in London, the housing market has

a greater reliance on overseas buyers, making it especially

susceptible to weaker sentiment from foreign investors.

"Areas which are more reliant on EU buyers, such as South

Kensington and Angel, may well see a price correction," Robin

Paterson, chief executive of U.K. Sotheby's International Realty,

on Friday. He noted that prices in other areas could still perform

well.

Transaction levels of high-end homes in central London had

already been falling over the past year. Tax hikes, years of rising

prices and Brexit uncertainty helped keep buyers at bay. Foreign

investors from Asia and the Mideast were also contending with

concerns over slowing global economic growth, weak oil prices and

stock-market shocks.

Some analysts have noted that the sharp drop in the value of

sterling against other currencies in the last few days could

encourage bargain hunters from abroad. Pressure on the British

pound intensified Monday after the currency closed at its lowest

levels in more than 30 years on Friday.

"Buyers will expect a seriously good deal," said Roarie

Scarisbrick, partner at buying agent Property Vision.

Transactions are a cornerstone for commission-lead brokers like

Foxtons, which, like other brokers and analysts, had expected a

boost to activity in the London housing market if Britons voted to

remain in the EU.

"The upturn we were expecting during the second half of this

year is now unlikely to materialize," Foxtons said in a statement.

Challenging conditions "are now likely to continue for at least the

remainder of the year."

Write to Art Patnaude at art.patnaude@wsj.com

(END) Dow Jones Newswires

June 27, 2016 12:09 ET (16:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

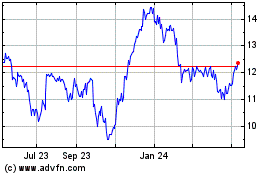

Barratt Development (PK) (USOTC:BTDPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barratt Development (PK) (USOTC:BTDPY)

Historical Stock Chart

From Apr 2023 to Apr 2024