Current Report Filing (8-k)

June 23 2016 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 23, 2016

SOUTHWEST AIRLINES CO.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Texas

|

|

1-7259

|

|

74-1563240

|

|

(State or other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

P.O. Box 36611, Dallas, Texas

|

|

75235-1611

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (214) 792-4000

Not Applicable

(Former

name or former address if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 7.01

|

Regulation FD Disclosure.

|

Southwest Airlines Co. (the “Company”) today held and webcast its

2016 Investor Day. A replay of the audio webcast of the Company’s remarks will be available on the Company’s website at http://investors.southwest.com, in the Events & Presentations section under Past Events and Related

Presentations. The slides used in conjunction with the Company’s 2016 Investor Day presentations are furnished herewith as Exhibit 99.1 and are incorporated by reference into this Item 7.01.

In addition, the Company is providing tables showing its restructured aircraft delivery schedule, as discussed during today’s presentations. The tables

are furnished herewith as Exhibit 99.2 and are incorporated by reference into this Item 7.01.

In conjunction with today’s presentations, the

Company is also providing the fair market value of its fuel derivative contracts. As of June 20, 2016, the net liability for the remainder of 2016 was approximately $533 million, and the net liability for the hedge portfolio in 2017 and 2018,

combined, was approximately $439 million.

The information furnished in this Item 7.01 shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits:

|

|

|

|

|

99.1

|

|

Southwest Airlines 2016 Investor Day Slide Presentations.

|

|

|

|

|

99.2

|

|

Restructured delivery schedule.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

June 23, 2016

|

|

|

|

By:

|

|

/s/ Tammy Romo

|

|

|

|

|

|

|

|

Executive Vice President & Chief Financial Officer

|

Exhibit Index

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Southwest Airlines 2016 Investor Day Slide Presentations.

|

|

|

|

|

99.2

|

|

Restructured delivery schedule.

|

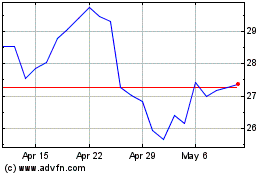

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

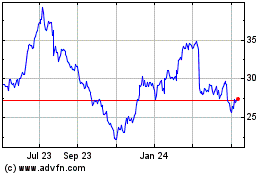

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Apr 2023 to Apr 2024