UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

þ

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

¨

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________________ to __________________________

Commission File Number 001-31921

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Compass Minerals International, Inc. Savings Plan

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Compass Minerals International, Inc.

9900 West 109

th

Street, Suite 100

Overland Park, Kansas 66210

Table of Contents

Report of Independent Registered Public Accounting Firm

The Plan Administrator

Compass Minerals International, Inc. Savings Plan

We have audited the accompanying statements of net assets available for benefits of Compass Minerals International, Inc. Savings Plan as of December 31, 2015 and 2014, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of Compass Minerals International, Inc. Savings Plan at December 31, 2015 and 2014, and the changes in its net assets available for benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets (held at end of year)

as of December 31, 2015,

has been subjected to audit procedures performed in conjunction with the audit of Compass Minerals International Inc. Savings Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

Kansas City, Missouri

June 23, 2016

|

|

|

|

|

|

|

|

|

|

|

Compass Minerals International, Inc. Savings Plan

|

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

December 31,

|

|

Assets

|

2015

|

2014

|

|

Investments, at fair value (Notes 2 and 3)

|

$

|

94,847,796

|

|

$

|

95,841,030

|

|

|

|

|

|

|

Receivables

|

|

|

|

Employer contributions

|

1,392,664

|

|

3,653,800

|

|

|

Notes receivable from participants

|

2,814,498

|

|

2,482,861

|

|

|

|

4,207,162

|

|

6,136,661

|

|

|

Net Assets Available for Benefits

|

$

|

99,054,958

|

|

$

|

101,977,691

|

|

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compass Minerals International, Inc. Savings Plan

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2015

|

2014

|

|

Additions to net assets attributed to:

|

|

|

|

Investment income

|

|

|

|

Net (depreciation) appreciation in fair value of investments

|

$

|

(2,400,855

|

)

|

$

|

779,077

|

|

|

Interest and dividend income

|

2,565,758

|

|

5,462,052

|

|

|

Net investment income

|

164,903

|

|

6,241,129

|

|

|

Contributions

|

|

|

|

Participants

|

5,115,087

|

|

4,338,899

|

|

|

Employer

|

4,786,240

|

|

6,679,982

|

|

|

Rollovers

|

481,104

|

|

628,835

|

|

|

Total contributions

|

10,382,431

|

|

11,647,716

|

|

|

|

|

|

|

Benefits paid to participants

|

(13,389,015

|

)

|

(15,896,689)

|

|

|

Administrative expenses

|

(81,052

|

)

|

(48,112)

|

|

|

Net (decrease) increase in net assets

|

(2,922,733

|

)

|

1,944,044

|

|

|

Net assets available for benefits at beginning of year

|

101,977,691

|

|

100,033,647

|

|

|

Net assets available for benefits at end of year

|

$

|

99,054,958

|

|

$

|

101,977,691

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

Note 1. Description of the Plan

The following description of the Compass Minerals International, Inc. Savings Plan (the “Plan”) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

: The Plan is a contributory, defined contribution plan covering eligible U.S. employees of Compass Minerals International, Inc. (the “Company” or “Compass Minerals”) and its subsidiaries. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Contributions

: Participants are allowed to contribute, on either a pre-tax or Roth after-tax basis, a percentage of their eligible compensation as defined by the Plan, up to the maximum of the lesser of 60% (increased to 75% effective November 2, 2015) of their eligible compensation or the annual limit allowed by the Internal Revenue Code, as amended (the “IRC”) – $18,000 in 2015 and $17,500 in 2014. Participants who are age fifty or older, and who contribute the maximum federal limit, are eligible to make an additional “catch-up contribution.” The maximum catch-up contribution for 2015 was $6,000 and for 2014 was $5,500. Participants may also elect to contribute to the Plan on an after-tax (non-Roth) basis. Participants may contribute from a minimum of 1% to a maximum of 10% of their eligible compensation on an after-tax basis, subject to the maximum allowed by IRC rules. Newly-hired participants are automatically enrolled in the Plan at an initial, pre-tax amount of 6% (1% prior to 2016) of their eligible compensation. Participants may terminate or change their election at any time subsequent to the automatic enrollment.

The Company contributes, for each participant, a non-discretionary matching contribution on up to 6% of a participant’s eligible compensation as follows: 100% of the participant’s contribution (either pre-tax or Roth) up to the first 3% of eligible compensation and 50% of the next 3% of eligible compensation. For non-union participants, the Company may also make profit sharing contributions to the Plan at the discretion of the Company’s Board of Directors. Participants must be employed on the last day of the Plan year to be eligible for discretionary profit-sharing contributions, except in the case of a participant’s death, disability, or retirement, as defined in the Plan document. For the years ended December 31, 2015 and 2014, discretionary profit sharing contributions totaling $1,317,424 and $3,550,290, respectively, were accrued for the Plan.

The Company has elected to make a fixed contribution to each participant’s account equal to 1% of the participant’s eligible compensation (as defined in the Plan document), which is automatically invested in Compass Minerals common stock. This contribution will remain in Compass Minerals common stock unless the participant redirects the investment into another investment option available under the Plan. In addition, the Company may designate a qualified non-elective contribution to be allocated to non-highly compensated employees to maintain compliance with IRC non-discrimination tests.

The Plan also allows participants to rollover part or all of an eligible rollover distribution received by the participant from another qualified plan.

Participant accounts

: Each participant’s account is credited with the participant’s contribution, the Company’s non-discretionary matching contribution, rollover contributions, allocation of the Company’s discretionary profit-sharing contribution (if applicable), the fixed employer contribution in Compass Minerals common stock and Plan earnings or losses. Allocations are based on earnings or account balances as defined in the Plan document. A participant is entitled to receive only the vested portion of their account balance at the time of a distributable event.

Eligibility

: All U.S. employees of the Company and its subsidiaries are eligible to participate in the Plan immediately upon employment, with the exception of employees who are citizens of Puerto Rico, certain non-resident aliens, leased employees, seasonal and temporary employees (including interns) and independent contractors, who are excluded from eligibility pursuant to the provisions of the Plan. Further, employees covered by a collective bargaining agreement are eligible only to the extent participation in the Plan is part of the negotiated collective bargaining agreement.

Participant investment options

: Each participant is responsible for directing the investment of his or her existing account balances and all future contributions made on his or her behalf among the designated investment alternatives, including shares of Compass Minerals common stock. Participants may change their investment options at any time throughout the year via the internet or by calling Fidelity Management Trust Company. However, participants who are subject to

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

trading window restrictions for transactions in Compass Minerals common stock may not have the ability to change their investment in Compass Minerals common stock during specified periods.

Vesting

: All participants are immediately vested in the portion of their Plan account related to participant contributions, rollover deposits, non-discretionary Company matching contributions, fixed Company contributions of funds to purchase Compass Minerals common stock and earnings or losses thereon. Participants vest in the Company discretionary profit sharing contributions, and any earnings or losses thereon, at a rate of 20% each year beginning on the participant’s first anniversary of employment.

Forfeitures

: Forfeitures of terminated participants’ non-vested Company contributions are used to pay Plan administrative expenses and reduce employer contributions. No forfeitures were used to reduce employer contributions in either 2015 or 2014. The Plan used forfeitures of $60,000 and $30,000 to pay Plan expenses in 2015 and 2014, respectively. At December 31, 2015, the forfeiture balance of $104,407, which was included in investments at fair value on the Statements of Net Assets Available for Benefits, was available to apply to future Plan administrative expenses or employer contributions.

Participant loans

: Participants are able to borrow from their fund accounts a minimum of $1,000 and up to a maximum amount equal to the lesser of $50,000 or 50% of their vested account balance. The loans are for terms of one to five years for general purpose loans and one to ten years for residential loans, except for certain loans grandfathered in under pre-existing plans which have terms of up to 30 years. The loans must be adequately secured by the vested account balance and bear interest at a rate commensurate with local prevailing rates. Interest rates on outstanding loans at December 31, 2015, range from 4.25% to 7.0%. Principal and interest are paid ratably through after-tax payroll deductions with maturity dates ranging from 2016 through 2025.

Payment of benefits

: Upon disability, retirement or termination of service, participants, or their designated beneficiaries in case of death, are eligible to request a distribution of their vested account balance. If a participant’s vested account balance exceeds $5,000, a participant or designated beneficiary may elect to receive a lump sum payment or defer distributions to a later date. Vested account balances of less than $5,000 but greater than $1,000 will be rolled-over into an investment retirement account while vested account balances of $1,000 or less will be distributed in one lump sum payment, unless the participant or designated beneficiary elects another option before the end of the Plan year. Distributions are made in accordance with Plan provisions in the form of lump sum distributions or installment distributions.

Administrative expenses

: Certain administrative functions are performed by officers or employees of the Company or its subsidiaries. No such officer or employee receives compensation from the Plan. Expenses incurred in the administration of the Plan, which consist primarily of trustee and record keeping fees, may be paid from Plan assets and, therefore, deducted from participant accounts, may be paid from forfeitures of non-vested Company contributions to the Plan or may be paid by the Company, in its discretion, on behalf of Plan participants.

Note 2. Significant Accounting Policies

The Plan’s significant accounting policies are as follows:

Basis of accounting

: The financial statements of the Plan are presented on the accrual basis of accounting, in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”).

Investment valuation and income recognition

: Investments held by the Plan are stated at fair value less costs to sell, if those costs are significant. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). See Note 3 for further discussion of fair value measurements.

Purchases and sales of securities are accounted for on a trade-date basis. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date.

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

Use of estimates

: The preparation of financial statements in conformity with U.S. GAAP requires the Company, as plan administrator, to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein. Actual results could differ from those estimates.

Payment of benefits

: Benefits are recorded when paid.

Notes receivable from participants

: Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Any related fees are recorded as administrative expenses and expensed when incurred. No allowance for losses has been recorded as of December 31, 2015 or 2014. The Plan’s receivables approximate fair value. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the remaining participant loan balance is recorded as a benefit payment.

Recent accounting pronouncements

: In May 2015, the Financial Accounting Standards Board (the “FASB”) issued guidance

which removes the requirement to categorize within the fair value hierarchy investments for which fair values are estimated using the net asset value practical expedient provided by the fair value measurement guidance in U.S. GAAP. The guidance is effective for fiscal years beginning after December 15, 2016. Early adoption is permitted. The Company elected early adoption as of December 31, 2015. The guidance has been applied retrospectively to all periods presented, as required.

In July 2015, the FASB issued guidance associated with plan accounting comprised of three parts. Part I eliminates the requirements to measure the fair value of fully benefit-responsive investment contracts and provide certain disclosures. Contract value is the only required measure for fully benefit-responsive investment contracts. Part II eliminates the requirements to disclose individual investments that represent five percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. It also simplifies the level of disaggregation of investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investment by nature, characteristics and risks. Further, the disclosure of information about fair value measurements must be provided by general type of plan asset. Part III is not applicable to the Plan. The guidance is effective for fiscal years beginning after December 15, 2016. Early adoption is permitted. The Company elected early adoption of Parts I and II as of December 31, 2015. The guidance has been applied retrospectively to all periods presented, as required.

Note 3. Fair Value Measurements

As required by U.S. GAAP, the Plan’s financial instruments are measured and reported at their estimated fair value less costs to sell, if those costs are significant. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction. The following provides a description of the fair value hierarchy of inputs that may be used to measure fair value.

Level 1 – Quoted market prices in active markets for identical assets or liabilities;

Level 2 – Inputs other than Level 1 that are either directly or indirectly observable; and

Level 3 – Unobservable inputs developed using estimates and assumptions developed by the Plan.

The Plan’s investments are measured using the following valuation methods:

Interest-bearing cash

: The carrying amount of the Plan’s cash accounts approximates fair value.

Mutual funds

: The fair value of these funds is determined using the net asset value based upon observable market quotations as of the close of business on the last trading day of the year.

Self-directed brokerage accounts

: These accounts primarily consist of interest-bearing cash, for which the carrying amount approximates fair value, and mutual funds and common stock, which are valued based upon observable market quotations as of the close of business on the last trading day of the year.

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

Compass Minerals common stock

: The fair value is based upon observable market quotations as of the close of business on the last trading day of the year.

Common/collective trusts

: The Principal Trust Income Funds and the Principal Trust Target Funds are held in common collective trust funds, which consist of investments in mutual funds, collective trusts and pooled-separate accounts. The Principal Trust Income Fund seeks current income and, as a secondary objective, capital appreciation. The Principal Trust Target Funds seek total return consisting of long-term growth of capital and current income, consistent with the investment strategy of an investor who expects to retire in a specific year.

The Fidelity Managed Income Portfolio Fund is also held in a common collective trust fund and is designed to deliver safety and stability by preserving principal and accumulating earnings. This fund is primarily invested in guaranteed investment contracts and synthetic investment contracts. Participant-directed redemptions have no restrictions; however, the Plan is required to provide a one-year redemption notice to liquidate its entire share in the fund.

Net asset value per unit, as determined by the fund trustee at year-end, is used as a practical expedient to estimate fair value for the investments held in common collective trusts. This practical expedient would not be used if it is determined to be probable that the fund will sell the investment for an amount different from the reported net asset value.

The fair values of investments as of December 31, 2015 and 2014, are included in the tables below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2015

|

Level 1

|

Level 2

|

Level 3

|

|

Interest-bearing cash

|

$

|

1,446,473

|

|

$

|

1,446,473

|

|

$

|

—

|

|

$

|

—

|

|

|

Mutual funds

|

22,122,513

|

|

22,122,513

|

|

—

|

|

—

|

|

|

Self-directed brokerage account

|

438,780

|

|

438,780

|

|

—

|

|

—

|

|

|

Compass Minerals common stock

|

5,536,993

|

|

5,536,993

|

|

—

|

|

—

|

|

|

Total assets in the fair value hierarchy

|

29,544,759

|

|

29,544,759

|

|

—

|

|

—

|

|

|

Investments measured at net asset value:

|

|

|

|

|

|

Common/collective trusts

|

65,303,037

|

|

—

|

|

—

|

|

—

|

|

|

Investments at fair value

|

$

|

94,847,796

|

|

$

|

29,544,759

|

|

$

|

—

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2014

|

Level 1

|

Level 2

|

Level 3

|

|

Interest-bearing cash

|

$

|

4,321,119

|

|

$

|

4,321,119

|

|

$

|

—

|

|

$

|

—

|

|

|

Mutual funds

|

75,102,194

|

|

75,102,194

|

|

—

|

|

—

|

|

|

Self-directed brokerage account

|

243,136

|

|

243,136

|

|

—

|

|

—

|

|

|

Compass Minerals common stock

|

5,907,018

|

|

5,907,018

|

|

—

|

|

—

|

|

|

Total assets in the fair value hierarchy

|

85,573,467

|

|

85,573,467

|

|

—

|

|

—

|

|

|

Investments measured at net asset value:

|

|

|

|

|

|

Common/collective trusts

|

10,267,563

|

|

—

|

|

—

|

|

—

|

|

|

Investments at fair value

|

$

|

95,841,030

|

|

$

|

85,573,467

|

|

$

|

—

|

|

$

|

—

|

|

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

Note 4. Reconciliation of Financial Statements to Form 5500

The following table is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 as of December 31 of each year.

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

2014

|

|

Net assets available for benefits per financial statements

|

$

|

99,054,958

|

|

$

|

101,977,691

|

|

|

Adjustment from contract value to fair value for interest in fully benefit-responsive investment contracts in common/collective trust

|

—

|

|

152,302

|

|

|

Net assets available for benefits per Form 5500

|

$

|

99,054,958

|

|

$

|

102,129,993

|

|

The following table is a reconciliation of the net increase in net assets per the financial statements and the net income as shown in the Form 5500 for the year ended December 31, 2015.

|

|

|

|

|

|

|

|

|

2015

|

|

Net decrease in net assets per financial statements

|

$

|

(2,922,733

|

)

|

|

Change in adjustment from contract value to fair value for fully benefit-responsive investment contracts held by a collective trust

|

(152,302

|

)

|

|

Net loss per Form 5500

|

$

|

(3,075,035

|

)

|

Note 5. Party-In-Interest Transactions

Plan investments include mutual funds and a common/collective trust, which are managed by Fidelity Management Trust Company. Fidelity Management Trust Company is the trustee as defined by the Plan and, therefore, these transactions qualify as party-in-interest transactions.

The Company, as plan administrator and sponsor, is a party-in-interest to the Plan. At December 31, 2015 and 2014, the Plan held 73,561.751 and 68,029.689 shares, respectively, of Compass Minerals common stock with market values of $5,536,993 and $5,907,018, respectively. During 2015 and 2014, the Plan purchased $1,302,371 and $1,223,961, respectively, of Compass Minerals common stock and sold $806,786 and $948,991, respectively, of Compass Minerals common stock. During 2015 and 2014, the Company declared and paid dividends of $2.64 and $2.40, respectively, per share of Compass Minerals common stock.

Note 6. Income Tax

The Plan received a favorable determination letter from the Internal Revenue Service (the “IRS”), dated April 27, 2012, confirming that the form of the Plan document was qualified under Section 401(a) of the IRC. The Plan was amended and restated in its entirety on October 30, 2015, to incorporate applicable changes in the law and to make certain other changes. The amended and restated Plan document is based on an IRS pre-approved volume submitter plan maintained by Fidelity Management & Research Company.

U.S. GAAP requires plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2015, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, the plan administrator believes there are currently no audits underway or in progress for any tax periods. The plan administrator believes the Plan is no longer subject to income tax examinations for years prior to 2012.

Note 7. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market volatility and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

could materially affect a participant’s account balance and the amounts reported in the statements of net assets available for benefits.

Note 8. Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants would become 100% vested in their accounts.

|

|

|

|

|

|

|

|

|

|

|

|

|

Compass Minerals International, Inc. Savings Plan

|

|

|

|

Employer Identification Number 36-3972986, Plan 001

|

|

|

|

Form 5500 Schedule H, Line 4i

|

|

|

|

|

Schedule of Assets (Held at end of Year)

|

|

|

|

As of December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

Identity of issuer, borrower, lessor or similar party

|

Description of investment including maturity date, collateral, par or maturity value

|

Number of Shares/Units

|

Current Value

|

|

|

Columbia

|

Columbia Dividend Inc Y - Mutual Fund

|

43,811.75

|

|

782,039

|

|

|

|

PIMCO

|

PIMCO High Yield Inst Fund - Mutual Fund

|

186,260.74

|

|

1,538,514

|

|

|

|

American Century

|

AmCent Inflation-Adj. Bond Fund Institutional Class - Mutual Fund

|

15,727.55

|

|

176,935

|

|

|

|

T. Rowe Price

|

International Discovery Fund - Mutual Fund

|

15,942.01

|

|

860,071

|

|

|

|

BlackRock

|

Total Return Fund Class K - Mutual Fund

|

182,701.56

|

|

2,102,895

|

|

|

*

|

Compass Minerals International, Inc.

|

Common Stock

|

73,561.75

|

|

5,536,993

|

|

|

|

Principal Trust

|

Principal Trust Target Income Fund I - Common/Collective Trust

|

19,573.27

|

|

293,403

|

|

|

|

Principal Trust

|

Principal Trust Target 2010 Fund I - Common/Collective Trust

|

105,201.20

|

|

1,869,425

|

|

|

|

Principal Trust

|

Principal Trust Target 2015 Fund I - Common/Collective Trust

|

180,558.24

|

|

3,385,467

|

|

|

|

Principal Trust

|

Principal Trust Target 2020 Fund I - Common/Collective Trust

|

624,736.74

|

|

12,351,045

|

|

|

|

Principal Trust

|

Principal Trust Target 2025 Fund I - Common/Collective Trust

|

508,375.84

|

|

10,396,286

|

|

|

|

Principal Trust

|

Principal Trust Target 2030 Fund I - Common/Collective Trust

|

460,864.74

|

|

9,691,985

|

|

|

|

Principal Trust

|

Principal Trust Target 2035 Fund I - Common/Collective Trust

|

442,226.38

|

|

9,534,401

|

|

|

|

Principal Trust

|

Principal Trust Target 2040 Fund I - Common/Collective Trust

|

165,614.22

|

|

3,635,232

|

|

|

|

Principal Trust

|

Principal Trust Target 2045 Fund I - Common/Collective Trust

|

114,189.46

|

|

2,556,702

|

|

|

|

Principal Trust

|

Principal Trust Target 2050 Fund I - Common/Collective Trust

|

70,041.68

|

|

1,565,432

|

|

|

|

Principal Trust

|

Principal Trust Target 2055 Fund I - Common/Collective Trust

|

36,840.03

|

|

831,479

|

|

|

|

Principal Trust

|

Principal Trust Target 2060 Fund I - Common/Collective Trust

|

8,301.65

|

|

89,575

|

|

|

*

|

Fidelity

|

Fidelity Equity Income K - Mutual Fund

|

38,947.20

|

|

1,988,644

|

|

|

*

|

Fidelity

|

Fidelity Growth Company K Fund - Mutual Fund

|

56,782.37

|

|

7,770,100

|

|

|

*

|

Fidelity

|

Fidelity Spartan Small Cap Index Fund - Mutual Fund

|

37,923.61

|

|

586,299

|

|

|

*

|

Fidelity

|

Fidelity Spartan 500 Index Inst - Mutual Fund

|

50,259.81

|

|

3,609,157

|

|

|

*

|

Fidelity

|

Fidelity Spartan Extended Market - Mutual Fund

|

25,852.73

|

|

1,297,807

|

|

|

*

|

Fidelity

|

Fidelity Spartan International Index - Mutual Fund

|

39,244.42

|

|

1,410,052

|

|

|

*

|

Fidelity

|

Fidelity Retirement Money Market Fund

|

1,445,784.90

|

|

1,445,785

|

|

|

*

|

Fidelity

|

Fidelity Managed Income Portfolio - Common/Collective Trust

|

9,102,604.68

|

|

9,102,605

|

|

|

*

|

Fidelity**

|

Brokeragelink (self-directed)

|

—

|

|

438,780

|

|

|

*

|

Plan Participants

|

Participant loans receivable (4.25% - 7.0%) maturing 2016 through 2025

|

—

|

|

2,814,498

|

|

|

|

|

|

|

$

|

97,661,606

|

|

|

|

|

|

*

|

Represents a party-in-interest.

|

** Includes Fidelity investments.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Compass Minerals International, Inc., as plan administrator for the Plan, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

COMPASS MINERALS INTERNATIONAL, INC. SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

By:

|

COMPASS MINERALS INTERNATIONAL, INC.,

as Plan Administrator

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

June 23, 2016

|

|

By:

|

/s/ Steven N. Berger

|

|

|

|

|

|

Name: Steven N. Berger

|

|

|

|

|

|

Title: Senior Vice President, Corporate Services

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description of Exhibit

|

|

23.1

|

Consent of Ernst & Young LLP.

|

|

|

|

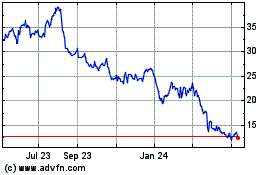

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

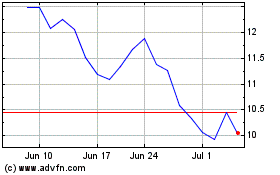

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Apr 2023 to Apr 2024