FedEx to Increase Capital Spending by 6% -- WSJ

June 22 2016 - 3:07AM

Dow Jones News

By Laura Stevens

It's going to be another expensive year for FedEx Corp., as the

delivery company again increases spending to accommodate growth in

e-commerce and to update its aircraft fleet.

The Memphis, Tenn., company said it would increase capital

spending for the year that started June 1 by 6% to $5.1 billion.

That doesn't include the cost of incorporating and integrating its

recent acquisition of Dutch parcel firm TNT Express NV.

The additional spending has pressured margins in some of the

delivery giant's business segments, which drew questions from

analysts on a Tuesday earnings call with FedEx executives.

"We don't manage FedEx Corporation trying to maximize each

segment margin each year and if we did that, we would never be able

to take advantage of this broad portfolio and the cross selling

that's available to us," said Chief Executive Fred Smith. "It would

be wonderful if every year we could have maximum margins at all of

our operating companies, but that's just not realistic."

FedEx issued guidance for its current financial year,

forecasting adjusted earnings of $11.75 to $12.25 a share excluding

all effects from its acquisition of TNT. Analysts polled by Thomson

Reuters expected profit of $12.05 a share.

Shares fell 1.5% to $161.50 after hours, although the company's

adjusted per-share earnings and revenue beat expectations.

For the first time, FedEx executives revealed more details of

its acquisition of TNT Express, which the company has owned for 28

days. The executives said senior leadership had been installed at

TNT and so far the company expects capital spending of $100 million

related to the acquisition, along with integration costs of $200

million for fiscal 2017. The acquisition could start contributing

to FedEx profits by its fiscal 2018.

While it is too early to provide many details, executives said

FedEx's technology base already has been developed with the goal of

being able to integrate customers and products from acquisitions,

including those it has made previously. "This is our largest

acquisition, but certainly not our first," said Rob Carter, chief

information officer.

FedEx is continuing to spend heavily on ground operations to

accommodate e-commerce. Still, Mr. Smith said the Millennial

generation will keep shopping in stores, and e-commerce will never

eliminate brick-and-mortar retail. Instead, it will "change the

character of retail," he said. "It's going to be a long time before

retail is threatened."

FedEx Ground volumes grew by 10% in the quarter. Ground revenue

increased 20% to $4.29 billion, while operating income was up 9% to

$656 million.

Mr. Smith added that he is concerned about the positions of both

presidential candidates when it comes to trade. "I would say we

have a hard time putting up a list of the things that don't concern

us giving the two candidates' positions," Mr. Smith said.

"Obviously we are concerned about the anti-trade rhetoric, a lot of

the antibusiness positions and it's very worrisome. But hopefully,

after the election, cooler heads will prevail."

For the period ended May 31, FedEx reported a loss of $70

million, or 26 cents a share, compared with a year-earlier loss of

$895 million, or $3.16 a share. Excluding pension-accounting

adjustments, TNT acquisition- and integration-related expenses and

other items, adjusted per-share earnings rose to $3.30 from

$2.66.

Revenue increased 7.4% to $13 billion.

--Tess Stynes contributed to this article.

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

June 22, 2016 02:52 ET (06:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

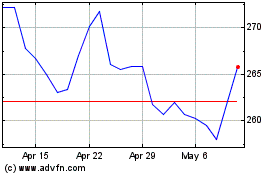

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

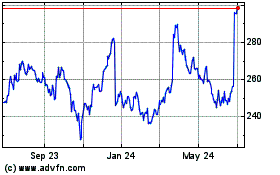

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024