UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 17, 2016

ENERGY

FUELS INC.

(Exact name of registrant as specified in its charter)

| Ontario |

001-36204 |

98-1067994 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

225 Union Blvd., Suite 600

Lakewood, Colorado |

80228 |

| (Address of principal executive offices) |

(Zip Code) |

| (303) 974-2140 |

| (Registrant’s telephone number, including area code) |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate

box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 8.01 Other Events.

On June 17, 2016, Energy Fuels Inc. issued

a press release attached hereto as Exhibit 99.1

The information furnished pursuant to this

Item 8.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise

subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing under the

Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press Release dated June 17, 2016

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

ENERGY FUELS INC.

(Registrant) |

| Dated: June 17, 2016 |

By: /s/ David C. Frydenlund

David C. Frydenlund

Senior Vice President, General Counsel and Corporate Secretary |

| |

|

Exhibit 99.1

Energy Fuels Initiates Advance Notice Procedures for Possible

Meeting of Holders of its Convertible Debentures

LAKEWOOD, CO, June 17, 2016 /CNW/ - Energy Fuels Inc. (NYSE

MKT:UUUU; TSX:EFR) ("Energy Fuels" or the "Company"), a leading producer of uranium in the United States,

is pleased to announce that it is considering seeking amendments to the terms of its existing Cdn$22 million principal amount of

floating rate, convertible, unsecured, subordinated debentures (the "Debentures"), and has commenced advance notice procedures

in order to be in a position to call a meeting of Debenture holders to be held on August 4, 2016, should the Company decide to

proceed with the amendments.

The amendments under consideration include an extension of

the term of the Debentures, which are currently set to mature on June 30, 2017, a reduction in the current conversion price of

Cdn$15.00, to a premium that better reflects current market conditions, the addition of certain redemption rights, the addition

of certain provisions required under the US Trust Indenture Act, as well as other amendments that the Company may determine would

be beneficial to the Company and the Debenture holders. The Debentures currently trade on the Toronto Stock Exchange ("TSX")

under the symbol "EFR.DB." Any amendments to the Debentures will be subject to the approval of the Debenture holders

and the TSX.

The Company has several alternatives available to it to address

the upcoming maturity of the Debentures, including retiring the Debentures with shares or cash under the existing terms of the

Debentures, refinancing the Debentures with another financing vehicle, or amending the terms of the Debentures to extend the maturity

date. The Company also previously announced that it has in place a Normal Course Issuer Bid ("NCIB") which allows

the Company to purchase for cancellation up to Cdn$2.2 million of the principal amount of the Debentures, through open market purchases

at prevailing prices on the TSX, should market conditions warrant. The NCIB will remain in effect until the earlier of October

1, 2016 or the date on which the Company has purchased the maximum number of Debentures permitted under the NCIB. As of the

date hereof, the Company has not repurchased any Debentures under the NCIB.

If the Company decides to seek amendments to the Debentures,

it is expected that a proxy circular will be mailed to the Debenture-holders on or before July 11, 2016. The circular will

describe the proposed revised terms. In order for the amendments to be approved, the votes of holders of two-thirds of the

principal amount of Debentures represented in person or by proxy at the meeting must be cast in favor of the amendments.

A quorum for the meeting will be 25% of the principal amount of Debentures.

If pursued, the alternative of extending the Debentures would

offer the Company additional financial flexibility, including the ability to preserve working capital to the extent the Debentures

would otherwise have been retired by the payment of cash and to reduce equity dilution in 2017 to the extent the Debentures would

otherwise have been retired by the issuance of equity in 2017. The amendments would also benefit Debenture holders by better

aligning the terms of the Debentures with current market conditions.

A decision on whether the Company will pursue the amendments

to the Debentures is expected to be announced in early-July, 2016. The Company intends to obtain input from certain holders

of Debentures before making its decision.

About Energy Fuels: Energy Fuels is

a leading integrated US-based uranium mining company, supplying U3O8 to major nuclear utilities. Energy

Fuels holds three of America's key uranium production centers, the White Mesa Mill in Utah, the Nichols Ranch Processing Facility

in Wyoming, and the Alta Mesa Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the

U.S. today and has a licensed capacity of over 8 million pounds of U3O8 per year. The Nichols Ranch

Processing Facility is an in situ recovery ("ISR") production center with a licensed capacity of 2 million pounds of

U3O8 per year. Alta Mesa is an ISR production center with an operating capacity of 1.5 million pounds

of U3O8 per year that is currently on standby. Energy Fuels also has the largest NI 43-101 compliant

uranium resource portfolio in the U.S. among producers, and uranium mining projects located in a number of Western U.S. states,

including one producing ISR project, mines on standby, and mineral properties in various stages of permitting and development.

The Company's common shares are listed on the NYSE MKT under the trading symbol "UUUU", and on the Toronto Stock Exchange

under the trading symbol "EFR".

Cautionary Note Regarding Forward-Looking Statements:

Certain information contained in this news release, including: any information relating to the Company being a leading producer

of uranium;the alternatives available to the Company regarding the upcoming maturity of the Debentures; whether or not any amendments

to the Debentures may be sought; whether any required approval of the TSX and the Debenture holders will be obtained; any flexibility

that may be provided to the Company from any such amendments, including preserving working capital and reducing dilution; any benefits

to the Company or the Debenture holders from any proposed amendments; and any other statements regarding Energy Fuels' future expectations,

beliefs, goals or prospects; constitute forward-looking information within the meaning of applicable securities legislation (collectively,

"forward-looking statements"). All statements in this news release that are not statements of historical fact (including

statements containing the words "expects", "does not expect", "plans", "anticipates", "does

not anticipate", "believes", "intends", "estimates", "projects", "potential",

"scheduled", "forecast", "budget" and similar expressions) should be considered forward-looking statements.

All such forward-looking statements are subject to important risk factors and uncertainties, many of which are beyond Energy Fuels'

ability to control or predict. A number of important factors could cause actual results or events to differ materially from

those indicated or implied by such forward-looking statements, including without limitation factors relating to: the Company being

a leading producer of uranium;the alternatives available to the Company regarding the upcoming maturity of the Debentures; whether

or not any amendments to the Debentures may be sought; whether any required approvals of the TSX and the Debenture holders will

be obtained; any flexibility that may be provided to the Company from any such amendments, including preserving working capital

and reducing dilution; any benefits to the Company or the Debenture holders from any proposed amendments; and other risk factors

as described in Energy Fuels' most recent annual report on Form 10-K and quarterly financial reports. Energy Fuels

assumes no obligation to update the information in this communication, except as otherwise required by law. Additional information

identifying risks and uncertainties is contained in Energy Fuels' filings with the various securities commissions which are available

online at www.sec.gov and www.sedar.com. Forward-looking statements are provided for the purpose of providing information

about the current expectations, beliefs and plans of the management of Energy Fuels relating to the future. Readers are cautioned

that such statements may not be appropriate for other purposes. Readers are also cautioned not to place undue reliance on

these forward-looking statements, that speak only as of the date hereof.

SOURCE Energy Fuels Inc.

%CIK: 0001385849

For further information: Investor Relations Inquiries: Energy

Fuels Inc., Curtis Moore - VP - Marketing & Corporate Development, (303) 974-2140 or Toll free: (888) 864-2125, investorinfo@energyfuels.com,

www.energyfuels.com

CO: Energy Fuels Inc.

CNW 17:45e 17-JUN-16

This regulatory filing also includes additional resources:

ex991.pdf

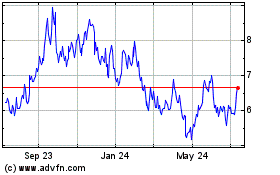

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Apr 2023 to Apr 2024