UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

|

|

|

Filed by the Registrant

Filed by the Registrant

|

|

¨

Filed by a Party other than the Registrant

|

|

|

|

|

|

Check the appropriate box:

|

|

¨

|

|

Preliminary Proxy Statement

|

|

¨

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2))

|

|

|

|

Definitive Proxy Statement

|

|

¨

|

|

Definitive Additional Materials

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12

|

McKESSON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

Payment of Filing Fee

(Check the appropriate box):

|

|

|

|

No fee required.

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

(5) Total fee paid:

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

|

(3) Filing Party:

|

|

|

|

(4) Date Filed:

|

|

|

|

Notice of 2016 Annual Meeting of Stockholders

|

Wednesday, July 27, 2016

8:30 a.m. Eastern Daylight Time

The 2016 Annual Meeting of

Stockholders of McKesson Corporation will be held at McKesson Medical-Surgical, 9954 Mayland Drive, Richmond, Virginia 23233.

ITEMS OF BUSINESS:

|

|

•

|

|

Elect for a one-year term a slate of nine directors as nominated by the Board of Directors;

|

|

|

•

|

|

Ratify the appointment of Deloitte & Touche LLP as the company’s independent registered public accounting

firm for the fiscal year ending March 31, 2017;

|

|

|

•

|

|

Conduct a non-binding advisory vote on executive compensation;

|

|

|

•

|

|

Vote on two proposals submitted by shareholders, if properly presented; and

|

|

|

•

|

|

Conduct such other business as may properly be brought before the meeting.

|

Shareholders of record at the close of business on May 31, 2016 are entitled to notice of and to vote at the meeting or any adjournment or

postponement of the meeting.

June 17, 2016

By Order of the Board of Directors,

John G. Saia

Associate General Counsel and Secretary

YOUR VOTE IS IMPORTANT

We encourage you to read the proxy statement and vote your shares as soon as possible. Specific

instructions on how to vote via Internet, by phone, by mail or in person are included on the proxy card.

TABLE OF CONTENTS

PROXY SUMMARY

This summary highlights certain information in this proxy statement and does not contain all the information you should consider in voting your shares.

Please refer to the complete proxy statement and our annual report prior to voting at the Annual Meeting of Stockholders to be held on July 27, 2016 (“Annual Meeting”).

Meeting Information

|

|

|

|

|

|

|

2016 Annual Meeting of Stockholders

|

|

|

|

|

Date and Time

|

|

Wednesday, July 27, 2016 | 8:30 a.m. Eastern

Daylight Time

|

|

|

|

|

Location

|

|

McKesson Medical-Surgical, 9954 Mayland Drive,

Richmond, Virginia 23233

|

|

|

|

|

Record Date

|

|

May 31,

2016

|

Voting Items

Our board of

directors (“Board” or “Board of Directors”) is asking you to take the following actions at the Annual Meeting:

|

|

|

|

|

|

|

|

|

|

|

Item

|

|

Your Board’s

Recommendation

|

|

Page

Reference

|

|

|

|

|

|

1 Election of Nine Directors for

a One-Year Term

|

|

Vote

FOR

|

|

5

|

|

|

|

|

|

2 Ratification of the

Appointment of the Independent Registered Public Accounting Firm

|

|

Vote

FOR

|

|

21

|

|

|

|

|

|

3 Non-binding Advisory Vote on

Executive Compensation

|

|

Vote

FOR

|

|

66

|

|

|

|

|

|

4 Shareholder Proposal on

Accelerated Vesting of Equity Awards

|

|

Vote

AGAINST

|

|

67

|

|

|

|

|

|

5 Shareholder Proposal on Disclosure of Political Contributions and Expenditures

|

|

Vote

AGAINST

|

|

69

|

How to Vote

(see pages 71 – 74 for additional voting information)

Your vote is important. On June 17, 2016, McKesson Corporation

(“Company,” “McKesson,” “we” or “us”) began delivering proxy materials to all shareholders of record at the close of business on May 31, 2016 (“Record Date”). As a shareholder, you are entitled

to one vote for each share of common stock you held on the Record Date. You can vote in any of the following ways:

|

|

|

|

|

|

|

|

|

Vote via Internet

|

|

Call Toll-Free

|

|

Vote by Mail

|

|

Vote in Person

|

|

|

|

|

|

|

|

|

|

|

|

|

|

www.proxyvote.com

|

|

Call the phone number

located at the top of your

|

|

Follow the instructions on

your proxy card

|

|

Attend our Annual Meeting

and vote by ballot

|

|

|

|

proxy card

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

1

|

PROXY SUMMARY

Director Nominees

There are nine nominees for election to the

Board of Directors. Alton F. Irby III and David M. Lawrence, M.D. will be retiring from the Board at the Annual Meeting. Upon their retirement, the size of the Board will be reduced to nine members. Additional information on each nominee may be

found under Item 1 — Election of Directors, beginning on page 5.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee Memberships

|

|

|

|

Name and Title

|

|

AC

|

|

CC

|

|

FC

|

|

GC

|

|

|

Andy D. Bryant

Chairman of the

Board, Intel Corporation

|

|

|

|

ü

|

|

ü

|

|

|

|

|

Wayne A. Budd

Senior Counsel,

Goodwin Procter LLP

|

|

ü

|

|

|

|

|

|

ü

|

|

|

N. Anthony Coles, M.D.

Chairman

and Chief Executive Officer, Yumanity Therapeutics, LLC

|

|

|

|

ü

|

|

ü

|

|

|

|

|

|

John H. Hammergren

Chairman of

the Board, President and Chief Executive Officer, McKesson Corporation

|

|

|

|

|

|

|

|

|

|

|

M. Christine Jacobs

Chairman of

the Board, President and Chief Executive Officer, Theragenics Corporation (Retired)

|

|

|

|

ü

|

|

|

|

ü

|

|

|

Donald R. Knauss

Executive

Chairman of the Board, The Clorox Company (Retired)

|

|

ü

|

|

|

|

|

|

ü

|

|

|

Marie L. Knowles

Executive Vice

President and Chief Financial Officer, ARCO (Retired)

|

|

ü

|

|

|

|

ü

|

|

|

|

|

Edward A. Mueller

(

Lead Independent

Director

)

Chairman of the Board and Chief Executive Officer, Qwest Communications International Inc.

(Retired)

|

|

|

|

ü

|

|

|

|

ü

|

|

|

Susan R. Salka

Chief Executive Officer and President, AMN Healthcare Services, Inc.

|

|

ü

|

|

|

|

|

|

ü

|

:

Independent

AC:

Audit Committee

CC:

Compensation Committee

FC:

Finance Committee

GC:

Governance

Committee

:

Independent

AC:

Audit Committee

CC:

Compensation Committee

FC:

Finance Committee

GC:

Governance

Committee

Independent, Experienced and Diverse Board

The nine director nominees standing for

reelection to the Board have diverse backgrounds, skills and experiences. We believe their varied backgrounds, including the examples described below, contribute to an effective and well balanced Board that is able to provide valuable insight to,

and effective oversight of, our senior executive team.

In March 2016, we were recognized by 2020 Women on Boards as a member of their 2020 Honor

Roll for having more than 20% of board seats held by women. We are proud that since 2002, fully one third of our Board seats have been held by women.

|

|

|

|

|

|

|

|

|

|

|

Tenure

|

|

|

|

Years of Service (as of Annual Meeting)

|

|

|

|

|

|

|

0 – 5

|

|

5 – 10

|

|

10 – 15

|

|

15+

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

|

|

|

PROXY SUMMARY

Balance of Industry and Functional Expertise

Our Board reflects the Company’s requirement that directors have broad experience at the policy-making level, and represent as a group a balance of

industry knowledge, skills and expertise.

|

|

|

|

|

|

|

|

|

|

|

Experienced Leaders

|

|

|

|

Healthcare

|

|

|

All

9

nominees are experienced business leaders, which equips them to provide constructive insight to our senior management team.

|

|

|

4

of the nominees are experienced leaders in the healthcare industry, including leaders of pharmaceutical and medical device companies and organizations providing healthcare services.

|

|

|

|

|

|

|

|

|

Financial Expertise

|

|

|

|

Supply Chain

|

|

|

8

of the nominees have valuable financial experience, having spent a significant portion of their careers focused on finance or as chief executives, with

3

of

them previously having served as chief financial officers.

|

|

|

7

of the nominees bring supply chain or manufacturing experience to our boardroom, which enhances the Board’s oversight of our Distribution Solutions businesses.

|

|

|

|

|

|

|

|

|

Global Leadership

|

|

|

|

Technology

|

|

|

6

of the nominees have substantial international experience, which brings critical perspective to our Board with our

expansion in the global marketplace.

|

|

|

4

of the nominees are experienced leaders in the technology industry, which allows them to effectively oversee the management of our Technology Solutions businesses.

|

Governance Highlights

The

Board has for many years been committed to sound and effective governance practices that promote long-term shareholder value and strengthen Board and management accountability to our shareholders, customers and other stakeholders. Highlighted below

are recent developments. Details on our corporate governance can be found on

pages 14 - 20.

|

|

|

|

|

|

|

|

|

Continued Focus on Governance

|

|

|

|

Corporate Governance Developments

|

|

|

|

|

|

ü

|

|

Leading on Proxy Access

|

|

Last year, McKesson adopted a proxy access By-Laws amendment, which received 80% support at

our 2015 Annual Meeting of Stockholders.

|

|

|

|

|

|

ü

|

|

Actively Refreshing the Board

|

|

The Board added three new independent directors during the past two years, and continues to

assess a pool of highly qualified, diverse and independent candidates for nomination to the Board.

|

|

|

|

|

|

ü

|

|

Gathering Outside Perspectives

|

|

Since the 2015 Annual Meeting of Stockholders, members of management and the Board have

engaged with institutional investors and pension funds representing over 61% of our outstanding shares on key governance matters. Our directors bring diverse views from their experience on other public, private and non-profit boards. None of our

directors serves on more than three public company boards, including our Board.

|

|

|

|

|

|

ü

|

|

Continuing Robust Lead Independent Director Role

|

|

Empowered by the Board in 2013 with a robust set of

responsibilities and authority, Mr. Edward A. Mueller is serving his second two-year term as our Lead Independent Director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

3

|

PROXY SUMMARY

Company Performance Highlights

It was a year of growth and

expansion across McKesson despite the headwinds resulting from generic pharmaceutical pricing trends and industry consolidation. Our results reflect solid execution and core operational growth from both segments. In addition, we delivered operating

cash flow that exceeded our expectations while applying our portfolio approach to capital deployment to create shareholder value. Recent accomplishments include:

|

|

ü

|

Total revenues of $190.9 billion, up 7% from $179.0 billion

|

|

|

|

ü

|

Operating Cash Flow of $3.7 billion, up 18% year over year from $3.1 billion

|

|

|

|

ü

|

Full year Adjusted Earnings of $12.08 per share, an increase of 9% from $11.11 per share

|

|

|

|

ü

|

Increased the quarterly dividend rate by 17% to $0.28 per share, which also represents an increase of more than 40% over the last five years

|

|

|

|

ü

|

Reshaped and expanded our portfolio of businesses with more than $4.0 billion in acquisitions announced

|

|

|

|

ü

|

Re-invested more than $677 million in the Company through internal capital spending

|

|

|

|

ü

|

Returned more than $1.5 billion in cash to shareholders via share buybacks

|

|

|

|

ü

|

Repaid $1.6 billion in long-term debt

|

|

Executive Compensation Highlights

|

|

|

|

|

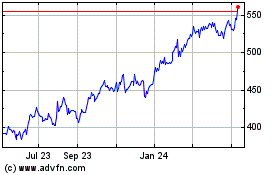

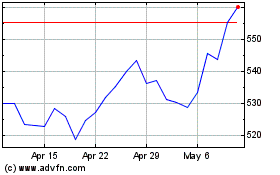

Total Shareholder Return of 106%,

CEO Direct Pay Down 20%

|

|

|

|

From the end of FY 2011 through the end of FY 2016, McKesson delivered total shareholder return (“TSR”) of 106%

while the Compensation Committee’s decisions and cumulative changes to our executive compensation program reduced CEO total direct compensation (“TDC”) by 20%. For more information, see page 28.

|

|

|

|

|

|

|

|

|

|

|

Pay Strategy Aligns with Shareholder Value Creation

|

|

|

|

|

|

Incentive Pay Element

|

|

Metric

|

|

Rationale

|

|

Management Incentive Plan

(annual cash incentive)

|

|

Adjusted EPS

|

|

Sets growth expectations for shareholders and serves as a key

indicator of operational performance and profitability

|

|

|

Adjusted OCF

|

|

Measures ability to translate earnings to cash and serves as

an important indicator of share value

|

|

|

Individual Modifier

|

|

Drives individual performance to achieve Company-wide and business unit results

|

|

|

|

|

|

|

|

|

|

Total Shareholder Return Units

(long-term equity incentive)

|

|

MCK TSR vs. S&P 500

Health Care Index

|

|

Rewards relative performance against peers over time

|

|

|

|

|

|

Stock Options

|

|

Stock Price

|

|

Directly aligns with value delivered to shareholders

|

|

|

|

|

|

Long-Term Incentive

Plan

(long-term cash incentive)

|

|

Long-Term Earnings Growth

|

|

Holds leaders accountable for operational performance and

profitability against long-term business objectives

|

|

|

Adjusted ROIC

|

|

Encourages leaders to make sound investments that will

generate strong future returns for shareholders

|

|

|

|

|

|

|

|

|

|

4

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

|

|

|

PROPOSALS TO BE VOTED ON

|

ITEM 1.

|

Election of Directors

|

There are nine nominees for election to the Board of

Directors of the Company. The directors elected at the Annual Meeting will hold office until the 2017 Annual Meeting of Stockholders and until their successors have been elected and qualified, or until their earlier death, resignation or removal.

All nominees are current directors. Andy D. Bryant, Wayne A. Budd, N. Anthony Coles, M.D., John H. Hammergren, M. Christine Jacobs, Donald R.

Knauss, Marie L. Knowles, Edward A. Mueller, and Susan R. Salka were elected to the Board at the 2015 Annual Meeting of Stockholders. Two directors, Alton F. Irby III and David M. Lawrence, M.D., will be retiring from the Board at the Annual

Meeting.

For purposes of the upcoming Annual Meeting, the Governance Committee has recommended the reelection of each nominee as a director. Each

nominee has informed the Board that he or she is willing to serve as a director. If any nominee should decline or become unable or unavailable to serve as a director for any reason, your proxy authorizes the persons named in the proxy to vote for a

replacement nominee, if the Board names one, as such persons determine in their best judgment. As an alternative, the Board may reduce the number of directors to be elected at the Annual Meeting.

The following is a brief description of the age, principal occupation, position and business experience, including other public company directorships, for

at least the past five years and major affiliations of each of the nominees. Each director’s biographical information includes a description of the director’s experience, qualifications, attributes or skills that qualify the director to

serve on the Company’s Board at this time.

Nominees

Your Board recommends a vote “FOR” each Nominee.

|

|

|

Andy D.

Bryant

|

|

Chairman of the Board, Intel

Corporation

|

Mr. Bryant, age 66, was elected Chairman of the Board of Intel Corporation in May 2012. He was named a director of

Intel’s board in July 2011 and served as Vice Chairman of the Board from that time until his election as Chairman. He served as Executive Vice President and Chief Administrative Officer of Intel from October 2007 to July 2011. Mr. Bryant

joined Intel in 1981 and held a number of management positions before serving as Intel’s Chief Financial Officer from February 1994 to October 2007. He is also a director of Columbia Sportswear Company. He was formerly a director of Synopsys

Inc. Mr. Bryant has been a director of the Company since January 2008. He is Chair of the Compensation Committee and a member of the Finance Committee.

Mr. Bryant’s years of experience as an executive at a large global company, including in the roles of

Chief Administrative Officer and Chief Financial Officer, provide to the Company’s Board operational, strategic planning and financial expertise and considerable business acumen, as well as international business experience. We believe the

Company benefits from his Board leadership perspective garnered from serving as both Vice Chairman and Chairman of Intel’s Board. Mr. Bryant also has other public company board experience with service on audit and governance committees.

|

|

|

|

|

|

|

|

|

|

|

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

5

|

ITEM 1. ELECTION OF DIRECTORS

|

|

|

Wayne A.

Budd

|

|

Senior Counsel, Goodwin Procter LLP

|

Mr. Budd, age 74, joined the law firm of Goodwin Procter LLP as Senior Counsel in October 2004. He had been Senior

Executive Vice President and General Counsel and a director of John Hancock Financial Services, Inc. since 2000 and a director of John Hancock Life Insurance Company since 1998. From 1996 to 2000, Mr. Budd was Group President-New England for Bell

Atlantic Corporation (now Verizon Communications, Inc.). From 1994 to 1997, Mr. Budd was a Commissioner, United States Sentencing Commission and from 1993 to 1996, he was a senior partner at the law firm of Goodwin Procter LLP. From 1992 to 1993, he

was the Associate Attorney General of the United States and from 1989 to 1992, he was United States Attorney for the District of Massachusetts. He is also a director of PBF Energy Inc. Mr. Budd has been a director of the Company since October 2003.

He is Chair of the Governance Committee and a member of the Audit Committee.

Mr. Budd brings to our Board significant legal and regulatory expertise gained from years of large law firm

practice and major governmental positions with law enforcement responsibilities. His legal experience and seasoned judgment have been instrumental in helping the Board navigate legal challenges. In recognition of his distinguished legal career and

important contributions to public life, Mr. Budd was named a 2011 recipient of the American Lawyer Lifetime Achievement Award. Additionally, Mr. Budd has senior executive business experience and public company board experience with service on audit,

compensation, special litigation and governance committees, including as current chair of the governance committee of PBF Energy Inc. His Board leadership skills have been enhanced through his role as Chairman of the National Board of Directors of

the American Automobile Association from April 2011 to April 2013.

|

|

|

N. Anthony

Coles, M.D.

|

|

Chairman and Chief Executive Officer, Yumanity

Therapeutics, LLC

|

Dr. Coles, age 56, was named Chairman and Chief Executive Officer of Yumanity Therapeutics, LLC, a company focused on

transforming drug discovery for neurodegenerative diseases, in October 2014. Prior to this, from October 2013, Dr. Coles served as Chairman and CEO of TRATE Enterprises LLC, a privately held company. Dr. Coles served as President, Chief Executive

Officer and Chairman of the Board of Onyx Pharmaceuticals, Inc., a biopharmaceutical company (“Onyx”), from 2012 until 2013, having served as its President, Chief Executive Officer and a member of its board of directors from 2008 until

2012. Prior to joining Onyx in 2008, he was President, Chief Executive Officer and a member of the board of directors of NPS Pharmaceuticals, Inc., a public biopharmaceutical company (“NPS”). Before joining NPS in 2005, he served in

various leadership positions in the biopharmaceutical and pharmaceutical industries, including

at Merck & Co., Inc., Bristol-Myers Squibb Company and Vertex Pharmaceuticals Incorporated. In addition to having previously served as a director of Onyx and NPS, he was formerly a director

of Laboratory Corporation of America Holdings and Campus Crest Communities, Inc. Dr. Coles has been a director of the Company since April 2014. He is a member of the Compensation Committee and the Finance Committee.

In light of his former and current chairman and chief executive positions, Dr. Coles brings to the Board executive and board leadership experience, as

well as business management and strategic planning experience, in the healthcare industry. He also brings an innovative mindset. We believe Dr. Coles’ training as a physician will serve the Board well as it provides oversight with respect to

various aspects of the Company’s businesses. In addition, having joined the Board in April 2014, he brings a fresh perspective to the Board and adds to the diversity of perspectives.

|

|

|

John H.

Hammergren

|

|

Chairman of the Board, President and Chief Executive

Officer, McKesson Corporation

|

Mr. Hammergren, age 57, has served as Chairman of the Board since July 2002, and President and Chief Executive Officer

of the Company since April 2001. Mr. Hammergren joined the Company in 1996 and held a number of management positions before becoming President and Chief Executive Officer. He was a director of the Hewlett-Packard Company from 2005 through April

2013. Mr. Hammergren is the Chairman of the Supervisory Board of Celesio AG. Additionally, he is currently a member of the Business Council, the Business Roundtable and the Healthcare Leadership Council, as well as the Board of Trustees for the

Center for Strategic & International Studies (“CSIS”). He has been a director of the Company since July 1999.

Mr. Hammergren brings more than 30 years of business and healthcare experience to the Board, including

service on other public company boards. Under Mr. Hammergren’s leadership, McKesson has become a leading provider of healthcare services and information technology solutions, increased revenues more than $148 billion, expanded global markets

and provided shareholders with a significant annual return on investment. The Board benefits from Mr. Hammergren’s extensive knowledge of the Company, including his deep understanding of its customer base, competition, management team,

workforce, challenges and opportunities. His involvement with the Healthcare Leadership Council, the Business Council and the Business Roundtable allows him to bring the Board new insights and perspectives on the changing healthcare industry, the

nation’s economic and regulatory climate and relevant public policy issues.

|

|

|

|

|

|

|

|

|

6

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

|

|

|

ITEM 1. ELECTION OF DIRECTORS

|

|

|

M. Christine

Jacobs

|

|

Chairman of the Board, President and Chief Executive

Officer, Retired, Theragenics Corporation

|

Ms. Jacobs, age 65, retired from Theragenics Corporation, a manufacturer of prostate cancer treatment devices and

surgical products, in 2013, having served as its Chairman, President and Chief Executive Officer. She held the position of Chairman from 2007 to 2013, and previously from 1998 to 2005. She was Co-Chairman of the Board from 1997 to 1998 and was

elected President in 1992 and Chief Executive Officer in 1993. Ms. Jacobs has been a director of the Company since January 1999. She is a member of the Compensation Committee and the Governance Committee.

Having led a public company within the healthcare industry for over 20 years, Ms. Jacobs brings to our Board significant relevant

industry experience and a keen understanding of and strong insight into issues, challenges and opportunities facing the Company, including those related to legislative healthcare initiatives. As

a Chairman and Chief Executive Officer of Theragenics Corporation, she was at the forefront of her company in regard to the evolving corporate governance environment, which enables her to provide ongoing valuable contributions as a member of the

Governance Committee of our Board. In September 2011, Ms. Jacobs began serving as Co-Chair of the Securities and Exchange Commission (“SEC”) Advisory Committee on Small and Emerging Companies, which reflects her leadership and public

company experience, including capital formation experience. At the request of SEC Chair Mary Jo White, she served a second term in that role. Ms. Jacobs’ Co-Chair term ended September 2015.

|

|

|

Donald R.

Knauss

|

|

Executive Chairman of the Board, Retired, The Clorox

Company

|

Mr. Knauss, age 65, retired from The Clorox Company in 2015, having served as Executive Chairman of the Board from

November 2014 until July 2015 and Chairman and Chief Executive Officer from October 2006 until November 2014. He was Executive Vice President of The Coca-Cola Company and President and Chief Operating Officer for Coca-Cola North America from

February 2004 until September 2006. Prior to his employment with The Coca-Cola Company, he held various positions in marketing and sales with PepsiCo, Inc. and Procter & Gamble and served as an officer in the United States Marine Corps. He is

also a director of the Kellogg Company and Target Corporation. He was formerly a director of URS Corporation. Mr. Knauss has been a director of the Company since October 2014. He is a member of the Audit Committee and the Governance Committee.

Mr. Knauss has gained substantial Board leadership skills through his chairmanship role at The Clorox

Company. He also brings substantial executive experience, including in the roles of Chief Executive Officer, President and Chief Operating Officer, through which he has developed valuable operational insights and strategic and long-term planning

capabilities. In addition, Mr. Knauss possesses extensive international business management experience, which provides him with valuable insights into global business strategy. He also possesses extensive retail expertise, which includes

experience in the retail pharmacy area. Mr. Knauss also has significant other public company board experience. Having worked outside of the healthcare industry, and as a new member of the Company’s Board, Mr. Knauss enhances the diverse

perspectives on the Board.

|

|

|

Marie L.

Knowles

|

|

Executive Vice President and Chief Financial Officer,

Retired, ARCO

|

Ms. Knowles, age 69, retired from Atlantic Richfield Company (“ARCO”) in 2000 and was Executive Vice

President and Chief Financial Officer from 1996 until 2000. She joined ARCO in 1972 and held a number financial and operating management positions including President of ARCO Transportation Company from 1993 to 1996. Ms. Knowles is also the Chair of

the Independent Trustees Fidelity Fixed Income and Asset Allocation Funds. Ms. Knowles was formerly a director of America West Holdings Corporation, ARCO, Phelps Dodge Corporation and URS Corporation. She has been a director of the Company since

March 2002. She is Chair of the Audit Committee and a member of the Finance Committee.

Ms. Knowles brings to the Board extensive financial experience gained through her career at ARCO, including

her tenure as Chief Financial Officer. This experience makes her well qualified to serve as Chair of the Company’s Audit Committee and as the audit committee financial expert. This experience also enables Ms. Knowles to provide critical

insight into, among other things, the Company’s financial statements, accounting principles and practices, internal control over financial reporting, and risk management processes. It is also noteworthy that Ms. Knowles was named a 2013

Outstanding Director by the San Francisco Business Times and the Silicon Valley Business Journal.

|

|

|

|

|

|

|

|

|

|

|

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

7

|

ITEM 1. ELECTION OF DIRECTORS

|

|

|

Edward A.

Mueller

|

|

Chairman of the Board and Chief Executive Officer,

Retired, Qwest Communications International Inc.

|

Mr. Mueller, age 69, retired as Chairman and Chief Executive Officer of Qwest Communications International Inc., a

provider of voice, data and video services, in April 2011. He held the position of Chairman and Chief Executive Officer of Qwest Communications from August 2007 to April 2011. From January 2003 until July 2006, he served as Chief Executive Officer

of Williams-Sonoma, Inc., a provider of specialty products for cooking. Prior to joining Williams-Sonoma, Inc., Mr. Mueller served as President and Chief Executive Officer of Ameritech Corporation, a subsidiary of SBC Communications, Inc., from

2000 to 2002. He was formerly a director of The Clorox Company, CenturyLink, Inc., Williams-Sonoma, Inc. and VeriSign, Inc. Mr. Mueller has been a director of the Company since April 2008 and was elected to the newly created role of Lead Independent

Director in July 2013. He was re-elected to a second two-year term as Lead Independent Director in July 2015. He is a member of the Compensation Committee and the Governance Committee.

Mr. Mueller brings to the Board chief executive leadership and business management experience, as well as a strong business acumen and strategic planning

expertise. Having worked outside the healthcare industry, he also adds to the mix of experiences and perspectives on our Board that promote a robust, deliberative decision-making process. While Chairman of the Board of Qwest Communications, Mr.

Mueller had a leadership role in corporate governance, which enables him to provide valuable contributions as a member of the Governance Committee of our Board. He also has public company board experience with audit committee service.

|

|

|

Susan R.

Salka

|

|

Chief Executive Officer and President, AMN Healthcare

Services, Inc.

|

Ms. Salka, age 51, has served as Chief Executive Officer and President of AMN Healthcare Services, Inc. since 2005, and

a director of the company since 2003. She has served in several other executive roles since joining the company in 1990, including Chief Operating Officer, Chief Financial Officer and Senior Vice President of Business Development. She was formerly a

director of Beckman Coulter Inc. and Playtex Products. Ms. Salka has been a director of the Company since October 2014. She is a member of the Audit Committee and the Governance Committee.

With over 25 years of experience in the healthcare services industry, Ms. Salka brings to the Board a deep

understanding of emerging trends in healthcare services. This industry experience gives her insight into important aspects of the Company’s businesses, including opportunities potentially available to those businesses. She has also served in a

number of executive leadership positions, including as a Chief Executive Officer, Chief Financial Officer and Chief Operating Officer, which have provided her with business management, operational, financial and long-range planning experience. Ms.

Salka also brings valuable experience acquired through significant public company board service. In addition, she brings a fresh perspective, having joined the Board in October 2014.

The Board, Committees

and Meetings

The Board of Directors is the Company’s governing body with responsibility for oversight, counseling and direction of the

Company’s management to serve the long-term interests of the Company and its shareholders. The Board’s goal is to build long-term value for the Company’s shareholders and to ensure the vitality of the Company for its customers,

employees and other individuals and organizations that depend on the Company. To achieve its goal, the Board monitors both the performance of the Company and the performance of the Chief Executive Officer (“CEO”). The Board consisted of 11

members during the fiscal year ended March 31, 2016 (“FY 2016”), all of whom were independent with the exception of John H. Hammergren, the Chairman of the Board (“Chairman”). Upon the retirement of Mr. Irby

and Dr. Lawrence at the Annual Meeting, the size of the Board will be reduced to nine members.

The Board has, and for many years has had,

standing committees: the Audit Committee, the Compensation Committee, the Finance Committee, and the Governance Committee. Each of these committees is governed by a written charter approved by the Board in compliance with the applicable requirements

of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”) listing requirements (collectively, the “Applicable Rules”). The charter of each committee requires an annual review by that

committee. Each member of our standing committees is independent, as determined by the Board, under the NYSE listing standards and the Company’s director independence standards. In addition, each member of the Audit Committee and Compensation

Committee meets the additional, heightened independence criteria applicable to such committee members under the Applicable Rules. The members of each standing committee are appointed by the Board each year for a term of one year or until their

successors are elected and qualified.

|

|

|

|

|

|

|

|

|

8

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

|

|

|

ITEM 1. ELECTION OF DIRECTORS

Board and Meeting Attendance

The Board met nine times during FY 2016.

Each director attended at least 75% of the aggregate number of meetings of the Board and of all the standing and other committees on which he or she served. Directors meet their responsibilities not only by attending Board and committee meetings,

but also through communication with executive management, independent accountants, advisors and consultants and others on matters affecting the Company. Directors are also expected to attend the upcoming Annual Meeting. All directors attended the

Annual Meeting of Stockholders held in July 2015. The membership of each standing committee and the number of meetings held during FY 2016 are identified in the table below.

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

Audit

|

|

Compensation

|

|

Finance

|

|

Governance

|

|

Andy D. Bryant

|

|

|

|

Chair

|

|

ü

|

|

|

|

Wayne A. Budd

|

|

ü

|

|

|

|

|

|

Chair

|

|

N. Anthony Coles, M.D.

|

|

|

|

ü

|

|

ü

|

|

|

|

John H. Hammergren

|

|

|

|

|

|

|

|

|

|

Alton F. Irby III

|

|

ü

|

|

|

|

Chair

|

|

|

|

M. Christine Jacobs

|

|

|

|

ü

|

|

|

|

ü

|

|

Donald R. Knauss

|

|

ü

|

|

|

|

|

|

ü

|

|

Marie L. Knowles

|

|

Chair

|

|

|

|

ü

|

|

|

|

David M. Lawrence, M.D.

|

|

|

|

ü

|

|

ü

|

|

|

|

Edward A. Mueller

|

|

|

|

ü

|

|

|

|

ü

|

|

Susan R. Salka

|

|

ü

|

|

|

|

|

|

ü

|

|

Number of meetings held during FY 2016

|

|

9

|

|

5

|

|

4

|

|

4

|

In addition, the Board has, on occasion, established committees to deal with particular matters the Board believes

appropriate to be addressed in that manner.

Committee Responsibilities and Other Information

Audit Committee

The Audit Committee is responsible for, among other things, reviewing with management the annual audited financial statements filed in the Annual Report

on Form 10-K, including any major issues regarding accounting principles and practices, as well as the adequacy and effectiveness of internal control over financial reporting that could significantly affect the Company’s financial statements.

Along with other responsibilities, the Audit Committee reviews with management and the independent registered public accounting firm (the “independent accountants”) the interim financial statements prior to the filing of the Company’s

quarterly reports on Form 10-Q. In addition to appointing the independent accountants, monitoring their independence, evaluating their performance and approving their fees, the Audit Committee has responsibility for reviewing and accepting the

annual audit plan, including the scope of the audit activities of the independent accountants. The Audit Committee at least annually reassesses the adequacy of its charter and recommends to the Board any proposed changes, and periodically reviews

major changes to the Company’s accounting principles and practices. The committee also reviews the appointment, performance and replacement of the senior internal audit department executive and advises the Board with respect to the

Company’s policies and procedures regarding compliance with applicable laws and regulations and with the Company’s code of conduct. Additionally, the committee performs such other activities and considers such other matters as the Audit

Committee or the Board deems necessary or appropriate, including review of cybersecurity risk mitigation initiatives and related policies and procedures. The composition of the Audit Committee, the attributes of its members, including the

requirement that each be “financially literate” and have other requisite experience, and the responsibilities of the committee, as reflected in its charter, are in accordance with the Applicable Rules for corporate audit committees.

Audit Committee Financial Expert

The Board has designated

Ms. Knowles as the Audit Committee’s financial expert and has determined that she meets the qualifications of an “audit committee financial expert” in accordance with SEC rules, and that she is “independent” as defined

for audit committee members in the listing standards of the NYSE and applicable SEC requirements, and in accordance with the Company’s director independence standards.

|

|

|

|

|

|

|

|

|

|

|

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

9

|

ITEM 1. ELECTION OF DIRECTORS

Compensation Committee

The Compensation Committee has responsibility for, among other things, reviewing all matters relating to executive officer compensation. Along with its

other responsibilities, the Compensation Committee, with respect to executive officers, annually reviews and determines the salary paid, the grants of cash-based incentives and equity compensation, the entering into or amendment or extension of any

employment contract or similar arrangement, the severance or change in control arrangements, the material perquisites provided, and any other executive officer compensation matter that may arise from time to time as directed by the Board.

The Compensation Committee periodically reviews and makes recommendations to the Board with respect to adoption of, or amendments to, all equity-based

incentive compensation plans for employees, and cash-based incentive plans for executive officers, including an evaluation of whether the relationship between the incentives associated with these plans and the level of risk-taking by executive

officers in response to such incentives is reasonably likely to have a material adverse effect on the Company. Subject to certain limitations, the Compensation Committee approves the grant of stock, stock options, stock purchase rights or other

equity grants to employees eligible for such grants. Annually, the Compensation Committee reviews its charter and recommends to the Board any changes it determines are appropriate. It participates with management in the preparation of the

Compensation Discussion and Analysis for the Company’s proxy statement. The committee also performs such other activities required by applicable law, rules or regulations and, consistent with its charter, as the Compensation Committee or the

Board deems necessary or appropriate.

The Compensation Committee may delegate to any officer or officers the authority to grant awards to employees

other than directors or executive officers, provided that such grants are within the limits established by the Delaware General Corporation Law and by resolution of the Board. The Compensation Committee determines the structure and amount of all

executive officer compensation, including awards of equity, after considering the initial recommendation of management and in consultation with the Compensation Committee’s independent compensation consultant.

In accordance with its charter, the Compensation Committee annually evaluates the qualifications, performance and independence of its advisors. The

Compensation Committee has the sole authority and right, when it deems necessary or appropriate, to retain, obtain the advice of and terminate compensation consultants, independent legal counsel or other advisors of its choosing. The committee has

the sole authority to approve the fee arrangement and other retention terms of such advisors, and the Company must provide for appropriate funding. In this regard, the Compensation Committee is directly responsible for the appointment, fee

arrangement and oversight of the work of any compensation consultant, independent legal counsel or other advisor retained.

During FY 2016, the

Compensation Committee engaged an independent compensation consultant, Semler Brossy Consulting Group, LLC (“Semler Brossy”), and independent legal counsel, Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP

(“Gunderson Dettmer”). In addition to advising the Compensation Committee on executive compensation matters, Semler Brossy also provided independent consulting services to the Governance Committee in the area of director compensation.

Additional information on the Compensation Committee’s process and procedures for consideration of executive compensation is addressed in the Compensation Discussion and Analysis.

Finance Committee

The Finance

Committee has responsibility for, among other things, reviewing the Company’s dividend policy, reviewing the adequacy of the Company’s insurance programs and reviewing with management the long-range financial policies of the Company.

Annually, the Finance Committee reviews its charter and recommends to the Board any changes it determines are appropriate. Along with other responsibilities, the Finance Committee provides advice and counsel to management on the financial aspects of

significant acquisitions and divestitures, major capital commitments, proposed financings and other significant transactions. The committee also makes recommendations concerning significant changes in the capital structure of the Company, reviews

tax planning strategies utilized by management, reviews the funding status and investment policies of the Company’s tax-qualified retirement plans, and reviews and (when authorized by the Board) approves the principal terms and conditions of

securities that may be issued by the Company.

Governance Committee

The Governance Committee has responsibility for, among other things, reviewing the size and composition of the Board and recommending measures to be taken

so that the Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity, recommending the slate of nominees to be proposed for election at the annual meeting of stockholders, recommending qualified candidates to

fill Board vacancies, and reviewing, in consultation with the Lead Independent Director, the composition of the standing committees of the Board and recommending any changes.

|

|

|

|

|

|

|

|

|

10

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

|

|

|

ITEM 1. ELECTION OF DIRECTORS

The Governance Committee annually reviews its charter and recommends to the

Board any changes it determines are appropriate. Along with other responsibilities, the Governance Committee evaluates the Board’s overall performance, develops and administers the Company’s related party transactions policy, monitors

emerging corporate governance trends, and oversees and evaluates the Company’s corporate governance policies and programs. The committee annually reviews non-employee director compensation, including equity awards to directors, and advises the

Board on these matters.

Director Qualifications, Nomination and Diversity

To fulfill its responsibility to recruit and recommend to the Board nominees for election as directors, the Governance Committee considers all qualified

candidates who may be identified by any one of the following sources: current or former Board members, a professional search firm, Company executives or shareholders. Shareholders who wish to propose a director candidate for consideration by the

Governance Committee may do so by submitting the candidate’s name, resume and biographical information and qualifications to the attention of the Secretary of the Company at One Post Street, 35th Floor, San Francisco, California 94104. All

proposals for recommendation or nomination received by the Secretary will be presented to the Governance Committee for its consideration. The Governance Committee and the Company’s CEO will interview those candidates who meet the criteria

described below, and the Governance Committee will recommend to the Board nominees who best suit the Board’s needs. In order for a recommended director candidate to be considered by the Governance Committee for nomination for election at an

upcoming annual meeting of stockholders, in accordance with the Advance Notice By-Law provisions, the recommendation must be received by the Secretary not less than 90 days nor more than 120 days prior to the anniversary date of the Company’s

most recent annual meeting of stockholders. Shareholders may also request that director nominees be included in the Company’s proxy materials in accordance with the proxy access provision in the By-Laws. Such requests must be received no

earlier than 150 days and no later than 120 days prior to the anniversary of the immediately preceding annual meeting of stockholders. Each shareholder seeking to include a director nominee in the Company’s proxy materials would be required to

provide certain information, representations and undertakings as outlined in the By-Laws.

In evaluating candidates for the Board, the Governance

Committee reviews each candidate’s biographical information and credentials, and assesses each candidate’s independence, skills, experience and expertise based on a variety of factors. Members of the Board should have the highest

professional and personal ethics, integrity and values consistent with the Company’s values. They should have broad experience at the policy-making level in business, technology, healthcare or public interest, or have achieved national

prominence in a relevant field as a faculty member or senior government officer. The Governance Committee will consider whether the candidate has had a successful career that demonstrates the ability to make the kind of important and sensitive

judgments that the Board is called upon to make, and whether the candidate’s skills are complementary to the existing Board members’ skills. Board members must take into account and balance the legitimate interests and concerns of all of

the Company’s shareholders and other stakeholders, and each must be able to devote sufficient time and energy to the performance of his or her duties as a director, as well as have a commitment to diversity.

The Governance Committee has responsibility under its charter to review annually with the Board the size and composition of the Board with the objective

of achieving the appropriate balance of knowledge, experience, skills, expertise and diversity required for the Board as a whole. Although the Board does not maintain a formal policy regarding diversity, the Governance Committee considers diversity

to include diversity of backgrounds, cultures, education, experience, skills, thought, perspectives, personal qualities and attributes, and geographic profiles (i.e., where the individuals have lived and worked), as well as race, ethnicity, gender,

national origin and other categories. A high level of diversity on our Board has been achieved in these areas, as evidenced by the information concerning our directors that is provided under “Nominees” above. Our Governance Committee and

the Board believe that a diverse representation on the Board fosters a robust, comprehensive, and balanced deliberation and decision-making process that is essential to the continued effective functioning of the Board and continued success of the

Company.

Director Compensation

The Company believes that compensation for non-employee directors should be competitive and should encourage ownership of the Company’s stock. The

compensation for each non-employee director of the Company includes an annual cash retainer, an annual restricted stock unit (“RSU”) award and meeting fees. With regard to the Board and standing committees, non-employee directors receive a

$1,500 per-meeting fee, except that the fee is $2,000 for Audit Committee meetings. With regard to meetings other than standing committee meetings, the Governance Committee determines on a case-by-case basis whether meeting fees are appropriate for

non-employee directors. The Board has established a $1,500 per-meeting fee in each case in which the Governance Committee determines a meeting fee is appropriate. In addition to the compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

11

|

ITEM 1. ELECTION OF DIRECTORS

described above, the Lead Independent Director and chairs of the standing

committees receive an annual retainer. Non-employee directors are paid their reasonable expenses for attending Board and committee meetings. Directors who are employees of the Company or its subsidiaries do not receive any compensation for service

on the Board. The Governance Committee annually reviews the level and form of the Company’s director compensation and, if it deems appropriate, recommends to the Board changes in director compensation.

As it does each year, the Governance Committee reviewed non-employee director compensation at its July 2015 meeting. For this meeting, the committee

requested from Semler Brossy, the Compensation Committee’s independent compensation consultant, a report which included a comparison of McKesson’s program to the market for director talent. The annual retainer of $50,000 provided to the

Lead Independent Director, which is delivered in equal amounts of cash and equity, was unchanged. However, the Governance Committee recommended, and the Board approved, that the non-employee director annual cash retainer be increased by $5,000, to

$80,000, and the grant date value of the annual RSU grant be increased by $30,000, to $180,000, in both cases effective with the payments or grants to be made following the 2015 Annual Meeting of Stockholders. In addition, the requirement applicable

to our non-employee directors under the Company’s director stock ownership guidelines was increased by 60%, from $300,000 to $480,000, equal to six times their annual cash retainer, further aligning our non-employee directors’ interests

with the long-term interests of our shareholders. Directors have six years from their initial election to the Board to meet the stock ownership guidelines.

Cash

Compensation

Directors may elect in

advance of a calendar year to defer up to 100% of their annual retainer (including any standing committee chair or Lead Independent Director retainer) and meeting fees into the Company’s Deferred Compensation Administration Plan III (“DCAP

III”). The minimum deferral period for any amounts deferred is five years; however, notwithstanding the director’s deferral election, if a director ceases to be a director of the Company for any reason other than death, disability or

retirement, the account balance will be paid in a lump sum in the first January or July which is at least six months following and in the year after the director’s separation from service. In the event of death, disability or retirement, the

account balance will be paid in accordance with the director’s deferral election. To be eligible for retirement, a director must have served on the Board for at least six consecutive years prior to the director’s separation. The

Compensation Committee approves the rate at which interest or earnings are credited each year to amounts deferred into DCAP III. Currently, the default interest rate selected by the committee is 120% of the long-term applicable federal rate

published for December 2015 by the Internal Revenue Service (“IRS”). In addition, the committee approved the crediting of earnings (or losses) to a director’s DCAP III account based on the director’s choice of a hypothetical

investment in some of the funds, other than the McKesson stock fund, available under the Company’s tax-qualified 401(k) plan.

The following

table summarizes the cash compensation provided to non-employee directors:

|

|

|

|

|

|

|

Non-Employee Director Cash Compensation

|

|

Total ($)

|

|

|

Annual cash retainer

|

|

|

80,000

|

|

|

Additional retainer for Lead Independent Director

|

|

|

25,000

|

|

|

Additional retainer for Chair of the Audit Committee

|

|

|

20,000

|

|

|

Additional retainer for Chair of the Compensation Committee

|

|

|

20,000

|

|

|

Additional retainer for Chair of all other standing committees

|

|

|

10,000

|

|

|

Meeting fee for each Audit Committee meeting attended

|

|

|

2,000

|

|

|

Meeting fee for each Board, committee or other meeting attended

|

|

|

1,500

|

|

Equity Compensation

Effective July 2015, non-employee directors

receive an automatic annual grant of RSUs with an approximate grant date value of $180,000. The actual number of RSUs granted is determined by dividing $180,000 by the closing price of the Company’s common stock on the grant date (with any

fractional unit rounded up to the nearest whole unit); provided, however, that the number of units granted in any annual grant will in no event exceed 5,000, in accordance with our 2013 Stock Plan. In addition to the $25,000 annual cash retainer for

the Lead Independent Director (as shown in the above table), the Lead Independent Director receives an annual grant of RSUs with an approximate grant date value of $25,000.

The RSUs granted to non-employee directors are vested upon grant. If a director meets the director stock ownership guidelines (currently $480,000, six

times the annual cash retainer), then the director will, on the grant date, receive the shares

|

|

|

|

|

|

|

|

|

12

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

|

|

|

ITEM 1. ELECTION OF DIRECTORS

underlying the RSUs, unless the director elects to defer receipt of the shares. The

determination of whether a director meets the director stock ownership guidelines is made as of the last day of the deferral election period preceding the applicable RSU award. If a non-employee director has not met the stock ownership guidelines as

of the last day of such deferral election period, then issuance of the shares underlying the RSUs will automatically be deferred until the director’s separation from service.

Recipients of RSUs are entitled to dividend equivalents at the same dividend rate applicable to the Company’s common shareholders, which is

determined by our Board and currently is $0.28 per share each quarter. For our directors, dividend equivalents on RSUs are credited quarterly to an interest-bearing cash account and are not distributed until the shares underlying the RSUs are issued

to the director. Interest accrues on directors’ credited dividend equivalents at the rate set by the Compensation Committee under the terms of our 2013 Stock Plan, which is currently 120% of the long-term applicable federal rate published for

December 2015 by the IRS.

All Other Compensation and Benefits

Non-employee directors are eligible to

participate in the McKesson Foundation’s Executive Request Program and Matching Gifts Program. Under the Executive Request Program, our non-employee directors may request that the foundation make donations to qualifying public charitable

organizations. Under the Matching Gifts Program, our non-employee directors’ own gifts to schools, educational associations or funds and other public charitable organizations are eligible for a match by the foundation of up to $5,000 per

director for each fiscal year.

2016 Director Compensation Table

The following table sets forth information

concerning the compensation paid to or earned by each non-employee director for the fiscal year ended March 31, 2016. Mr. Hammergren, our Chairman, President and CEO, is not included in this table as he is an employee of the Company and

receives no compensation for his service as a director. The compensation paid to or earned by Mr. Hammergren as an officer of the Company is shown in the 2016 Summary Compensation Table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees Earned

or Paid

in Cash

($)

(1)

|

|

|

Stock

Awards

($)

(2)

|

|

|

All Other

Compensation

($)

(4)

|

|

|

Total

($)

|

|

|

Andy D. Bryant

|

|

|

123,000

|

|

|

|

180,119

|

|

|

|

10,439

|

|

|

|

313,558

|

|

|

Wayne A. Budd

|

|

|

125,000

|

|

|

|

180,119

|

|

|

|

14,281

|

|

|

|

319,400

|

|

|

N. Anthony Coles, M.D.

|

|

|

103,000

|

|

|

|

180,119

|

|

|

|

-0-

|

|

|

|

283,119

|

|

|

Alton F. Irby III

|

|

|

125,000

|

|

|

|

180,119

|

|

|

|

11,201

|

|

|

|

316,320

|

|

|

M. Christine Jacobs

|

|

|

104,500

|

|

|

|

180,119

|

|

|

|

-0-

|

|

|

|

284,619

|

|

|

Donald R. Knauss

|

|

|

108,500

|

|

|

|

180,119

|

|

|

|

12,698

|

|

|

|

301,317

|

|

|

Marie L. Knowles

|

|

|

135,000

|

|

|

|

180,119

|

|

|

|

17,131

|

|

|

|

332,250

|

|

|

David M. Lawrence, M.D.

|

|

|

101,500

|

|

|

|

180,119

|

|

|

|

16,548

|

|

|

|

298,167

|

|

|

Edward A. Mueller

|

|

|

129,500

|

|

|

|

205,299

|

(3)

|

|

|

15,270

|

|

|

|

350,069

|

|

|

Susan R. Salka

|

|

|

113,500

|

|

|

|

180,119

|

|

|

|

14,227

|

|

|

|

307,846

|

|

|

(1)

|

Consists of the following, as applicable, whether paid or deferred: director annual cash retainer; standing committee

meeting fees; other meeting fees; and the annual standing committee chair and Lead Independent Director retainers.

|

|

(2)

|

Represents the aggregate grant date fair value of RSUs, computed in accordance with Accounting Standards Codification

issued by the Financial Accounting Standards Board, Topic 718, labeled “Compensation — Stock Compensation” (“ASC Topic 718”) disregarding any estimates of forfeitures related to service-based vesting conditions. Such values

do not reflect whether the recipient has actually realized a financial benefit from the award. For information on the assumptions used to calculate the value of the awards, refer to Financial Note 6 of the Company’s consolidated financial

statements in its Annual Report on Form 10-K for the fiscal year ended March 31, 2016 as filed with the SEC on May 5, 2016.

|

|

(3)

|

Represents both the regular annual grant of RSUs and the annual grant of RSUs for service as Lead Independent Director.

|

|

(4)

|

Represents the value of air travel and other items or services provided to our directors and their spouses in connection

with the annual Board of Directors planning sessions. The value of perquisites provided to Dr. Coles and Ms. Jacobs did not meet the threshold value for disclosure in this proxy statement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

13

|

ITEM 1. ELECTION OF DIRECTORS

Corporate Governance

The Board is committed to, and for many years has adhered to, sound and effective corporate governance practices. In addition to routine monitoring

of best practices, at least annually the Board and its committees review the Company’s current corporate governance practices, the corporate governance environment and update the committees’ written charters as necessary. The Board

diligently exercises its oversight responsibilities with respect to the Company’s business and affairs consistent with the highest principles of business ethics, and in order to meet the corporate governance requirements of federal law, state

law and the NYSE.

You can access the following governance materials on our website at

www.mckesson.com

under the caption

“Investors — Corporate Governance.”

|

|

•

|

|

Certificate of Incorporation

|

|

|

•

|

|

Corporate Governance Guidelines

|

|

|

•

|

|

Director Independence Standards

|

Key Governance Attributes

The Board actively seeks input from our

shareholders and is committed to continuous monitoring of sound and effective governance practices. Below are highlights of some of our key governance attributes.

Proxy Access

The Board strives to maintain and adopt industry-leading governance best practices. In 2015, the Company submitted to its shareholders a proposal to amend

the By-Laws to allow for proxy access, which received 80% approval at the 2015 Annual Meeting of Stockholders. Under the amended By-Laws, a shareholder or shareholder group who has owned at least three percent of the Company’s stock for at

least three years, and who complies with specified procedural and disclosure requirements, may include in McKesson’s proxy materials shareholder-nominated director candidates to fill up to 20% of the available board seats. The Company’s

proposal was the result of Company engagement with our shareholders, informed by ongoing review of the evolving governance landscape.

Shareholder Right to Call

a Special Meeting

Recognizing the

interest of a number of shareholders in being able to take action between annual meetings, and having considered the alternative processes for achieving that result, the Board, in January 2013, adopted amendments to the Company’s By-Laws, which

were approved by the shareholders at the 2013 Annual Meeting of Stockholders. The 2013 amendments to the By-Laws permit shareholders who meet certain requirements to call a special meeting of shareholders. Specifically, record holders who have held

a net long position of at least 25% of the outstanding shares of common stock of the Company for at least one year are able to call a special meeting. This important expansion of shareholder rights empowers our shareholders to act between annual

meetings and enhances their ability to participate in issues vital to the Company.

|

|

|

|

|

|

|

|

|

14

|

|

- 2016 Proxy Statement

- 2016 Proxy Statement

|

|

|

|

|

ITEM 1. ELECTION OF DIRECTORS

Elimination of Supermajority Voting Requirements

In 2011, the Board recommended, and our

shareholders approved, amendments to the Company’s Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) and, in effect, the By-Laws, to eliminate the Company’s shareholder supermajority voting

requirements. Specifically, the Company replaced the supermajority voting requirement with a majority of shares outstanding standard for the following actions: (A) amendment of the By-Laws and (B) amendment of the Certificate of

Incorporation in any manner that would adversely affect holders of Series A Junior Participating Preferred Stock. In addition, the supermajority voting provisions and associated “fair price” provisions applicable to certain business

combinations were eliminated from the Certificate of Incorporation altogether.

Majority Voting Standard for Election of Directors

The By-Laws provide for a majority voting

standard for the election of directors. This standard states that in uncontested director elections, a director nominee will be elected only if the number of votes cast “for” the nominee exceeds the number of votes cast “against”

that nominee. To address the “holdover” director situation in which, under Delaware law, a director remains on the Board until his or her successor is elected and qualified, the By-Laws require each director nominee to submit an

irrevocable resignation in advance of the shareholder vote. The resignation would be contingent upon both the nominee not receiving the required vote for reelection and acceptance of the resignation by the Board pursuant to its policies.

Director Stock Ownership Guidelines

Our Board believes that directors should hold a meaningful equity stake in McKesson. To that end, by the terms of our Director Stock Ownership Guidelines,

directors are expected to own shares or share equivalents of the Company’s common stock with a value of at least six times the annual cash retainer within six years of joining our Board. We believe these terms serve the important purpose of

aligning our directors’ economic interests with those of our shareholders. As of May 31, 2016, all of our directors were in compliance with the Director Stock Ownership Guidelines, except for Dr. Coles, Mr. Knauss and

Ms. Salka, who have six years from their initial election to the Board to meet the guidelines.

Corporate Governance Guidelines

Consistent with NYSE listing requirements, the

Company’s Corporate Governance Guidelines address various governance matters, including, among others: director qualification standards and the director nomination process; shareholder communications with directors; director responsibilities;

selection and role of the Lead Independent Director; director access to management and, as necessary and appropriate, independent advisors; director compensation; director stock ownership guidelines; director orientation and continuing education;

management succession; and an annual performance evaluation of the Board. The Governance Committee is responsible for overseeing the guidelines and at least annually assesses the need or advisability for any amendments to the guidelines to reflect

corporate governance best practices.