Home Depot Files Antitrust Lawsuit Against Visa, MasterCard -- Update

June 15 2016 - 5:02PM

Dow Jones News

By Robin Sidel

Home Depot Inc. filed an antitrust lawsuit against Visa Inc. and

MasterCard Inc. reigniting claims from a decade ago that merchants

pay too much for debit- and credit-card transactions and adding new

contentions about the effectiveness of chip-based cards to reduce

fraud.

The lawsuit comes several years after Home Depot and hundreds of

other retailers opted out of a settlement, then valued at $7.25

billion, in a price-fixing case that addressed many of the same

issues.

This time, the do-it-yourself retailer also contends that Visa

and MasterCard colluded to prevent the adoption of new chip-based

cards that require consumers to enter a personal identification

number, or PIN, to authorize a transaction. "Visa and MasterCard

know perfectly well that a signature alone, without the additional

step of requiring a PIN, provides virtually no protection against

many types of payment card fraud," Home Depot said in the lawsuit

filed Monday in U.S. District Court for the northern district of

Georgia.

The new chip cards being rolled out in the U.S. are embedded

with a computer chip. This creates a unique code for each

transaction, reducing the chance that criminals can create

counterfeit cards if they hack into a retailer's payment

system.

The chip cards have long been used around the world, where they

often require a PIN instead of a signature.

U.S. bank executives have said that they don't want to burden

Americans with a PIN when they are using their credit cards at the

check-out line. The banks collect higher merchant fees for

signature credit-card transactions than PIN-based ones.

"While chip-and-PIN authentication is proven to be more secure,

it is less profitable for Visa, MasterCard, and their member banks

and it provides a greater threat to their market dominance," the

lawsuit claimed.

The legal action also contends that Visa and MasterCard, which

set the so-called interchange fees collected by banks, are engaged

in price-fixing that prevent competition for merchant acceptance.

"We had hoped to resolve our claims outside of litigation but those

efforts proved to be unsuccessful," Home Depot spokesman Stephen

Holmes said.

Visa said it is aware of the lawsuit. It is seeking to transfer

the case to a federal court in Brooklyn that is handling other

"opt-out" cases filed by merchants including Target Corp. and

7-Eleven Inc. Wal-Mart Stores Inc. also opted out of the 2012

merchant settlement, but later settled separately.

MasterCard said the lawsuit wasn't a surprise given Home Depot

opted out of the 2012 settlement. It also said it leaves the

decision on how to verify cardholder identity, via PIN or

signature, to the merchant and card-issuing financial institution.

"Regardless of how the cardholder's identity is confirmed, the chip

makes data much more secure, rendering it almost useless to create

fraudulent cards or transactions," MasterCard said,

The Home Depot lawsuit comes a month after Wal-Mart sued Visa

for the right to choose how customers authorize debit-card

purchases. The retailer wants customers to use a PIN, but Visa

requires that shoppers can have the choice between a PIN and a

signature.

--Paul Ziobro contributed to this article.

Write to Robin Sidel at robin.sidel@wsj.com

(END) Dow Jones Newswires

June 15, 2016 16:47 ET (20:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

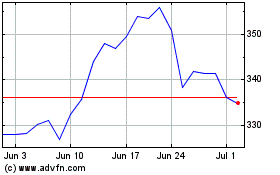

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024