As filed with

the Securities and Exchange Commission on June 15, 2016.

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

______________________

|

WEARABLE

HEALTH SOLUTIONS, INC.

|

|

(Exact name of registrant as specified

in its charter)

|

|

Nevada

|

8082

|

26-3534190

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

|

200 W. Church Road, Suite B, King of Prussia, PA 19406

Telephone: (877) 639-2929

|

|

(Address, including zip code, and telephone

number,

including area code, of registrant’s

principal executive offices)

|

|

National Registered

Agents, Inc. of Nevada

311

S Division Street

Carson

City, NV 89703

Telephone: (800) 767-1553

|

|

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

|

|

Copies of all communications, including communications sent to agent for service, should be sent to:

|

|

Harvey J. Kesner,

Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

|

Approximate date of commencement

of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box. [X]

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

|

|

|

CALCULATION

OF REGISTRATION FEE

|

Title of Class of Securities to be Registered

|

|

Amount To

be Registered

|

|

Proposed

Maximum

Aggregate

Price

Per Share (1)

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

Amount of

Registration

Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock,

$0.001 par value per share (2)

|

|

|

3,000,000

|

|

|

|

shares

|

|

|

$

|

.09

|

|

|

$

|

270,000

|

|

|

$

|

27.19

|

|

|

Total number of securities to be registered

|

|

|

3,000,000

|

|

|

|

shares

|

|

|

$

|

.09

|

|

|

$

|

270,000

|

|

|

$

|

27.19

|

|

|

(1)

|

|

Estimated solely for purposes of calculating the registration fee pursuant to Rule

457(c) under the Securities Act of 1933, as amended, using the average of the bid and ask prices as reported on the OTCQB on April

5, 2016.

|

|

(2)

|

|

Represents 1,611,110 shares of common stock issuable upon conversion of outstanding

convertible notes and 1,388,890 shares of common stock issuable upon conversion of preferred stock, offered by the selling stockholders.

|

The registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section

8(a), may determine.

The information in this prospectus is not complete and

may be changed. The selling stockholders may not sell these securities under this prospectus until the registration statement

of which it is a part and filed with the Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not

permitted.

SUBJECT TO COMPLETION, DATED JUNE

15, 2016

PRELIMINARY PROSPECTUS

3,000,000 Shares of Common Stock

MEDICAL ALARM CONCEPTS HOLDING, INC.

This prospectus relates to the public offering

of up to 3,000,000 shares of common stock of Wearable Health Solutions, Inc. f/k/a Medical Alarm Concepts Holding,

Inc. (the “Company”) by the selling stockholders, including 1,611,110 shares issuable upon conversion of outstanding

convertible notes (the “Notes”) and 1,388,890 shares issuable upon conversion of 138,889 outstanding shares of Series

C Preferred Stock (“Series C Preferred”).

The selling stockholders may sell the shares

from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions.

We will not receive any of the proceeds

from the sale of the shares by the selling stockholders. We have agreed to pay the expenses of this registration.

Investing in our common stock involves

a high degree of risk. You should consider carefully the risk factors beginning on page 2 of this prospectus before

purchasing any of the shares offered by this prospectus.

Our common stock is quoted on the OTCQB

and trades under the symbol “WHSI”. On May 25, 2016, the last reported sale price of our common

stock as reported on the OTCQB was $.15 per share.

We may amend or supplement this prospectus

from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or

supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

_________,

2016.

TABLE OF CONTENTS

You should rely only on the information

contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities

in any jurisdiction where offer or sale is not permitted. You should assume that the information appearing in this prospectus is

accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and

prospects may have changed since that date.

For investors outside the United States,

we have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction

where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to

observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

This prospectus includes estimates, statistics

and other industry and market data that we obtained from industry publications, research, surveys and studies conducted by third

parties and publicly available information. Such data involves a number of assumptions and limitations and contains projections

and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty.

This prospectus also includes data based on our own internal estimates. We caution you not to give undue weight to such projections,

assumptions and estimates.

Prospectus Summary

This summary highlights information contained

in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider

before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed

information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially the section entitled

“Risk Factors” and our consolidated financial statements and related notes, before deciding to buy our securities.

Unless otherwise stated, all references to “us,” “our,” “we,” “Wearable Health Solutions,

Inc.” the “Company” and similar designations refer to Wearable Health Solutions, Inc. and its subsidiaries.

Our Company

We were organized in 2008.

We manufacture medical alarm devices that are used to summon help in the event of an emergency. While these devices are primarily

designed for the elderly, we believe there is also a market for those who are physically disabled, as well as for persons living

alone.

Our flagship product is

called the MediPendant®, which is a personal emergency alarm that is used to summon help in the event of an emergency at home.

Currently, approximately 60% of all medical alarms being sold in the United States right now are first-generation technologies

that require the user to speak and listen through a central base station unit. The MediPendant®, however, offers a product

that has the speaker in the pendant, enabling the user to simply speak and listen directly through the pendant in the event of

an emergency.

We also manufacture the

iHelp mobile medical alarm device. The iHelp is a next-generation medical alarm that utilizes T-Mobile’s 2G network. Users

of the iHelp mobile medical alarm can take the device with them wherever there is cellular service. There is no base station and

the iHelp only requires a cellular signal in order to work.

We are in the process of

implementing a new product called the iHelp+ (iHelp plus 3G). iHelp+ is a cellular medical alert system that operates on a 3G network.

Initially, it will be operating on the AT&T network (GSM - Global), and within a few months it will also be able to operate

on the Verizon (CDMA - USA) network as well. It is Bluetooth and Wi-Fi enabled. It has a much broader reach than the iHelp, as

well as additional functions, such as fall detection and geo-fencing (ability to pre-set an area and alert loved ones if the user

leaves or enters the pre-set area).

|

The Offering

|

|

Common stock offered by the selling stockholders:

|

3,000,000 shares of the Company’s $.0001 par value common stock

|

|

|

|

|

Common stock outstanding before and after this offering:

|

7,874,177

(1)

and 10,874,177

(2)

|

|

|

|

|

Use of proceeds:

|

We will not receive any proceeds from the sale of shares in this offering by the selling stockholders.

|

|

|

|

|

Trading symbol:

|

WHSI

|

|

|

|

|

Risk factors:

|

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set

forth in the “Risk Factors” section beginning on page 3 of this prospectus before deciding whether or not to

invest in shares of our common stock.

|

|

(1)

|

|

The number of outstanding shares before the offering is based upon 7,874,177 shares outstanding as of May 25, 2016.

|

|

(2)

|

|

The number of outstanding shares after the Offering assumes that all outstanding Notes and Preferred Stock for which the underlying shares have been registered herein will be converted or exercised into shares of Common Stock.

|

About Us

Our principal executive

offices are located at 200 West Church Road, Suite B, King of Prussia, PA 19406, and our telephone number is (877) 639-2929.

Our website addresses’

are www.medipendant.com, www.ihelpalarm.com and www.medicalalarmconcepts.com. The information contained on, connected to or that

can be accessed via our websites are not part of this prospectus. We have included our website addresses in this prospectus as

an inactive textual reference only and not as an active hyperlink.

RISK FACTORS

An investment in our common stock involves a

high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other

information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition

could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risks Related to Our Business and Industry

Our investors may lose their entire investment

because our financial status creates a doubt whether we will continue as a going concern.

As of June 30, 2015,

the Company has a working capital deficit of $808,693. The Company did not generate cash from our operations, have had

a stockholders’ deficit of $808,693, and had operating losses for the past two years. These circumstances, among significant

others, raise substantial doubt about our ability to continue as a going concern.

While we are attempting

to generate sufficient revenues, our cash position may not be enough to support our daily operations. While we believe in the viability

of our strategy to increase revenues and in our ability to raise additional funds, there can be no assurances to that effect. Our

ability to continue as a going concern is dependent upon our ability to further implement our business plan and generate sufficient

revenues.

We may incur operating losses in the foreseeable

future. Therefore, our auditors have raised substantial doubt about our ability to continue as a going concern.

If we are unable to successfully execute

any material part of our growth strategy, our future growth and ability to make profitable investments in our business would be

harmed.

Our success depends on

our ability to expand our business while maintaining profitability. We may not be able to sustain our growth or achieve profitability

on a quarterly or annual basis in future periods. Our future growth and profitability will depend upon a number of factors, including,

without limitation:

|

•

|

|

the level of competition in our industry;

|

|

•

|

|

our ability to offer new products and to extend existing brands and products into

new markets, including international markets;

|

|

•

|

|

our ability to identify, acquire and integrate strategic acquisitions;

|

|

•

|

|

our ability to remain competitive in our pricing;

|

|

•

|

|

our ability to maintain efficient, timely and cost-effective production and delivery

of our products;

|

|

•

|

|

the efficiency and effectiveness of our sales and marketing efforts in building product

and brand awareness and cross-marketing our brands;

|

|

•

|

|

our ability to identify and respond successfully to emerging trends in our industry;

|

|

•

|

|

the level of consumer acceptance of our products; and

|

|

•

|

|

general economic conditions and consumer confidence.

|

We may not be successful

in executing our growth strategy, and even if we achieve our targeted growth, we may not be able to sustain profitability. Failure

to successfully execute any material part of our growth strategy would significantly impair our future growth and our ability to

make profitable investments in our business.

Our disclosure controls and procedures

have been found to be ineffective and we do not have sufficient and skilled accounting personnel with an appropriate level of technical

accounting knowledge and experience to identify and remedy material weaknesses in such controls and procedures.

Ronnie Adams, our Chief

Executive Officer/Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures as of the end

of our fiscal year ended June 30, 2015.

Based on the evaluation,

Mr. Adams concluded that our disclosure controls and procedures and our internal controls over financial reporting were not effective

as of June 30, 2015.

In the course of making

our assessment of the effectiveness of internal controls over financial reporting, we identified the following material weaknesses

in our internal control over financial reporting: we are lacking qualified resources to perform the internal audit functions properly

and, in addition, the scope and effectiveness of our internal audit function are yet to be developed; we currently do not have

an audit committee; and we are relatively inexperienced with certain complexities within US GAAP and SEC reporting. We did not

have sufficient and skilled accounting personnel with an appropriate level of technical accounting knowledge and experience in

the application of generally accepted accounting principles accepted in the United States of America commensurate with our disclosure

controls and procedures requirements, which resulted in a number of deficiencies in disclosure controls and procedures that were

identified as being significant. Our management believes that the number and nature of these significant deficiencies, when aggregated,

was determined to be a material weakness.

We face intense competition and competitive

pressures, which could adversely affect our results of operations and financial condition.

Our business is highly

competitive. Our products may be subject to competition from lower-cost imports that intensify the price competition faced in various

markets. Some of our competitors are privately owned and have more latitude to operate than we do as a public company. If we do

not successfully compete with these competitors on factors such as new product development, innovation, brand, delivery, customer

service, price, and quality, our customers may consider other products. Competitive pressures from our competitors could adversely

affect our results of operations and financial condition.

We source our products from third-party

suppliers located in Asia, which reduces our control over the manufacturing process and may cause variations in quality or delays

in our ability to fill orders.

We source all of our Medical

Alert parts and materials from third party suppliers located in Asia. We depend on these suppliers to deliver products that are

free from defects, comply with our specifications, meet health, safety and delivery requirements, and are competitive in cost.

If our suppliers deliver products that are defective or that otherwise do not meet our specifications, our return rates may increase,

and the reputation of our products and brands may suffer. In addition, if our suppliers do not meet our delivery requirements or

cease doing business with us for any reason, we might miss our customers’ delivery deadlines, which could in turn cause our

customers to cancel or reduce orders, refuse to accept deliveries, demand reduced prices, or change suppliers. The overseas sourcing

of products subjects us to the numerous risks of doing business abroad, including but not limited to, rapid changes in economic

or political conditions, civil unrest, political instability, war, terrorist attacks, international health epidemics, work stoppages

or labor disputes, currency fluctuations, increasing export duties, trade sanctions and tariffs, and variations in product quality.

We may also experience temporary shortages due to disruptions in supply caused by weather or transportation delays. Even if acceptable

alternative suppliers are found, the process of locating and securing such alternatives is likely to disrupt our business, and

we may not be able to secure alternative suppliers on acceptable terms that provide the same quality product or comply with all

applicable laws. Any of these events would cause our business, results of operations, and financial condition to suffer. We had

only one supplier during the years ended June 30, 2014 and 2013, respectively, and had two suppliers in the year ended June 30,

2015. If relations with either of these suppliers become unfavorable or if we are unable to purchase our product from either of

these suppliers for any reason whatsoever, whether within or not within our control, we will need to find other suppliers on at

least the same terms and conditions as our current suppliers.

Requirements associated with being a

public company have, and will continue to, increase our costs significantly and divert significant resources and management attention.

We are not currently

subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

because we have not registered our common stock pursuant to the Exchange Act. However, we have made filings on a voluntary

basis and intend to make changes in our corporate governance, corporate internal controls, internal audit, disclosure controls

and procedures and financial reporting and accounting systems to manage our growth and our obligations as a public company. In

addition, we will become subject to the Exchange Act reporting requirements under Section 15(d) upon effectiveness of this Registration

Statement for at least one year. The expenses that will be required in order to adequately manage our obligations as a public

company are material. Compliance with the various reporting and other requirements applicable to public companies will also require

considerable time and attention of management. We cannot predict or estimate the amount of the additional costs we may incur,

the timing of such costs, or the degree of impact that our management’s attention to these matters will have on our business.

In addition, the changes we make may not be sufficient to allow us to satisfy our obligations as a public company on a timely

basis. In addition, being a public company could make it more difficult or more costly for us to obtain certain types of insurance,

including directors’ and officers’ liability insurance, and we may be forced to accept reduced policy limits and coverage

or incur substantially higher costs to obtain the same or similar coverage. The impact of these events could also make it more

difficult for us to attract and retain qualified persons to serve on our Board of Directors, our board committees or as executive

officers.

Many of our competitors

are also not subject to these requirements, because they do not have securities that are publicly traded on a U.S. securities

exchange or other securities exchanges. As a result, these competitors are not subject to the risks identified above. In addition,

the public disclosures that are provided pursuant to the SEC’s rules and regulations may furnish our competitors with greater

competitive information regarding our operations and financial results than we are able to obtain regarding their operations and

financial results, thereby placing us at a competitive disadvantage.

Our reporting

obligations under Section 15(d) of the Exchange Act may be suspended automatically if we have fewer than 300 holders of record

on the first day of our fiscal year after the year of effectiveness.

Our Common Stock

is not currently registered under the Exchange Act. While we are not currently subject to the reporting requirements of the

Exchange Act and have been voluntarily filing reports, we will become subject to the Exchange Act reporting requirements under

Section 15(d) upon effectiveness of the current registration statement for at least one year after effectiveness. Our obligation

to file reports under Section 15(d) of the Exchange Act will be automatically suspended if, on the first day of any fiscal year,

other than a fiscal year in which a registration statement under the Securities Act has gone effective, we have fewer than 300

holders of record. This suspension is automatic and does not require any filing with the SEC. In such an event, we may cease providing

periodic reports and current or periodic information, including operational and financial information. As of May 25, 2016, we

had approximately 132 holders of record.

Unless we register a class of our

securities pursuant to Section 12 of the Exchange Act, we will only be subject to the periodic reporting obligations imposed by

Section 15(d) of the Exchange Act which may limit the information on the Company available to shareholders.

Unless we register

a class of our securities pursuant to Section 12 of the Exchange Act, we will only be subject to the periodic reporting obligations

imposed by Section 15(d) of the Exchange Act. Accordingly, we will not be subject to the proxy rules, short-swing profit provisions,

going-private regulation, beneficial ownership reporting, and the majority of the tender offer rules and the reporting requirements

of the Exchange Act. Accordingly, shareholders may have access to less information regarding the activities of the Company and

its officers and directors than they otherwise may have if a class of the Company’s securities was registered under the

Exchange Act.

Risks Related to Our Operations

In the event we are not successful in

reaching our revenue targets, additional funds may be required.

We may not be able to proceed

with our business plan for the development and marketing of our core services. Should this occur, we may be forced to suspend or

cease operations. Management intends to raise additional funds by way of a public or private offering. While we believe in the

viability of our strategy to increase revenues and in our ability to raise additional funds, there can be no assurances to that

effect. Our ability to continue as a going concern is dependent upon our ability to further implement our business plan, raise

additional money, and generate sufficient revenues.

While we are attempting to generate sufficient

revenues, our cash position may not be enough to support our daily operations.

Management intends to raise

additional funds by way of a public offering or additional private offerings, by the exercise of outstanding warrants, or by alternative

methods. While we believe in the viability of our strategy to increase revenues and in our ability to raise additional funds, there

can be no assurances to that effect. Our ability to continue as a going concern is dependent upon our ability to further implement

our business plan, raise additional money, and generate sufficient revenues.

Our ability to adapt to industry changes

in technology, or market circumstances, may drastically change the business environment in which we operate.

If we are unable to recognize

these changes in good time, are late in adjusting our business model, or if circumstances arise such as pricing actions by competitors,

then this could have a material adverse effect on our growth ambitions, financial condition and operating results

The global increase in security threats

and higher levels of professionalism in computer crime have increased the importance of effective IT security measures, including

proper identity management processes to protect against unauthorized systems access.

Our systems, networks,

products, solutions and services remain potentially vulnerable to attacks, which could potentially lead to the leakage of confidential

information, improper use of our systems and networks, which could in turn materially adversely affect our financial condition

and operating results.

We rely on the attraction and retention

of talented employees

.

Attracting and retaining

talented employees in sales and marketing, research and development, finance and general management, as well as of specialized

technical personnel, is critical to our success and could also result in business interruptions. There can be no assurance that

we will be successful in attracting and retaining all the highly qualified employees and key personnel needed in the future.

We may from time to time be subject to

warranty and product liability claims with regard to product performance and effects.

We could incur product

liability losses as a result of repair and replacement costs in response to customer complaints or in connection with the resolution

of contemplated legal proceedings relating to such claims. Successful claims for damages may be made that are in excess of our

insurance coverage. Our insurance could become more expensive and there is no assurance that insurance will still be available

on acceptable terms. In addition to potential losses arising from claims and related legal proceedings, product liability claims

could affect our reputation and relationships with key customers. As a result, product liability claims could materially impact

our financial condition and operating results.

In order to develop additional revenues

and further our current products, we have plans to invest in product(s) that are synergistic with our current products.

Investing in these products’

adaptive technologies or business models may or may not be successful. They may not be timely nor cost-effective, and there is

no assurance the desired results will be achieved. We may need to increase our inventory levels, increase our accounts receivables,

and be exposed to bad debt and obsolete inventory, and this would negatively impact our operations and balance sheet.

We are not averse to acquiring other

companies that will increase our revenues, cash flow, and profits.

We would entertain the

notion of acquiring attractive candidates that are synergistic to our business model and are accretive to our projected earnings;

there is a risk that we will not have the ability to properly integrate these businesses, products, or services with our current

business line. We are not certain that we will be able to successfully identify suitable acquisition candidates, and negotiate

these deals on terms acceptable to us. In addition, successful integration may involve operational changes, additions, and significant

expenses. We may need to borrow money and leveraging ourselves for acquisitions could limit our financial flexibility in the future.

If we fail to successfully manage our new product(s) and/or acquisitions, our business may suffer.

We face a risk of a change in control

due to the fact that our current of officers and directors do not own a majority of our outstanding voting stock.

Our current officers

and our directors do not hold voting control over the Company. As a result, our shareholders who are not officers and directors

may be able to obtain a sufficient number of votes to choose who serves on our Board of Directors and/or to remove our current

directors from the Board of Directors. Because of this, the current composition of our Board of Directors may change in the future,

which could in turn have an effect on those individuals who currently serve in management positions with us. If that were to happen,

our new management could affect a change in our business focus and/or curtail or abandon our business operations, which in turn

could cause the value of our securities, if any, to decline or become worthless.

The ability of our principal stockholders

to control our business may limit or eliminate minority stockholders’ ability to influence corporate affairs.

The principal holder

of our voting capital stock holds 138,889 shares of Series C Preferred Stock, pursuant to a subscription agreement with the Company

entered into on March 1, 2016, which gives them majority voting control of the Company, until February 25, 2017. Even thereafter,

they will be entitled to ten votes for each share of Series C Preferred Stock owned. Because of their stock ownership, they are

in a position to significantly influence membership of our board of directors as well as all other matters requiring stockholder

approval. For example, the principal holder of our voting capital stock recently exercised their voting power to approve an amendment

to our Articles of Incorporation to increase the amount of the Company’s authorized capital stock. The interests of our

principal stockholder may differ from the interests of other stockholders with respect to the issuance of shares, business transactions

with or sales to other companies, selection of other officers and directors and other business decisions. The minority stockholders

have no way of overriding decisions made by our principal stockholder. This level of control may also have an adverse impact on

the market value of our shares because our principal stockholder may institute or undertake transactions, policies or programs

that result in losses and/or may not take any steps to increase our visibility in the financial community and/or may sell sufficient

numbers of shares to significantly decrease our price per share.

Risks Related to Our Common Stock

The market price of our common stock

may decline.

Fluctuations in the price

of our securities could contribute to the loss of all or part of your investment. The trading price of our shares has been subject

to wide fluctuations in response to various factors, some of which are beyond our control. Any of the factors listed below could

have a material adverse effect on your investment in our securities and our securities may trade at prices significantly below

the price you paid for them. In such circumstances, the trading price of our securities may not recover and may experience a further

decline.

Factors affecting the

trading price of our securities may include:

|

•

|

|

actual or anticipated fluctuations in our quarterly financial results or the quarterly

financial results of companies perceived to be similar to us;

|

|

•

|

|

changes in the market’s expectations about our operating results;

|

|

•

|

|

success of competitors;

|

|

•

|

|

our operating results failing to meet the expectation of securities analysts or investors

in a particular period;

|

|

•

|

|

changes in financial estimates and recommendations by securities analysts concerning

us or the consumer goods market in general;

|

|

•

|

|

operating and stock price performance of other companies that investors deem comparable

to the Company;

|

|

•

|

|

our ability to market new and enhanced products on a timely basis;

|

|

•

|

|

changes in laws and regulations affecting our business;

|

|

•

|

|

commencement of, or involvement in, litigation involving the Company;

|

|

•

|

|

changes in our capital structure, such as future issuances of securities or the incurrence

of additional debt;

|

|

•

|

|

the volume of shares of our common stock available for public sale;

|

|

•

|

|

any major change in our board or management;

|

|

•

|

|

sales of substantial amounts of common stock by our directors, executive officers

or significant stockholders or the perception that such sales could occur; and

|

|

•

|

|

general economic and political conditions such as recessions, interest rates, fuel

prices, international currency fluctuations and acts of war or terrorism.

|

Broad market and industry

factors may materially harm the market price of our securities irrespective of our operating performance. The stock market in general

has experienced price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of

the particular companies affected. The trading prices and valuations of these stocks, and of our securities, may not be predictable.

A loss of investor confidence in the market for retail stocks or the stocks of other companies which investors perceive to be similar

to the Company could depress our stock price regardless of our business, prospects, financial conditions or results of operations.

A decline in the market price of our securities also could adversely affect our ability to issue additional securities and our

ability to obtain additional financing in the future.

An active and visible trading market

for our common stock may not develop.

We cannot predict whether

an active market for our common stock will develop in the future. In the absence of an active trading market:

|

●

|

|

investors may have difficulty buying and selling or obtaining market quotations;

|

|

●

|

|

market visibility for our common stock may be limited; and

|

|

●

|

|

a lack of visibility for our common stock may have a depressive effect on the market

price for our common stock.

|

Volatility in the price of our common

stock may subject us to securities litigation.

The market for our common

stock may be characterized by significant price volatility, and we expect that our share price will continue to be more volatile

than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation

against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of

similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s

attention and resources.

Our common stock may be considered

a “penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult

to sell.

Our

common stock may be considered to be a “penny stock” if it does not qualify for one of the exemptions from the definition

of “penny stock” under Section 3a51-1 of the Exchange Act, as amended. Our common stock may be a “penny

stock” if it meets one or more of the following conditions: (i) the stock trades at a price less than $5.00 per share; (ii)

it is NOT traded on a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Capital Market, or even

if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with

net tangible assets less than $5 million. The principal result or effect of being designated a “penny stock”

is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock” regulations

set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers

dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually

signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for

the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of

any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires

the broker-dealer to: (i) obtain from the investor information concerning his or her financial situation, investment experience

and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable

for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks

of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer

made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming

that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance

with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to

third parties or to otherwise dispose of them in the market or otherwise.

A sale or perceived sale of a substantial

number of shares of our common stock may cause the price of our common stock to decline.

The

market price of our shares could decline as a result of sales of substantial amounts of our shares in the public market including

the shares included in this Registration Statement, or the perception that these sales could occur. Moreover, the perceived risk

of this potential dilution could cause shareholders to attempt to sell their shares and investors to short our common stock. These

sales also may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that

we deem reasonable or appropriate.

The recent

increase in our authorized capital stock and issuance of common stock upon conversion of outstanding convertible notes and warrants

may result in immediate and substantial dilution.

The

issuance of common stock upon conversion of the convertible notes and warrants outstanding will result in immediate and substantial

dilution to the interests of other stockholders since the holders of the convertible notes and warrants may ultimately receive

and sell the full amount of shares issuable in connection with the conversion of such convertible notes and warrants. Although

certain of the convertible notes may not be converted if such conversion would cause the holders thereof to own more than 4.99%

or 9.99% of our outstanding common stock, this restriction does not prevent the holders of the convertible notes subject to such

restrictions from converting some of their holdings, selling those shares, and then converting the rest of its holdings, while

still staying below the 4.99%/9.99% limit. In this way, the holders could sell more than any applicable ownership limit while

never actually holding more shares than the applicable limits allow. If the holders choose to do this, it will cause substantial

dilution to the then holders of our common stock. The recent increase in our authorized capital stock allows shares of common

stock to be issued upon such exercises or conversions without having to get stockholder approval in the future. The table below

provides the number of shares issuable upon exercise or conversion of each convertible and exchangeable class of securities.

|

Security

|

Underlying

Shares of Common Stock

|

Underlying

Shares of Preferred Stock

|

|

Convertible

Notes

|

67,375,000

|

|

|

Warrants

|

106,666,720

|

6,666,672

Series C

|

|

Series

A Preferred

|

688

|

|

|

Series

B Preferred

|

9,938

|

|

|

Series

C Preferred

|

68,055,610

|

|

|

Series

D Preferred

|

40,000,000

|

|

We do not foresee paying cash dividends

in the foreseeable future and, as a result, our investors’ sole source of gain, if any, will depend on capital appreciation,

if any.

We

do not plan to declare or pay any cash dividends on our shares of common stock in the foreseeable future and currently intend to

retain any future earnings for funding growth. As a result, investors should not rely on an investment in our securities if they

require the investment to produce dividend income. Capital appreciation, if any, of our shares may be investors’ sole source

of gain for the foreseeable future. Moreover, investors may not be able to resell their common stock at or above the price they

paid for them.

FORWARD-LOOKING STATEMENTS

This

prospectus includes forward-looking statements. These statements are based on our management’s beliefs and assumptions and

on information currently available to our management. The forward-looking statements are contained principally under the headings

“Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

and “Business.” Forward-looking statements include statements concerning:

|

|

•

|

our possible or assumed future results of operations;

|

|

|

•

|

our business strategies;

|

|

|

•

|

our ability to attract and retain customers;

|

|

|

•

|

our ability to sell additional products and services to customers;

|

|

|

•

|

our cash needs and financing plans;

|

|

|

•

|

our competitive position;

|

|

|

•

|

our industry environment;

|

|

|

•

|

our potential growth opportunities;

|

|

|

•

|

expected technological advances by us or by third parties and our ability to leverage them;

|

|

|

•

|

the effects of future regulation; and

|

|

|

•

|

the effects of competition.

|

All statements in this prospectus

that are not historical facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,”

“believes,” “could,” “estimates,” “expects,” “intends,” “may,”

“plans,” “potential,” “predicts,” “projects,” “should,” “will,”

“would” or similar expressions or the negative of such items that convey uncertainty of future events or outcomes to

identify forward-looking statements.

Forward-looking statements

are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation

to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may

be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including

the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements

to actual results.

USE OF PROCEEDS

We will receive no proceeds from the sale

of shares of common stock offered by the selling stockholders.

MARKET PRICE OF AND DIVIDENDS ON REGISTRANT’S

COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market for our Common Stock

Our common stock

has been quoted on the OTCQB system under the symbol “WHSI” since June 3, 2016. Prior to June 3, 2016, our common

stock was quoted on the OTCQB system under the symbol “MDHI” since March 23, 2016. Prior to March 23, 2016, our

common stock was quoted on the OTC Pink Marketplace (formally the OTC Bulletin Board) system under the symbol “MDHI”

since January 2, 2009.

The market price of our

common stock will be subject to significant fluctuations in response to variations in our quarterly operating results, general

trends in the market, and other factors, over which we have little or no control. In addition, broad market fluctuations, as well

as general economic, business and political conditions, may adversely affect the market for our common stock, regardless of our

actual or projected performance.

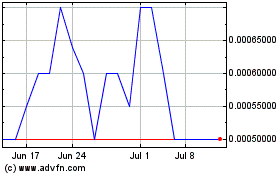

The following table sets forth the range of

the high and low sales prices per share of our common stock for the fiscal quarters indicated.

|

Fiscal Year 2016

|

|

High

|

|

Low

|

|

First Quarter

|

|

$

|

0.24

|

|

|

$

|

0.03

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year 2015

|

|

High

|

|

Low

|

|

First Quarter

|

|

$

|

0.50

|

|

|

$

|

0.30

|

|

|

Second Quarter

|

|

$

|

0.47

|

|

|

$

|

0.15

|

|

|

Third Quarter

|

|

$

|

0.35

|

|

|

$

|

0.10

|

|

|

Fourth Quarter

|

|

$

|

0.17

|

|

|

$

|

0.11

|

|

|

Fiscal Year 2014

|

|

High

|

|

Low

|

|

First Quarter

|

|

$

|

1.76

|

|

|

$

|

1.12

|

|

|

Second Quarter

|

|

$

|

1.28

|

|

|

$

|

0.64

|

|

|

Third Quarter

|

|

$

|

1.12

|

|

|

$

|

0.15

|

|

|

Fourth Quarter

|

|

$

|

0.52

|

|

|

$

|

0.22

|

|

On May 25, 2016, the last reported sale price of our common

stock as reported on the OTCQB was $.15 per share.

Holders of Record

As of May 25, 2016,

there were approximately 132 shareholders of record of our common shares.

Dividends

We currently do not pay

regular dividends on our outstanding stock. Our policy is to reinvest earnings in order to fund future growth. Therefore, we have

not paid, and currently do not plan to declare dividends on our common stock. Although we intend to retain our earnings, if any,

to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends

in the future.

Payment of dividends in

the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Equity Compensation Plan Information

We do not have any equity

compensation plans under which equity securities of the Company are authorized for issuance and we have not granted any stock options.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

This discussion should be read in conjunction

with the other sections of this Registration Statement, including “Risk Factors,” “Description of Business”

and the Financial Statements attached hereto pursuant and the related exhibits. The various sections of this discussion contain

a number of forward-looking statements, all of which are based on our current expectations and could be affected by the uncertainties

and risk factors described throughout this prospectus. See “Forward-Looking Statements.” Our actual results may differ

materially.

The following discussion

provides information which management believes is relevant to an assessment and understanding of our results of operations and

financial condition. The discussion should be read along with our financial statements and notes thereto contained elsewhere in

this Registration Statement. The following discussion and analysis contains forward-looking statements, which involve risks and

uncertainties. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking

statements.

You should read the following

information in conjunction with our financial statements and related notes contained elsewhere in this report. You should consider

the risks and difficulties frequently encountered by early-stage companies, particularly those engaged in new and rapidly evolving

markets and technologies. Our limited operating history provides only a limited historical basis to assess the impact that critical

accounting policies may have on our business and our financial performance.

Overview and Recent Events

We manufacture medical

alarm devices that are used to summon help in the event of an emergency. While these devices are primarily designed for the elderly,

there is also a market for those who are physically disabled, as well as for persons living alone.

We were organized in 2008.

Traditional financing has not been available to us and because of this we have historically been forced to raise capital on terms

that were highly dilutive. This type of financing, along with several other issues, prevented us from realizing a robust growth

rate for our first few years of operation. Since that time, considerable management time has been spent and investor money utilized

to turn our operation around.

Our flagship product is

called the MediPendant®, which is a personal emergency alarm that is used to summon help in the event of an emergency at home.

Since approximately 60% of all medical alarms currently being sold in the United States right now, are first-generation technologies

that require the user to speak and listen through a central base station unit, the MediPendant® has found success by offering

a product that has the speaker in the pendant, enabling the user to simply speak and listen directly through the pendant in the

event of an emergency.

The MediPendant® is

designed to be worn in the bath or shower and offers a 600-foot range, so that the wearer can operate the unit from virtually anywhere

within their home or on their property. The product is extremely durable, very reliable, and offers an extremely long battery life.

The MediPendant® has voice prompts that alert the user of the operational status of the device. This gives the user some peace

of mind during an emergency because they know with certainty that their distress signal has been activated and help is being summoned.

We also manufacture the

iHelp mobile medical alarm device. The iHelp is a next-generation medical alarm that utilizes T-Mobile’s 2G network. Users

of the iHelp mobile medical alarm can take the device with them wherever there is cellular service. There is no base station and

only requires a cellular signal in order to work.

We have invested time,

manpower, and money into the development of this product. On September 30, 2014, we signed an agreement for a $300,000 line of

credit to enable us to launch the iHelp, and to build the infrastructure that allowed us to buy and track air time from T-Mobile

for cellular operation of this unit. The credit line was increased to $500,000 in January 2015. The iHelp has enhanced features

and functions including an advanced GPS system, the ability to remotely locate a loved one, and a dealer portal that enables dealers

to manage their own iHelp customer base. A significant amount of time was spent on the backend systems, including the dealer portal.

iHelp dealers have significant benefits, most importantly the ease of use in ordering product, activating and deactivating customers,

tracking their customer usage, and creating and printing a variety of reports to assist in billing and collecting revenues. The

iHelp dealer program is a turn-key program that offers the dealer the opportunity to provide his/her customers with the latest

products without having to change his/her own backend.

We are in the process of

implementing a new product called the iHelp+ (iHelp plus 3G). iHelp+ is a cellular medical alert system that operates on a 3G network.

Initially, it will be operating on the AT&T network (GSM - Global), and within a few months we expect that it should also be

able to operate on the Verizon (CDMA - USA) network as well. It is Bluetooth and Wi-Fi enabled. It has a much broader reach than

the iHelp, as well as additional functions, such as fall detection and geo-fencing (ability to pre-set an area and alert loved

ones if the user leaves or enters the pre-set area).

Additionally, the iHelp+

will be used as the communication device for a wellness bracelet and other Bluetooth-enabled devices used for collecting vital

sign data and storing the data in any requested manner in encrypted HIPAA-compliant cloud servers for access by proper parties.

On July 10, 2008, we entered

into a Purchase Agreement and Patent Assignment Agreement (the “Agreement”) effective July 31, 2008. We were obligated

to pay the seller $2,500,000 on June 30, 2012. The Agreement specifies interest of 6% payable monthly, commencing on July 31, 2008.

The seller had the right to reacquire all patents and applications if payment was not made on June 30, 2012; however, this agreement

has been extended quarterly since June 30, 2012. The patent purchase agreement refers to patent #RE41845 and RE41392. The scope

of the patents is as follows: A personal emergency communication system includes a user-carried portable communication unit having

a single button, which when depressed by the user, wirelessly sends a call request signal to a base unit. The base unit initiates

a telephone call through a dial-up network to an emergency response center and places an operator at the emergency center responder

in wireless voice communication with the portable unit when the call is connected. The telephone number to be called can be stored

in at least one of the portable unit and the base unit. A speech synthesizer operating in combination with automated voice messages

stored in at least one of the base unit and portable unit system memory are used to advise the user of the status of the call,

and to provide the user with verbal confirmation that functional systems of the base unit are operating properly.

In June 2015, we made a

decision to terminate our patent agreement with Nevin Jenkins, the patent holder. Mr. Jenkins and the Company agreed to a new revised

licensing agreement whereby we still have the ability to order product utilizing the patent. We feel that the old agreement was

too costly, and money would be better served based on our decision of investing in more cellular type mPERS devices. Our new agreement

with Mr. Jenkins will enable us to continue selling the MediPendant® based on a cost plus structure. Pursuant to the terms

of the new agreement, we agreed to turn over to Mr. Jenkins all excess parts in inventory and tooling that were in our factory

in China. In exchange for this, we retained the license to sell the MediPendant® in the United States. We also agreed that

were we to purchase the MediPendant® from Mr. Jenkins, we would pay “cost” plus $25 per unit. The excess parts

and tooling in China amount to approximately $35,000 and were not valued on our books. We agreed to a credit of $25 on each MediPendant®

sold to us until the entire $35,000 was utilized. This number converts to 1,400 units.

Pursuant to certain subscription

agreements dated March 1, 2016 and March 3, 2016, we sold $612,500 worth of units (the “Units”), pursuant to separate

subscription agreements with accredited investors entered into on March 1, 2016 and March 3, 2016, at a purchase price of $25,000

per Unit. Each Unit consisted of (i) $25,000 face amount of 10% original issue discount unsecured convertible notes, convertible

into shares of the Company’s common stock, par value $0.0001 per share at a conversion price equal to $0.01 and (ii) one

warrant to purchase 277,778 shares of Series C Convertible Preferred Stock, par value $0.0001 per share, at an exercise price of

$0.09 per share (such sale and issuance, the “Private Placement”). D2CF, LLC, one of the selling stockholders, exercised

their rights pursuant to their Warrant and received 138,889 shares of Series C Preferred Stock.

On April 21, 2016 (the

“Closing Date”), we closed the sale of one unit for $400,000 (the “Unit”), pursuant to a subscription

agreement (the “Subscription Agreement”) with an accredited investor (the “Investor”). The Unit consisted

of (i) 400,000 shares of Series D Preferred Stock, par value $0.0001 per share (the “Preferred D Shares”). Each of

the Preferred D Shares are convertible into 100 shares of the Company’s common stock, par value $0.0001 per share; and (ii)

one warrant (the “Warrant”) to purchase 40,000,000 shares of Common Stock, $0.001 par value per share, at an exercise

price of $0.01 per share, subject to adjustment, and expires three years from the date of issuance.

The Company is prohibited

from effecting a conversion of the Preferred D Shares to the extent that, as a result of such conversion, such Investor would

beneficially own more than 4.99% of the number of shares of Common Stock outstanding immediately after giving effect to the issuance

of shares of Common Stock upon conversion of the Preferred D Shares, which beneficial ownership limitation may be increased by

the holder up to, but not exceeding, 9.99%.

Results of Operations

Comparison of Three Months Ended March 31, 2016 and 2015

Revenue.

Revenue

generated during the quarters ended March 31, 2016 and 2015 were $325,095 and $279,627, respectively; representing a 16% or $45,468

increase, resulting from a change in strategic business direction toward larger orders to dealers with its new product(s), and

more widespread product distribution. The Company believes this change in business direction will lead to stronger growth and

margins and higher overall sales during future periods. During the quarters ended March 31, 2016 and 2015, revenue were generated

from sales to distributors, resellers and from direct sales to consumers who pay the Company for monthly monitoring services.

Cost of Revenue.

Cost of revenue incurred during quarters ended March 31, 2016 and 2015 were $91,470 and $124,490, respectively, representing

a 27% or $33,020 decrease. The decrease in cost of revenue was mainly due to the Company’s new product iHelp and its sales

method of selling equipment to other dealers, which has lower cost than products sold during the same period last year.

Gross Profit.

Gross

profit generated during quarters ended March 31, 2016 and 2015 was $233,625 and $155,137, respectively. The gross profit margin

for quarters ended March 31, 2016 and 2015 was 72% and 55%, respectively. The increase of gross profit was the result of both

increased revenue and decreased cost of revenue.

General and Administrative.

General and administrative expenses for quarters ended March 31, 2016 and 2015 were $353,896 and $225,337, respectively; representing

57% or $128,559 increase in general and administrative expense mainly due to the increase of salary and consulting fees.

Selling Expenses.

Selling expenses incurred during quarters ended March 31, 2016 and 2015 were $69,768 and $107,835, respectively. The $38,067

or 35% decrease was mainly due to the reduced amount of marketing expenses charged by Costco.

Change in Fair Value

of Derivative Instrument.

Changes in fair value of derivative instrument generated income of $82,057 during quarter ended

March 31, 2016. The Company didn’t have any derivative liabilities during the quarter ended March 31, 2015.

Interest expense-related

party.

Interest expense-related party was $6,643 and $5,487 for the quarters ended December 31, 2016 and 2015, respectively.

Interest Expense.

Interest expense for the quarters ended March 31, 2016 and 2015 was $32,280 and $37,910, respectively. The $5,630 or 15% decrease

in interest expense was mainly due to the termination of patent loan agreement.

Net Loss.

Net

loss incurred during quarters ended March 31, 2016 and 2015 was $146,905 and $221,432, respectively. Change in net loss is due

to the reasons stated above.

Comparison of Nine Months Ended March 31, 2016 and 2015

Revenue.

Revenue

generated during the nine months ended March 31, 2016 and 2015 were $996,727 and $791,708, respectively; representing a 26% or

$205,019 increase, resulting from a change in strategic business direction toward more widespread product distribution to dealers.

The Company believes this change in business direction will lead to stronger growth and margins and higher overall sales during

future periods. During the nine months ended March 31, 2016 and 2015, revenue were generated from sales to distributors, resellers

and from direct sales to consumers who pay the Company for monthly monitoring services.

Cost of Revenue.

Cost of revenue incurred during nine months ended March 31, 2016 and 2015 were $301,427 and $227,549, respectively, representing

a 32% or $73,878 increase. The increase in cost of revenue was mainly due to the Company’s new product iHelp and its sales

method of selling equipment to other dealers, thereby increasing revenues and as a result sales margins.

Gross Profit.

Gross

profit generated during nine months ended March 31, 2016 and 2015 was $695,300 and $564,159, respectively. The gross profit margin

for nine months ended March 31, 2016 and 2015 was 70% and 71%, respectively. The decrease in gross profit margin was mainly due

to more revenue generated from the sales of its new product iHelp directly to other dealers, which has lower gross profit margin.

General and Administrative.

General and administrative expenses for nine months ended March 31, 2016 and 2015 were $939,250 and $591,051, respectively;

representing 59% or $348,199 increase in general and administrative expense mainly due to the increase of salary and consulting

fees.

Selling Expenses.

Selling expenses incurred during nine months ended March 31, 2016 and 2015 were $122,700 and $237,719, respectively. The $115,019

or 48% decrease was mainly due to the reduced amount of marketing expenses charged by Costco.

Change in Fair Value

of Derivative Instrument.

Change in fair value of derivative instrument incurred income of $82,057 during nine months ended

March 31, 2016; in contrast, changes in fair value of derivative instrument generated expense of $11,335 during nine months ended

March 31, 2015.

Interest expense-related

party.

Interest expense-related party was $19,378 and $8,421 for the nine months ended March 31, 2016 and 2015, respectively.

The $10,957 or 130% increase was due to the increase of credit line.

Interest Expense.

Interest expense for the nine months ended March 31, 2016 and 2015 was $59,428 and $113,455, respectively. The $54,027 or

48% decrease in interest expense was mainly due to the termination of patent loan agreement.

Net Loss.

Net

loss incurred during nine months ended March 31, 2016 and 2015 was $363,399 and $397,822, respectively. Change in net loss is

due to the reasons stated above.

Comparison of Fiscal Years Ended June

30, 2015 and June 30, 2014

Revenue.

Revenue

generated during the years ended June 30, 2015 and 2014 were $1,147,099 and $1,153,693, respectively; representing a 1% or $6,594

decrease in the year ended June 30, 2015 comparing with last year, resulting from a change in strategic business direction toward

more widespread product distribution and away from reliance on only a few resellers and distributors. We believe this change in

business direction will lead to stronger growth and margins and higher overall sales during future periods. During 2015 and 2014,

revenue was generated from sales to distributors, resellers and from direct sales to consumers who pay us for monthly monitoring

services.

Cost of Revenue.

Cost

of revenue incurred during years ended June 30, 2015 and 2014 were $366,702 and $324,503, respectively, representing a 13% or $42,199

increase in the year ended June 30, 2015 comparing with last year. The increase of cost of sales was mainly due to higher cost

of sales products sold during current fiscal year as compared with previous fiscal year.

Gross Profit.

Gross

profit generated during fiscal 2015 and 2014 was $780,397 and $829,190, representing 6% or $48,793 decrease in the year ended June

30, 2015 comparing with last year. The gross profit margin for 2015 and 2014 were 68% and 72%, respectively.

Selling Expenses.

Selling

expenses incurred during fiscal 2015 and 2014 was $305,738 and $212,133, respectively, representing $93,605 or 44% increase in

the year ended June 30, 2015 comparing with last year. During fiscal 2015, we shifted our sales emphasis more toward brand marketing,

which contributed to the increase in sales expenses.

General and Administrative.

General and administrative expenses for fiscal 2015 and 2014 were $987,035 and $1,695,423, respectively; representing 42% or

$708,388 decrease in the year ended June 30, 2015 comparing with last year,. During the year ended June 30, 2014, the Company issued

1,493,669 shares of common stock to management pursuant to Global Settlement Agreement and recorded stock compensation expense

of $ 955,948. The Company also issued 50,000 shares of common stocks to a shareholder for consulting services during the year ended

June 30, 2014 which was valued at $38,500.

During the year ended June

30, 2015, the Company issued 1,375,000 shares of common stock to consultants for services performed. Those shares were valued at

$305,039 which was amortized over service period.

Change in Fair Value

of Derivative Instrument.

Changes in fair value of derivative instrument generated $1,514,947 income during fiscal 2014; while

expense generated from the changes in fair value of derivative instrument during 2015 was $11,335.

Interest Expense.

Interest

expense for fiscal 2015 and 2014 were $117,350 and $189,220, respectively. The $71,870 or 38% decrease in interest expense was

mainly due to the decrease of loan amount. The Company also recorded interest expense of $8,436 and $22,320 for the year ended

June 30, 2015 and 2014, respectively, on credit line from related parties.

Gain from Termination

of Patent Agreement.

On July 10, 2008, the Company entered into a Purchase Agreement and Patent Assignment Agreement (the "Agreement")

effective July 31, 2008. The Company was obligated to pay the seller $2,500,000 on June 30, 2012. The Agreement specifies interest

of 6% payable monthly, commencing on July 31, 2008. The seller had the right to reacquire all patents and applications if payment

was not made on June 30, 2012. This agreement had been extended quarterly since June 30, 2012. This patent was recorded as an intangible

asset and amortized over its estimated useful life. In June 2015, we made decision to terminate the Agreement. Upon termination

of this Agreement, the loan payable of $2,500,000 and unamortized balance of intangible asset of $1,023,804 were written off and

a gain of $1,476,196 was recorded.

Net Income (Loss).

Net income for 2015

and 2014 was $826,699 and $225,041, respectively, for the reasons stated above.

Liquidity and Capital Resources

As of March 31, 2016

and June 30, 2015, we had $134,088 and $1,335 in cash, respectively.

During

the nine months ended March 31, 2016 and 2015, our operating activities incurred net cash outflow of $462,969 and $366,828, respectively.

The main reasons for the change in net cash used in operating activities are outlined below:

|

1.

|

Changes in fair value of derivative instrument during nine months

ended March 31, 2016 generated non-cash income of $82,057; in contrast such changes incurred non-cash

cost of $11,335 during same period of last year.

|

|

2.

|

During the nine months ended March 31, 2016 and 2015, stock-based

compensation generated non-cash expense of $166,919 and $1,750, respectively.

|

|

3.

|

During the nine months ended March 31, 2015, amortization of

patent generated non-cash loss of $58,877; during the same period of current year, there was no

accounting transaction of similar nature.

|

|

4.

|

During the nine months ended March 31, 2016, amortization of

debt discount generated non-cash loss of $25,080; during the same period of last fiscal year, there

was no accounting transaction of similar nature.

|

|

5.

|

During the nine months ended March 31, 2016, the increase of

prepaid expense generated net cash outflow of $164,192 and $18,350, respectively.

|

|

6.

|

During the nine months ended March 31, 2016, the Company generated

net cash inflow of $5,228 through decreasing of inventories; comparably during the same period

of 2015, the purchasing of inventory generated net cash outflow of $91,151.

|

During the nine

months ended March 31, 2015, the Company lent $30,000 to one of employees. There was no transaction in similar nature during

the same period of current year.

During

the nine months ended March 31, 2016 and 2015, financing activities generated net cash inflow of $586,222 and $391,608, respectively.

Main reasons for the change in net cash provided by financing activities were outlined below:

|

1.

|

During the nine months ended March 31, 2016, the Company received

proceeds of $612,500 through issuance of convertible notes; there was no transaction of similar

nature during the same period of previous fiscal year.

|

|

2.

|

During the nine months ended March 31, 2016 and 2015, the Company

received proceeds of $0 and $396,608 by obtaining a credit line from a company, which is partially

owned by the Company’s CEO.

|

|

3.

|

During the nine months ended March 31, 2016 and 2015, the Company

spent $39,713 and $5,000 for the repayment of other notes payables.

|

|

4.

|

During the nine months ended March 31, 2016, the Company received

proceeds of $20,000 from an unrelated individual; there was no transaction of similar nature during

corresponding period last year.

|

|

5.

|