UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 13, 2016

ENERGY

FUELS INC.

(Exact name of registrant as specified in its charter)

| Ontario |

001-36204 |

98-1067994 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

225 Union Blvd., Suite 600

Lakewood, Colorado |

80228 |

| (Address of principal executive offices) |

(Zip Code) |

| (303) 974-2140 |

| (Registrant’s telephone number, including area code) |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate

box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 8.01 Other Events.

On June 13, 2016, Energy Fuels Inc. issued

a press release attached hereto as Exhibit 99.1

The information furnished pursuant to this

Item 8.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise

subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing under the

Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press Release dated June 13, 2016

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

ENERGY FUELS INC.

(Registrant) |

| Dated: June 13, 2016 |

By: /s/ David C. Frydenlund

David C. Frydenlund

Senior Vice President, General Counsel and Corporate Secretary |

| |

|

Exhibit 99.1

Energy Fuels Provides Update on Acquisition of Mesteña

Uranium; Closing Expected On or Before June 16, 2016

LAKEWOOD, CO, June 13, 2016 /CNW/ - Energy Fuels Inc. (NYSE

MKT: UUUU; TSX: EFR) ("Energy Fuels" or the "Company"), a leading producer of uranium in the United States,

wishes to report that it currently expects to complete the acquisition of Mesteña Uranium, LLC ("Mesteña")

on or before Thursday, June 16, 2016, subject only to final approval for the transfer of its Radioactive Materials License by the

Texas Commission on Environmental Quality ("TCEQ"), which is expected sometime this week. Mesteña is a privately-held

in situ recovery ("ISR") uranium producer that owns the Alta Mesa ISR Project ("Alta Mesa"), a fully-licensed

uranium project, currently on standby, located in South Texas.

As previously announced on March 7, 2016,

the Company expects to issue 4,551,284 common shares of the Company to the current owners of Mesteña at closing. Together

with the Company's recently announced transaction that increased the Company's ownership in the Roca Honda Project to 100%, the

Company expects to have a total of 57.7 million shares issued and outstanding upon completion of the acquisition of Mesteña.

It is expected that, if this transaction closes as contemplated this week, the shares issued for the acquisition of Mesteña

will be available for consideration in the final rebalancing of the FTSE Russell 3000 Index this month.

Energy Fuels' acquisition of Mesteña

is expected to further cement Energy Fuels' position as the dominant integrated uranium producer in the U.S., especially now that

Cameco has announced that it is reducing production in the U.S. Mesteña's Alta Mesa Project is a fully-permitted and

constructed ISR operation and processing facility, with a well-established track record of lower cost uranium production, which

will diversify Energy Fuels' operations into a third production center, along with the Nichols Ranch ISR Project (Wyoming) and

the White Mesa Mill (Utah). Alta Mesa is currently on standby and ready to resume production, as market conditions warrant,

and it can reach commercial production levels with limited required capital within six months of a production decision. Mesteña

also controls a large land package totaling 195,501 contiguous acres, including 4,575-acres currently under a lease and mining

permit and 190,926-acres under a lease-option and exploration/testing permit. Mesteña also has extensive exploration

results across the area that have identified significant uranium resources that Energy Fuels expects can be recovered at lower

costs, as market conditions warrant. Between Alta Mesa, Nichols Ranch, and the White Mesa Mill, Energy Fuels' licensed processing

capacity will exceed 11.5 million pounds of uranium per year.

Stephen P. Antony, President and CEO

of Energy Fuels stated: "Energy Fuels looks forward to completing our acquisition of Mesteña and its lower-cost

ISR uranium production which is economic at today's quoted term prices. Although the long-term fundamentals for the uranium

sector are as strong as ever, it is critical for us to lower all-in costs of production in today's weak uranium price environment.

In addition to other cost-cutting and cash conservation efforts we are actively pursuing, our acquisition of Mesteña is

expected to move Energy Fuels down the cost curve which will allow us to increase production sooner and at lower uranium prices.

"I have had the pleasure of meeting

with the Mesteña shareholders recently, and they have expressed their enthusiasm for closing this transaction and becoming

shareholders in the Company. We will be very excited to welcome them as shareholders on the expected completion of this acquisition,

and to see the future development of the Alta Mesa project and other Mesteña assets."

About Energy Fuels: Energy

Fuels is a leading integrated US-based uranium mining company, supplying U3O8 to major nuclear utilities.

Energy Fuels operates two of America's key uranium production centers, the White Mesa Mill in Utah and the Nichols Ranch Processing

Facility in Wyoming. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today and has a licensed

capacity of over 8 million pounds of U3O8 per year. The Nichols Ranch Processing Facility is an in

situ recovery ("ISR") production center with a licensed capacity of 2 million pounds of U3O8 per

year. Energy Fuels also has the largest NI 43-101 compliant uranium resource portfolio in the U.S. among producers, and uranium

mining projects located in a number of Western U.S. states, including one producing ISR project, mines on standby, and mineral

properties in various stages of permitting and development. The Company's common shares are listed on the NYSE MKT under

the trading symbol "UUUU", and on the Toronto Stock Exchange under the trading symbol "EFR".

Cautionary Note Regarding Forward-Looking

Statements: Certain information contained in this news release, including any information relating to: the Company

being a leading producer of uranium;the Company's expectations with regard to the date of and successful closing of the acquisition

of Mesteña Uranium, LLC; the expected receipt, timing and substance of TCEQ approval; the Company's market capitalization

and any impact on rebalancing of the FTSE Russell 3000 Index; the Company's expectations as to longer term fundamentals in the

market; the Alta Mesa Project's costs, capital requirements, economics, and timing for restarting production; exploration potential;

the Company's licensed production capacity; and any other statements regarding Energy Fuels' future expectations, beliefs, goals

or prospects; constitute forward-looking information within the meaning of applicable securities legislation (collectively, "forward-looking

statements"). All statements in this news release that are not statements of historical fact (including statements containing

the words "expects", "does not expect", "plans", "anticipates", "does not anticipate",

"believes", "intends", "estimates", "projects", "potential", "scheduled",

"forecast", "budget" and similar expressions) should be considered forward-looking statements. All such

forward-looking statements are subject to important risk factors and uncertainties, many of which are beyond Energy Fuels' ability

to control or predict. A number of important factors could cause actual results or events to differ materially from those

indicated or implied by such forward-looking statements, including without limitation factors relating to: any information relating

to the Company being a leading producer of uranium;the Company's expectations with regard to the date of and successful closing

of the acquisition of Mesteña Uranium, LLC; the expected receipt, timing and substance of TCEQ approval; the Company's market

capitalization and any impact on rebalancing of the FTSE Russell 3000 Index; the Company's expectations as to longer term fundamentals

in the market; the Alta Mesa Project's costs, capital requirements, economics, and timing for restarting production; exploration

potential; the Company's licensed production capacity; and other risk factors as described in Energy Fuels' most recent annual

report on Form 10-K and quarterly financial reports. Energy Fuels assumes no obligation to update the information

in this communication, except as otherwise required by law. Additional information identifying risks and uncertainties is

contained in Energy Fuels' filings with the various securities commissions which are available online at www.sec.gov and www.sedar.com.

Forward-looking statements are provided for the purpose of providing information about the current expectations, beliefs and plans

of the management of Energy Fuels relating to the future. Readers are cautioned that such statements may not be appropriate

for other purposes. Readers are also cautioned not to place undue reliance on these forward-looking statements, that speak

only as of the date hereof.

SOURCE Energy Fuels Inc.

%CIK: 0001385849

For further information: Investor Relations Inquiries: Energy

Fuels Inc., Curtis Moore - VP - Marketing & Corporate Development, (303) 974-2140 or Toll free: (888) 864-2125, investorinfo@energyfuels.com,

www.energyfuels.com

CO: Energy Fuels Inc.

CNW 09:00e 13-JUN-16

This regulatory filing also includes additional resources:

ex991.pdf

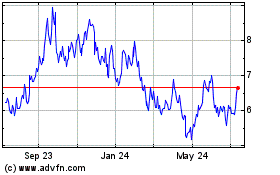

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Apr 2023 to Apr 2024