Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

x

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

o

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-8503

HAWAIIAN ELECTRIC INDUSTRIES RETIREMENT SAVINGS PLAN

Hawaiian Electric Industries, Inc.

1001 Bishop Street, Suite 2900, Honolulu, Hawaii 96813

Table of Contents

REQUIRED INFORMATION

Financial Statements

. The statements of net assets available for benefits at December 31, 2015 and 2014, and the statements of changes in net assets available for benefits for the years then ended, Schedule H, Line 4i — Schedule of Assets (Held at End of Year) at December 31, 2015, together with notes to financial statements, and PricewaterhouseCoopers LLP’s Report of Independent Registered Public Accounting Firm thereon, are filed as a part of this annual report, as listed in the accompanying index.

Exhibit

. The written consent of PricewaterhouseCoopers LLP with respect to the incorporation by reference of the Plan’s financial statements and supplemental schedule in registration statement No. 333-02103 on Form S-8 of Hawaiian Electric Industries, Inc. is filed as a part of this annual report and attached hereto as Exhibit 23.1.

Table of Contents

SIGNATURES

The Plan

. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HAWAIIAN ELECTRIC INDUSTRIES

|

|

|

RETIREMENT SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

Date: June 10, 2016

|

By:

|

HAWAIIAN ELECTRIC INDUSTRIES, INC.

|

|

|

|

PENSION INVESTMENT COMMITTEE

|

|

|

|

Its Named Fiduciary

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ James A. Ajello

|

|

|

|

James A. Ajello

|

|

|

|

Its Chairman

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Chester A. Richardson

|

|

|

|

Chester A. Richardson

|

|

|

|

Its Secretary

|

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Financial Statements

December 31, 2015 and 2014

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Ind

ex

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Administrator of

Hawaiian Electric Industries Retirement Savings Plan

In our opinion, the accompanying statements of net assets available for benefits and the related statements of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of Hawaiian Electric Industries Retirement Savings Plan (the “Plan”) at December 31, 2015 and 2014, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

The supplemental Schedule of Assets (Held at End of Year) at December 31, 2015 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the Schedule of Assets (Held at End of Year) is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

Los Angeles, California

June 10, 2016

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Statements of Net Assets Available for Benefits

December 31, 2015 and 2014

|

|

|

2015

|

|

2014

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

Plan interest in Master Trust

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

428,195,142

|

|

$

|

426,933,212

|

|

|

Notes receivable from participants

|

|

7,510,554

|

|

7,245,146

|

|

|

Participant contributions receivable

|

|

442,487

|

|

807,120

|

|

|

Employer contributions receivable

|

|

42,787

|

|

45,503

|

|

|

Due from Fidelity

|

|

10,603

|

|

21,288

|

|

|

Total assets

|

|

436,201,573

|

|

435,052,269

|

|

|

Liabilities

|

|

|

|

|

|

|

Accounts payable

|

|

5,174

|

|

5,860

|

|

|

Net assets available for benefits

|

|

$

|

436,196,399

|

|

$

|

435,046,409

|

|

The accompanying notes are an integral part of these financial statements.

2

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Statements of Changes in Net Assets Available for Benefits

Years Ended December 31, 2015 and 2014

|

|

|

2015

|

|

2014

|

|

|

|

|

|

|

|

|

|

Additions

|

|

|

|

|

|

|

Investment income

|

|

|

|

|

|

|

Plan interest in Master Trust

|

|

|

|

|

|

|

Net (depreciation) appreciation in fair value of investments

|

|

$

|

(19,569,340

|

)

|

$

|

21,866,427

|

|

|

Dividends and interest

|

|

18,606,535

|

|

19,959,237

|

|

|

Total investment (loss) income

|

|

(962,805

|

)

|

41,825,664

|

|

|

Master Trust interest from participants’ notes receivable

|

|

360,205

|

|

333,334

|

|

|

Revenue credit

|

|

42,412

|

|

85,151

|

|

|

Contributions

|

|

|

|

|

|

|

Participants

|

|

22,995,642

|

|

21,717,457

|

|

|

Employer

|

|

1,482,571

|

|

981,161

|

|

|

Rollover

|

|

1,264,094

|

|

1,302,167

|

|

|

Total contributions

|

|

25,742,307

|

|

24,000,785

|

|

|

Total additions

|

|

25,182,119

|

|

66,244,934

|

|

|

Deductions

|

|

|

|

|

|

|

Distributions to participants

|

|

(23,952,764

|

)

|

(22,336,672

|

)

|

|

Administrative expenses and other

|

|

(79,365

|

)

|

(130,031

|

)

|

|

Total deductions

|

|

(24,032,129

|

)

|

(22,466,703

|

)

|

|

Net increase

|

|

1,149,990

|

|

43,778,231

|

|

|

Net assets available for benefits

|

|

|

|

|

|

|

Beginning of year

|

|

435,046,409

|

|

391,268,178

|

|

|

End of year

|

|

$

|

436,196,399

|

|

$

|

435,046,409

|

|

The accompanying notes are an integral part of these financial statements.

3

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

1.

Plan Description

The Hawaiian Electric Industries Retirement Savings Plan (the “Plan” or “HEIRS Plan”) was established by Hawaiian Electric Industries, Inc. (the “Company” or “HEI”) effective April 1, 1984. The Plan is a defined contribution 401(k) plan that provides certain tax-favored retirement benefits to participating employees. As of December 31, 2015, the Participating Employers in the Plan were Hawaiian Electric Industries, Inc., Hawaiian Electric Company, Inc. (“Hawaiian Electric”), Maui Electric Company, Limited (“Maui Electric”), and Hawaii Electric Light Company, Inc. (“Hawaii Electric Light”).

Effective May 1, 2011, the HEIRS Plan was amended and restated in its entirety to incorporate benefit changes negotiated with the electrical workers’ union representing employees of Hawaiian Electric, Maui Electric and Hawaii Electric Light. The changes include a 50% employer matching contribution on the first 6% of compensation deferred to the HEIRS Plan by all employees who commence employment on or after May 1, 2011. The matching contribution is subject to a six-year graded vesting schedule. As part of the restatement, HEI, the Plan sponsor, was designated as the Plan “Administrator,” as defined in the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Effective January 1, 2013, the HEIRS Plan was again amended and restated in its entirety to incorporate all amendments required by the 2011 Cumulative List of Changes in Plan Qualification Requirements, including amendments to comply with the Pension Protection Act of 2006, the Heroes Earnings Assistance and Relief Tax Act of 2008, and the Worker, Retiree, and Employer Recovery Act of 2008.

In November 2014, the HEIRS Plan was amended to add an “eligible automatic contribution arrangement” (an “EACA”), under which eligible employees are automatically enrolled in the Plan. The amendment was effective January 1, 2015.

On January 16, 2015, the Internal Revenue Service (“IRS”) issued the latest favorable determination letter covering the Plan. This latest determination letter does not cover amendments made to the Plan since January 1, 2013. The Company and its outside ERISA/tax counsel believe that the amendments made since January 1, 2013 meet applicable federal tax law requirements.

Effective February 1, 2015, the HEIRS Plan was amended to add a Roth contribution feature and a Roth in-Plan conversion feature.

In March 2015, technical amendments were made to the HEIRS Plan at the request of the Internal Revenue Service to complete the most recent determination letter process for the HEIRS Plan. Additional amendments were also made with respect to the Roth features.

The following description of the Plan provides only general information. Participants should refer to the Plan document for its detailed provisions, which are also summarized in the most recent prospectus for the Plan and in the summary plan description:

a.

Plan Administration

The Company is the Administrator of the Plan. The board of directors of the Company has established the Pension Investment Committee (“PIC”) to oversee the administration of the Plan and the investment options offered under the Plan. The PIC has appointed an Administrative Committee to oversee the day-to-day administration of the Plan, which includes the discretionary authority to interpret the Plan’s provisions. The PIC has also appointed an

4

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

Investment Committee to oversee the day-to-day financial affairs of the Plan. The Administrative and Investment Committees are comprised of employees of the Company and its subsidiaries and are chaired by a member of the PIC.

The Participating Employers and the Plan currently pay the Plan’s administrative fees. The Plan’s trustee and certain of the mutual funds offered under the Plan also provide revenue credits to the Plan, which are used to pay for Plan administration including recordkeeping. Fees charged directly to the Plan that are not paid by revenue credits may be allocated to participant accounts. Participants may also be assessed interest and fees related to participants’ notes receivable and withdrawals.

b.

Eligibility

All nonbargaining unit employees of the Participating Employers (other than leased employees or contract employees hired for specific tasks or assignments) are eligible to participate in the Plan upon employment. Bargaining unit employees are eligible to participate in the Plan upon becoming “regular” employees under the terms of the applicable collective bargaining agreement (and subject to any future changes therein). Participation in the Plan is voluntary for eligible employees.

c.

Salary Deferral Contributions

Employees participate in the Plan by making salary deferral contributions of up to 30% of compensation, subject to a federal tax limit of $18,000 in 2015 and $17,500 in 2014.

Participants who are age 50 or older, or who attain age 50 during the year, may elect to make catch-up contributions, as defined in the Plan, subject to a federal tax limit of $6,000 in 2015 and $5,500 in 2014.

For purposes of calculating contributions to the Plan, compensation is defined as Box 1, W-2 earnings, modified to (a) exclude discretionary bonuses, fringe benefits, employer nonelective contributions to a cafeteria plan, reimbursements, moving and other expense allowances, and special executive compensation; and (b) include nontaxable elective contributions made by a Participating Employer to the Plan, a cafeteria plan, or a pretax transportation spending plan. Special executive compensation is noncash compensation and nonqualified deferred compensation available only to a select group of management employees.

Federal tax law limits the amount of annual compensation that may be taken into account in determining contributions to the Plan. The maximum limit was $265,000 in 2015 and $260,000 in 2014.

d.

Matching Contributions for New Employees

Effective May 1, 2011, the Participating Employers began matching the 401(k) contributions of their respective participants who were first employed (or deemed to be new employees under Section 1.2 of the Retirement Plan for Employees of Hawaiian Electric Industries, Inc. and Participating Subsidiaries) after April 30, 2011. The amount of the match is 50% of the first 6% of annual compensation deferred by the participant (i.e., maximum matching contribution of 3% of the participant’s annual compensation).

e.

Participant Accounts

Each participant has an individual account in the Plan, which may include one or more subaccounts. Each participant is 100% vested in all of the participant’s subaccounts other

5

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

than a matching contribution subaccount (if any). A participant’s benefits equal the vested balance in the participant’s account at the time of distribution. Each participant’s account is credited with the participant’s elective contributions, matching contributions, if applicable, and allocations of Plan earnings and gains or losses (whether realized or unrealized), and charged with an allocation of any administrative expenses paid directly by the Plan or charged directly to the participant’s account. Individual expenses, such as fees associated with loans and distributions, are charged directly to a participant’s individual account. Other administrative expenses, such as recordkeeping expenses, are paid through investment level expenses that are borne by participants in proportion to their investments in the designated investment alternatives that generate revenue credits for the Plan. Participant accounts are valued at the end of each day that the New York Stock Exchange is open.

The Plan is intended to be an ERISA Section 404(c) plan, under which the fiduciaries of the Plan are relieved of liability for any losses that are the direct and necessary result of a participant’s or beneficiary’s exercise of control over the investments in his or her individual account. Participants are responsible for directing the investment of all amounts in their accounts using investment options offered under the Plan and for the performance of such investments. The Plan currently offers various mutual funds and target-date funds, and a unitized common stock fund that consists of shares of HEI common stock and short-term liquid investments. Participants may change their investment elections at any time. If a participant does not choose an investment option for any portion of the participant’s account, such amounts are automatically invested in the age-appropriate Fidelity Freedom Index Fund or such other investment as the PIC may direct, pending other direction by the participant.

The portion of the Plan comprising the HEI Common Stock Fund is designated as an employee stock ownership plan (“ESOP”). Amounts contributed to the Plan for investment in the HEI Common Stock Fund or transferred to the HEI Common Stock Fund from other investment alternatives become part of the ESOP component of the Plan.

Participants are not required to make any investment in the HEI Common Stock Fund, and there are two limitations on the amount a participant may invest in the HEI Common Stock Fund. First, a participant may not direct more than 20% of any contribution to the HEI Common Stock Fund. Second, participants and beneficiaries are prohibited from making transfers or exchanges from other investment alternatives into the HEI Common Stock Fund if the transfer or exchange would cause the participant’s or beneficiary’s investment in the HEI Common Stock Fund to exceed 20% of the participant’s or beneficiary’s total account balance.

f.

Distributions

Distributions from participants’ accounts are generally made upon retirement, death, permanent disability or other termination of employment. Distributions may be made in a single lump sum, or a retired or terminated participant may elect to receive partial distributions (once per year) until the participant’s account has been distributed in full or the participant elects to receive a single-sum distribution of the remaining account balance. Retired participants may also elect to receive required minimum distributions from the Plan.

Account balances of $5,000 or less are automatically distributed upon termination of employment. Any automatic distribution of more than $1,000 (but not more than $5,000) is made in the form of an automatic direct rollover to an Individual Retirement Account (“IRA”) designated by the Administrative Committee, unless the participant requests a cash distribution or a direct rollover to an IRA or tax-qualified retirement plan of the participant’s choosing.

6

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

Distributions from the HEI Common Stock Fund are in the form of HEI common stock or, if the participant so elects, cash (with any fractional shares paid in cash). Distributions of HEI Stock Ownership Plan (“HEISOP”) subaccounts invested in the HEI Common Stock Fund may be made in installments, generally over a period of no more than five years, or may be made in a single lump sum (in stock or in cash).

The participant’s account will be reduced by any unpaid note balance at the time of distribution. However, unless rolled over, the balance of the unpaid note will be taxable to the participant.

g.

Death Benefits

Upon the death of a participant, the full value of the participant’s vested account balance is payable as a death benefit to the participant’s designated beneficiary.

h.

Withdrawals While Employed

Prior to termination of employment, salary deferral and catch-up contributions (and income earned on such contributions prior to 1989) and certain other contributions may be withdrawn in the event of hardship. A participant who receives a hardship withdrawal is prohibited from making additional salary deferral contributions to the Plan for six months following the hardship withdrawal.

Upon request, a participant may withdraw certain contributions (and the associated investment earnings), including tax-deductible voluntary contributions and after-tax contributions no longer permitted under the Plan and after-tax and Roth rollover contributions.

Participants who elect to invest portions of their account balances in the HEI Common Stock Fund (the ESOP component of the Plan) may elect to receive cash distributions of periodic dividends attributable to such investments or may elect to have such dividends reinvested. If the dividends are reinvested, they are fully vested.

A participant who is age 59½ or older may elect to receive an in-service distribution from his or her vested account balance once per year, except that in-service distributions are not permitted from a participant’s matching contribution subaccount.

i.

Notes Receivable from Participants

Participants may borrow from their accounts. All loans must be on commercially reasonable terms and be evidenced by a note. The minimum note amount is $1,000, and the maximum amount of all notes under the Plan is limited to the lesser of $50,000, reduced by the highest outstanding note balance during the prior 12 months, or 50% of the participant’s vested account balance. The term of a note generally may not exceed 5 years, except that a note used to purchase a principal residence may have a term of up to 15 years. The interest rate on a note is set at the time a participant applies for the note. The interest rate for 2015 was two percentage points above the Federal Reserve prime rate of interest as of the last working day of the month preceding the month the note was made. All outstanding notes are collateralized by 50% of the participant’s vested account balance, determined when a note is approved. No allowance for credit losses has been recorded as of December 31, 2015 or 2014. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be in default, the default will be a deemed distribution. However, the participant’s account will not be reduced until a distributable event occurs under the terms of the Plan. Notes outstanding at December 31, 2015 bear interest at various rates ranging from 3.50% to 9.25%. Principal and interest payments are made ratably through payroll

7

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

deductions. Participants are allowed up to two notes outstanding at any one time from the Plan.

j.

Vesting

Salary deferral contributions, including catch-up contributions, are fully vested when made. Matching contributions for participants first employed after April 30, 2011 are subject to a six-year graded vesting schedule as noted below, except that such amounts become fully vested when the participant attains age 65 if the participant is still employed by a Participating Employer or another subsidiary of HEI that is not a Participating Employer.

|

|

|

Vested

|

|

|

Years of Vesting Service

|

|

Percentage

|

|

|

|

|

|

|

|

Less than 2 years

|

|

0

|

%

|

|

2 years

|

|

20

|

%

|

|

3 years

|

|

40

|

%

|

|

4 years

|

|

60

|

%

|

|

5 years

|

|

80

|

%

|

|

6 or more years

|

|

100

|

%

|

k.

Forfeitures

Plan forfeitures are used to pay Plan administrative expenses and to reduce Participating Employers’ matching contributions. Forfeitures of terminated nonvested account balances used for the years ended December 31, 2015 and 2014 totaled $44,357 and $46,307, respectively. The ending balances in the forfeiture accounts at December 31, 2015 and 2014 were $44,605 and $32,731, respectively.

l.

Collective Bargaining Agreement

As of December 31, 2015 and 2014, approximately 49% and 50%, respectively, of the electric utilities’ employees were members of the International Brotherhood of Electrical Workers, AFL-CIO, Local 1260, which is the only union representing employees of the electric utilities.

2.

Summary of Significant Accounting Policies

a.

Basis of Accounting

The Plan prepares its financial statements under the accrual method of accounting.

b.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires the Plan Administrator to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

c.

Investment Valuation and Income Recognition

The Plan’s investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The PIC is responsible for the Plan’s valuation principles and utilizes information provided by the Plan’s investment advisers and custodian. See Note 3 for a discussion of fair value measurements. Net appreciation or depreciation in

8

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

the fair value of investments includes realized and unrealized changes in the values of investments bought, sold, and held during the year.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

d.

Notes Receivable From Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is treated as a deemed distribution and is recorded in distributions to participants.

e.

Payment of Benefits

The Plan records benefits when they are paid.

f.

Expenses

Certain expenses of maintaining the Plan, such as legal, audit, consulting and recordkeeping fees, are paid directly by the Participating Employers and are excluded from these financial statements. Fees related to the administration of notes receivable from participants are charged directly to the participant’s account and are included in administrative expenses. Investment related expenses are included in net appreciation in fair value of investments.

g.

Risks and Uncertainties

The Plan may invest in various types of investment securities. Investment securities are exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and such changes could materially affect the amounts reported in the statements of net assets available for benefits.

On December 3, 2014, HEI and NextEra Energy, Inc. entered into an agreement and plan of merger. Failure to complete the merger could negatively impact the HEI common stock price and the future business and financial results of HEI. For more information, see HEI’s Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 23, 2016 and the merger proxy statement filed on March 26, 2015.

Approximately 15% and 18% of the Plan’s net assets at December 31, 2015 and 2014, respectively, consisted of HEI common stock.

h.

Recent Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2015-07: Disclosures for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent). This guidance simplifies disclosure requirements relating to investments for which fair value is measured using the net asset value per share, or its equivalent. The update removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. Investments that calculate net asset value per share (or its equivalent), but for which the practical expedient is not applied, will continue to be included in the fair value hierarchy. The update removes the requirement to make certain disclosures for all

9

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

investments that are eligible to be measured at fair value using the net asset value per share practical expedient. A reporting entity should continue to disclose information on investments for which fair value is measured at net asset value as a practical expedient to help users understand the nature and risks of the investments and whether the investments, if sold, are probable of being sold at amounts different from net asset value. The ASU is effective for financial statements with fiscal years beginning on or after December 15, 2016, and interim periods within those fiscal years. The Plan has yet to adopt ASU 2015-07, and has not evaluated the impact of adopting the ASU on the Plan’s financial statements.

On July 31, 2015, the FASB issued ASU 2015-12 — Plan Accounting: Defined Benefit Pension Plans, Defined Contribution Pension Plans and Health and Welfare Benefit Plans. This ASU is comprised of three parts. Parts I and III of the update are not applicable to the Plan. Part II of the update eliminates the requirement for disclosure of: i) individual investments that represent 5% or more of net assets available for benefits; and ii) Net appreciation or depreciation for investments disaggregated by general type — net appreciation or depreciation will only be required to be presented in the aggregate. Investments will only be grouped by general type (e.g., mutual funds, common stock, government securities, etc.), eliminating the need to disaggregate investments on the basis of nature, characteristics, and risks and provides for self-directed brokerage accounts as an investment type. For investments measured using net asset value per share (or its equivalent) as a practical expedient and if the investment is a direct filing entity, disclosure of the investment’s strategy is no longer required. The provisions of ASU 2015-12 will be effective for fiscal years beginning after December 15, 2015 and early application is permitted. The guidance in Part II must be applied retrospectively when adopted by the Plan. The Plan early adopted ASU 2015-12 Part II, and the ASU did not have a material impact on the Plan’s financial statements.

i.

Subsequent Events

The Plan Administrator has evaluated subsequent events through the date the financial statements were issued.

3.

Fair Value Measurements

a.

Fair Value of Financial Instruments

The following is a description of the valuation methodologies used for assets measured at fair value:

Mutual Funds

Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the SEC. These funds are required to publish their daily NAV and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

10

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

Hawaiian Electric Industries, Inc. Common Stock Fund

Invests primarily in shares of HEI common stock with a fractional amount invested in interest-bearing cash equivalents. The HEI Common Stock Fund is valued at NAV. The underlying HEI common stock held by the HEI Common Stock Fund is valued at the closing price reported on the last business day of the Plan year on the active market on which the common stock is traded. The underlying cash equivalents include investments in money market mutual funds valued at the NAV. The HEI Common Stock Fund trades daily without any prior redemption notice period.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values, which may be materially affected by market conditions and other circumstances. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

b.

Fair Value Hierarchy

Accounting Standards Codification 820,

Fair Value Measurements and Disclosures,

provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The following are the three levels of the fair value hierarchy under this standard:

Level 1

Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Plan has the ability to access at the measurement date.

Level 2

Inputs are quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; inputs other than quoted prices that are observable for the asset or liability; or inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3

Inputs are unobservable inputs for the asset or liability.

The level in the fair value hierarchy within which a fair measurement in its entirety falls is based on the lowest level of input that is significant to the fair value measurement in its entirety.

4.

Interest in Master Trust

All of the assets of the HEIRS Plan are held together with all of the assets of the American Savings Bank 401(k) Plan in a master trust (the “Master Trust”) pursuant to a Master Trust Agreement between HEI and American Savings Bank, F.S.B. (“ASB”) and Fidelity Management Trust Company (the “Trustee”) that was amended and restated in its entirety as of September 4, 2012. Each participating plan has an undivided interest in the Master Trust determined by the specific interest each participant has in their account.

11

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

The value of the Plan’s interest in the Master Trust is based on the beginning of the year value of the Plan’s interest in the Master Trust plus actual contributions, transfers and allocated investment income or loss less actual distributions and allocated administrative expenses. At both December 31, 2015 and 2014, the Plan’s interest in the assets of the Master Trust was approximately 81%. Investment income and administrative expenses relating to the Master Trust are allocated to the individual plans based upon the daily valuation of the balances invested by each plan.

The following table presents the assets of the Master Trust and the Plan’s interest in the Master Trust:

|

|

|

2015

|

|

2014

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

451,825,542

|

|

$

|

435,062,485

|

|

|

HEI Common Stock Fund

|

|

75,212,413

|

|

89,253,599

|

|

|

Total investments

|

|

527,037,955

|

|

524,316,084

|

|

|

Notes receivable from participants

|

|

10,851,986

|

|

10,438,442

|

|

|

Participant contributions receivable

|

|

508,126

|

|

807,120

|

|

|

Employer contributions receivable

|

|

1,811,636

|

|

1,608,707

|

|

|

Due from Fidelity

|

|

12,088

|

|

26,376

|

|

|

Accounts payable

|

|

(12,689

|

)

|

(9,571

|

)

|

|

Total net assets

|

|

$

|

540,209,102

|

|

$

|

537,187,158

|

|

|

Plan interest in Master Trust

|

|

|

|

|

|

|

Investments

|

|

$

|

428,195,142

|

|

$

|

426,933,212

|

|

|

Notes receivable from participants

|

|

7,510,554

|

|

7,245,146

|

|

The following table presents the income of the Master Trust and the Plan’s interest in the income of the Master Trust:

|

|

|

2015

|

|

2014

|

|

|

|

|

|

|

|

|

|

Net (depreciation) appreciation in fair value of investments

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

(12,182,507

|

)

|

$

|

6,525,933

|

|

|

HEI Common Stock Fund

|

|

(11,655,719

|

)

|

19,537,154

|

|

|

Dividends and interest

|

|

22,736,036

|

|

24,212,492

|

|

|

Total investment (loss) income

|

|

$

|

(1,102,190

|

)

|

$

|

50,275,579

|

|

|

Interest from participants’ notes receivable

|

|

$

|

513,288

|

|

$

|

470,795

|

|

|

Plan interest in Master Trust

|

|

|

|

|

|

|

Investment (loss) income

|

|

$

|

(962,805

|

)

|

$

|

41,825,664

|

|

|

Interest from participants’ notes receivable

|

|

360,205

|

|

333,334

|

|

12

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

The following table presents the changes in net assets of the Master Trust:

|

|

|

2015

|

|

2014

|

|

|

|

|

|

|

|

|

|

Net (depreciation) appreciation in fair value of investments

|

|

$

|

(23,838,226

|

)

|

$

|

26,063,087

|

|

|

Dividends and interest

|

|

22,736,036

|

|

24,212,492

|

|

|

Net investment (loss) income

|

|

(1,102,190

|

)

|

50,275,579

|

|

|

Net transfers

|

|

4,124,134

|

|

3,416,738

|

|

|

Increase in net assets

|

|

3,021,944

|

|

53,692,317

|

|

|

Net assets

|

|

|

|

|

|

|

Beginning of year

|

|

537,187,158

|

|

483,494,841

|

|

|

End of year

|

|

$

|

540,209,102

|

|

$

|

537,187,158

|

|

The following tables set forth by level, within the fair value hierarchy, the Master Trust’s investments at fair value as of December 31, 2015 and 2014. There are no Level 3 investments held by the Master Trust. Also included is the Plan’s percentage interest in each investment type.

|

|

|

Quoted Prices

|

|

|

|

|

|

|

|

|

|

|

in Active

|

|

Significant

|

|

|

|

|

|

|

|

|

Markets for

|

|

Other

|

|

|

|

|

|

|

|

|

Identical

|

|

Observable

|

|

|

|

|

|

|

|

|

Assets

|

|

Inputs

|

|

December 31,

|

|

Plan’s

|

|

|

|

|

(Level 1)

|

|

(Level 2)

|

|

2015

|

|

Interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

451,825,542

|

|

|

|

$

|

451,825,542

|

|

80

|

%

|

|

HEI Common Stock Fund

|

|

|

|

75,212,413

|

|

75,212,413

|

|

86

|

%

|

|

|

|

$

|

451,825,542

|

|

$

|

75,212,413

|

|

$

|

527,037,955

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quoted Prices

|

|

|

|

|

|

|

|

|

|

|

in Active

|

|

Significant

|

|

|

|

|

|

|

|

|

Markets for

|

|

Other

|

|

|

|

|

|

|

|

|

Identical

|

|

Observable

|

|

|

|

|

|

|

|

|

Assets

|

|

Inputs

|

|

December 31,

|

|

Plan’s

|

|

|

|

|

(Level 1)

|

|

(Level 2)

|

|

2014

|

|

Interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

435,062,485

|

|

|

|

$

|

435,062,485

|

|

80

|

%

|

|

HEI Common Stock Fund

|

|

|

|

89,253,599

|

|

89,253,599

|

|

86

|

%

|

|

|

|

$

|

435,062,485

|

|

$

|

89,253,599

|

|

$

|

524,316,084

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

The Trustee has the power and authority to borrow funds from a bank not affiliated with the Trustee in order to provide sufficient liquidity to process Plan transactions in the HEI Common Stock Fund in a timely fashion; provided that the cost of such borrowing shall be allocated to the HEI Common Stock Fund. In 2015 and 2014, there were no such transactions for the Plan. There were no outstanding amounts as of year end 2015 and 2014.

5.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time or to terminate the Plan, and each Participating Employer has the right to discontinue its contributions or terminate its participation. In the event of Plan termination, affected participants become 100% vested in their accounts to the extent then funded.

6.

Federal Income Taxes

The Plan and Master Trust are qualified under the Internal Revenue Code (“Code”) and are exempt from federal income taxes under Sections 401(a) and 501(a) of the Code. On January 16, 2015, the Internal Revenue Service (“IRS”) issued the latest favorable determination letter covering the Plan. This latest determination letter does not cover amendments made to the Plan since January 1, 2013. The Company and its outside ERISA/tax counsel believe that the amendments made since January 1, 2013 meet applicable federal tax law requirements.

The Company is not aware of any Code or ERISA violations that would jeopardize the Plan’s tax exempt status and, as of December 31, 2015 and 2014, has concluded that there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is periodically audited by the IRS and the U.S. Department of Labor (“DOL”); however, there are currently no audits in progress. The Company believes that the Plan is no longer subject to income tax examinations for tax years prior to 2012.

7.

Related-Party Transactions

Certain Plan investments represent shares of mutual funds managed by Fidelity Management and Research Company (“FMR”). Fidelity Management Trust Company (“FMTC”), an affiliate of FMR, is the Trustee of the Plan, and therefore, transactions with FMR qualify as party-in-interest transactions for which a prohibited transaction exemption exists.

Effective January 1, 2012, a revenue credit program for the Plan was implemented by FMTC. Certain recordkeeping, legal and consulting fees incurred by the Plan are included in the statements of changes in net assets available for benefits because they are paid through the revenue credit program (“RCP”). These RCP payments amounted to approximately $58,000 and $108,000 for the years ended December 31, 2015 and 2014, respectively. Fees for recordkeeping services provided by Fidelity Investments Institutional Operations Company, Inc., an affiliate of both FMR and FMTC, amounted to approximately $49,000 and $40,000 for the years ended December 31, 2015 and 2014, respectively, and were paid directly by the Participating Employers and/or through the RCP.

Plan participants may also elect to invest in the HEI Common Stock Fund, which consists of shares of HEI common stock and short-term liquid investments. Since HEI is the Plan sponsor, investments in the HEI Common Stock Fund are party-in-interest transactions under the prohibited transaction rules of ERISA for which a statutory exemption exists. During the year ended December 31, 2015, the Master Trust made purchases of 74,832 shares of HEI common stock for

14

Table of Contents

Hawaiian Electric Industries

Retirement Savings Plan

Notes to Financial Statements

December 31, 2015 and 2014

a total purchase price of $1.9 million and sales of 174,978 shares of HEI common stock for total sales proceeds of $4.5 million. During the year ended December 31, 2014, the Master Trust made purchases of 69,124 shares of HEI common stock for a total purchase price of $1.5 million and sales of 313,268 shares of HEI common stock for total sales proceeds of $7.0 million.

15

Table of Contents

Hawaiian Electric Industries Retirement Savings Plan

EIN: 99-0208097, Plan: 003

Schedule H, Line 4i

Schedule of Assets (Held at End of Year)

December 31, 2015

|

|

|

|

|

(c)

|

|

|

|

|

|

|

(b)

|

|

Description of investment including

|

|

(e)

|

|

|

|

|

Identity of issue, borrower,

|

|

maturity date, rate of interest,

|

|

Current

|

|

|

(a)

|

|

lessor, or similar party

|

|

collateral, par, or maturity value

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Plan interest in HEIRS Plan and

ASB 401(k) Plan Master Trust

|

|

Master Trust

|

|

$

|

428,195,142

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

666 loans with interest rates from 3.5%

|

|

|

|

|

*

|

|

Participant Loans

|

|

to 9.25%, maturing 2016 through 2030

|

|

7,510,554

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

435,705,696

|

|

*Party in interest

NOTE:

Participant loans are legally held by the Hawaiian Electric Industries Retirement Savings Plan and American Savings Bank 401(k) Plan Master Trust (“DFE”), however Form 5500 Instructions and the Department of Labor’s electronic filing system require that the participant loans be reported at the individual plan level. As such, the participant loans and attendant interest are reported in the individual plans’ Form 5500 and not in the DFE’s Form 5500.

16

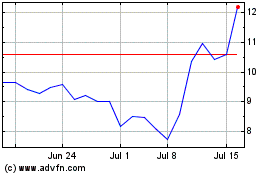

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Apr 2023 to Apr 2024