As filed with the Securities and Exchange Commission on June 9, 2016

Registration No. 333-___

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

NovaBay Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

|

|

68-0454536

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

|

(I.R.S. Employer

Identification No.)

|

5980 Horton Street, Suite 550

Emeryville, CA 94608

(510) 899-8800

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Mark M. Sieczkarek

Chief Executive Officer

5980 Horton Street, Suite 550

Emeryville, CA 94608

(510) 899-8800

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

|

Justin M. Hall, Esq.

General Counsel

NovaBay Pharmaceuticals, Inc.

5980 Horton Street, Suite 550

Emeryville, CA 94608

(510) 899-8800

|

|

|

Abby E. Brown, Esq.

Squire Patton Boggs (US) LLP

2550 M Street, NW

Washington, DC 20037

(202) 457-6000

|

Approximate date of commencement of proposed sale to the public

: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

(Do not check if a smaller reporting company)

|

|

Smaller reporting company ☒

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered

(1)

|

|

|

Proposed

Maximum

Offering

Price per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee

|

|

|

Shares of Common Stock underlying Warrants

|

|

|

138,621

|

(2)

|

|

$

|

2.78

|

(

4

)

|

|

$

|

385,366.38

|

(

4

)

|

|

$

|

39

|

|

|

Shares of Common Stock underlying Warrants

|

|

|

442,802

|

(

3

)

|

|

$

|

2.78

|

(

4

)

|

|

$

|

1,230,989.56

|

(

4

)

|

|

$

|

124

|

|

|

TOTAL

|

|

|

581

,

423

|

|

|

$

|

-

|

|

|

$

|

1,616,355.94

|

|

|

$

|

163

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, or the Securities Act, this Registration Statement shall also cover any additional shares of the Registrant’s common stock that become issuable by reason of any stock split, stock dividends, recapitalization, or other similar transactions.

|

|

|

(2)

|

Represents shares of common stock underlying warrants issued to investors in our previous registered direct offering that closed on July 5, 2011.

|

|

|

(3)

|

Represents shares of common stock underlying warrants issued to investors in our previous public offering that closed on October 27, 2015.

|

|

|

(4)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(g) under the Securities Act. The price per share and aggregate offering price are based on the average of the high and low prices of the Registrant’s common stock on June

8, 2016, as reported on the NYSE MKT.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this

R

egistration

S

tatement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the

R

egistration

S

tatement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Form S-3 relates to the offer and sale by us of up to 581,423 shares of our common stock, consisting of 138,621 shares and 442,802 shares of common stock issuable upon the exercise of (i) the warrants issued by us in our registered direct offering that closed on July 5, 2011, or the July 2011 Offering, as subsequently amended in connection with the October 2015 Offering (as defined below), and (ii) the warrants issued by us in our public offering that closed on October 27, 2015, or the October 2015 Offering, respectively. The 138,621 shares of common stock were originally registered by us in our July 2011 Offering pursuant to a registration statement on Form S-3 (No. 333-159917), which initially became effective on August 5, 2009 and was subsequently amended by two post-effective amendments that became effective on August 11, 2009 and July 9, 2010, respectively. The 442,802 shares of common stock were originally registered by us in our October 2015 Offering pursuant to a registration statement on Form S-3 (No. 333-180460), which became effective on May 1, 2012.

The information contained in this

preliminary

prospectus is not complete and may be changed.

These

securities

may not be sold until the registration statement filed with the

Securities and Exchange Commission

is effective

. This preliminary prospectus

is

not an offer to sell these securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

JUNE

9

, 201

6

PROSPECTUS

581,423

Shares of Common Stock

Issuable

u

pon Exercise of Outstanding Warrants

This prospectus relates to the offer and sale by us of up to 581,423 shares of our common stock, par value $0.01 per share, that are issuable at an exercise price of $1.81 per share, subject to adjustment as described below, from time to time upon the exercise of (i) the currently outstanding warrants that we issued in July 2011 as part of a registered direct offering, or the July 2011 Offering, as subsequently amended in connection with the October 2015 Offering (as defined below), and (ii) the currently outstanding warrants that we issued in October 2015 as part of a public offering, or the October 2015 Offering. While the warrants are outstanding, if we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the warrants, the exercise price of the warrants will be reduced to equal such lower price, subject to certain exemptions as provided in the warrants. The current exercise price of the warrants at $1.81 per share reflects a reduction from an exercise price at $5.00 per share as of the closing of our October 2015 Offering as a result of our private placement of common stock in February 2016.

We will receive the proceeds from any cash exercises of the warrants. The warrants issued in the July 2011 Offering, or the July 2011 Warrants, are exercisable for an aggregate 138,621 shares of our common stock at any time until March 6, 2020. The warrants issued in the October 2015 Offering, or the October 2015 Warrants, are exercisable for an aggregate 442,802 shares of our common stock at any time until October 27, 2020. If all of the warrants are exercised for cash at the current exercise price, we will receive aggregate proceeds of approximately $1.1 million. However, if the exercise price of the warrants is adjusted as described above, the aggregate proceeds we would receive upon exercise of all of the warrants could be substantially less. No securities are being offered pursuant to this prospectus other than the shares of our common stock that will be issued upon exercise of those currently outstanding warrants.

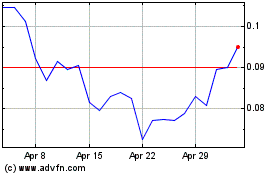

Our common stock is listed on the NYSE MKT under the symbol "NBY." On June 8, 2016, the last reported sale price of our common stock was $2.73 per share.

Investing in our securities involves significant risks. Before

exercising the

warrants, please review the information, including information incorporated by reference, under the heading "Risk Factors" beginning on page

5

of this prospectus

.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

i

|

|

PROSPECTUS SUMMARY

|

1

|

|

RISK FACTORS

|

5

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

6

|

|

USE OF PROCEEDS

|

6

|

|

DILUTION

|

7

|

|

DIVIDEND POLICY

|

8

|

|

DESCRIPTION OF CAPITAL STOCK

|

8

|

|

DESCRIPTION OF WARRANTS

|

10

|

|

PLAN OF DISTRIBUTION

|

13

|

|

LEGAL MATTERS

|

13

|

|

EXPERTS

|

13

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

13

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

14

|

___________________________________________

About This Prospectus

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC. As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s web site or its offices described under the heading “Where You Can Find More Information” in this prospectus.

This prospectus and the documents incorporated by reference in this prospectus include important information about us, the securities being offered and other information you should know before exercising the warrants. You should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We have not authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained or incorporated by reference in this prospectus is accurate as of any date other than as of the date of this prospectus, or in the case of the documents incorporated by reference, the date of such documents, regardless of the time of delivery of this prospectus or any issuance of our shares of common stock. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus contains statistical data and estimates, including those relating to market size, competitive position and growth rates of the markets in which we participate, that we obtained from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions have been verified by any independent source.

Unless the context requires otherwise, (i) all references in this prospectus to "we," "our," "us," the "Company," "NovaBay" and "NovaBay Pharmaceuticals" refer to NovaBay Pharmaceuticals, Inc. and its subsidiaries, and with respect to NovaBay Pharmaceuticals, Inc. refer to the California corporation prior to the date of the Reincorporation (as defined herein), and to the Delaware corporation on and after the date of the Reincorporation, and (ii) all references in this prospectus to “warrants” refer to the July 2011 Warrants and the October 2015 Warrants.

This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

On December 18, 2015, we effected a 1-for-25 reverse stock split of our outstanding common stock. Unless the context indicates or otherwise requires, all share numbers and share price data included in this prospectus have been adjusted to give effect to such reverse stock split.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, including the financial data and related notes, risk factors and other information incorporated by reference in this prospectus, before making an investment decision.

Overview

We are a biopharmaceutical company developing products for the eye care market. We are currently focused primarily on commercializing prescription Avenova® for managing hygiene of the eyelids and lashes in the United States.

Avenova is the only eye care product formulated with a proprietary, stable and pure form of hypochlorous acid called Neutrox™. By replicating the anti-microbial chemicals used by white blood cells to fight infection, Neutrox has proven in laboratory testing to have broad antimicrobial properties. Avenova with Neutrox removes debris from the skin on eyelids and lashes without burning or stinging.

In November 2015, we introduced a new business strategy to focus on growing sales of Avenova in the U.S. market and to restructure our business with the goal of achieving profitability from operations by the end of 2016. Our three-part business strategy is comprised of: (1) focusing our resources on growing the commercial sales of Avenova in the U.S. eye care market, including the implementation of an innovative sales and marketing strategy to increase product margin and profitability; (2) significantly reducing expenses through the restructuring of our operations and other cost reduction measures; and (3) seeking additional sources of revenue through partnering, divesting and/or other means of monetizing non-core assets in urology, dermatology, and wound care.

We have developed additional commercial products containing Neutrox, including our NeutroPhase® Skin and Wound Cleanser for wound care and CelleRx® for the dermatology market. We have partnerships for NeutroPhase in the U.S. as well as select overseas markets, most notably China.

In addition to our Neutrox family of products, we have also synthesized and developed a second category of novel compounds aimed at harnessing the power of white blood cell chemistry to address the global, topical anti-infective market. This second product category includes auriclosene, our lead clinical-stage Aganocide® compound, which is a patented, synthetic molecule with a broad spectrum of activity against bacteria, viruses and fungi.

Avenova

Prescription Avenova (0.01% Neutrox) is well-suited for daily eyelid and eyelash hygiene by the approximately 30 million Americans who suffer from blepharitis and dry eye. Additionally, we estimate that an additional 11 million patients suffering from other conditions could potentially benefit from the use of Avenova, bringing the total potential market to approximately 41 million patients.

We are targeting a customer base of prescribers that includes the approximately 17,000 ophthalmologists and approximately 37,000 optometrists in the U.S. In August 2014, we launched a dedicated Avenova sales force of 10 direct medical sales representatives in 10 major metropolitan areas across the United States. This sales and marketing campaign initially targeted major urban areas where large numbers of individuals suffer from problems with their eyelids and lashes. These markets included New York, Los Angeles, Boston, Atlanta, and San Francisco.

Based on positive sales performance, we expanded our sales force to 35 direct medical sales representatives in February 2015 and to 43 direct medical sales representatives in August 2015. The sales representatives recruited for this effort have extensive experience with eye care products and medical devices—a skill set critical for rapid adoption of Avenova. Based on extensive market research, we have assigned our sales representatives to the markets across the U.S. representing the highest sales potential. These direct medical sales representatives are calling on targeted ophthalmologists and optometrists in those markets that treat large numbers of blepharitis and dry eye patients. Avenova is a natural addition to their existing lid hygiene regimens.

We have distribution agreements with McKesson Corporation, Cardinal Health and AmerisourceBergen Corporation that make Avenova accessible in 90% of the approximate 67,000 retail pharmacies across the U.S. Avenova also is marketed through the top ophthalmology and optometry networks. These include Vision Source Independent Optometry Network, the largest independent optometry network in the country representing 2,800 independent optometrist offices, and ALLDocs Optometry Group (also known as The Association of LensCrafters Leaseholding Doctors), the second largest independent optometry group in the U.S., which works closely with its LensCrafters partners. Through a partnership with ALPHAEON, Avenova is available to member ophthalmologists on the ShoutMD® Store, the first social commerce store for lifestyle healthcare products. Avenova is also available for order online with a prescription, and we provide an online pharmacy locator to assist patients with filling prescriptions.

We expect that our prescription business will be the main driver of long-term Avenova sales growth. Reimbursement under insurance coverage continues to grow with 68% of Avenova prescriptions covered by insurance plans at the end of 2015. Supported by the high percentage rate of insurance reimbursement, we are focusing our primary sales efforts on building our prescription business under a new value pricing model. We are working to improve insurance reimbursement coverage for Avenova and aligning our product pricing accordingly.

Although we are focusing on our prescription sales, we expect continued growth in the doctor to patient direct sales channel. We also expect to invest in systems that support prescribing physicians’ efforts to educate their patients. We have made it easy for doctors to get Avenova into the hands of patients by providing availability through well-known national pharmacy chains, specialty pharmacies, or directly through the practitioners’ office. Furthermore, in order to ensure consistent pricing, we have instituted rebate cards to ensure the best price for the patient at the pharmacy. This sales model combined with the prospect for further increases in reimbursement under insurance plans has the potential to provide us with additional revenue upside.

Partnerships to Monetize Other Assets

We intend to seek additional sources of revenue and reduce expenses by licensing or selling select non-core assets, possibly including intelli-Case, NeutroPhase, CelleRx and our Aganocide compounds, including auriclosene.

Currently, the program with the most potential is our urology program. Statistically-significant and clinically-meaningful results from a Phase 2 clinical study of our Auriclosene Irrigation Solution, or AIS, used to reduce urinary catheter blockage and encrustation, or UCBE, were announced in September 2013. This study, comparing AIS to saline solution, achieved its primary endpoints and showed clear benefits for patients with long-term indwelling catheters. We initiated the next Phase 2 study in the fourth quarter of 2014 and in the fourth quarter of 2015 announced completion of that study. Patients with long-term indwelling urinary catheters were treated with AIS or its Vehicle. The results of this more demanding study showed that AIS was better than its Vehicle in preventing the reduction of flow through catheters due to encrustation, the primary efficacy measure, by a statistically-significant margin. Furthermore, there were no cases of clinical catheter blockage in the AIS arm of the study; all cases of clinical blockage requiring catheter removal occurred only in the Vehicle arm.

NovaClear intelli-Case.

In June 2015, we received FDA-clearance for the NovaClear intelli-Case, a highly innovative, easy-to-use device for use with hydrogen peroxide disinfection solutions for soft and rigid gas permeable contact lenses. The intelli-Case monitors the neutralization of hydrogen peroxide during the disinfection cycle with sophisticated microprocessor electronics embedded in the cap of what otherwise looks like a standard peroxide lens case. The LED indicators on the lid inform the user if the lenses are safe to insert into the eyes, resulting in a disinfection system that is safe yet simple to use. We are seeking potential partners with the resources to make this break-through device available to the largest number of contact lens wearers as soon as possible.

Additional Neutrox-based Products

In addition to Avenova, the Neutrox-branded products currently being commercialized as prescription medical devices are NeutroPhase and CelleRx.

NeutroPhase (Wound Care).

Since its launch in the U.S. in 2013, NeutroPhase has impacted how wound care is administered. Consisting of 0.03% Neutrox, NeutroPhase is used to cleanse and remove microorganisms from any type of acute or chronic wound and can be used with any type of wound care modality. Recently, NeutroPhase has been found to be an effective irrigation solution as part of the adjunct treatment for Necrotizing Fasciitis, or NF. Also known as flesh-eating disease, NF typically has high mortality and amputation rates (30% and 70%, respectively), even with aggressive debridement and antibiotic treatment. We believe that NeutroPhase is also well-suited to treat the six million patients in the U.S. who suffer from chronic non-healing wounds, such as pressure, venous stasis and diabetic ulcers.

In the U.S. and internationally, NeutroPhase is distributed through commercial partners. In January 2012, we entered into an exclusive distribution agreement with Pioneer Pharma Company Limited, or Pioneer, a Shanghai-based company, for the distribution of NeutroPhase throughout Southeast Asia and mainland China. We subsequently expanded the agreement with Pioneer so that it includes the licensing rights to CelleRx and Avenova. In September 2014, China’s Food and Drug Administration cleared our NeutroPhase Skin and Wound Cleanser for sale throughout mainland China. In November 2014, Taiwan’s Food and Drug Administration cleared our NeutroPhase Skin and Wound Cleanser for sale in Taiwan. We began shipping NeutroPhase to China and Taiwan in the fourth quarter of 2014 to support our launch of NeutroPhase Skin and Wound Cleanser by Pioneer. In the U.S., NeutroPhase is distributed through our partner, Principle Business Enterprise, or PBE.

CelleRx (Dermatology).

Created for cosmetic procedures, CelleRx (0.015% Neutrox) is a gentle cleansing solution that is effective for post-laser resurfacing, chemical peels and other cosmetic surgery procedures. Cosmetic surgeons and aesthetic dermatologists have found that CelleRx results in less pain, erythema, and exudate compared to Dakin solution, which contains bleach impurities. CelleRx is a non-alcohol formulation that does not dry or stain the skin, and most importantly, has been shown to reduce the patient’s downtime post procedure.

Recent Development

On April 4, 2016, we entered into a securities purchase agreement for the sale of an aggregate of 6,173,299 shares of our common stock and warrants exercisable for 3,086,651 shares to accredited investors for an aggregate purchase price of $11,791,000 in a private placement. For each share purchased at $1.91 per share, the purchasers will receive a warrant to purchase one-half a share, with such warrants having a four-year term and an exercise price of $1.91, callable by us if the closing price of our common stock, as reported on the NYSE MKT, is $4.00 or greater for five sequential trading days.

The private placement was designed to close in two tranches. The first tranche of 4,079,058 shares of common stock and warrants to purchase 2,039,530 shares of common stock, at an aggregate subscription price of $7,791,000, closed on May 9, 2016, which we refer to as the May 2016 Primary Closing. The closing of the second tranche is expected to occur on July 31, 2016.

On April 4, 2016, we also entered into a separate registration rights agreement with certain purchasers in the private placement, pursuant to which we agreed to file registration statements with the SEC to cover the resale of the shares, including the shares underlying the warrants, held by such purchasers.

For more information about this private placement, please refer to our Current Reports on Form 8-K filed with the SEC on April 5, 2016 and May 9, 2016, which are incorporated herein by reference.

Company Information

We were incorporated under the laws of the State of California on January 19, 2000 as NovaCal Pharmaceuticals, Inc., and subsequently changed our name to NovaBay Pharmaceuticals, Inc. In June 2010, we changed the state in which we are incorporated, which we refer to as the Reincorporation, and are now incorporated under the laws of the State of Delaware.

Our corporate address is 5980 Horton Street, Suite 550, Emeryville, CA 94608, and our telephone number is (510) 899-8800. Our website address is

www.novabay.com

. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus. Our website address is included in this document as an inactive textual reference only.

The Offering

|

Common stock offered by us pursuant to this prospectus

|

|

581,423 shares of common stock, consisting of (i) 138,621 shares of common stock issuable upon the exercise of the July 2011 Warrants, which are exercisable until March 6, 2020, and (ii) 442,802 shares of common stock issuable upon the exercise of the October 2015 Warrants, which are exercisable until October 27, 2020, both at an exercise price of $1.81 per share, subject to adjustment as described below.

While the warrants are outstanding, if we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the warrants, the exercise price of the warrants will be reduced to equal such lower price, subject to certain exemptions as provided in the warrants. The current exercise price of the warrants at $1.81 per share reflects a reduction from an exercise price at $5.00 per share as of the closing of our October 2015 Offering as a result of our private placement of common stock in February 2016.

|

|

|

|

|

|

|

|

Common stock to be outstanding after this offering if all of the warrants are exercised for cash

|

|

Up to 9,736,147 shares.

|

|

|

|

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds of this offering for working capital and general corporate purposes. See “Use of Proceeds” for further information.

|

|

|

|

|

|

|

|

Risk Factors

|

|

See “Risk Factors” beginning on page 5 of this prospectus and the other information included in, or incorporated by reference into, this prospectus for a discussion of certain factors you should carefully consider before deciding to exercise the warrants for shares of our common stock.

|

|

|

|

|

|

|

|

NYSE MKT symbol

|

|

“NBY”

|

|

The number of shares of our common stock that will be issued and outstanding after this offering, if all of the warrants are exercised for cash, as shown above, is based on 9,154,724 shares of common stock issued and outstanding as of May 31, 2016, and excludes the following:

|

|

•

|

shares of common stock issuable upon the exercise of stock options outstanding, of which there were 425,659 outstanding as of May 31, 2016 with a weighted average exercise price of $24.56 per share;

|

|

|

|

|

|

|

•

|

shares of common stock issuable upon the settlement of outstanding restricted stock units, of which there were 9,750 outstanding as of May 31, 2016;

|

|

|

|

|

|

|

•

|

2,913,958 shares of common stock issuable upon the exercise of our outstanding warrants (excluding the outstanding warrants relating to the shares offered in this prospectus), of which there were warrants outstanding as of May 31, 2016 to purchase 656,553 shares of common stock at an exercise price of $1.81 per share, 217,875 shares of common stock at an exercise price of $19.50 per share, and 2,039,530 shares of common stock at an exercise price of $1.91 per share; and

|

|

|

|

|

|

|

•

|

1,232,274 shares of common stock not subject to stock awards and reserved for issuance under our equity incentive plans.

|

RISK FACTORS

An investment in our common stock involves a high degree of risk. Prior to making a decision about investing in our common stock, you should consider carefully the specific risk factors discussed below and in the sections entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, as filed with the SEC, which are incorporated in this prospectus by reference in their entirety, as well as any amendment or updates to our risk factors reflected in subsequent filings with the SEC. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common stock could decline and you might lose all or part of your investment.

Risks Relating to this Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us. Our failure to apply these funds effectively could have a material adverse effect on our business or the commercialization of our product candidates and cause the price of our common stock to decline.

You will experience immediate and substantial dilution in the net tangible book value per share of the common stock you receive upon exercise of the warrants.

Since the exercise price per share of the warrants is substantially higher than the net tangible book value per share of our common stock, you will incur substantial dilution in the net tangible book value of the common stock you receive upon exercise of the warrants. Based on the sale of 581,423 shares of common stock to investors exercising warrants for cash at $1.81 per share, a net tangible book value per share of our common stock of $0.10 as of March 31, 2016, after giving effect to the issuance and sale of 4,079,058 shares of common stock and the accompanying warrants upon our May 2016 Primary Closing pursuant to a private placement, and after deducting the estimated offering expenses payable by us, if you exercise warrants to purchase common stock in this offering, you will incur immediate and substantial dilution of $1.71 per share in net tangible book value of our common stock. See the section entitled “Dilution” in this prospectus for a more detailed discussion of the dilution you will incur if you exercise the warrants for shares of our common stock.

We may require additional capital funding, and as a result you may experience future dilution as a result of future equity offerings.

We may require additional capital in the future to continue our planned operations and comply with NYSE MKT listing requirements. To raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock. We cannot assure you that additional capital will be available when needed or that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the current exercise price of the warrants, and investors purchasing shares or other securities in the future could have rights, preferences and privileges superior to existing stockholders. If in the future we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the warrants, the exercise price of the warrants will be reduced to equal such lower price, subject to certain exemptions as provided in the warrants. Our warrants issued in March 2015, which are exercisable for an aggregate of 656,553 shares of our common stock, also include the above price protection provision. Thus, you may incur dilutions upon a future offering at a price per share or exercise price per share lower than the exercise price you actually paid when exercising the warrants.

Additionally, you may incur dilution as a result of grants of equity awards under our equity incentive plans, or upon exercise of options or other warrants currently outstanding with exercise prices at or below the exercise price of the warrants. See the section entitled "Dilution" in this prospectus for a more detailed discussion of the dilution you will incur if you participate in this offering.

A substantial number of shares of our common stock may be issued upon exercise of the warrants, which could cause the price of our common stock to decline.

Upon exercise of the warrants, we will issue up to 581,423 shares, or approximately 6.3% of our outstanding common stock as of May 31, 2016. This sale and any future sales of a substantial number of shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

Special NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements in this prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are subject to a number of risks and uncertainties. All statements that are not historical facts are forward-looking statements, including statements about our product candidates, market opportunities, competition, strategies, anticipated trends and challenges in our business and the markets in which we operate, and anticipated expenses and capital requirements. These statements appear in a number of places and can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “future,” “intend,” or “potential” or the negative of these terms or other variations or comparable terminology, or by discussions of strategy.

Our actual results may differ materially from the results expressed or implied by these forward-looking statements because of the risk factors and other factors disclosed in this prospectus and documents incorporated by reference. The risk factors may not be all of the factors that could cause actual results to vary materially from the forward-looking statements. The forward-looking statements made or incorporated in this prospectus relate only to circumstances as of the date on which the statements are made. Readers should not place undue reliance on these forward-looking statements and are cautioned that any such forward-looking statements are not guarantees of future performance.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

USE OF PROCEEDS

If all of the warrants are exercised for cash at the exercise price of $1.81, we estimate that the net proceeds of this offering will be approximately $1.1 million. While the warrants are outstanding, if we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the warrants, the exercise price of the warrants will be reduced to equal such lower price, subject to certain exemptions as provided in the warrants. If the exercise price of the warrants is adjusted as described above, the aggregate proceeds we would receive upon exercise of all of the warrants could be substantially less. We cannot predict when, whether or at what price the warrants will be exercised, and it is possible that the warrants may expire and never be exercised.

We currently intend to use any net proceeds received from the exercise of warrants for working capital and general corporate purposes, including selling, general and administrative expenses. As a result, our management will retain broad discretion in the allocation and use of the net proceeds of this offering, and investors will be relying on the judgment of our management with regard to the use of these net proceeds. Pending application of the net proceeds for the purposes described above, we expect to invest the net proceeds in short-term, interest-bearing securities, investment grade securities, certificates of deposit or direct or guaranteed obligations of the U.S. government.

DILUTION

Our net tangible book value as of March 31, 2016, was approximately ($7,299,000) or ($1.46) per share of common stock. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of our shares of outstanding common stock. As of March 31, 2016, after giving effect to the issuance and sale upon our May 2016 Primary Closing of 4,079,058 shares of common stock and the accompanying warrants that resulted in net proceeds of approximately $7,275,000, our as adjusted net tangible book value would have been approximately ($24,000), or ($0.003) per share of common stock.

If you exercise the warrants to receive our common stock, your interest will be diluted to the extent of the difference between the exercise price and the net tangible book value per share of our common stock immediately after this offering.

After further giving effect to the sale of 581,423 shares of common stock to investors exercising warrants for cash at $1.81 per share, and after deducting the estimated offering expenses payable by us, our as further adjusted net tangible book value as of March 31, 2016 would have been approximately $1,011,213 or $0.10

per share of common stock. This represents an immediate increase in net tangible book value of $0.10

per share to our existing stockholders and an immediate dilution in net tangible book value of $1.71

per share to investors exercising the warrants at a price of $1.81 per share. The following table illustrates this dilution per share to investors participating in this offering:

|

Exercise price per share

|

|

|

|

|

|

$

|

1.81

|

|

|

Net tangible book value per share as of March 31, 2016

|

|

$

|

(1.46

|

)

|

|

|

|

|

|

As adjusted net tangible book value per share as of March 31, 2016, after giving effect to the issuance and sale of common stock and warrants upon our May 2016 Primary Closing

|

|

$

|

(0.003

|

)

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors participating in this offering

|

|

$

|

0.10

|

|

|

|

|

|

|

As further adjusted net tangible book value per share after giving effect to the issuance and sale of common stock and warrants upon our May 2016 Primary Closing and this offering

|

|

|

|

|

|

$

|

0.10

|

|

|

Dilution per share to new investors participating in this offering by exercising the warrants

|

|

|

|

|

|

$

|

1.71

|

|

The above table does not take into account further dilution to new investors that could occur upon the exercise of outstanding options and warrants having a per share exercise price less than $1.81, upon the vesting of outstanding restricted stock units, or upon the reduction of the exercise price of the warrants pursuant to the terms of the warrants, which would occur if we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the warrants, subject to certain exemptions as provided in the warrants.

The above discussion and table are based on 5,003,257 shares of common stock issued and outstanding as of March 31, 2016, after giving effect to the issuance of 4,079,058 shares of common stock upon our May 2016 Primary Closing, and excludes:

|

|

•

|

the shares of common stock issuable upon the exercise of outstanding stock options or warrants or upon the settlement of outstanding restricted stock units as of March 31, 2016; and

|

|

|

•

|

the shares of common stock not subject to stock awards and reserved for issuance under our equity incentive plans as of March 31, 2016.

|

We expect that additional capital may be needed in the future to continue our planned operations. In addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

DIVIDEND POLICY

We have not paid any dividends on our common stock to date and do not anticipate that we will pay dividends in the foreseeable future. Any payment of cash dividends on our common stock in the future will be dependent upon the amount of funds legally available, our earnings, if any, our financial condition, our anticipated capital requirements and other factors that the Board of Directors may think are relevant. However, we currently intend for the foreseeable future to follow a policy of retaining all of our earnings, if any, to finance the development and expansion of our business and, therefore, do not expect to pay any dividends on our common stock in the foreseeable future.

DESCRIPTION OF CAPITAL STOCK

General

Our authorized capital stock consists of 240,000,000 shares of common stock, $0.01 par value per share, and 5,000,000 shares of preferred stock, $0.01 par value per share. A description of material terms and provisions of our amended and restated certificate of incorporation and bylaws affecting the rights of holders of our capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to our amended and restated certificate of incorporation and bylaws. As of March 31, 2016, there were 5,003,257 shares of common stock outstanding, and no shares of preferred stock outstanding.

On December 18, 2015, we effected a 1-for-25 reverse stock split and 25 shares of our outstanding common stock decreased to one share of common stock. Similarly, the number of shares of common stock issuable upon the exercise of outstanding stock options or warrants, or upon the vesting of outstanding restricted stock units, decreased on a 1-for-25 basis, and the exercise price of each outstanding option and warrant increased proportionately.

Common Stock

Dividend rights

. Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our common stock are entitled to receive dividends out of funds legally available if our Board of Directors, in its discretion, determines to issue dividends and then only at the times and in the amounts that our Board of Directors may determine.

Voting rights

. Each holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Our amended and restated certificate of incorporation does not provide for the right of stockholders to cumulate votes for the election of directors. Our amended and restated certificate of incorporation establishes a classified Board of Directors, divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

No preemptive or similar rights

. Our common stock is not entitled to preemptive rights and is not subject to conversion, redemption or sinking fund provisions. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that we may designate and issue in the future.

Right to receive liquidation distributions

. Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to holders of our common stock are distributable ratably among the holders of our common stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights and payment of liquidation preferences, if any, on any outstanding shares of our preferred stock.

The rights of the holders of our common stock are subject to, and may be adversely affected by, the rights of holders of shares of any preferred stock that we may designate and issue in the future.

Preferred Stock

Our Board of Directors is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions. Our Board of Directors can also increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our Board of Directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our common stock. The issuance of preferred stock, while providing flexibility in connection with financings, possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring, discouraging or preventing a change in control of our company, may adversely affect the market price of our common stock and the voting and other rights of the holders of common stock, and may reduce the likelihood that common stockholders will receive dividend payments and payments upon liquidation.

Anti-Takeover Effects of Provisions of Our Amended and Restated Certificate of Incorporation and Bylaws and Delaware law

Amended and restated certificate of incorporation and bylaws.

Our amended and restated certificate of incorporation provides that our Board of Directors is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Because holders of our common stock do not have cumulative voting rights in the election of directors, stockholders holding a majority of the shares of common stock outstanding are able to elect all of our directors. Our Board of Directors is able to elect a director to fill a vacancy created by the expansion of the Board of Directors or due to the resignation or departure of an existing board member. Our amended and restated certificate of incorporation and bylaws also provide that all stockholder actions must be effected at a duly-called meeting of stockholders and not by written consent, and that only the Board of Directors pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders. In addition, our bylaws include a requirement for the advance notice of nominations for election to the Board of Directors or for proposing matters that can be acted upon at a stockholders’ meeting. Our amended and restated certificate of incorporation provides for the ability of the Board of Directors to issue, without stockholder approval, up to 5,000,000 shares of preferred stock with terms set by the Board of Directors, which rights could be senior to those of our common stock. Our amended and restated certificate of incorporation and bylaws also provide that approval of at least 66-2/3% of the shares entitled to vote at an election of directors will be required to adopt, amend or repeal our bylaws, or repeal the provisions of our amended and restated certificate of incorporation regarding the election of directors and the inability of stockholders to take action by written consent in lieu of a meeting.

The foregoing provisions make it difficult for holders of our common stock to replace our Board of Directors. In addition, the authorization of undesignated preferred stock makes it possible for our Board of Directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of our company.

Section 203 of the Delaware General Corporation Law

We are

subject to the provisions of Section 203 of the Delaware General Corporation Law regulating corporate takeovers. This section prevents some Delaware corporations from engaging, under some circumstances, in a business combination, which includes a merger or sale of at least 10% of the corporation’s assets with any interested stockholder, meaning a stockholder who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of the corporation’s outstanding voting stock, unless:

|

|

●

|

the transaction is approved by the Board of Directors prior to the time that the interested stockholder became an interested stockholder;

|

|

|

●

|

upon consummation of the transaction which resulted in the stockholder’s becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

|

|

●

|

at or subsequent to such time that the stockholder became an interested stockholder, the business combination is approved by the Board of Directors and authorized at an annual or special meeting of stockholders by at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We do not plan to “opt out” of these provisions. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire us.

Transfer Agent and Registrar

Computershare Shareholder Services, Inc., located in Providence, Rhode Island, Providence County, is the transfer agent and registrar for our common stock in the United States, and Computershare Investor Services, Inc., located in Toronto, Ontario, Canada, is the co-transfer agent and registrar for our common stock in Canada.

Listing on the NYSE MKT

Our common stock is listed on the NYSE MKT under the symbol “NBY.”

DESCRIPTION OF WARRANTS

July 2011 Warrants

As of May 31, 2016, we had outstanding July 2011 Warrants exercisable for a total of 138,621 shares of common stock. The following is a brief summary of certain terms and conditions of the July 2011 Warrants and is subject in all respects to the provisions contained in such July 2011 Warrants.

Form.

The July 2011 Warrants were issued as individual warrant agreements to the investors.

Exercisability.

The July 2011 Warrants are exercisable at any time beginning 180 days from the date of issuance until March 6, 2020, at which time any unexercised warrants will expire and cease to be exercisable. As originally issued, the July 2011 Warrants were to expire on July 5, 2016, the date that is five years from the date of issuance, but its expiration date has been extended in connection with the October 2015 Offering. The July 2011 Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice and by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. In addition, the July 2011 Warrant holders are entitled to a "cashless exercise" option under certain conditions as described below under “—

Cashless Exercise.

” No fractional shares of common stock will be issued in connection with the exercise of a July 2011 Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price.

Exercise Limitation.

A holder will not have the right to exercise any portion of a July 2011 Warrant if the holder (together with its affiliates) would beneficially own in excess of 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the July 2011 Warrants, provided that such beneficial ownership limitation may be increased or decreased to any other percentage not in excess of 9.99% by the holder upon notice to us, provided further that any increase in such beneficial ownership limitation shall not be effective until 61 days following such notice to us.

Exercise Price.

Each July 2011 Warrant will be exercisable for the purchase of 0.03 of a share of common stock at an exercise price of $1.81 per whole share, payable in U.S. dollars, subject to adjustment as described below under “—

Subsequent

Equity Sales

.” The exercise price and the number of shares issuable upon exercise of the July 2011 Warrants is also subject to appropriate adjustment in the event of certain stock dividends, stock splits, stock combinations, recapitalization or similar events affecting our common stock.

Cashless Exercise

. The July 2011 Warrant holders are entitled to a "cashless exercise" option if at the time of exercise there is no registration statement effective or available for the issuance of the shares underlying the July 2011 Warrants. This option entitles the July 2011 Warrant holders to elect to receive fewer shares without paying the cash exercise price. The number of shares to be issued would be determined by a formula based on the total number of shares with respect to which the July 2011 Warrant is being exercised, the daily volume weighted average price for our shares on the trading day immediately prior to the date of exercise and the applicable exercise price of the July 2011 Warrants.

Call Provision.

In the event that the closing bid price of our stock equals or exceeds 200% of the then-current exercise price for 10 of 15 consecutive trading days during the period when the July 2011 Warrants are exercisable, we have the right to require that each of the holders exercise up to one-third of the July 2011 Warrants held by them, subject to certain conditions, and if they do not do so, or only a partial exercise is made, then the rights of the holders to exercise the portions of the July 2011 Warrants that we required to be exercised will terminate.

Transferability.

Subject to applicable laws, the July 2011 Warrants may be offered for sale, sold, transferred or assigned without our consent. There is currently no trading market for the July 2011 Warrants, and a trading market is not expected to develop.

Exchange Listing.

There is no public trading market for the July 2011 Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the July 2011 Warrants on any securities exchange or other trading system.

Subsequent Equity Sales

. While the warrants are outstanding, if we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the warrants, then the exercise price of the warrants will be reduced to equal such lower price, subject to certain exemptions as described in the warrants. This provision was not included in the July 2011 Warrants as initially issued. In connection with the October 2015 Offering, the July 2011 Warrants were amended to add this provision and reduce the exercise price per share from $33.25 per share to $5.00 per share. The current exercise price of the warrants at $1.81 per share reflects a reduction from $5.00 per share as of the closing of the October 2015 Offering as a result of our private placement of common stock in February 2016.

Fundamental Transactions.

In the event of a fundamental transaction, as described in the July 2011 Warrants and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, or our consolidation or merger with or into another person, the holders of the July 2011Warrants will be entitled to receive upon exercise of such July 2011 Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the July 2011 Warrants immediately prior to such fundamental transaction. In addition, in the event of a fundamental transaction that is (1) an all-cash transaction, (2) a “Rule 13e-3 transaction” as defined in Rule 13e-3 of the Exchange Act, or (3) a fundamental transaction involving a person or entity not traded on an Eligible Market (as defined in the July 2011 Warrants), the holders of the July 2011 Warrants will have the right to require us or our successor to repurchase the July 2011 Warrants at their value based on the Black-Scholes Option Pricing Model as described in the July 2011 Warrants.

Rights as a Stockholder.

Except as otherwise provided in the July 2011 Warrants or by virtue of such holder's ownership of shares of our common stock, the holder of a July 2011 Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the July 2011 Warrant; provided, holders will be entitled to participate in any rights offering which we may undertake in the future, on an as-if-exercised basis.

Amendment

. No amendment to the July 2011 Warrants will be effective to the extent that such amendment applies to less than all holders of the July 2011 Warrants.

October 2015 Warrants

As of May 31, 2016, we had outstanding October 2015 Warrants exercisable for a total of 442,802 shares of common stock. The following is a brief summary of certain terms and conditions of the October 2015 Warrants and is subject in all respects to the provisions contained in such October 2015 Warrants.

Form.

The October 2015 Warrants were issued as individual warrant agreements to the investors.

Exercisability.

The October 2015 Warrants are exercisable at any time after the date of issuance until October 27, 2020, the date that is five years from the date of issuance, at which time any unexercised October 2015 Warrants will expire and cease to be exercisable. The October 2015 Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice and by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. In addition, the October 2015 Warrant holders are entitled to a "cashless exercise" option under certain conditions as described below under “—

Cashless Exercise.

” No fractional shares of common stock will be issued in connection with the exercise of an October 2015 Warrant. In lieu of fractional shares, we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

Exercise Limitation.

A holder will not have the right to exercise any portion of the October 2015 Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the October 2015 Warrants, provided that such beneficial ownership limitation may be increased to any other percentage not in excess of 9.99% by the holder upon notice to us, provided further that any increase in such beneficial ownership limitation shall not be effective until 61 days following such notice to us.

Exercise Price.

Each October 2015 Warrant will be exercisable for the purchase of 0.036 of a share of common stock at an exercise price of $1.81 per whole share, payable in U.S. dollars, subject to adjustment as described below under “—

Subsequent

Equity Sales

.” The exercise price and the number of shares issuable upon exercise of the October 2015 Warrants is also subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock.

Cashless Exercise

. The October 2015 Warrant holders are entitled to a "cashless exercise" option if at the time of exercise there is no effective registration statement registering, or no current prospectus available for, the issuance or resale of the shares underlying the October 2015 Warrants. This option entitles the October 2015 Warrant holders to elect to receive fewer shares without paying the cash exercise price. The number of shares to be issued would be determined by a formula based on the total number of shares with respect to which the October 2015 Warrant is being exercised, the daily volume weighted average price for our shares on the trading day immediately prior to the date of exercise and the applicable exercise price of the October 2015 Warrants.

Transferability.

Subject to applicable laws, the October 2015 Warrants may be offered for sale, sold, transferred or assigned without our consent. There is currently no trading market for the October 2015 Warrants, and a trading market is not expected to develop.

Exchange Listing.

There is no public trading market for the October 2015 Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the October 2015 Warrants on any securities exchange or other trading system.

Subsequent Equity Sales

. While the October 2015 Warrants are outstanding, if we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the October 2015 Warrants, then the exercise price of the October 2015 Warrants will be reduced to equal such lower price, subject to certain exemptions as described in the October 2015 Warrants. The current exercise price of the October 2015 Warrants at $1.81 per share reflects a reduction from an exercise price at $5.00 per share as of the closing of our October 2015 Offering as a result of our private placement of common stock in February 2016.

Fundamental Transactions.

In the event of a fundamental transaction, as described in the October 2015 Warrants and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, or our consolidation or merger with or into another person, the holders of the October 2015 Warrants will be entitled to receive upon exercise of the October 2015 Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the October 2015 Warrants immediately prior to such fundamental transaction. In addition, in the event of a fundamental transaction, the holders of the October 2015 Warrants will have the right to require us or our successor to repurchase the October 2015 Warrants at their value based on the Black-Scholes Option Pricing Model as described in the October 2015 Warrants.

Rights as a Stockholder.

Except as otherwise provided in the October 2015 Warrants or by virtue of such holder's ownership of shares of our common stock, the holder of an October 2015 Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the October 2015 Warrant; provided, holders will be entitled to participate in any rights offering which we may undertake in the future, on an as-if-exercised basis.

Equal Treatment of Holders

. No consideration may be offered to any holder of the October 2015 Warrants to amend or consent to a waiver under the October 2015 Warrants unless the same consideration is also offered to all holders of the October 2015 Warrants. However, no holder may take any action to prevent such amendment, consent or waiver if such holder receives the same consideration as offered to all the other holders of the October 2015 Warrants.

PLAN OF DISTRIBUTION

The common stock referenced on the cover page of this prospectus will be offered solely by us and will be issued and sold upon the exercise of the warrants. We will deliver shares of our common stock upon exercise of the warrants. The July 2011 Warrants are exercisable at an exercise price of $1.81 per share, subject to adjustment as described below, until March 6, 2020, for a total of up to 138,621 shares of our common stock, and no more of the July 2011 Warrants will be issued. The October 2015 Warrants are exercisable at an exercise price of $1.81 per share, subject to adjustment as described below, until October 27, 2020, for a total of up to 442,802 shares of our common stock, and no more of the October 2015 Warrants will be issued. While the warrants are outstanding, if we sell, or grant options or rights to purchase, our common stock at an effective price per share less than the exercise price of the warrants, the exercise price of the warrants will be reduced to equal such lower price, subject to certain exemptions as provided in the warrants. We will not issue fractional shares upon exercise of these warrants. Each of these warrants contains instructions for exercise. In order to exercise any of these warrants, the holder must deliver to us or our transfer agent the information required in such warrants, along with payment for the exercise price of the shares of our common stock to be purchased.

LEGAL MATTERS

Certain legal matters with respect to the validity of the issuance of the securities offered hereby will be passed upon by our counsel, Squire Patton Boggs (US) LLP, Washington, DC.

EXPERTS

OUM & Co. LLP, independent registered public accounting firm, has audited our consolidated balance sheet as of December 31, 2015 and 2014, and the related consolidated statements of operations and comprehensive loss, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2015, as set forth in their report, which is incorporated by reference in this prospectus. Our financial statements are incorporated by reference in reliance on OUM & Co. LLP's report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the SEC's public reference facilities at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the public reference facilities. SEC filings are also available at the SEC's website at http://www.sec.gov.

This prospectus is part of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act and therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration statement that are excluded from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other document. You may inspect a copy of the registration statement, including the exhibits and schedules, without charge, at the public reference room or obtain a copy from the SEC upon payment of the fees prescribed by the SEC.

We also maintain a website at http://www.novabay.com, through which you can access our SEC filings. The information set forth on our website is not part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to "incorporate by reference" the information we file with the SEC. This permits us to disclose important information to you by referring to these filed documents. Any information referred to in this way is considered part of this prospectus. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the following documents that have been filed with the SEC (other than information furnished under Item 2.02 or Item 7.01 of Form 8-K and all exhibits related to such items):

|

|

•

|

our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 4, 2016;

|

|

|

•

|

the information specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December 31, 2015, from our definitive proxy statement in connection with our 2016 Annual Meeting of Stockholders which was filed with the SEC on April 18, 2016;

|

|

|

•

|

our Quarterly Reports on Form 10-Q for the quarterly period ended March 31, 2016, as filed with the SEC on May 12, 2016;

|

|

|

•

|

our current reports on Form 8-K, filed with the SEC on January 5, 2016, January 6, 2016, January 14, 2016, January 29, 2016, February 17, 2016, February 24, 2016, March 1, 2016, March 22, 2016, March 23, 2016, April 5, 2016, May 9, 2016 and May 27, 2016; and

|

|

|

•

|

the description of our common stock in our registration statement on Form 8-A filed with the SEC on August 29, 2007, as updated by our Form 8-K filed with the SEC on June 29, 2010.

|

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this prospectus modifies or replaces such information. We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering of the securities made by this prospectus, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.