Auto-Parts Makers Invest in Mexico, China on Production Strength

June 09 2016 - 4:50PM

Dow Jones News

Three top auto-industry suppliers are investing a combined

almost $500 million in two of the biggest vehicle production

hubs—China and Mexico—in new signs of confidence that global demand

for cars will continue to rise.

Milwaukee, Wis.-based Johnson Controls Inc. said Thursday it has

formed a joint-venture with a Chinese parts maker to build its

fourth automotive battery manufacturing plant in that country. The

$200 million facility, slated to open in 2019, will employ about

650 people. The plant will produce both traditional and stop-start

batteries. About 7.5 million batteries are expected to be produced

annually. Johnson Controls is working with Binzhou Bohai Piston

Co., an affiliate of Beijing Automotive Industry Group Co.

Nucor Corp. announced it has also reached a joint venture deal

with Japan's JFE Steel Corp. to build and operate a plant in

central Mexico to supply the needs of automotive manufactures

there. The $270 million facility will have the capacity to produce

400,000 tons of galvanized sheet steel a year. Nucor is based in

Charlotte, N.C.

Rounding out the investments, Robert Bosch GmbH completed the

expansion of its Aguascalientes, Mexico, plant which doubles the

output of automotive components such as anti-locking braking and

electronic stability systems. The company invested about $21

million into the expansion.

The three announcements come a day after automotive seat maker

Lear Corp. announced plans to build a new headquarters for its

Asia-Pacific operations in Shanghai. The new building will house

about 800 employees. Lear didn't disclose the size of the

investment.

The expansions are being made even as the U.S. market, one of

the biggest for new car sales, continues to show signs of slowing.

Sales fell 6% to 1.54 million cars in May compared with the same

period a year ago as the pent-up demand for new cars that had

pushed sales since the financial crisis continues to lose steam.

Full-year sales this year are expected to hit 17.7 million which

would break last year's record of 17.5 million but is a bit softer

than the original expectation of 17.8 million, according to

analysts at LMC Automotive.

But Mike Mansuetti, president of Bosch's North American

operations, said global automotive demand remains strong and many

parts suppliers are positioning themselves to meet the rising

demands from car makers to produce parts closer to their assembly

plants.

Global automotive light vehicle production is expected to

increase to 91.4 million this year, 93.5 million next year and 96

million in 2018, according to IHS Automotive statistics.

"We continue to see growth in the Asia-Pacific region and we are

also seeing some niche increases in North America," Mr. Mansuetti

said Thursday during an interview at the company's Farmington

Hills, Mich. location. "Our philosophy is also to build what we

sell locally and that is leading us to invest in the Southeast,

Midwest and the Mexico markets."

Bosch is already working on expanding a steering wheel

manufacturing plant in Florence, Ky. Bosch took over the plant last

year after acquiring ZF Friedrichshafen AG's steering unit. The

deal was cut so ZF could acquire TRW Automotive Holdings Corp. to

create the second-largest automotive supplier in the world.

Mr. Mansuetti added that new technologies, such as automatic

braking systems, are pushing parts makers to expand their product

portfolios and offer more components.

Write to Jeff Bennett at jeff.bennett@wsj.com

(END) Dow Jones Newswires

June 09, 2016 16:35 ET (20:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

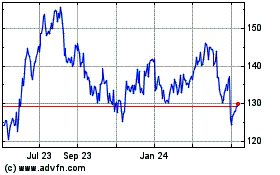

Lear (NYSE:LEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

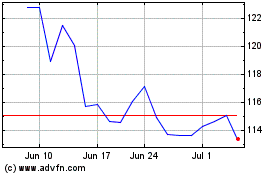

Lear (NYSE:LEA)

Historical Stock Chart

From Apr 2023 to Apr 2024