Monster Beverage Says Modified Dutch Auction Offer Was Oversubscribed

June 09 2016 - 9:54AM

Dow Jones News

By Tess Stynes

Monster Beverage Corp. (MNST) said its offer to repurchase as

much as $2 billion of its shares through a modified "Dutch auction"

tender offer was oversubscribed.

The energy-drink maker said it expects to repurchase roughly

12.8 million shares at a purchase price of $156 each. Monster said

roughly 13.6 million shares were tendered at $156 each, along with

an additional 6.5 million shares through notice of guaranteed

delivery at or below that price. Chief Executive Rodney Sacks and

Vice Chairman Hilton Schlosberg tendered 1.85 million shares and

1.06 million shares, respectively.

The company has just over 200 million shares outstanding,

according to FactSet.

The Corona, Calif., company's stock, up 24% in the past 12

months, rose 64 cents in recent premarket trading to $155.82.

The modified "Dutch auction" is part of the Corona, Calif.,

company's plans to return capital to shareholders this year. In

February, Monster unveiled a new share-repurchase program of up to

$1.75 billion, in addition to $250 million remaining at the time

under a previous authorization. Monster had been sitting on a large

pile of cash since last June, when Coca-Cola Co. (KO) paid $2.15

billion to acquire a 16.7% stake in the company.

Under the modified "Dutch auction," Monster had offered to

repurchase shares for between $142 and $160 apiece. Shareholders

had the option of tendering their shares with or without specifying

a specific price. Monster had said that if the offer was fully

subscribed, the $2 billion stock repurchase would comprise between

6.2% and 6.9% of its outstanding shares.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

June 09, 2016 09:39 ET (13:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

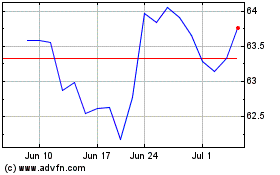

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024