Current Report Filing (8-k)

June 02 2016 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 26, 2016

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Utah

|

|

0-18592

|

|

87-0447695

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

1600 West Merit Parkway

|

|

|

|

South Jordan, Utah

|

|

84095

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(801) 253-1600

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01.

Entry into a Material Definitive Agreement

On May 26, 2016, Merit Medical Systems, Inc. (the “Company”) entered into Employment Agreements (the “Employment Agreements”) with a number of senior employees of the Company, including the following executive officers of the Company: Fred P. Lampropoulos, Chief Executive Officer and President; Bernard J. Birkett, Chief Financial Officer and Treasurer;

Ronald A. Frost, Chief Operating Officer; Joseph C. Wright, President, International Division; Justin J. Lampropoulos, Executive Vice President of Global Sales Marketing & Strategy; and Brian G. Lloyd, Chief Legal Officer and Corporate Secretary. With respect to Messrs. Fred Lampropoulos and Frost, their Employment Agreements replace preexisting Employment Agreements, dated December 30, 2010 and December 12, 2014, respectively. The Employment Agreements, which are “at-will” agreements terminable by either the Company or the executive, do not modify the existing base salary, bonus and commission arrangements between the Company and the applicable executive officers. The Employment Agreements do, however, provide that if an executive officer's employment with the Company is terminated by the Company “without cause,” (as defined in the Employment Agreements) or by the executive for “good reason” (as defined in the Employment Agreements) within two years after a “change of control” (as defined in the Employment Agreements) of the Company, the terminated executive will be entitled to be paid a cash severance benefit equal to two times (or three times for Mr. Fred Lampropoulos) the sum of the executive’s then-current annual base salary, bonus and, as applicable, commission payments. The Employment Agreements also obligate the Company, to the extent permitted by law and the Company’s applicable insurance policies, to continue to provide to the executive and his or her spouse and dependent children employment-related benefits at least equal to the benefits which would have been provided to the executive in accordance with the welfare plans, programs, practices and policies of the Company if the executive’s employment had not been terminated or, if more favorable to the executive, as in effect generally at any time thereafter with respect to peer executives of the Company and its affiliated companies. The Employment Agreements also contain other terms and conditions which the Company believes are customary for agreements of such nature.

The foregoing summary of the Employment Agreements does not purport to be complete and is qualified in its entirety by the terms and provisions of the Employment Agreements, the forms of which the Company intends to file as exhibits to the Company's Annual Report on Form 10-Q for the quarter ending June 30, 2016.

Item 5.07.

Submission of Matters to a Vote of Security Holders.

On May 26, 2016, the Company held its 2016 Annual Meeting of Shareholders (the “Annual Meeting”). A total of 44,285,041 shares of the Company’s common stock were entitled to vote as of March 28, 2016, the record date for the Annual Meeting, of which 41,284,799 shares were represented in person or by proxy at the Annual Meeting.

The shareholders of the Company voted on the following matters at the Annual Meeting: (i) the election of three directors of the Company, to serve until the annual meeting of the Company’s shareholders to be held in 2019 and until their respective successors have been duly elected and qualified, (ii) a non-binding advisory resolution to approve the compensation of the Company’s named executive officers, otherwise known as a “say-on-pay” vote, and (iii) the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016.

Matter 1

Each of the three nominees listed below was re-elected to serve as a director of the Company. The votes cast for or withheld for each nominee, excluding 1,784,415 broker non-votes, were as follows:

|

|

|

|

|

|

|

|

|

Nominee

|

|

For

|

|

Withheld

|

|

Richard W. Edelman

|

|

38,027,603

|

|

1,472,781

|

|

Michael E. Stillabower, M.D.

|

|

38,022,520

|

|

1,477,864

|

|

F. Ann Millner, Ed.D.

|

|

39,006,722

|

|

493,662

|

Matter 2

The results of the voting on a non-binding advisory resolution to approve the compensation of the Company’s named executive officers were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

|

38,706,710

|

|

767,923

|

|

25,751

|

|

1,784,415

|

|

Accordingly, a majority of votes cast with respect to the advisory “say-on-pay” resolution were “for” approval of the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement distributed in connection with the Annual Meeting.

Matter 3

The voting results with respect to the proposal to ratify the appointment of Deloitte & Touche LLP to serve as the Company’s independent registered public accountant for the fiscal year ending December 31, 2016 were as follows:

|

|

|

|

|

|

|

|

|

|

For

|

|

Opposed

|

|

Abstained

|

|

|

40,861,013

|

|

410,966

|

|

12,820

|

|

Accordingly, the Company’s shareholders ratified the appointment of Deloitte and Touche LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MERIT MEDICAL SYSTEMS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 2, 2016

|

|

By:

|

|

/s/ Brian G. Lloyd

|

|

|

|

|

|

Chief Legal Officer and Secretary

|

|

|

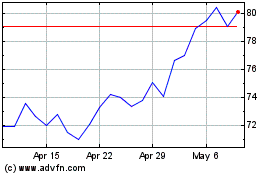

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

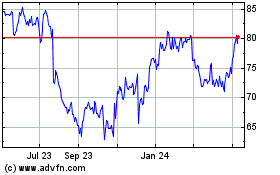

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024