By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Energy shares tumble; ADP report misses impact of Verizon

strike; ECB leaves interest rates unchanged

U.S. stocks were in the red Thursday morning, weighed by falling

oil prices after the Organization of the Petroleum Exporting

Countries failed to reach an agreement on a production ceiling.

Fresh U.S. private-sector employment data

(http://www.marketwatch.com/story/adp-reports-173000-private-sector-jobs-added-in-may-2016-06-02-8103345)came

roughly within expectations, while first-time unemployment benefits

declined somewhat, increasing the likelihood of an interest-rate

increase by the Federal Reserve this summer.

Meanwhile on the other side of the Atlantic, the European

Central Bank left key interest rates unchanged, in line with

investors' expectations. But ECB President Mario Draghi said the

central bank remains ready to use all the tools within its mandate

(http://blogs.marketwatch.com/thetell/2016/06/02/ecb-live-blog-draghi-faces-questions-on-inflation-greece-and-corporate-bonds/)

to makes sure that the low inflation environment doesn't become

"entrenched."

The S&P 500 index fell 5 points, or 0.2%, to 2,094, led by a

1.1% drop in energy shares and a 0.5% drop in materials shares,

which were both dragged down by tumbling oil prices .

The Dow Jones Industrial Average fell 33 points, or 0.2%, to

17,754, led by a 1.8% drop in energy giant Exxon Mobil Corp.(XOM)

followed by a 1.4% drop in shares of Microsoft Corp.(MSFT).

Meanwhile, the Nasdaq Composite was down 7 points, or 0.1%, at

4,945.

Oil blues: OPEC on Thursday broke off its meeting without

reaching any new agreements

(http://www.marketwatch.com/story/opec-fails-to-agree-on-output-cap-2016-06-02)on

oil production, continuing a hands-off policy that members say is

gradually bringing supply and demand back into balance and boosting

prices. In the opening address, Qatar's oil minister Mohammed Bin

Saleh al-Sada said the 13-member cartel expects a sharp drop

(http://www.marketwatch.com/story/opec-sees-sharp-drop-in-non-opec-output-in-2016-2016-06-02)

in non-OPEC output in 2016.

Oil prices

(http://www.marketwatch.com/story/oil-prices-hold-steady-as-opec-members-gather-in-vienna-2016-06-02)

tumbled on the news, weighing on broader risk appetite in global

markets, while assets traditionally viewed as havens in times of

market turmoil, such as U.S. Treasurys and gold futures gained.

Growing evidence of risk aversion in the market was also

supported by the fact that the S&P 500 was flirting with a

major technical level, namely the 2,100-point "great wall," said

Mike Antonelli, equity sales trader at R.W Baird & Co.

The index has been trading in a range between 2,040 and 2,100

since April and it's unlikely that it would "go over that great

wall" ahead of two major events this month, namely the Fed's

meeting on monetary policy and the Brexit referendum, Antonelli

added.

(http://www.marketwatch.com/story/key-issues-opec-must-wrestle-with-at-june-meeting-even-as-oil-nears-50-2016-05-25)Economic

data: Private-sector employment gains accelerated slightly in May

as employers added 173,000 jobs, Automatic Data Processing Inc.

reported

(http://www.marketwatch.com/story/adp-reports-173000-private-sector-jobs-added-in-may-2016-06-02-8103345)Thursday.

Economists use ADP's private payrolls report to get a feeling

for the Labor Department's employment report, which will be

released Friday and covers government jobs in addition to the

private sector.

But economists expect the government's report to show fewer

payroll gains than the ADP survey on Friday. That's because the

government estimate will be held down by the impact of the

month-long strike by Verizon Communications (VZ) workers. Roughly

35,000 striking workers were classified as unemployed in May due to

the strike. The Verizon strike wasn't included in the ADP

estimate.

"Just as importantly, however, a low number will not necessarily

affect the chances of a Fed rate hike over the summer because that

strike was just a temporary disruption. Those workers are already

back at work and will boost the gain in employment in June," said

Paul Ashworth, chief U.S. economist at Capital Economics, in

emailed comments.

Fed. Governor Gov. Daniel Tarullo

(http://www.marketwatch.com/story/feds-tarullo-sounds-in-no-hurry-to-raise-interst-rates-2016-06-02)said

that he's inclined to hold off on interest-rate hikes to let the

labor market strengthen further.

Dallas Fed President Robert Kaplan will speak at Boston College

at 1 p.m. Eastern.

Other markets:The Stoxx Europe 600 index

(http://www.marketwatch.com/story/european-stocks-step-slightly-lower-with-ecb-opec-meetings-on-deck-2016-06-02)

held its gains after the ECB left its rates unchanged and announced

that it would kick off its previously announced corporate-bond

buying program June 8.

Read:Oil rally leaves ECB room to 'celebrate' at Thursday's

meeting

(http://www.marketwatch.com/story/oil-rally-leaves-ecb-room-to-celebrate-at-thursdays-meeting-2016-05-31)

(http://www.marketwatch.com/story/oil-rally-leaves-ecb-room-to-celebrate-at-thursdays-meeting-2016-05-31)The

dollar

(http://www.marketwatch.com/story/yen-soars-to-two-week-high-vs-dollar-after-boj-comment-2016-06-02)

took another hit overnight as the yen moved higher, knocking 2.3%

off the Nikkei 225 index

(http://www.marketwatch.com/story/nikkei-drops-another-2-as-yen-continues-to-dominate-2016-06-02),

while Asian markets overall were mixed. The euro moved lower

against the dollar

(http://www.marketwatch.com/story/yen-soars-to-two-week-high-vs-dollar-after-boj-comment-2016-06-02)after

Draghi warned that the central bank could push interest rates

further into negative territory if needed.

Stocks to watch:Apple Inc.(AAPL) fell 1% after Goldman Sachs cut

Apple's price target

(http://www.marketwatch.com/story/goldman-cuts-apple-price-target-to-factor-in-lower-smartphone-growth-2016-06-02)

to $124 from $136 a share to factor in lower smartphone growth, but

maintained its buy rating on the iPhone maker.

Tesla Motors Inc.(TSLA) fell 0.8% after Chief Executive Officer

Elon Musk offered explanations at a Recode Code Conference for

delays in Model X shipments, citing supplier issues and a shootout

on the Mexican border that held up a shipment of trunk carpets. He

also said he would like to get humans to Mars by 2025

(http://www.marketwatch.com/story/elon-musks-promise-spacex-to-take-a-human-to-mars-by-2025-2016-06-02).

Hovnanian Enterprises Inc.(HOV) tumbled 10.9% after the

homebuilder lowered its outlook for the year as it posted an

unexpected loss in the latest quarter.

Shares of Box Inc.(BOX) tumbled 11.5% after the cloud-storage

company's billings for the quarter fell short of Wall Street

expectations late Wednesday.

Johnson & Johnson(JNJ) inched higher 0.6% after the company

said it would pay $3.3 billion for privately-held hair care

products group Vogue International

(http://www.marketwatch.com/story/johnson-johnson-to-pay-33-billion-for-vogue-international-2016-06-02).

(END) Dow Jones Newswires

June 02, 2016 10:49 ET (14:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

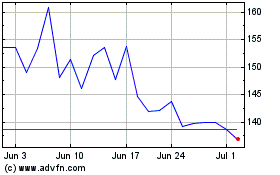

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Apr 2023 to Apr 2024