Allegheny Technologies Announces Exercise of Over-Allotment Option to Purchase Additional Convertible Senior Notes

June 01 2016 - 4:15PM

Business Wire

Allegheny Technologies Incorporated (NYSE: ATI) announced today

that, in connection with its previously announced underwritten

public offering of 4.75% Convertible Senior Notes due 2022 (the

“Notes”), the underwriters have exercised in full their

over-allotment option to purchase an additional $37.5 million

aggregate principal amount of Notes. The closing of the option

exercise is expected to occur on June 2, 2016. Following the

closing of the option exercise, ATI will have issued a total of

$287.5 million aggregate principal amount of Notes.

Citigroup, J.P. Morgan and BofA Merrill Lynch are the joint

book-running managers for the offering.

This news release does not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of any

of the Notes in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. A registration

statement relating to the Notes has been filed with the Securities

and Exchange Commission (the “SEC”).

Copies of the prospectus and prospectus supplement meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended, may be obtained from Citigroup Global Markets Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

New York 11717, telephone (800) 831-9146 or email

prospectus@citi.com, J.P. Morgan Securities LLC, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, New York

11717, telephone (800) 831-9146, or Merrill Lynch, Pierce, Fenner

& Smith Incorporated, NC1-004-03-43, 200 North College Street,

3rd floor, Charlotte, North Carolina 28255-0001, Attn: Prospectus

Department, email dg.prospectus_requests@baml.com, or from the SEC

website at www.sec.gov.

This news release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Certain statements in this news release relate to future

events and expectations and, as such, constitute forward-looking

statements. Forward-looking statements include those containing

such words as “anticipates,” “believes,” “estimates,” “expects,”

“would,” “should,” “will,” “will likely result,” “forecast,”

“outlook,” “projects,” and similar expressions. Forward-looking

statements are based on management’s current expectations and

include known and unknown risks, uncertainties and other factors,

many of which we are unable to predict or control, that may cause

our actual results, performance or achievements to differ

materially from those expressed or implied in the forward-looking

statements. Important factors that could cause actual results to

differ materially from those in the forward-looking statements

include: (a) material adverse changes in economic or industry

conditions generally, including global supply and demand conditions

and prices for our specialty metals; (b) material adverse changes

in the markets we serve, including the aerospace and defense,

electrical energy, oil and gas/chemical and hydrocarbon processing

industry, medical, automotive, construction and mining, and other

markets; (c) our inability to achieve the level of cost savings,

productivity improvements, synergies, growth or other benefits

anticipated by management from strategic investments and the

integration of acquired businesses, whether due to significant

increases in energy, raw materials or employee benefits costs,

project cost overruns or unanticipated costs and expenses, or other

factors; (d) continued decline in, or volatility of, prices,

and availability of supply, of the raw materials that are critical

to the manufacture of our products; (e) declines in the value of

our defined benefit pension plan assets or unfavorable changes in

laws or regulations that govern pension plan funding;

(f) significant legal proceedings or investigations adverse to

us; (g) labor disputes or work stoppages; and (h) other risk

factors summarized in our Annual Report on Form 10-K for the year

ended December 31, 2015, and in other reports filed with the

Securities and Exchange Commission. We assume no duty to update our

forward-looking statements.

Creating Value Thru Relentless Innovation®

Allegheny Technologies Incorporated is one of the largest and

most diversified specialty materials and components producers in

the world with revenues of approximately $3.4 billion for the

twelve month period ending March 31, 2016. ATI employees use

innovative technologies to offer global markets a wide range of

specialty materials solutions. Our major markets are aerospace and

defense, oil & gas/chemical and hydrocarbon process industry,

electrical energy, medical, automotive, food equipment and

appliance, and construction and mining.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160601006885/en/

Allegheny TechnologiesDan Greenfield412-394-3004

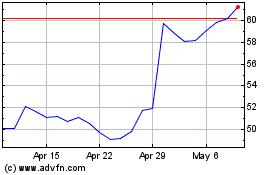

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

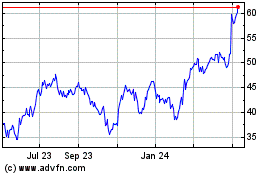

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024