Current Report Filing (8-k)

June 01 2016 - 8:23AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): May 30, 2016

NEKTAR

THERAPEUTICS

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

0-24006

|

94-3134940

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

(Commission

File

Number)

|

(IRS

Employer

Identification

No.)

|

455

Mission Bay Boulevard South

San

Francisco, California 95128

(Address

of Principal Executive Offices and Zip Code)

Registrant’s

telephone number, including area code: (415) 482-5300

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

1.01. Entry into a Material Definitive Agreement

Effective

May 30, 2016 (the “Effective Date”), Nektar Therapeutics, a Delaware corporation (“Nektar”), entered into

a Collaboration and License Agreement (the “Agreement”) with Daiichi Sankyo Europe GmbH, a German limited liability

company (“Daiichi”).

Under

the terms of the Agreement, Nektar granted Daiichi exclusive commercialization rights in the European Economic Area, Switzerland,

and Turkey (the “European Territory”) to Nektar’s proprietary product candidate ONZEALD™ (etirinotecan

pegol), which is also known as NKTR-102, a long-acting topoisomerase I inhibitor in clinical development for the treatment

of adult patients with advanced breast cancer who have brain metastases (“BCBM”). Nektar retains all rights to ONZEALD

in all countries outside the European Territory including the United States.

Under

the terms of the Agreement and in consideration for the exclusive commercialization rights in the European Territory, Daiichi

will pay Nektar a $20 million up-front payment and Nektar will be eligible to receive up to an aggregate of $60 million in regulatory

and commercial milestones, including a $10 million payment upon the first commercial sale of ONZEALD following conditional approval

by the European Medicines Agency (“EMA”) and the European Commission (the “EC”), a $25 million payment

upon the first commercial sale following final marketing authorization approval of ONZEALD by the EMA and EC, and a $25 million

sales milestone upon Daiichi’s first achievement of a certain specified annual net sales target. Nektar is also eligible

to receive a 20% royalty on net sales of ONZEALD by Daiichi in all countries in the European Territory except for net sales in

Turkey where Nektar is eligible to receive a 15% royalty. Nektar’s right to receive royalties (subject to certain adjustments)

in any particular country will expire, on a country-by-country basis upon the later of (a) a specified period of time after the

first commercial sale of the product in that country or (b) the expiration of patent rights in that particular country. The parties

will enter into a supply agreement whereby Nektar will be responsible for supplying Daiichi with its requirements for ONZEALD

on a fully burdened reimbursed cost basis. Daiichi will be responsible for all commercialization activities for ONZEALD in the

European Territory and will bear all associated costs.

Nektar

is responsible for funding and conducting a Phase 3 confirmatory trial in approximately 350 patients with BCBM (the “Confirmatory

Trial”). The Confirmatory Trial will compare ONZEALD to a treatment of physician’s choice. The primary endpoint in

the trial will be overall survival (“OS”). The Confirmatory Trial will include a pre-specified interim analysis for

OS which is to be conducted after 130 events have occurred in the trial.

A

joint steering committee of representatives of Nektar and Daiichi will oversee development, manufacturing, and regulatory activities.

The Agreement also includes various representations, warranties, covenants, indemnities and other provisions, including with respect

to intellectual property rights, that are customary for transactions of this nature. Prior to the EC granting conditional marketing

approval of ONZEALD

,

Daiichi

may terminate the Agreement in the event that the EC does not grant conditional marketing approval for ONZEALD based on the Confirmatory

Trial or the conditional marketing approval for ONZEALD is not granted prior to a pre-specified future date (a “Daiichi

Pre-Conditional Approval Termination”). Nektar may terminate the Agreement in the event that the EC requires changes in

the Confirmatory Trial that materially increase the costs of such trial and Daiichi elects not to reimburse Nektar for such incremental

costs (a “Nektar Pre-Conditional Approval Termination”). In the event of a Daiichi Pre-Conditional Approval Termination

or a Nektar Pre-Conditional Approval Termination, Nektar would be obligated to pay Daiichi a $12.5 million termination payment.

Following conditional approval of ONZEALD by the EC, Nektar would no longer have such termination payment obligation. Each party

has certain other termination rights based on the safety or efficacy findings including the outcome of the Confirmatory Trial

and any material uncured breaches of the Agreement.

The

foregoing summary does not purport to be complete and is qualified in its entirety by reference to the Agreement, which will be

filed as an exhibit to Nektar’s Quarterly Report on Form 10-Q for the period ended June 30, 2016.

Item

7.01. Regulation FD Disclosure

Nektar

currently anticipates that the future cost of the Confirmatory Trial will be in the range of approximately $40 to $50 million

over the next approximately 3.5 years that is currently estimated to be required to complete such trial. This cost estimate range

is based on a several variables that can be difficult to estimate, including the number of clinical trial sites and the average

number of patients enrolled at each site, the total time required to recruit the target number of patients to be enrolled in the

Confirmatory Trial, the time required to observe the minimum number of events to support the interim and final analysis, the outcome

of the pre-planned interim analysis, clinical drug supply costs, as well as numerous other factors that can impact the actual

costs of a clinical trial.

Nektar

plans to submit a marketing authorization application filing (the “MAA”) in June 2016 seeking conditional approval

from the EMA for the use of ONZEALD in the treatment of adult patients with advanced breast cancer having brain metastases and

having received prior anthracycline, taxane and capecitabine. On May 26, 2016, the Committee for Medicinal Products

for Human Use (CHMP) granted the planned ONZEALD MAA filing an accelerated assessment procedure which provides for an accelerated

MAA review timeline. Nektar expects the EMA review of the MAA to commence on July 14, 2016, and the CHMP review is expected to

take 6-8 months with the CHMP opinion to be issued in the first quarter of 2017.

On

June 1, 2016, Nektar issued a press release announcing entry into the Agreement, which is filed herewith as Exhibit 99.1 to this

Current Report. The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not

be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liability of that section, nor shall such information be deemed to be incorporated by reference in

any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as

otherwise stated in such filing.

FORWARD

LOOKING STATEMENTS

In

this Form 8-K Nektar makes certain forward-looking statements including potential milestone payments payable by Daiichi to Nektar

upon the achievement of certain specified regulatory and commercial objectives and the estimated cost of the Confirmatory Trial.

These forward-looking statements involve substantial risks and uncertainties including but not limited to: (i) multi-year cost

estimates, such as that provided by Nektar in this filing for the Confirmatory Trial, are based on numerous variables such as

those specifically identified above and a multi-year cost estimate is by its nature subject to significant and unpredictable variability;

(ii) the EMA has substantial discretion as to whether to grant conditional or final marketing approval for ONZEALD and the EMA’s

final decisions are difficult to predict even after preliminary feedback from EMA representatives, and the final decisions of

the EMA and EC for conditional or final approval of ONZEALD have significant financial consequences under the terms of the Agreement,

including the termination payment and milestone provisions; (iii) the risk of failure of any product candidate that is in clinical

development and prior to regulatory approval is high and can occur at any stage due to efficacy, safety or other factors; (iv)

the failure to achieve pre-specified regulatory outcomes with the EMA could result in Nektar having to make a termination payment

to Daiichi described above or result in reduced or no further milestone or royalty payments to Nektar from Daiichi, (v) the timing

of the commencement or end of the Confirmatory Trial and the commercial launch of ONZEALD may be delayed or unsuccessful due to

regulatory delays, required institutional review board review and approvals, slower than anticipated patient enrollment, manufacturing

challenges, changing standards of care, evolving regulatory requirements, clinical trial design, clinical outcomes, competitive

factors, or delay in obtaining regulatory approval in one or more important markets; (vi) patents may not issue from Nektar’s

patent applications for ONZEALD and patents that have issued may not be enforceable; (vii) potential future third-party intellectual

property or licensing disputes, and (viii) certain other important risks and uncertainties set forth in our Quarterly Report on

Form 10-Q filed with the Securities and Exchange Commission on May 4, 2016. Actual results could differ materially from

these forward-looking statements. Nektar undertakes no obligation to update forward-looking statements, whether as

a result of new information, future events or otherwise.

(d)

Exhibits

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

Press

Release issued on June 1, 2016 by Nektar Therapeutics announcing the European collaboration and license agreement with Daiichi

for ONZEALD™ (etirinotecan pegol).

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

|

Nektar

Therapeutics

|

|

|

|

|

|

Date: June

1, 2016

|

By:

|

/s/

Gil M. Labrucherie

|

|

|

|

Gil

M. Labrucherie

|

|

|

|

General

Counsel and Secretary

|

|

|

|

|

|

|

|

|

EXHIBIT

INDEX

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

Press

Release issued on June 1, 2016 by Nektar Therapeutics announcing the European collaboration and license agreement with Daiichi

for ONZEALD™ (etirinotecan pegol).

|

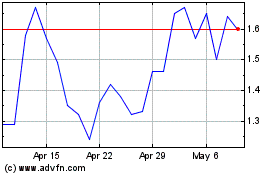

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Apr 2023 to Apr 2024