Samsung's Web TVs Show Additional Ads To Drive Up Revenue -- WSJ

May 31 2016 - 3:06AM

Dow Jones News

By Min-Jeong Lee

SEOUL -- Samsung Electronics Co. is quietly adding more

advertisements to its Internet-connected televisions as it seeks

new revenue sources for its struggling TV business.

The world's largest maker of TVs by shipments added new tile ads

to the main menu bar of its premium TVs in the U.S. in June 2015

and is planning to expand the program to Europe in coming months,

people familiar with the matter said.

Samsung is working to expand its pool of advertising clients by

using agencies and its ad-sales team in New York, according to one

of these people, and by using software updates to retroactively

activate tile ads on older smart TV models.

The push is being spearheaded by Executive Vice President Lee

Won-jin, a 48-year-old ad sales expert that Samsung poached from

Google Inc. in early 2014. Mr. Lee oversees Samsung's partnerships

with companies like Netflix Inc., from which Samsung collects a

share of the revenue generated by streaming video through its TVs,

according to a person familiar with the matter.

Samsung's decision to expand its advertising initiative marks a

fresh attempt to move beyond hardware sales, a problem that it has

worked hard to overcome at its mobile division.

Samsung sells an estimated 50 million television sets a year and

has a dominant 20% share of the global market, analysts estimate.

It has invested heavily in hardware to enhance screen technology,

but that hasn't helped much to increase earnings as the industry as

a whole shrinks.

In the first quarter, global shipments of TV sets with liquid

crystal displays totaled 48.3 million units, representing a 20.9%

quarterly decline and a 6.3% year-over-year drop, according to data

from research firm TrendForce. The outlook remains bleak due to

market saturation and weak demand, TrendForce says.

Worse, Samsung's profit margins from TVs have been razor thin at

about 3% to 5% over the past few years, according to analysts'

estimates. The company doesn't break out its TV margins. And

Samsung's profit margins are under threat as low-cost Chinese

producers drive TV prices down.

"Samsung is a competent TV maker, but this industry isn't

growing anymore," said Lee Seung-woo, an analyst with IBK

Securities in Seoul. "Samsung needs to find a way to monetize the

business through content."

Competing products like Roku TVs from China's TCL Corp. and

Hisense Co. and Firefox TVs from Japan's Panasonic Corp. already

feature prominent ads.

Last year, Samsung's unit in charge of TV ads eked out revenue

of about $20 million to $30 million by selling ads and collecting

revenue from service partners, the people familiar with the matter

said. The amount is negligible compared with the 29.2 trillion

Korean won ($24.8 billion) in revenue that Samsung generated from

its TV business in 2015. The TV advertising unit is far from

turning a profit.

Samsung declined to make Mr. Lee available for an interview and

didn't comment on its TV ad sales or revenue sharing with streaming

partners like Netflix.

Expanding the tile ads program to its smart TVs in Europe could

be a challenge as Samsung seeks to persuade regulators, TV networks

and consumers who could find the unending ad streams annoying.

The ads, which appear on the home screen next to apps like

Netflix, YouTube and Hulu, open up interactive features when a user

clicks on them. In one campaign last year, a Samsung ad was used to

promote Walt Disney Co.'s animated movie "The Good Dinosaur." When

selected by the user, the ad opened a quiz that purported to match

consumers with characters from the movie.

Samsung said it positioned the ad placements in the menu bar "to

deliver relevant brands and content to consumers."

Samsung sold ads on its televisions in the past, starting in

2012 with what it now calls "integrated ads," where Samsung sells

partner ads that appear as an app alongside other apps, though they

are now only visible to users who first click on the apps

button.

"We're likely to see a host of new devices that allow users to

consume video content in various ways, which leads to thinking that

competition which has centered around picture quality, will change

significantly," said Kim Hyun-suk, the head of Samsung's TV

business, at a recent media event.

--Jonathan Cheng in Seoul and Geoffrey A. Fowler in San

Francisco contributed to this article.

Write to Min-Jeong Lee at min-jeong.lee@wsj.com

(END) Dow Jones Newswires

May 31, 2016 02:51 ET (06:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

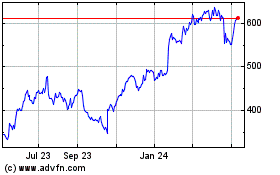

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

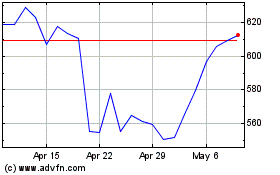

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024