Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 26 2016 - 5:17PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to

Rule 433

Registration Statement No. 333-209921

To

Prospectus Supplement dated May 26, 2016

(to Prospectus dated March

30, 2016)

Treasury Offering of Units

May 26, 2016

A final short form base shelf prospectus dated March 7, 2016

and a prospectus supplement dated May 26, 2016 containing important information

relating to the securities described in this document have been filed with the

securities regulatory authorities in British Columbia, Alberta and Ontario.

Copies of the final short form base shelf prospectus, any amendment to the short

form base shelf prospectus and any applicable shelf prospectus supplement may be

obtained from the Lead Agent at: syndication@globalsec.com.

The Company (as defined herein) has filed a registration

statement (including a prospectus)

and a prospectus supplement with the

United States Securities and Exchange Commission (“SEC”) for the offering to

which this communication relates. Before you invest, you should read the

prospectus in that registration statement and other documents the Company has

filed with the SEC for more complete information about the Company and this

offering. You may get these documents for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, the Company or any of the Agents

participating in the offering will arrange to send you the prospectus, as

supplemented, if you request it by contacting the Lead Agent at:

syndication@globalsec.com.

This document does not provide full disclosure of all

material facts relating to the securities offered. Investors should read the

short form base shelf prospectus, any amendment and any applicable shelf

prospectus supplement for disclosure of those facts, especially risk factors

relating to the securities offered, before making an investment decision.

Investors should be aware that the acquisition of the Units described herein may

have tax consequences. Investors should read the tax discussion in the

prospectus supplement filed for the Units, however, the short form base shelf

prospectus or such prospectus supplement may not fully describe these tax

consequences.

This communication shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall there be any

sale of these securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

|

Issuer:

|

Northern Dynasty Minerals Ltd. (the “Company”).

|

|

|

|

|

Offering:

|

Treasury offering of 31,111,111 units (the “Units”),

before giving effect to the Over-Allotment Option.

|

|

|

|

|

Units:

|

Each Unit consists of one common share (a “Share”) and

one common share purchase warrant (a “Warrant”).

|

|

|

|

|

Warrants:

|

Each Warrant is exercisable into one common share (a

“Warrant Share”) at an exercise price of $0.65 per Warrant Share for a

period of five (5) years from the Closing Date.

|

|

|

|

|

Issue Price:

|

$0.45 per Unit.

|

|

|

|

|

Amount:

|

Up to $14,000,000 ($16,100,000 to the extent the

Over-Allotment Option is exercised in full).

|

|

|

|

|

Over-Allotment

Option:

|

The Company has granted the Agents an option,

exercisable, in whole or in part, at any time, and from time to time,

until and including 30 days following the closing of the Offering, to

purchase up to an additional 4,666,667 Units at the Issue Price

to cover over-allotments, if any.

|

|

|

Treasury Offering of Units

|

|

May 26, 2016

|

|

|

|

Concurrent

Offering:

|

The Offering is being conducted concurrently with an

offering of up to 2,222,222 Units at the Offering Price for additional

gross proceeds of up to $1,000,000.

|

|

|

|

|

Use of Proceeds:

|

The net proceeds of the Offering will be used to fund the

Company’s multi- dimensional strategy to address the United States

Environmental Protection Agency’s proposed pre-emptive regulatory action

under the United States Clean Water Act and to prepare the Pebble Project

to initiate federal and state permitting under the United States National

Environmental Policy Act, costs to keep the Pebble project in good

standing, costs to advance a potential partner(s) transaction, and for

working capital and general corporate purposes.

|

|

|

|

|

Form of Offering:

|

Marketed deal on a commercially reasonable efforts basis

offered (i) publicly in the provinces of British Columbia, Alberta and

Ontario by way of a base shelf prospectus and prospectus supplement; (ii)

publicly in the United States only to “Qualified Institutional Buyers” (as

defined in Rule 144A of the U.S. Securities Act of 1933, as amended) by

way of a U.S. base shelf prospectus and prospectus supplement; and (iii)

in jurisdictions outside of Canada and the United States, in each case in

accordance with all applicable laws provided that no prospectus,

registration statement or similar document is required to be filed in such

jurisdiction.

|

|

|

|

|

Agents:

|

Global Securities Corporation (the “

Lead Agent

”)

and Industrial Alliance Securities Inc.

|

|

|

|

|

Listing:

|

The existing common shares of the Company are listed on

the Toronto Stock Exchange (the “TSX”) under the symbol “NDM” and on the

NYSE MKT under the symbol “NAK”. The Company will use its best efforts to

obtain the necessary approvals to list the Shares and Warrant Shares on

the TSX and the NYSE MKT, and the Warrants on the TSX.

|

|

|

|

|

Eligibility:

|

Eligible for RRSPs, RRIFs, RESPs, DPSPs, RDSPs and TFSAs.

|

|

|

Treasury Offering of Units

|

|

May 26, 2016

|

|

|

|

Commission:

|

2.0% of the gross proceeds of the Offering payable in

cash, provided that the Commission may be increased to a maximum of 4.0%

for sales to non-U.S. purchasers in order to permit a concession fee to be

paid to licensed broker-dealers, brokers or investment dealers in

connection with sales under the Offering.

|

|

|

|

|

Closing Date:

|

On or about June 10, 2016, as

mutually agreed to by the Company and the Agents.

|

An investment in the Units involves a high degree of risk

and must be considered speculative due to the nature of the Company’s business

and the present stage of exploration and development of certain of its

properties. Prospective investors should carefully consider the risk factors

described in the Prospectus under “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements”.

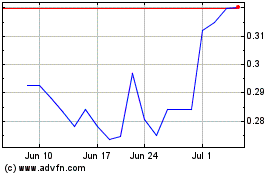

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

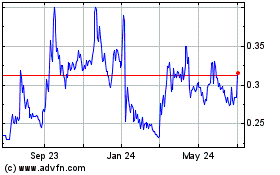

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Apr 2023 to Apr 2024