Goldman Sachs Dumps Employee-Ranking System

May 26 2016 - 11:00AM

Dow Jones News

Goldman Sachs Group Inc. is shaking up performance reviews for

the firm's roughly 36,500 workers.

The Wall Street bank is eliminating numerical rankings in

employee reviews starting next month, and this fall will experiment

with an online system where employees can give and receive

continuous feedback on their performance.

Big companies have been rethinking the way they track and grade

workers' performance. Accenture PLC and General Electric Co.

recently scrapped annual performance reviews in favor of more

frequent check-ins between managers and employees. Gap Inc., Adobe

Systems Inc. and Microsoft Corp. have abolished numerical ratings,

which executives say can grind down employee morale.

Goldman, which announced the changes in a pair of firmwide

memos, is not doing away with performance reviews entirely.

Instead, the bank will focus on giving employees specific

directives on improving their work rather than grading performance

for the previous year, said Edith Cooper, the bank's global head of

human capital management.

Bank employees want "more direction with respect to how they can

improve," Ms. Cooper said. In internal surveys, Goldman staffers

requested "more frequent and constructive feedback," according to

one of the memos.

The firm will keep its 360-degree annual review, in which an

employee solicits feedback from his or her manager and a select

group of colleagues, including peers and reports. Gone is an

employee ranking on a nine-point scale, she said.

More firms are eliminating numerical ratings for workers as

bosses realize "the person receiving the rating is now stuck with

the number for an entire year that labels them," said Josh Bersin,

a principal at Deloitte Consulting LLP who advises companies on

talent management.

Performance reviews play a role in determining employee bonuses

and promotions at the firm, and will continue to do so, Ms. Cooper

said. She declined to say how much weight those evaluations

carry.

Goldman typically culls roughly 5% of its workers early in the

year, in part to make way for new hires. This year, though, the

cuts have been deeper in some of the businesses, like debt trading,

that are wading through a prolonged slump.

The firm is also paring the maximum number of designated

reviewers from 10 to six to decrease demands on colleagues' time,

she said. Review conversations will now take place over the summer

rather than in the fall, giving employees additional time to

improve their performance ahead of bonus decisions and annual

cuts.

In addition, Goldman will try out a Web-based tool for some

employees to give and receive performance feedback at any time, Ms.

Cooper said. The hope is that the additional input will lead to

more frequent one-on-one conversations with employees and managers,

she said. The bank has not determined which departments will try

out the system.

The adjustments to its performance-review process are the latest

in a series of management changes the firm has made in recent

months, the bulk of which have been focused on retaining junior

bankers. Last fall, the bank announced it would speed the path to

promotions for top-performing analysts and associates, and would

work to eliminate some of the grunt work that often falls to

younger employees.

Justin Baer contributed to this article.

Write to Lindsay Gellman at Lindsay.Gellman@wsj.com

(END) Dow Jones Newswires

May 26, 2016 10:45 ET (14:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

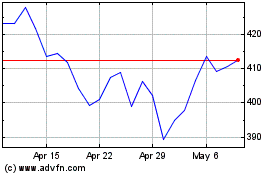

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024