EPS $1.87, up 26.4%; Adjusted EPS $1.95, up

20.4%; Fiscal 2017 Earnings Guidance Reaffirmed

Signet Jewelers Limited (“Signet”) (NYSE: SIG), the world's

largest retailer of diamond jewelry, today announced its results

for the 13 weeks ended April 30, 2016 (“first quarter Fiscal

2017”).

Highlights:

- Diluted earnings per share ("EPS") grew

26.4%. Adjusted EPS grew 20.4%.

- Same store sales up 2.4%. Total sales

$1.6 billion up 3.2%. Total sales at constant exchange rate up

3.9%.

- Annual earnings guidance

reaffirmed.

- Zale acquisition integration

progressing well; synergies remain on-target.

- Repurchased over 1.1 million shares in

first quarter for $125.0 million.

- Conducting strategic evaluation of

credit portfolio; first quarter credit metrics improved

sequentially and in-line with expectations.

Mark Light, Chief Executive Officer of Signet Jewelers said,

“Signet delivered another period of solid performance resulting in

record first quarter EPS and strong operating margin expansion. We

gained profitable market share despite a challenging retail

environment through strong sales of Ever Us and other fashion

jewelry collections as well as select branded bridal. Our 26% EPS

growth was driven by higher same store sales and total sales along

with solid expense management and synergies, leading to 190 basis

points of operating margin expansion. In addition to delivering

earnings results at the top end of our guided range, we achieved

sales growth across real estate formats and in each of our

divisions and our credit metrics showed strong sequential

improvement.

Mr. Light added, "This Sunday marks the two-year anniversary of

the close of our acquisition of Zale. The integration continues to

go extremely well across all aspects of our business. The synergies

we expect to deliver this year will be mostly driven by operating

expense savings as a result of the sound investments and strategic

management of the integration over the past couple of years.

Learnings from our customer segmentation study and business results

since the acquisition have validated our growth assumptions, and we

have an enviable position with the three leading U.S. brands in a

heavily fragmented and growing middle market jewelry industry. We

are pursuing the opportunity to grow square footage both near-term,

driven principally by Kay, and medium-term driven more by

Zales.

“I want to thank all Signet team members for their contributions

to our results. Their superior experience and dedication is the key

to our ability to deliver consistently solid performance in an

ever-changing environment.”

EPS Analysis:

First quarter EPS was $1.87. First quarter Adjusted EPS was

$1.95. Adjusted EPS can be reconciled to EPS as follows:

Adjustments EPS Purchase accounting

Integration Adjusted EPS1 $1.87 $(0.04)

$(0.04) $1.95 1. Throughout this release, Signet uses

adjusted metrics which adjust for purchase accounting and

integration costs in relation to the Zale acquisition and its

integration into Signet. See non-GAAP reconciliation tables.

Adjusted EPS is a non-GAAP measure and is defined as EPS adjusted

for the impact of purchase accounting and integration costs.

Purchase accounting includes deferred revenue adjustments related

to acquisition accounting which resulted in a reset of deferred

revenue associated with extended service plans previously sold by

Zale Corporation. Integration costs are severance and consulting

costs associated with organizational changes and information

technology ("I/T") implementations to drive synergies.

Financial Guidance:

13 weeks ended July 30, 2016 (2nd Quarter) Same store sales

1.0% to 2.0% EPS $1.39 to $1.46 Adjustments (purchase

accounting and integration costs) ($0.10) to ($0.08) Adjusted EPS

$1.49 to $1.54 Fiscal 2017 (Annual) Same store sales

2.0% to 3.5% EPS $7.88 to $8.23 Adjustments (purchase

accounting and integration costs) ($0.37) to ($0.32) Adjusted EPS

$8.25 to $8.55 Effective tax rate 27% to 28% Capital

expenditures $315 million to $365 million Net selling square

footage growth 3.0% to 3.5%

Capital expenditures will be driven primarily by new Kay and

Jared stores, store remodels, and I/T to support global

implementations. Most of Signet’s new square footage growth is

slated for real estate channels other than enclosed malls.

Cumulative Net Synergies Fiscal 2017 (Fiscal 2016 plus Fiscal 2017)

$158 million to $175 million Fiscal 2018 (Fiscal 2016

plus Fiscal 2017 plus Fiscal 2018) $225 million to $250 million

Fiscal 2017 Store and Kiosk Changes Net

selling Gross locations Net locations square feet Kay

Jewelers +60 to +70 +55 to +65 +7% to 8% Jared +8 to +10 +5 to +7

+2% to 3% Zales +30 to +35 +15 to +20 +2% to 3% Peoples 0 to +3 ~0

~0 Regional stores in total 0 -45 to -50 -10% to -11% Piercing

Pagoda +35 to +40 +20 to +30 +1% to +2% H.Samuel +12 to +15 +10 to

+12 +1% to +2% Ernest Jones 0 to +3 ~0 ~0

Signet

Total +145 to +176 +55 to +89

+3.0% to +3.5% Strategic Evaluation of Credit

Portfolio

Signet also announced that its Board of Directors has authorized

management to conduct a strategic evaluation of the Company’s

credit portfolio. Goldman Sachs has been engaged as the Company’s

financial advisor in this process. Signet will consider a full

range of options with respect to its credit operations and update

investors as appropriate.

Mr. Light said, “We are always looking for the best ways to

optimize our operating model, and to that end, the Board has

determined to undertake a formal and comprehensive strategic

evaluation of the Company’s credit portfolio. This is a top

priority and as we move through this review, we will remain focused

on executing our operational plans and driving profitable growth in

our business. The primary objective of this process will be to

ensure Signet has an optimized business structure that enhances our

ability to execute against our strategic objectives which in turn

delivers value for shareholders.”

First quarter Fiscal 2017 Sales Highlights:

Signet's total sales were $1,578.9 million, up $48.3 million or

3.2%, compared to $1,530.6 million in the 13 weeks ended May 2,

2015 ("first quarter Fiscal 2016"). Same store sales increased 2.4%

compared to an increase of 3.6% in the first quarter Fiscal 2016,

driven primarily by strong sales in select branded bridal and

diamond fashion jewelry. Ecommerce sales in the first quarter

Fiscal 2017 were $80.1 million, or 5.1% of sales, up $3.2 million,

or 4.2%, compared to $76.9 million in the first quarter Fiscal

2016.

Overall, average transaction value ("ATV") was higher and number

of transactions were lower due to merchandise mix.

- Sterling Jewelers' same store sales

increased 2.3%. ATV increased 5.7% and the number of transactions

decreased 5.6%. This was driven principally by strong sales of

select branded bridal jewelry as well as fashion jewelry and lower

sales of Charmed Memories and low-priced promotional items which

tend to drive more transactions.

- Zale Jewelry's same store sales

increased 2.0%. ATV increased 5.8%, while the number of

transactions decreased 3.7%. This was driven primarily by strong

sales of diamond fashion jewelry as well as branded bridal and

lower sales of low-priced promotional items which tend to drive

more transactions.

- Piercing Pagoda's same store sales

increased 5.6%. ATV increased 13.7%, while the number of

transactions decreased 6.9%. The higher sales were driven

principally by strong sales of gold chains and diamond jewelry.

Transactions declined primarily due to fewer piercings.

- UK Jewelry's same store sales increased

3.4%. ATV increased 4.3% and the number of transactions decreased

1.0%. This was driven principally by strong sales of diamond

jewelry and prestige watches. Transactions declined due primarily

to beads and fashion watches.

Sales change from previous year First quarter

Fiscal 2017

Samestoresales¹

Non-samestoresales, net²

Total sales

at constantexchangerate³

Exchangetranslationimpact

Total

sales

Total sales

(in millions)

Kay 4.7

%

1.7

%

6.4

%

—

%

6.4

%

$ 634.5 Jared (1.7 )% 3.3

%

1.6

%

—

%

1.6

%

$ 300.2 Regional brands (3.6 )% (8.7 )% (12.3

)% —

%

(12.3 )% $ 45.7

Sterling Jewelers division

2.3

%

1.5

%

3.8

%

—

%

3.8

%

$ 980.4 Zales Jewelers 3.1

%

2.2

%

5.3

%

—

%

5.3

%

$ 313.1 Gordon’s Jewelers (9.3

)%

(9.5 )% (18.8 )% —

%

(18.8 )% $ 16.9 Zale US Jewelry 2.4

%

1.3

%

3.7

%

—

%

3.7

%

$ 330.0 Peoples Jewellers (0.5 )% 1.6

%

1.1

%

(6.4 )% (5.3 )% $ 44.7 Mappins (1.6 )% (4.0 )% (5.6 )% (6.2 )%

(11.8 )% $ 6.7 Zale Canada Jewelry (0.6 )% 0.8

%

0.2

%

(6.4 )% (6.2 )% $ 51.4 Zale Jewelry 2.0

%

1.2

%

3.2

%

(0.9 )% 2.3

%

$ 381.4 Piercing Pagoda 5.6

%

1.9

%

7.5

%

—

%

7.5

%

$ 69.0

Zale division 2.5

%

1.4

%

3.9

%

(0.9 )% 3.0

%

$ 450.4 H.Samuel 2.7

%

(0.4 )% 2.3

%

(5.8 )% (3.5 )% $ 72.2 Ernest Jones 4.0

%

1.9

%

5.9

%

(5.8 )% 0.1

%

$ 71.8

UK Jewelry division 3.4

%

0.6

%

4.0

%

(5.7 )% (1.7 )%

$ 144.0 Other segment —

%

46.4

%

46.4 % —

%

46.4

%

$ 4.1 Signet 2.4

%

1.5

%

3.9

%

(0.7 )% 3.2

%

$ 1,578.9 Adjusted Signet3

$

1,583.1 Notes: 1=For stores open for at least 12 months. 2=For

stores not open in the last 12 months. 3=Non-GAAP measure.

First quarter Fiscal 2017 Financial Highlights:

Gross margin was $600.4 million or 38.0% of sales, up 100 basis

points versus first quarter Fiscal 2016. Adjusted gross margin rate

was 38.2%, up 40 basis points from first quarter Fiscal 2016. The

higher adjusted gross margin rate was mostly related to the Zale

division and favorably driven by gross margin synergies such as

sourcing, favorable commodity costs, and leverage on store

occupancy.

- Sterling Jewelers gross margin

increased $16.4 million compared to first quarter Fiscal 2016. The

gross margin rate increased 20 basis points due to commodity

costs.

- Zale gross margin increased $18.7

million, or 320 basis points, compared to first quarter Fiscal

2016. Included in gross margin were purchase accounting adjustments

totaling $4.0 million compared to $15.5 million in prior year.

Adjusted gross margin in the Zale division increased $7.2 million,

or 90 basis points, compared to first quarter Fiscal 2016 as

synergies favorably affected many areas including merchandise

margins, distribution costs, and store operating costs.

- UK Jewelry gross margin decreased $1.2

million compared to prior year first quarter, and the gross margin

rate decreased 30 basis points. The gross margin rate decline was

driven principally by lower sales and merchandise margin deleverage

as a result of currency exchange rates.

Selling, general, and administrative expense ("SGA") was $462.7

million or 29.3% of sales compared to $453.2 million or 29.6% of

sales in first quarter Fiscal 2016. Included in first quarter

Fiscal 2017 SGA are adjustments of $6.6 million.

- First quarter Fiscal 2017 adjusted SGA

was $456.1 million or 28.8% of adjusted sales compared to $450.9

million or 29.3% in the prior year. The favorable 50 basis points

of leverage was due primarily to lower store and corporate payroll

expenses related to organizational realignment as well as lower

advertising expenses offset in part by I/T expenses related to

Signet’s I/T modernization and standardization initiatives.

Other operating income was $74.3 million compared to $63.5

million in the prior year first quarter, up $10.8 million or 17.0%.

The increase was due to the Sterling division’s higher interest

income earned from higher outstanding receivable balances.

In first quarter Fiscal 2017 Signet's operating income was

$212.0 million, or 13.4% of sales, compared to $176.2 million, or

11.5% of sales, in first quarter Fiscal 2016. Included in first

quarter Fiscal 2017 operating income are adjustments of $10.6

million. Adjusted operating income was $222.6 million, or 14.1% of

adjusted sales, compared to $194.0 million, or 12.6% of adjusted

sales in the prior year reflecting 150 basis points of operating

leverage this year.

Operating income, net ($ in millions) First Quarter Fiscal

2017 First Quarter Fiscal 2016 $ % of sales $

% of sales Sterling Jewelers division 198.3 20.2 % 178.2 18.9 %

Zale division1 26.1 5.8 % 15.5 3.5 % UK Jewelry division 1.3 0.9 %

0.5 0.3 % Other2 (13.7 ) nm (18.0 ) nm 1. In the first

quarter Fiscal 2017, Zale division includes net operating loss

impact of $5.3 million for purchase accounting adjustments.

Excluding the impact from accounting adjustments, Zale division's

operating income was $31.4 million or 6.9% of sales. The Zale

division operating income included $18.3 million from Zale Jewelry

or 4.8% of sales and $7.8 million from Piercing Pagoda or 11.3% of

sales. In the first quarter Fiscal 2016, Zale division includes net

operating loss impact of $11.4 million for purchase accounting

adjustments. Excluding the impact from accounting adjustments, Zale

division's operating income was $26.9 million or 6.0% of sales. The

Zale division operating income included $10.4 million from Zale

Jewelry or 2.8% of sales and $5.1 million from Piercing Pagoda or

7.9% of sales. 2. Other includes $5.3 million and $6.4 million of

transaction and integration expenses in the first quarter of Fiscal

2017 and 2016, respectively. Amounts represent advisor fees for

legal, tax, information technology implementations and consulting

services, as well as severance costs. nm not meaningful

Income taxes were $53.4 million, compared to $46.4 million in

first quarter Fiscal 2016, resulting in a first quarter Fiscal 2017

effective tax rate of 26.7%, versus 28.1% in first quarter Fiscal

2016, driven by the anticipated annual mix of pre-tax income by

jurisdiction.

Balance Sheet and Other Highlights

Cash and cash equivalents were $113.0 million as of April 30,

2016 compared to $122.6 million as of May 2, 2015. The lower

cash position was primarily due to share repurchases partially

offset by favorable cash provided by operating activities. During

the first quarter Fiscal 2017, Signet repurchased $125.0 million

worth of its stock, or 1,121,543 shares at an average cost of

$111.45 per share. As of April 30, 2016, there was $760.6

million remaining under Signet's share repurchase authorization

programs.

Sterling division in-house net accounts receivable were $1,654.3

million, up 11.1% compared to $1,489.4 million as of May 2, 2015

driven primarily by a higher in-house credit penetration rate

combined with higher average purchases. The Sterling Jewelers

in-house credit participation rate was 61.7% in first quarter

Fiscal 2017 compared to 60.7% in first quarter Fiscal 2016 which

contributed to an increase in credit sales of 5.6%.

- For the first quarter Fiscal 2017,

finance charge income was $72.8 million and net bad debt was $33.6

million -- a favorable difference of $39.2 million. This was

favorable to the prior year by $2.9 million.

- Non-performing loans and the total

valuation allowance as a percentage of gross receivables were 3.6%

and 6.6%, respectively, at the end of first quarter Fiscal 2017.

Both ratios were down 40 basis points from the prior quarter and up

10 basis points from the prior year first quarter. Sequentially,

fiscal year-end to the first quarter of the following year, the

aging metrics both improved 10 basis points compared to prior year.

Credit team execution and credit marketing initiatives drove

improvement in the credit receivable mix.

Net inventories were $2,512.6 million, up 1.0% compared to

$2,487.8 million at the prior year period. The increase was lower

than sales growth due to strong inventory management.

Long-term debt was $1,311.5 million compared to $1,347.2 million

in the prior year period. Long-term debt is entirely representative

of the financing of the Zale acquisition. Signet's credit programs

are self-funded and therefore not vulnerable to rising interest

rates, as the primary value of the program is in the facilitation

of jewelry sales not the spread on rates.

Signet has a diversified real estate portfolio. Based upon

sales, slightly more than half of Signet's selling square footage

is in enclosed malls and nearly half is in a variety of other real

estate types. On April 30, 2016, Signet had 3,611 stores totaling

5.0 million square feet of selling space. Compared to prior

year-end, store count decreased by 14 stores.

Store count Jan 30, 2016

Openings Closures Apr 30, 2016

Kay 1,129 3 — 1,132 Jared 270 1 — 271

Regional brands 141 — (10 ) 131

Sterling Jewelers division 1,540

4 (10 ) 1,534 Zales 730 5

(5 ) 730 Gordons 59 — (4 ) 55 Peoples 145 — — 145 Mappins 43 — (5 )

38 Total Zale Jewelry 977 5 (14 ) 968 Piercing Pagoda 605

7 (6 ) 606

Zale division

1,582 12 (20 )

1,574 H.Samuel 301 — — 301 Ernest Jones 202 —

— 202

UK Jewelry division

503 — — 503

Signet 3,625 16

(30 ) 3,611

Quarterly Dividend:

Reflecting the Board's confidence in the strength of the

business, Signet's ability to invest in growth initiatives, and the

Board's commitment to building long-term shareholder value, a

quarterly cash dividend of $0.26 per Signet Common Share was

declared for the second quarter of Fiscal 2017 payable

on August 26, 2016 to shareholders of record on July

29, 2016, with an ex-dividend date of July 27, 2016.

Conference Call:

A conference call is scheduled today at 8:30 a.m. ET and a

simultaneous audio webcast and slide presentation are available at

www.signetjewelers.com. The slides are available to be downloaded

from the website. The call details are:

Dial-in: 1-647-788-4901

Conference ID: 1710201

A replay and transcript of the call will be posted on Signet's

website as soon as they are available and will be accessible for

one year.

About Signet and Safe Harbor Statement:

Signet Jewelers Limited is the world's largest retailer of

diamond jewelry. Signet operates approximately 3,600 stores

primarily under the name brands of Kay Jewelers, Zales, Jared The

Galleria Of Jewelry, H.Samuel, Ernest Jones, Peoples and Piercing

Pagoda. Further information on Signet is available at

www.signetjewelers.com. See also www.kay.com, www.zales.com,

www.jared.com, www.hsamuel.co.uk, www.ernestjones.co.uk,

www.peoplesjewellers.com and www.pagoda.com.

This release contains statements which are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements, based upon management's

beliefs and expectations as well as on assumptions made by and data

currently available to management, include statements regarding,

among other things, Signet's results of operation, financial

condition, liquidity, prospects, growth, strategies and the

industry in which Signet operates. The use of the words "expects,"

"intends," "anticipates," "estimates," "predicts," "believes,"

"should," "potential," "may," "forecast," "objective," "plan," or

"target," and other similar expressions are intended to identify

forward-looking statements. These forward-looking statements are

not guarantees of future performance and are subject to a number of

risks and uncertainties, including but not limited to general

economic conditions, risks relating to Signet being a Bermuda

corporation, the merchandising, pricing and inventory policies

followed by Signet, the reputation of Signet and its brands, the

level of competition in the jewelry sector, the cost and

availability of diamonds, gold and other precious metals,

regulations relating to customer credit, seasonality of Signet's

business, financial market risks, deterioration in customers’

financial condition, exchange rate fluctuations, changes in

Signet's credit rating, changes in consumer attitudes regarding

jewelry, management of social, ethical and environmental risks,

security breaches and other disruptions to Signet's information

technology infrastructure and databases, inadequacy in and

disruptions to internal controls and systems, changes in

assumptions used in making accounting estimates relating to items

such as extended service plans and pensions, the impact of the

acquisition of Zale Corporation on relationships, including with

employees, suppliers, customers and competitors, and our ability to

successfully integrate Zale's operations and to realize synergies

from the transaction.

For a discussion of these and other risks and uncertainties

which could cause actual results to differ materially from those

expressed in any forward-looking statement, see the "Risk Factors"

section of Signet's Fiscal 2016 Annual Report on Form 10-K filed

with the SEC on March 24, 2016. Signet undertakes no obligation to

update or revise any forward-looking statements to reflect

subsequent events or circumstances, except as required by law.

The below tables reflect the impact of costs associated with the

acquisition of Zale Corporation. Management finds the information

useful to analyze the results of the business excluding these items

in order to appropriately evaluate the performance of the business

without the impact of significant and unusual items. Management

views acquisition-related impacts as events that are not

necessarily reflective of operational performance during a period.

In particular, management believes the consideration of measures

that exclude such expenses can assist in the comparison of

operational performance in different periods which may or may not

include such expenses.

Non-GAAP Reconciliation for the first quarter ended April 30,

2016 (in mil. of $ except per share data) Signet

PurchaseAccounting1

IntegrationCosts2

Adjusted Signet Sales 1,578.9 100.0

%

(4.2 ) — 1,583.1 100.0

%

Cost of sales (978.5 ) (62.0 )% 0.2 —

(978.7 ) (61.8 )% Gross margin 600.4 38.0

%

(4.0 ) — 604.4 38.2

%

Selling, general and administrative expenses (462.7 ) (29.3 )% (1.3

) (5.3 ) (456.1 ) (28.8 )% Other operating income, net 74.3

4.7

%

— — 74.3 4.7

%

Operating income 212.0 13.4

%

(5.3 ) (5.3 ) 222.6 14.1

%

Interest expense, net (11.8 ) (0.7 )% —

— (11.8 ) (0.8 )% Income before income taxes

200.2 12.7

%

(5.3 ) (5.3 ) 210.8 13.3

%

Income taxes (53.4 ) (3.4 )% 2.0 2.0

(57.4 ) (3.6 )% Net income 146.8

9.3

%

(3.3 ) (3.3 ) 153.4 9.7

%

Earnings per share – diluted 1.87 (0.04

) (0.04 ) 1.95 1.

Includes deferred revenue adjustments related to acquisition

accounting which resulted in a reset of deferred revenue associated

with extended service plans previously sold by Zale Corporation.

Similar to the Sterling Jewelers division, historically, Zale

Corporation deferred the revenue generated by the sale of lifetime

warranties and recognized revenue in relation to the pattern of

costs expected to be incurred, which included a profit margin on

activities related to the initial selling effort. In acquisition

accounting, deferred revenue is only recognized when a legal

performance obligation is assumed by the acquirer. The fair value

of deferred revenue is determined based on the future obligations

associated with the outstanding plans at the time of the

acquisition. The acquisition accounting adjustment results in a

reduction to the deferred revenue balance from $183.8 million to

$93.3 million as of May 29, 2014 as the fair value was determined

through the estimation of costs remaining to be incurred, plus a

reasonable profit margin on the estimated costs. Revenues generated

from the sale of extended services plans subsequent to the

acquisition are recognized in revenue in a manner consistent with

Signet’s methodology. Additionally, accounting adjustments include

the amortization of acquired intangibles. 2. Integration costs are

severance and consulting costs associated with organizational

changes and I/T implementations to drive synergies.

Non-GAAP Reconciliation for the first quarter ended May 2, 2015

(in mil. of $ except per share data) Signet

PurchaseAccounting1

TransactionCosts2

Adjusted Signet Sales 1,530.6 100.0

%

(8.6 ) — 1,539.2 100.0

%

Cost of sales (964.7 ) (63.0 )% (6.9 ) —

(957.8 ) (62.2 )% Gross margin 565.9 37.0

%

(15.5 ) — 581.4 37.8

%

Selling, general and administrative expenses (453.2 ) (29.6 )% 4.1

(6.4 ) (450.9 ) (29.3 )% Other operating income, net 63.5

4.1

%

— — 63.5 4.1

%

Operating income 176.2 11.5

%

(11.4 ) (6.4 ) 194.0 12.6

%

Interest expense, net (11.0 ) (0.7 )% —

— (11.0 ) (0.7 )% Income before income taxes

165.2 10.8

%

(11.4 ) (6.4 ) 183.0 11.9

%

Income taxes (46.4 ) (3.0 )% 4.0 2.4

(52.8 ) (3.4 )% Net income 118.8

7.8

%

(7.4 ) (4.0 ) 130.2 8.5

%

Earnings per share – diluted 1.48 (0.09

) (0.05 ) 1.62 1.

Includes deferred revenue adjustments related to acquisition

accounting which resulted in a reset of deferred revenue associated

with extended service plans previously sold by Zale Corporation.

Similar to the Sterling Jewelers division, historically, Zale

Corporation deferred the revenue generated by the sale of lifetime

warranties and recognized revenue in relation to the pattern of

costs expected to be incurred, which included a profit margin on

activities related to the initial selling effort. In acquisition

accounting, deferred revenue is only recognized when a legal

performance obligation is assumed by the acquirer. The fair value

of deferred revenue is determined based on the future obligations

associated with the outstanding plans at the time of the

acquisition. The acquisition accounting adjustment resulted in a

reduction to the deferred revenue balance from $183.8 million to

$93.3 million as of May 29, 2014 as the fair value was determined

through the estimation of costs remaining to be incurred, plus a

reasonable profit margin on the estimated costs. Revenues generated

from the sale of extended services plans subsequent to the

acquisition are recognized in revenue in a manner consistent with

Signet’s methodology. Additionally, accounting adjustments include

the recognition of a portion of the inventory fair value step-up of

$32.2 million and amortization of acquired intangibles. 2.

Transaction costs include transaction-related and integration

expenses associated with advisor fees for legal, tax, accounting

and consulting expenses. These costs are included within Signet’s

Other segment.

Condensed Consolidated Income

Statements(Unaudited)

13 weeks ended (in millions, except per share

amounts)

April 30, 2016 May 2, 2015

Sales 1,578.9 1,530.6 Cost of sales (978.5 )

(964.7 )

Gross margin 600.4 565.9 Selling,

general and administrative expenses (462.7 ) (453.2 ) Other

operating income, net 74.3 63.5

Operating income 212.0 176.2 Interest expense,

net (11.8 ) (11.0 )

Income before income taxes

200.2 165.2 Income taxes (53.4 ) (46.4

)

Net income 146.8 118.8 Earnings per share:

Basic $ 1.87 $ 1.49 Diluted $ 1.87 $ 1.48 Weighted average common

shares outstanding: Basic 78.6 80.0 Diluted 78.7 80.2 Dividends

declared per share $ 0.26 $ 0.22

Condensed Consolidated Balance

Sheets(Unaudited)

(in millions, except par value per share

amount)

April 30, 2016 January 30, 2016

May 2, 2015 Assets Current assets: Cash and cash

equivalents 113.0 137.7 122.6 Accounts receivable, net 1,689.3

1,756.4 1,499.9 Other receivables 63.7 84.0 56.5 Other current

assets 161.2 152.6 130.6 Income taxes 1.4 3.5 5.3 Inventories

2,512.6 2,453.9 2,487.8

Total current assets 4,541.2

4,588.1 4,302.7 Non-current assets: Property, plant

and equipment, net of accumulated depreciation of $993.6, $949.2

and $848.8, respectively 725.7 727.6 668.7 Goodwill 519.7 515.5

520.7 Intangible assets, net 430.4 427.8 445.9 Other assets 157.2

154.6 132.1 Deferred tax assets — — 2.2 Retirement benefit asset

53.5 51.3 38.1

Total assets 6,427.7 6,464.9

6,110.4 Liabilities and Shareholders’ equity Current

liabilities: Loans and overdrafts 110.1 57.7 43.0 Accounts payable

255.7 269.1 256.5 Accrued expenses and other current liabilities

409.5 498.3 420.5 Deferred revenue 261.4 260.3 244.0 Income taxes

19.1 65.7 28.3

Total current liabilities 1,055.8

1,151.1 992.3 Non-current liabilities: Long-term debt

1,311.5 1,321.0 1,347.2 Other liabilities 229.7 230.5 224.4

Deferred revenue 644.4 629.1 597.3 Deferred tax liabilities 88.1

72.5 57.3

Total liabilities 3,329.5 3,404.2

3,218.5 Commitments and contingencies Shareholders’

equity: Common shares of $0.18 par value: authorized 500 shares,

78.4 shares outstanding (January 30, 2016: 79.4 outstanding; May 2,

2015: 80.2 outstanding) 15.7 15.7 15.7 Additional paid-in capital

275.9 279.9 265.2 Other reserves 0.4 0.4 0.4 Treasury shares at

cost: 8.8 shares (January 30, 2016: 7.8 shares; May 2, 2015: 7.0

shares) (620.4 ) (495.8 ) (393.2 ) Retained earnings 3,665.1

3,534.6 3,238.1

Accumulated other comprehensive loss

(238.5 ) (274.1 ) (234.3

) Total shareholders’ equity 3,098.2

3,060.7 2,891.9 Total liabilities and

shareholders’ equity 6,427.7 6,464.9

6,110.4

Condensed Consolidated Statements of

Cash Flows(Unaudited)

13 weeks ended (in millions)

April

30, 2016 May 2, 2015 Cash flows from operating

activities Net income 146.8 118.8 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 45.6 41.8

Amortization of unfavorable leases and

contracts

(4.9 ) (8.8 ) Pension benefit (0.4 ) — Share-based compensation 3.8

3.3 Deferred taxation 15.4 6.9 Excess tax benefit from exercise of

share awards (1.3 ) (5.1 ) Amortization of debt discount and

issuance costs 0.9 0.9 Other non-cash movements (0.3 ) 2.2 Changes

in operating assets and liabilities: Decrease in accounts

receivable 67.4 67.7 Decrease in other receivables and other assets

18.2 5.8 Increase in other current assets (3.5 ) (1.7 ) Increase in

inventories (34.8 ) (43.7 ) Decrease in accounts payable (12.4 )

(19.0 ) Decrease in accrued expenses and other liabilities (90.8 )

(71.1 ) Increase in deferred revenue 13.3 27.7 Decrease in income

taxes payable (48.1 ) (57.9 ) Pension plan contributions

(0.5 ) (0.8 )

Net cash provided by operating

activities 114.4 67.0

Investing activities Purchase of property, plant and equipment

(39.3 ) (42.9 ) Purchase of available-for-sale securities (0.8 )

(1.4 ) Proceeds from sale of available-for-sale securities

1.2 3.5

Net cash used in investing

activities (38.9 ) (40.8

) Financing activities Dividends paid (17.5 ) (14.4 )

Proceeds from issuance of common shares 0.3 0.1 Excess tax benefit

from exercise of share awards 1.3 5.1 Repayments of term loan (7.5

) (5.0 ) Proceeds from securitization facility 696.5 638.2

Repayments of securitization facility (696.5 ) (638.2 ) Proceeds

from revolving credit facility 99.0 — Repayments of revolving

credit facility (55.0 ) — Repurchase of common shares (125.0 )

(19.1 ) Net settlement of equity based awards (4.6 ) (8.7 )

Principal payments under capital lease obligations (0.1 ) (0.3 )

Proceeds from (repayment of) short-term borrowings 6.0

(55.0 )

Net cash used in financing activities

(103.1 ) (97.3 ) Cash and

cash equivalents at beginning of period 137.7 193.6 Decrease in

cash and cash equivalents (27.6 ) (71.1 ) Effect of exchange rate

changes on cash and cash equivalents 2.9 0.1 Cash and cash

equivalents at end of period 113.0 122.6

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160526005269/en/

Signet JewelersInvestors:James Grant, VP Investor Relations,

+1-330-668-5412orMedia:David Bouffard, VP Corporate Affairs,

+1-330-668-5369

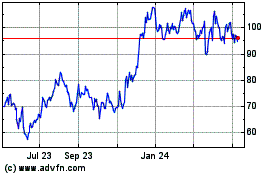

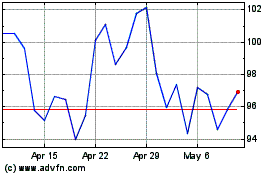

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024