By Sue Chang and Ellie Ismailidou, MarketWatch

Crude oil settles at highest mark since October

U.S. stocks advanced for a second straight session on Wednesday,

with the S&P 500 posting its highest close in nearly a month on

the back of a rally in energy and materials shares.

A jump in oil prices following a Tuesday report which showed a

decline in crude inventories

(http://www.marketwatch.com/story/crude-oil-rockets-to-near-50-a-barrel-as-data-hints-at-us-supply-drop-2016-05-25)

helped lift energy and materials stocks.

Oil futures settled at their highest level since Oct. 9, 2015,

up 1.9% at $49.56 a barrel.

The S&P 500 rose 14.48 points, or 0.7%, to end at 2,090.54,

its highest close since April 27 as energy and materials sectors

both gained more than 1%. The utilities sector was the only sector

finishing in negative territory, down 0.3%.

The Dow Jones Industrial Average added 145.46 points, or 0.8%,

to close at 17,851.51, led by a 2.3% jump in Goldman Sachs Group

Inc. (GS).

The Nasdaq Composite closed up 33.84 points, or 0.7%, to finish

at 4,894.89.

A combination of stronger crude prices and mounting expectations

that the Federal Reserve will raise interest rates this summer

helped buoy sentiment, said Kristina Hooper, U.S. investment

strategist for Allianz Global Investors. "The market seems to be

embracing the greater likelihood of a Fed rate hike in June,

viewing the possibility of it as a vote of confidence for the

American economy," she said.

Several key technical indicators suggest that the market has

potential to add to its gains, according to Andrew Adams, technical

analyst at Raymond James, who shared the following chart in a

note.

"My favorite breadth indicator, the NYSE Common Stock Only

Advance/Decline Line, had a good day as well yesterday to break

above the downtrend line that had been keeping it in check. This

helps support our view that Tuesday may have been the beginning of

something real," he said.

The possibility of the Fed tightening its monetary policy as

early as next month helped financial companies' shares, as higher

interest rates tend to boost banks' balance sheets.

"A big part of this rally is central-bank induced," said Quincy

Krosby, market strategist at Prudential Financial. The fact that

financials are leading the advance implies, according to Krosby,

that investors are betting that a potential rate hike will push the

10-year benchmark Treasury yield higher, boosting bank

profitability.

But overall, it is typically thought that "the market always

prefers a rate cut to a rate hike," Krosby said, so in order for

this rally to continue in a sustainable way, there needs to be

"broad market participation."

Some analysts pointed to nascent signs of such broad

participation. For instance, the recent rally in the technology

sector has been "much more broad-based than what we saw during most

of the last two years," said Tim Anderson, managing director at MND

Partners, in emailed comments.

Strong financial and tech stocks underpinned Tuesday's sharp

advance. The main difference from past rallies, according to

Anderson, is that dozens of technology stocks have been part of the

Nasdaq's advance since last Thursday, including many sub groups

that have been languishing for many quarters.

Other strategists pointed to a shift in investor sentiment.

"Traders continue to view the [Federal Reserve] moving toward an

interest-rate increase as a positive sign that the U.S. economy is

strong and overseas economic risks are fading, setting up a

positive environment for corporate earnings growth," said Colin

Cieszynski, chief market strategist at CMC Markets, in emailed

comments.

The surge in risk appetite, according to Cieszynski, weighed on

gold futures as capital continued to leave defensive havens, like

gold and U.S. Treasurys, for more aggressive positions.

Other markets: European stocks were up while Asian markets

mostly closed higher

(http://www.marketwatch.com/story/asian-stocks-boosted-by-strong-oil-prices-upbeat-us-data-2016-05-25).

Gold futures lost ground, and the ICE U.S. Dollar Index inched

lower.

Read:Citi expects Brent crude to reach $50 a barrel in the third

quarter

(http://www.marketwatch.com/story/new-age-for-oil-prompts-citi-to-raise-2017-forecast-to-65-2016-05-24)

Economic news: Investors shrugged off a report that showed the

nation's trade deficit widened in April

(http://www.marketwatch.com/story/us-goods-deficit-shows-higher-trade-gap-in-april-2016-05-25),

as imports increased faster than exports.

Individual movers: Luxury jewelry seller Tiffany & Co.(TIF)

recovered to close fractionally higher, overcoming disappointing

quarterly revenue and outlook

(http://www.marketwatch.com/story/tiffanys-stock-rocked-by-sales-miss-downbeat-outlook-2016-05-25),

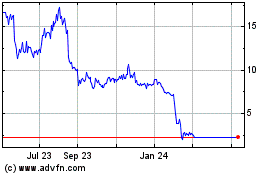

and clothing retailer Express Inc.(EXPR) tumbled 8.4% following its

quarterly report

(http://www.marketwatch.com/story/express-cuts-outlook-after-revenue-flattens-2016-05-25).

Shares in Hewlett Packard Enterprise Co.(HPE) surged 6.8%, its

best percentage gain in a single day since March 4. The company

late Tuesday said it would spin off its enterprise services

business and merge it

(http://www.marketwatch.com/story/hewlett-packard-enterprise-surges-on-move-to-merge-services-unit-with-csc-2016-05-24)

with Computer Sciences Corp.(CSC)

Read:Hewlett Packard Enterprise--another day, another spinoff?

(http://www.marketwatch.com/story/hewlett-packard-enterprise-another-day-another-spinoff-2016-05-24)

Microsoft Corp. shares (MSFT) gained 1% after the tech giant

early Wednesday said it will lay off 1,850 workers

(http://www.marketwatch.com/story/microsoft-to-layoff-1850-from-smartphone-business-2016-05-25)

from its ailing smartphone business.

Alibaba Group Holding Ltd.'s (BABA) stock sank 6.8% after the

China-based e-commerce giant disclosed in a filing that it was

being investigated by the U.S. Securities and Exchange Commission.

(http://www.marketwatch.com/story/alibabas-stock-slumps-after-disclosure-of-sec-probe-into-singles-day-data-consolidation-practices-2016-05-25)

(http://www.marketwatch.com/story/alibabas-stock-slumps-after-disclosure-of-sec-probe-into-singles-day-data-consolidation-practices-2016-05-25)--Victor

Reklaitis contributed to this article.

(END) Dow Jones Newswires

May 25, 2016 16:52 ET (20:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Express (NYSE:EXPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Express (NYSE:EXPR)

Historical Stock Chart

From Apr 2023 to Apr 2024