Current Report Filing (8-k)

May 24 2016 - 5:05PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report:

May 19, 2016

(Date of Earliest Event Reported)

REALTY INCOME CORPORATION

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

1-13374

|

|

33-0580106

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On May 19, 2016, Realty Income Corporation (the “Company”) entered into a purchase agreement with Credit Suisse Securities (USA) LLC, Morgan Stanley & Co. LLC and UBS Securities LLC (the “Underwriters”), pursuant to which the Company agreed to issue and sell 6,500,000 shares of the Company’s common stock, par value $0.01 per share.

The transaction closed on May 24, 2016. Total net proceeds of the offering, before deducting offering expenses, were approximately $383.8 million. The Company expects to use the net proceeds from the offering to repay borrowings under its $2.0 billion revolving credit facility and, to the extent not used for that purpose, to fund potential investment opportunities and/or for other general corporate purposes.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

1.1

|

Purchase Agreement, dated May 19, 2016, between the Underwriters and the Company.

|

|

5.1

|

Opinion of Venable LLP.

|

|

23.1

|

Consent of Venable LLP (contained in the opinion filed as Exhibit 5.1 hereto).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: May 24, 2016

6

|

REALTY INCOME CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ MICHAEL R. PFEIFFER

|

|

|

|

|

|

|

|

Michael R. Pfeiffer

|

|

|

|

Executive Vice President, General

Counsel and Secretary

|

INDEX TO EXHIBITS

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

1.1

|

|

Purchase Agreement, dated May 19, 2016, between the Underwriters and the Company.

|

|

5.1

|

|

Opinion of Venable LLP.

|

|

23.1

|

|

Consent of Venable LLP (contained in the opinion filed as Exhibit 5.1 hereto).

|

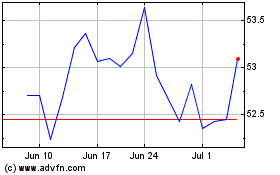

Realty Income (NYSE:O)

Historical Stock Chart

From Mar 2024 to Apr 2024

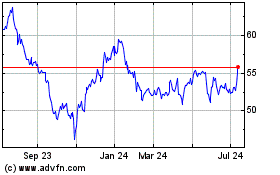

Realty Income (NYSE:O)

Historical Stock Chart

From Apr 2023 to Apr 2024