Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 24 2016 - 6:07AM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration No. 333-202110

Issuer Free Writing Prospectus dated May 23, 2016

Relating to Preliminary Prospectus Supplement dated May 23, 2016

LAM RESEARCH CORPORATION

Pricing Term Sheet

2.800% Senior

Notes due 2021

3.450% Senior Notes due 2023

3.900% Senior Notes due 2026

|

Issuer:

|

Lam Research Corporation

|

|

Title:

|

2.800% Senior Notes due 2021 (the “2021 Notes”)

|

|

|

3.450% Senior Notes due 2023 (the “2023 Notes”)

|

|

|

3.900% Senior Notes due 2026 (the “2026 Notes” and, together with the 2021 Notes and the 2023 Notes, the “notes”)

|

|

Principal Amount:

|

2021 Notes: $800,000,000

|

|

|

2026 Notes: $1,000,000,000

|

|

Maturity Date:

|

2021 Notes: June 15, 2021

|

|

|

2023 Notes: June 15, 2023

|

|

|

2026 Notes: June 15, 2026

|

|

Coupon:

|

2021 Notes: 2.800%

|

|

Price to Public:

|

2021 Notes: 99.916% of face amount, plus accrued interest, if any, from June 7, 2016

|

|

|

2023 Notes: 99.697% of face amount, plus accrued interest, if any, from June 7, 2016

|

|

|

2026 Notes: 99.744% of face amount, plus accrued interest, if any, from June 7, 2016

|

|

Net Proceeds (before expenses):

|

$2,379,900,000

|

|

Yield to Maturity:

|

2021 Notes: 2.818%

|

|

Benchmark Treasury:

|

2021 Notes: UST 1.375% due April 2021

|

|

|

2023 Notes: UST 1.625% due April 2023

|

|

|

2026 Notes: UST 1.625% due May 2026

|

|

Spread to Benchmark Treasury:

|

2021 Notes: T+145 bps

|

|

Benchmark Treasury Price and Yield:

|

2021 Notes: 100-01; 1.368%

|

|

|

2023 Notes: 99-27; 1.649%

|

|

|

2026 Notes: 98-04; 1.831%

|

|

Interest Payment Dates:

|

June 15 and December 15, commencing December 15, 2016

|

|

Special Mandatory Redemption:

|

In the event (1) we do not complete the KLA-Tencor Merger on or prior to December 30, 2016 or (2) the Merger Agreement is terminated on or at any time prior to such date, we will be required to redeem all of the 2023 Notes and the

2026 Notes then outstanding, at a redemption price equal to 101% of the aggregate principal amount of such notes, plus accrued and unpaid interest from the date of initial issuance (or the most recent interest payment date on which interest was

paid) to, but not including, the Special Mandatory Redemption Date (as defined in the Prospectus Supplement related to the notes). The 2021 Notes are not subject to this special mandatory redemption.

|

|

Optional Redemption:

|

2021 Notes: Prior to May 15, 2021 (1 month prior to their maturity date), make-whole call at any time at the greater of a price of 100% or a discount rate of Treasury plus 25 basis points; on or after May 15, 2021, at any time at par.

|

2

|

|

2023 Notes: Prior to April 15, 2023 (2 months prior to their maturity date), make-whole call at any time at the greater of a price of 100% or a discount rate of Treasury plus 30 basis points; on or after April 15, 2023, at any time at

par.

|

|

|

2026 Notes: Prior to March 15, 2026 (3 months prior to their maturity date), make-whole call at any time at the greater of a price of 100% or a discount rate of Treasury plus 35 basis points; on or after March 15, 2026, at any time at

par.

|

|

Change of Control Put:

|

101% of the principal amount plus accrued and unpaid interest, if any

|

|

Settlement Date:**

|

T+10; June 7, 2016

|

|

CUSIP/ISIN:

|

2021 Notes: 512807 AR9/US512807AR99

|

|

|

2023 Notes: 512807 AQ1/US512807AQ17

|

|

|

2026 Notes: 512807 AP3/US512807AP34

|

|

Denominations:

|

Minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

|

|

Joint Book-Running Managers:

|

Goldman, Sachs & Co.

|

|

|

Citigroup Global Markets Inc.

|

|

|

J.P. Morgan Securities LLC

|

|

|

BNP Paribas Securities Corp.

|

|

|

Deutsche Bank Securities Inc.

|

|

|

Mitsubishi UFJ Securities (USA), Inc.

|

|

|

Mizuho Securities USA Inc.

|

|

|

Wells Fargo Securities, LLC

|

|

Co-Managers:

|

HSBC Securities (USA) Inc.

|

|

|

SunTrust Robinson Humphrey, Inc.

|

3

|

Ratio of Earnings to Fixed Charges:

|

Our previously presented ratio of earnings to fixed charges for the nine months ended March 27, 2016, on both an actual and pro forma basis, omitted interest expense of approximately $27 million associated with the amortization of debt

issuance costs relating to the bridge commitment letter from the computation of fixed charges for such nine-month period. Accordingly, including these expenses, our ratio of earnings to fixed charges for the nine months ended March 27, 2016

would have been 7.6x on an actual basis, and our pro forma ratio of earnings to fixed charges (giving effect to the KLA-Tencor Transactions and related financings as outlined in “Use of Proceeds” in the preliminary prospectus supplement,

and assuming the KLA-Tencor Senior Notes are exchanged for new series of Lam Research senior unsecured notes) for the nine months ended March 27, 2016 would have been 3.6x.

|

|

Capitalization:

|

With regard to the stockholders’ equity portion of the “Capitalization” table in the preliminary prospectus supplement, after giving effect to the assumed issuance of approximately 77.9 million shares of Lam Research common stock

in the KLA-Tencor Merger, on an adjusted basis as of March 27, 2016: common stock would have been 237; additional paid in capital would have been 11,308,955; retained earnings would have been 4,531,721; and total stockholders’ equity would have

been 11,364,667 (all numbers in thousands except the total number of shares of Lam Research common stock assumed to be issued in the KLA-Tencor Merger).

|

*A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal by the assigning rating

organization at any time. Each rating should be evaluated independently of any other rating.

4

**Under Rule 15c6-1 of the Exchange Act, trades in the secondary market are required to settle in three

business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes prior to the third business day before the settlement date will be required, by virtue of the fact that the notes initially will

settle on the tenth business day following the pricing date (T+10), to specify alternative settlement arrangements to prevent a failed settlement.

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the SEC for the

offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete information

about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, the underwriters or any dealer participating in the offering will arrange to send you the

prospectus if you request it by calling Goldman, Sachs & Co. at 1-866-471-2526; Barclays Capital Inc. at 1-888-603-5847, Citigroup Global Markets Inc. at 1-800-831-9146 or J.P. Morgan Securities LLC High Grade Syndicate Desk at

1-212-834-4533.

5

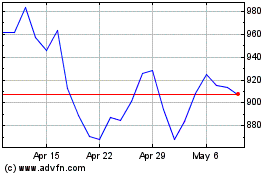

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

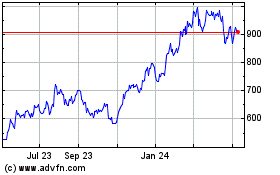

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024