PDVSA Offers Debt Exchange to Service Providers

May 23 2016 - 9:50PM

Dow Jones News

CARACAS—Venezuela's cash-strapped state oil company is offering

service providers a debt exchange, proposing to swap $2.5 billion

worth of debt for dollar bonds, according to two contractors who

were offered the deal and documents reviewed by the Wall Street

Journal.

Under the deal, a subsidiary of Petró leos de Venezuela SA,

known as PDVSA, would issue a three-year international bond and

hand it to approved suppliers in exchange for cancelling some of

the $20 billion worth of unpaid invoices. The bond would be priced

at about a 40% discount to the company's benchmark obligation,

which currently trades at about 45 cents on the dollar, said the

sources and the deal prospectus.

PDVSA representatives began sounding out local and international

suppliers last week to gauge interest in the swap, and the company

has hired Miami firm CP Capital Securities to arrange the

transaction, said the sources. PDVSA and CP Capital didn't reply to

requests for comment.

"CP Capital has been hired to advise PDVSA on the exchange of

commercial invoices for financial debt with a minimum amount of

$2.5 billion," read a deal prospectus viewed by The Wall Street

Journal.

Venezuela's oil production has slipped 150,000 barrels this year

to 2.5 million barrels per day, according to the Organization of

the Petroleum Exporting Countries, as service giants Schlumberger

and Halliburton reduced activity because of unpaid bills. The

government has been struggling to boost output to alleviate acute

shortages of imported food and medicine, which are fuelling riots

and looting across the country.

Both contractors interviewed by the Wall Street Journal said

they would reject the deal in its current form, as the value of the

offered bonds is less than the amount of debt they expect to get

back through litigation.

The bond issue would raise the financial burden for a government

already struggling to meet its international obligations. The

Venezuelan government and PDVSA are due to make about $6 billion

worth of bond payments through the end of the year, obligations

which consultancy Sintesis Financiera believes can only be met by

cutting imports of basic goods to the lowest per capita levels

since the 1950s.

(END) Dow Jones Newswires

May 23, 2016 21:35 ET (01:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

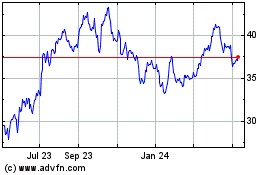

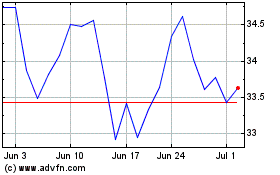

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024