Fed's Tarullo Outlines Rules for Big U.S. Insurers

May 20 2016 - 9:40AM

Dow Jones News

WASHINGTON—Big U.S. insurers Prudential Financial Inc. and

American International Group Inc. would face tougher capital

requirements than their peers under new rules outlined for the

first time Friday by the Federal Reserve's point-man on

regulation.

Fed Gov. Daniel Tarullo said the Fed will propose rules "in the

coming weeks" that will have higher compliance costs for insurers

considered "systemically important" to the U.S. financial

system.

That group currently includes AIG and Prudential, but not

MetLife Inc., which won a court case overturning its systemic label

earlier this year. The government has appealed MetLife's win.

The Fed gained authority for the first time to regulate

insurance companies under the 2010 Dodd Frank law, but has taken

more than five years to propose rules for the industry. Mr.

Tarullo's remarks Friday were the central banks most detailed

description to date of the pending regulations.

Mr. Tarullo didn't give all the details of the Fed rules, but he

sketched them out in a speech to the National Association of

Insurance Commissioners, a group of state regulators. He said the

Fed will propose different rules for systemic insurers than for

other insurance companies it regulates.

The central bank also regulates a dozen U.S. insurance companies

that own banks, including Nationwide Mutual Insurance Co. and State

Farm Mutual Automobile Insurance Co.

"Our tentative conclusion is that a bifurcated approach to a

capital regime for insurance companies makes sense," Mr. Tarullo

said.

The rules for non-systemic insurance companies are likely to

have a "relatively low regulatory burden," aggregating capital

requirements that already exist at the state level, Mr. Tarullo

said.

Prudential and AIG are likely to face a different capital

requirement based on "risk segments," with the Fed placing assets

and liabilities in categories based on the potential risks they

pose to the company and the financial system, Mr. Tarullo said. The

companies would have to maintain more capital against segments with

higher risk, he said, adding that the rules for systemic firms

would result in higher compliance costs.

Mr. Tarullo said the Fed also intends to impose stricter rules

on systemic firms in the areas of corporate governance, risk

management, and liquidity, following on a mandate from Congress to

set out tougher standards on firms that have a size and complexity

that a crisis at that institution could ripple through the broader

financial system, the way AIG's woes aggravated the 2008 financial

crisis.

He said the firms would likely face capital and liquidity

"stress tests" examining their ability to fund themselves and keep

operating in a crisis.

Mr. Tarullo said the Fed would issue an "advance notice" of the

rules, giving the industry multiple chances to comment on them.

Write to Ryan Tracy at ryan.tracy@wsj.com

(END) Dow Jones Newswires

May 20, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

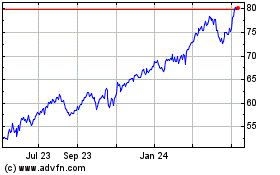

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

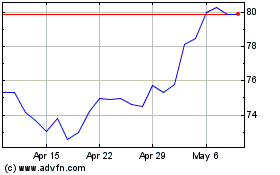

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024