Additional Proxy Soliciting Materials (definitive) (defa14a)

May 19 2016 - 6:02AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

x

Filed by a Party other than the Registrant

o

Check the appropriate box:

|

|

|

|

|

o

|

|

Preliminary Proxy Statement

|

|

|

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

o

|

|

Definitive Proxy Statement

|

|

|

|

|

x

|

|

Definitive Additional Materials

|

|

|

|

|

o

|

|

Soliciting Material Pursuant to §240.14a-12

|

Territorial Bancorp, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

|

No fee required.

|

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1

|

)

|

|

Title of each class of securities to which transaction applies: N/A

|

|

|

|

(2

|

)

|

|

Aggregate number of securities to which transaction applies: N/A

|

|

|

|

(3

|

)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A

|

|

|

|

(4

|

)

|

|

Proposed maximum aggregate value of transaction: N/A

|

|

|

|

(5

|

)

|

|

Total fee paid: N/A

|

|

o

|

|

Fee paid previously with preliminary materials.

|

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1

|

)

|

|

Amount Previously Paid: N/A

|

|

|

|

(2

|

)

|

|

Form, Schedule or Registration Statement No.: N/A

|

|

|

|

(3

|

)

|

|

Filing Party: N/A

|

|

|

|

(4

|

)

|

|

Date Filed: N/A

|

YOUR PROXY VOTE IS VERY IMPORTANT!

|

|

Because our annual meeting is on May 26

th

and because of the 6 hour time difference between Hawaii and the East Coast, we hope that this e-mail will be of some use to you in your decision on your say on pay vote.

|

We believe Territorial has not only had very strong performance in 2015 but also been responsive to the issues important to our stockholders in the area of executive compensation. The incentive pay changes below started in 2014 as a result of concerns expressed by a number of institutional investors that year.

2015 PERFORMANCE:

Total Stockholder Return of 32.7% - 98

th

Percentile of Peers

2015 EXECUTIVE COMPENSATION ADJUSTMENTS:

CEO total compensation decrease of 5.8% in 2015

CEO total compensation decrease of 20.5% since 2011

CEO INCENTIVE PAY CHANGES:

|

•

|

More Rigorous Annual Incentive Targets –

Annual plan does not allow for discretionary payouts and is 100% based on objective metrics to relative peer performance. No payouts at target unless 75

th

percentile of peers is achieved (up from previous 50

th

percentile target). Plan does not payout at maximum level unless 85

th

percentile of peers is achieved.

|

|

•

|

Different Metrics for Short and Long Term Plans:

Long-term plan now based upon return on average equity as well as total shareholder return to alleviate overlap with the annual incentive plan. Previously, long-term incentive plan was based on return on average assets.

|

|

•

|

Increased Focus on Long-Term Compensation:

Total incentive pay opportunity adjusted more toward long-term incentive plan - now 55% as compared previous 44%.

|

|

•

|

More

Rigorous

Long-Term Incentive Targets:

For 2014 – 2016 long-term plan, target for the return on average assets component retroactively increased to 75

th

percentile target, up from previous 50

th

percentile target. Going forward, the return on average equity component’s target is at the 75

th

percentile. The target for the relatively new total shareholder return component is at the 50

th

percentile because management cannot directly control TSR.

|

|

•

|

Amendment

to

2010 Stock Equity Plan.

We are requesting the approval of an amendment to the 2010 Equity Incentive Plan that would provide for an increase in the overall number of common stock shares reserved for issuance of equity incentives in lieu of certain cash payments. This is being done in response to discussions we’ve had with our shareholders.

|

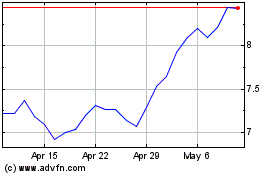

Territorial Bancorp (NASDAQ:TBNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

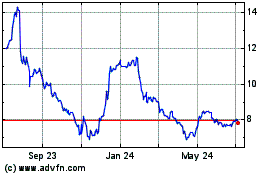

Territorial Bancorp (NASDAQ:TBNK)

Historical Stock Chart

From Apr 2023 to Apr 2024