Southwest Raises Dividend, Approves Stock Repurchase

May 18 2016 - 1:00PM

Dow Jones News

Southwest Airlines Co. said Wednesday it boosted its quarterly

dividend 33% and rolled out a new $2 billion share-buyback plan,

joining other carriers in sweeping cash returns to

shareholders.

Chief Executive Gary Kelly said the authorization was the

largest for the company in its "decades-long history of returning

value back to our shareholders." Southwest recently completed its

previous buyback, totaling 37.3 million shares, for $1.5

billion.

The quarterly dividend will increase to 10 cents a share from

7.5 cents, beginning Wednesday. That pushes the annual dividend

yield to about 1% based on Tuesday's closing stock price. Southwest

said the increase amounts to $255 million annually.

Earlier this year, United Continental Holdings Inc., the

third-largest U.S. airline by traffic, said it plans to repurchase

$750 million in shares during the first quarter, having bought back

$1.2 billion during 2015.

Last month, American Airlines Group Inc., confident of its

long-term success, announced another $2 billion share-buyback

program to run through 2017. This came after the company, the

nation's largest airline, has returned $6.6 billion to investors

through dividends and share repurchases since mid-2014.

On Monday, Delta Air Lines Inc., the nation's No. 2 airline by

traffic, said it would boost its annual dividend and finish off a

$5 billion stock-buyback program in May of next year.

Southwest shares were recently up 2.2% at $43.14.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 18, 2016 12:45 ET (16:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

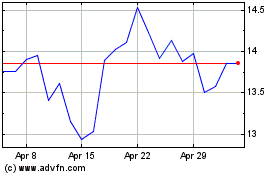

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

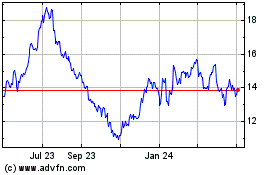

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024